Liberty Gold Reports Q3 2023 Financial and Operating Results

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the “Company”), is pleased to announce its financial and operating results for the nine months ended September 30, 2023. All amounts are presented in United States dollars unless otherwise stated.

THIRD QUARTER OF 2023 AND RECENT HIGHLIGHTS

- On September 15, 2023, closed a non-brokered private placement raising proceeds of $5.7 million, anchored by a $5.0 million strategic investment by Wheaton Precious Metals Corp. (“Wheaton”)[1].

- On September 5, 2023, published second annual ESG report: Developing Gold Deposits in a Responsible and Sustainable Manner[2].

- On November 8, 2023, announced the appointment of Cal Everett as CEO and Jon Gilligan as President, effective November 10, 2023[3].

At the Black Pine project (“Black Pine”), we:

- Announced on September 11, 2023 the purchase of the existing 0.5% Net Smelter Royalty (“NSR”) at Black Pine, and the sale of a new 0.5% NSR to an affiliate of Wheaton which includes an option to reduce the NSR to 0.25% in the future1.

- On September 6, 2023, announced the submission of a Mining Pre-Plan of Operations to US Federal Agencies, and the selection of M3 Consulting Ltd. as lead engineer for the pre-feasibility study (“PFS”)[4].

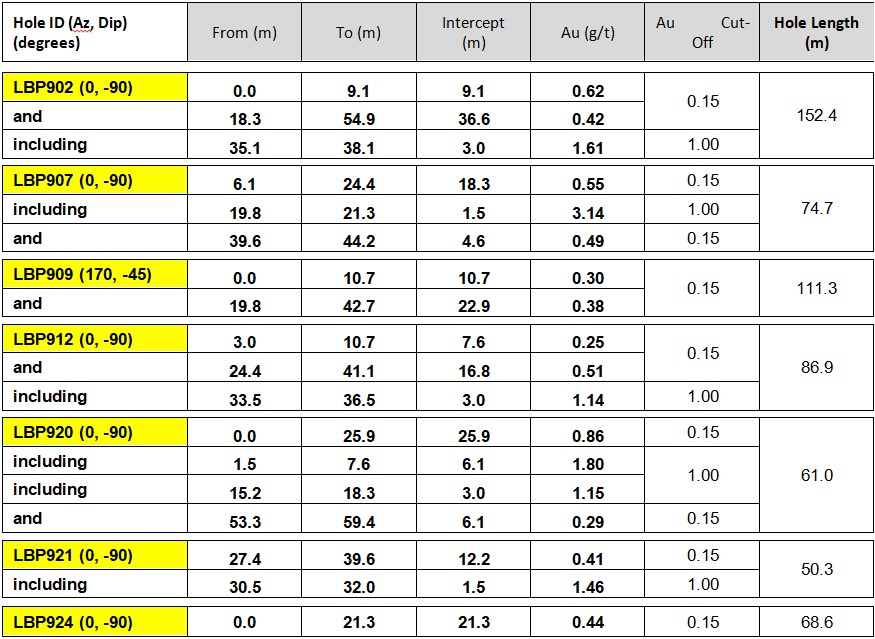

- Published reverse circulation (“RC”) exploration drill results from:

- Discovery Zone:

- 0.77 grams per tonne (“g/t”) gold (“Au”) over 65.5 meters (“m”) including 2.47 g/t Au over 10.7 m in LBP9327.

- Back Range Zone:

- 3.40 g/t Au over 32.0 m, including 6.74g/t Au over 9.1 m LBP945[5].

- 1.41 g/t Au over 22.9 m, including 4.28 g/t Au over 6.1 m LBP9435.

- 1.41 g/t Au over 30.5 m including 1.83 g/t Au over 13.7 m in LBP9267.

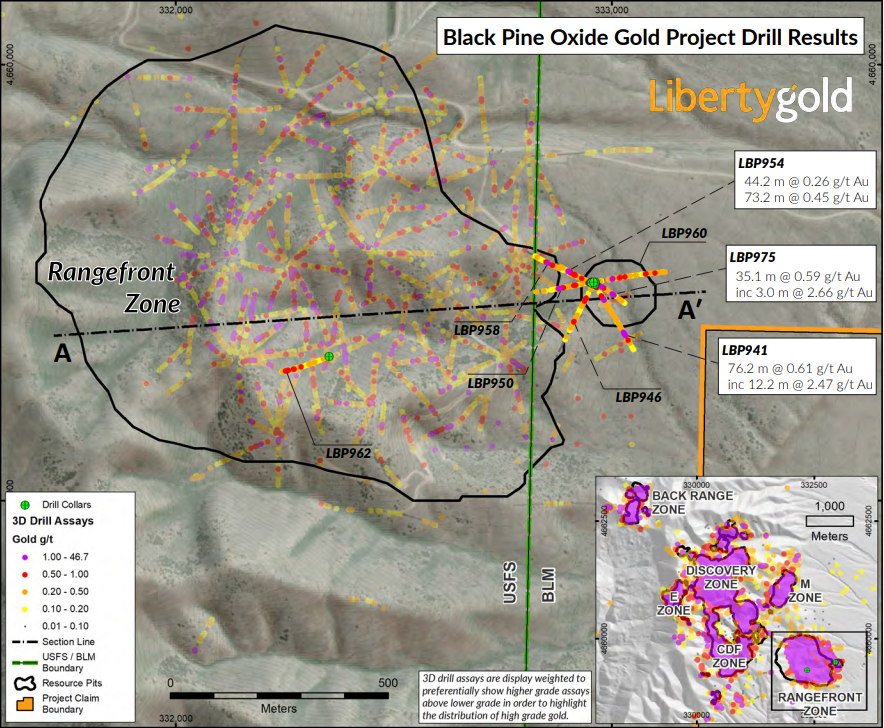

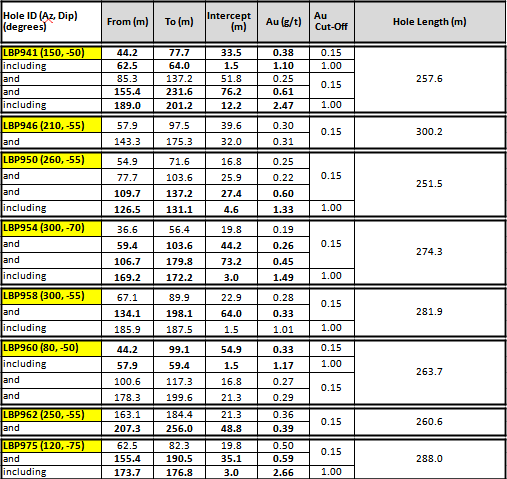

- Rangefront Zone:

- 0.61 g/t Au over 76.2 m, including 2.47 g/t Au over 12.2 m in LBP941[6].

- 0.45 g/t Au over 73.2 m, including 1.50 g/t Au over 3.0 m in LBP9546.

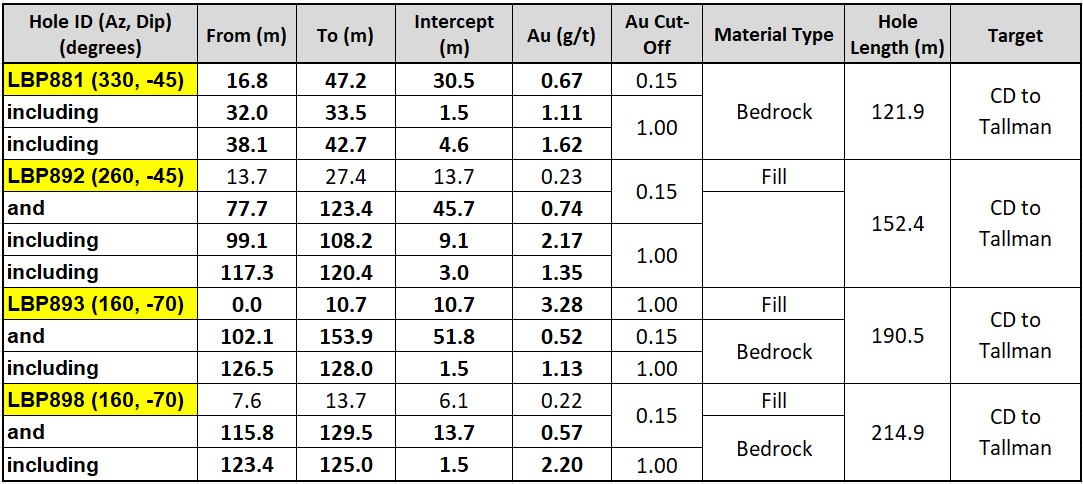

- CD-Tallman Zone:

- 0.86 g/t Au over 25.9 m including 1.80 g/t Au over 6.1 m in LBP920[1].

- Discovery Zone:

- Completed 2023 RC exploration drilling program as of September 30, 2023, for a total of 27,461 meters drilled.

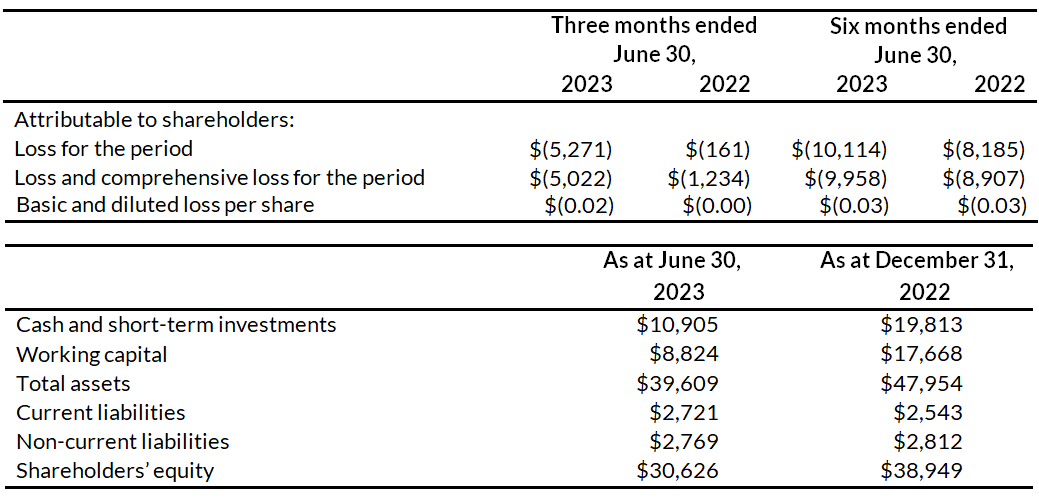

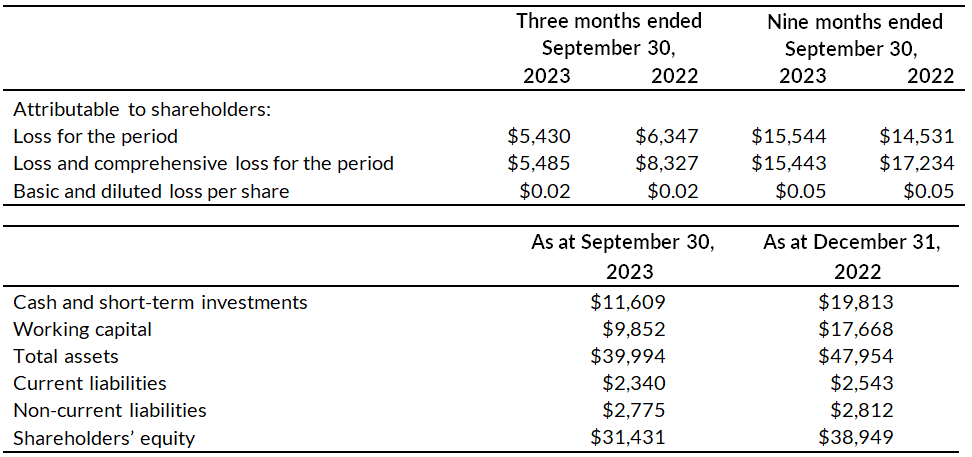

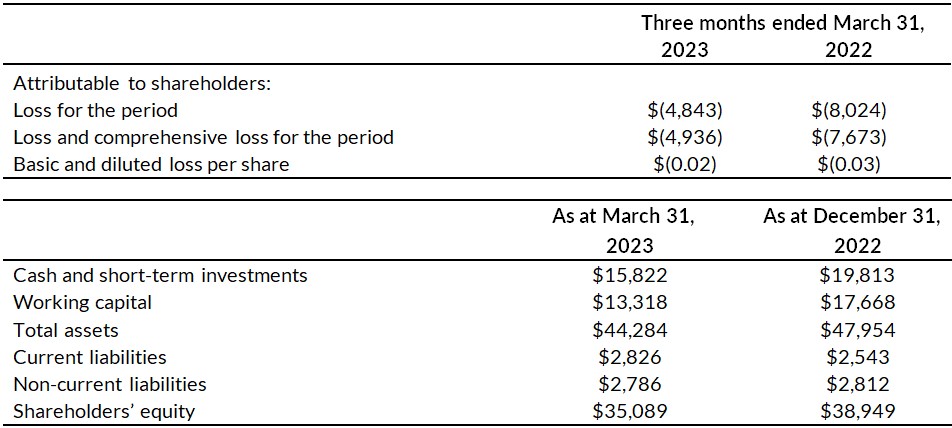

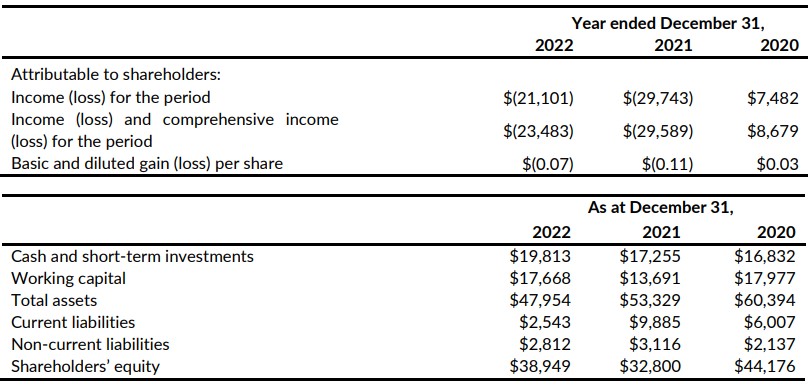

SELECTED FINANCIAL DATA

The following selected financial data is derived from our unaudited condensed interim consolidated financial statements and related notes thereto (the “Interim Financial Statements”) for the nine months ended September 30, 2023, as prepared in accordance with International Accounting Standards – IAS 34: Interim Financial Statements.

A copy of the Interim Financial Statements is available on the Company’s website at www.libertygold.ca or on SEDAR at www.sedar.com.

The information in the tables below is presented in $000s, except ‘per share’ data:

[1] See press release dated September 11, 2023

[2] See press release dated September 5, 2023

[3] See press release dated November 8, 2023

[4] See press release dated September 6, 2023

[5] See press release dated September 5, 2023

[6] See press release dated September 7, 2023

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates and timing of preliminary economic assessments (“PEAs”) or pre-feasibility studies; sufficiency of funds to meet exploration expenditure commitments through to the end of 2023; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, timing or results of the publication of any mineral resources, PEA or pre-feasibility study, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources ,PEAs or pre-feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold Announces Leadership Transition

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the “Company”) today announces a leadership transition with the re-appointment of Cal Everett as CEO and the promotion of Dr. Jon Gilligan to the role of President and COO effective Friday, November 10. These appointments followed the receipt of notice of resignation of Jason Attew, President and CEO, who will be joining Osisko Gold Royalties Ltd. as President and Chief Executive Officer.

Cal Everett, the former President and CEO of Liberty Gold, will remain a Director. Mr. Everett, previously held the CEO position for over 5 years, is well-acquainted with the Company's operations and is excited to once again advance the development of the Company’s Black Pine and Goldstrike projects.

Dr. Gilligan, who currently serves as Chief Operating Officer, brings a wealth of technical expertise and leadership experience, as well as in-depth knowledge of the Company’s assets, to his new expanded role.

Mr. Rob Pease, Chairman of Liberty Gold, commented on the transition, saying, “We are excited to welcome Cal back into the CEO and Director role, and we have the utmost confidence in his ability and passion to lead the Company forward. Jon's appointment as President and COO further strengthens our executive team, and we are very pleased to have Cal and Jon leading the charge on the Black Pine prefeasibility studies and future exploration."

Mr. Cal Everett expressed his enthusiasm for the Company's future, "I am excited to rejoin the Company as CEO and work closely with Jon as we guide the Company. Together, we are dedicated to advancing our projects and maximizing the potential of our assets. We will focus on capital markets business development, raising capital, completion of prefeasibility studies, permitting and exploration testing of newly acquired ground."

Dr. Jon Gilligan stated, “I’m enthusiastic about this opportunity and the future of the Company. Black Pine is a remarkable asset with tremendous exploration potential. We are working hard toward the delivery of a prefeasibility study with robust economic metrics.”

The Board of Directors is confident in this leadership team and their ability to drive the Company's continued success and growth with an aggressive project wide approach.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, the potential size of the mineralized zone, the proposed timing of exploration and development plans, the expansion and future resource growth expected at Black Pine, expected capital costs at Black Pine, expected gold recoveries from the Black Pine mineralized material, the potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for future additions to the current mineral resource estimate, the 2023 work program and the results thereof, the timing and results of any resource updates and the planned development work at Black Pine. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any prefeasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

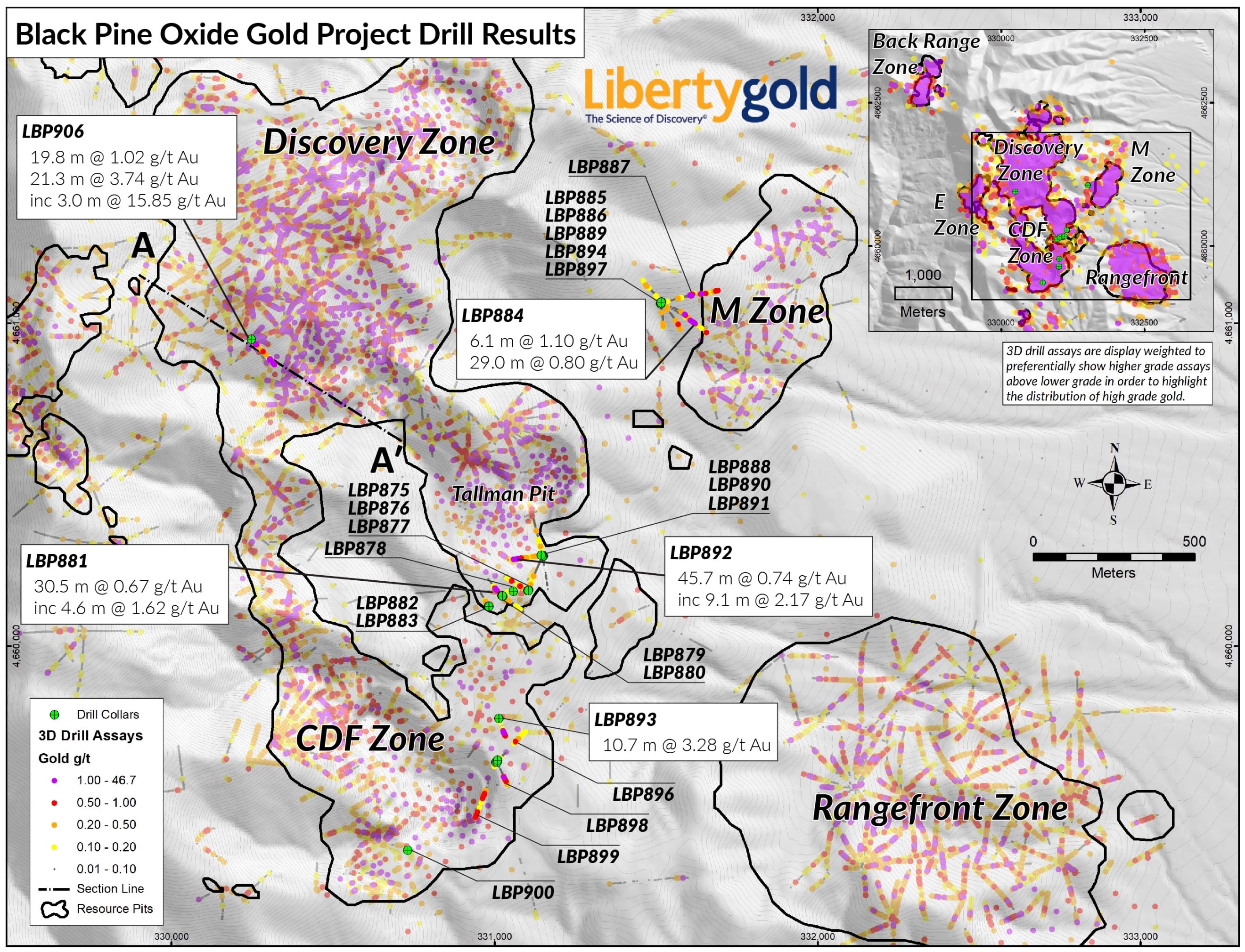

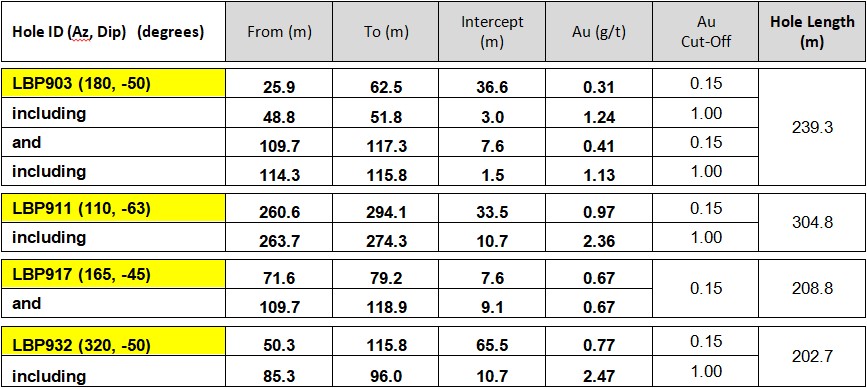

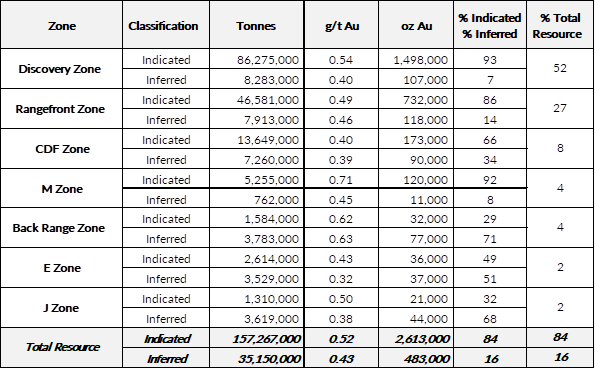

Liberty Gold Reports Additional Drill Results at the Black Pine Oxide Gold Project, Idaho

0.42 g/t Au over 68.6 m including 1.08 g/t Au over 3.0 m at Back Range Zone

0.50 g/t Au over 32.0 m including 1.26 g/t Au over 3.0 m at Rangefront Zone

0.63 g/t Au over 18.3 m including 1.24 g/t Au over 6.1 m at M Zone

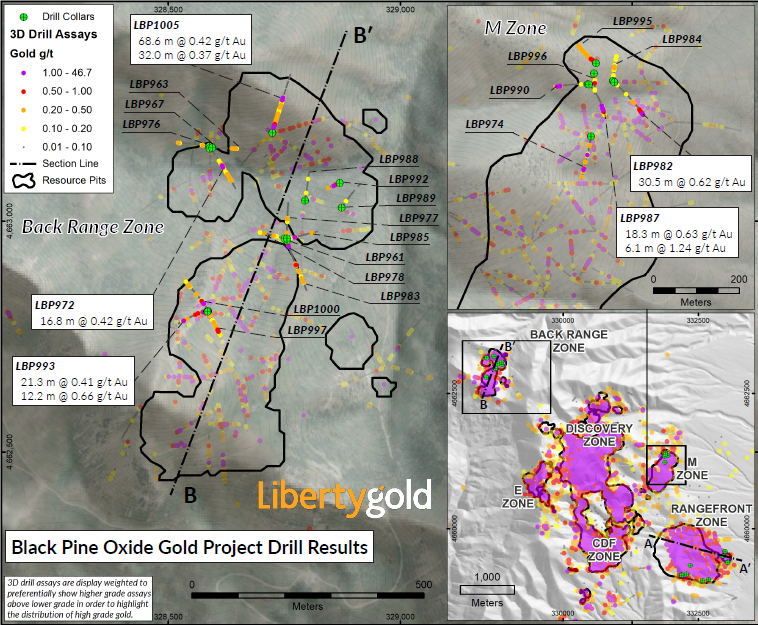

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the “Company”) is pleased to report additional assay results from the reverse circulation (“RC”) exploration drill program at its Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho. Results released herein are from 39 drill holes, located in the Back Range Zone, Rangefront Zone and M Zone areas.

Jason Attew, President and CEO of Liberty Gold commented, “We are very pleased with these assay results as they highlight the size and continuity of the oxide gold mineralizing system at Black Pine and confirm our views on tremendous growth potential for the deposit. We are further encouraged as the majority of these holes demonstrate mineralization at or near surface which was consistent with the design of our 2023 drilling program. These results should have a positive impact on the economics of the pending pre-feasibility study in 2024.”

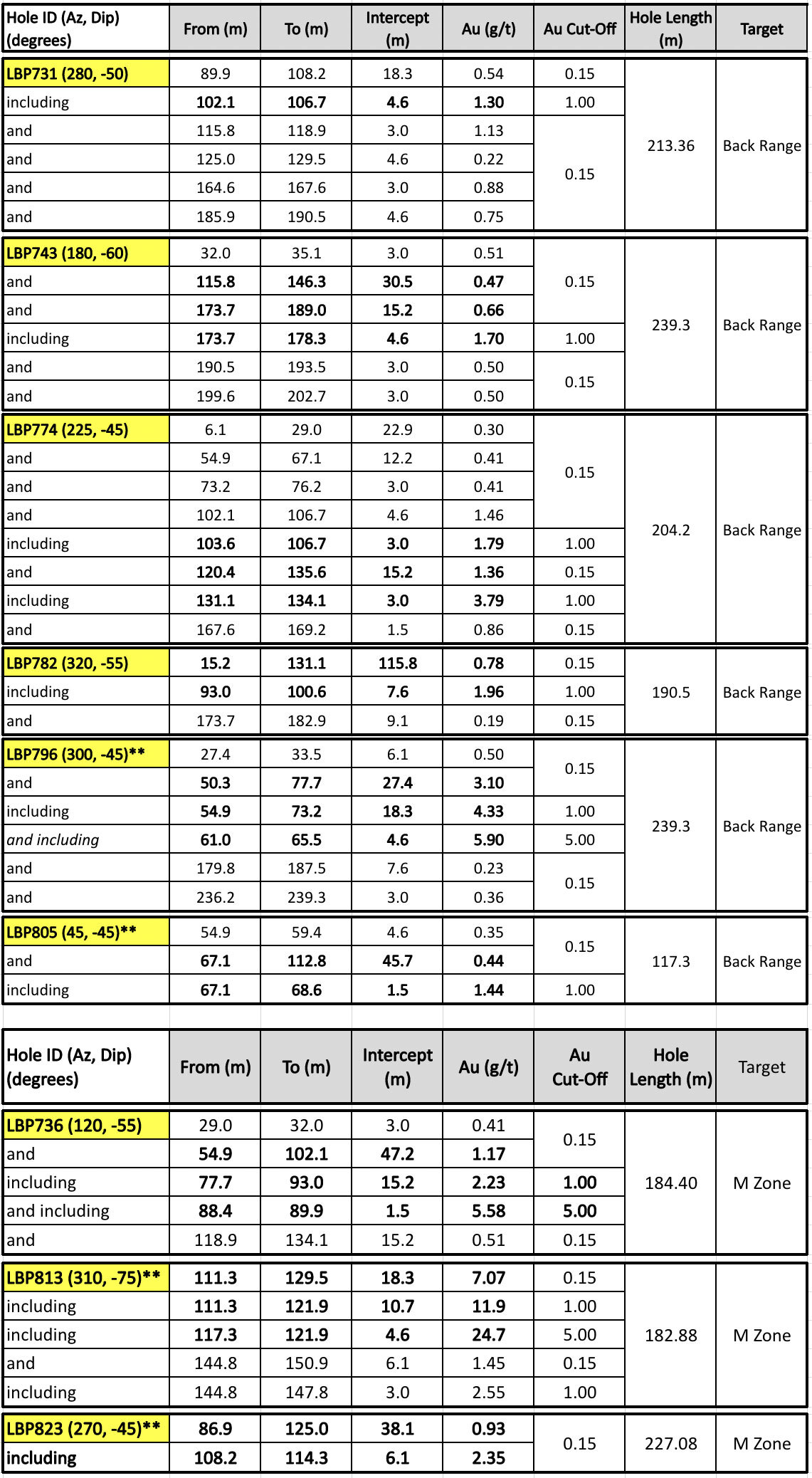

BACK RANGE ZONE HIGHLIGHTS:

Drill results from 16 additional RC drill holes completed in the Back Range Zone have been received with results confirming the known mineralization and opening up potential new zones of mineralization to the north and west. Notably a thick zone of mineralization defined by hole LBP1005 begins at surface and extends down to 100 metres (“m”) depth. This is the northernmost hole drilled in the Back Range Zone and this new zone of mineralization is open for extension and expansion through additional drill testing in 2024.

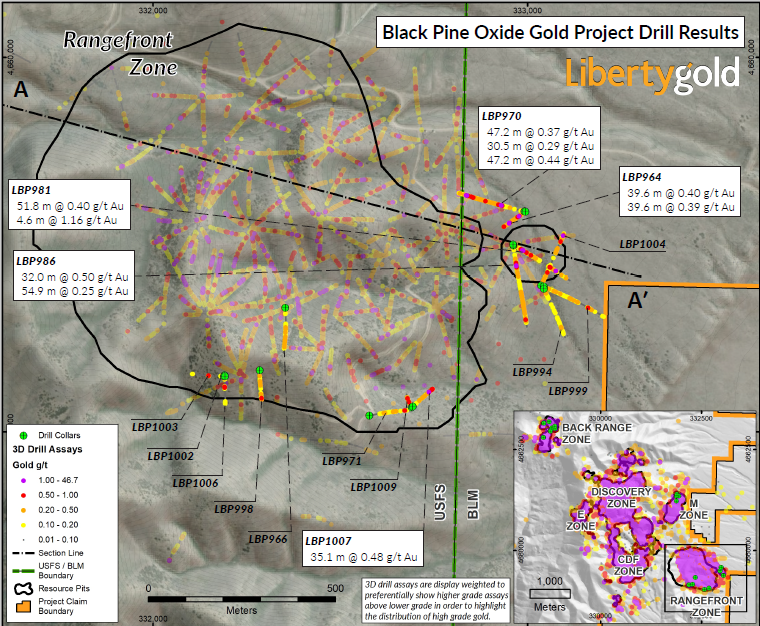

Figure 1: Back Range Zone and M Zone Drill Hole Locations

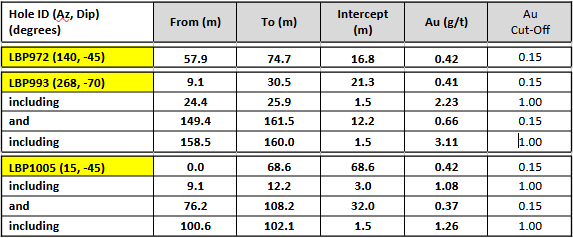

BACK RANGE ZONE DRILL HIGHLIGHT TABLE*

* Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Some intercepts have zones of reduced cyanide solubility, please refer to the full table at the link above for complete results. Gold grades are uncapped. Au (g/t) = grams per tonne of gold.

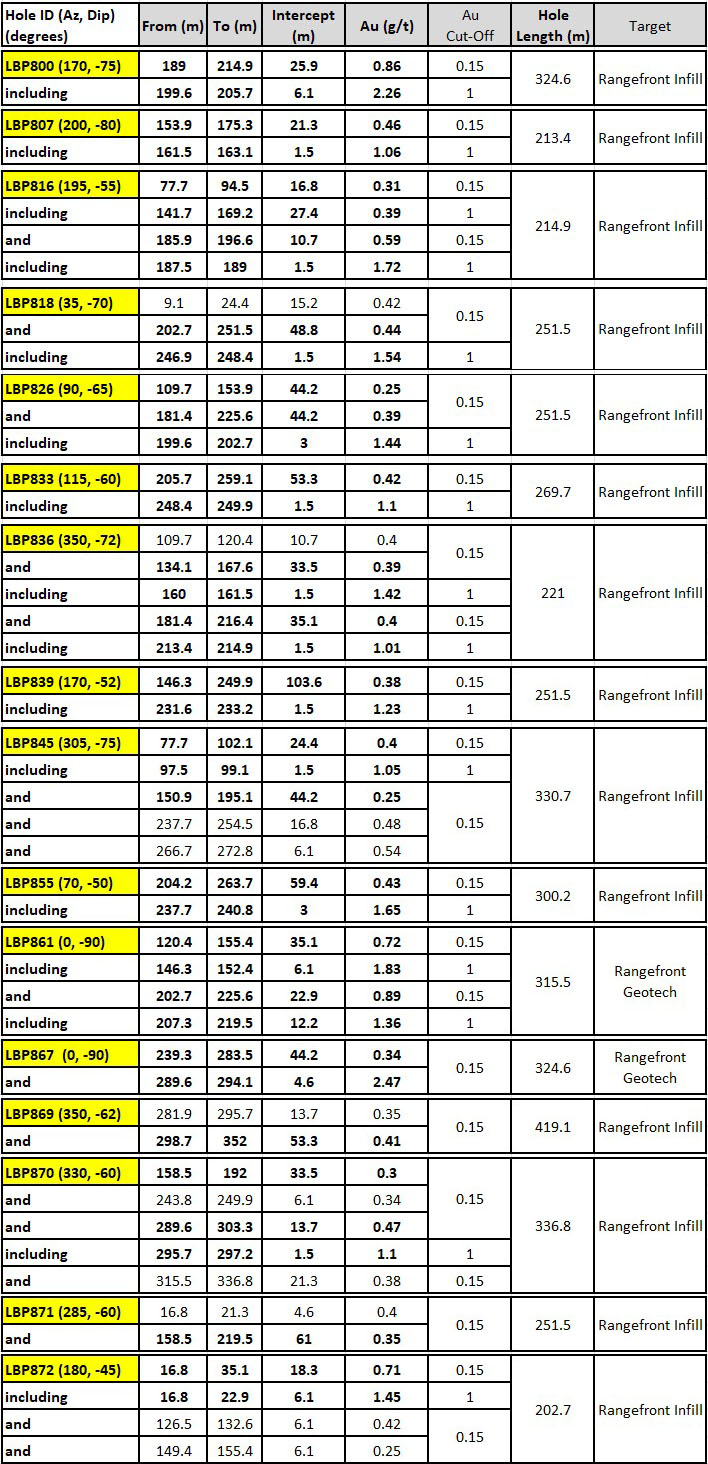

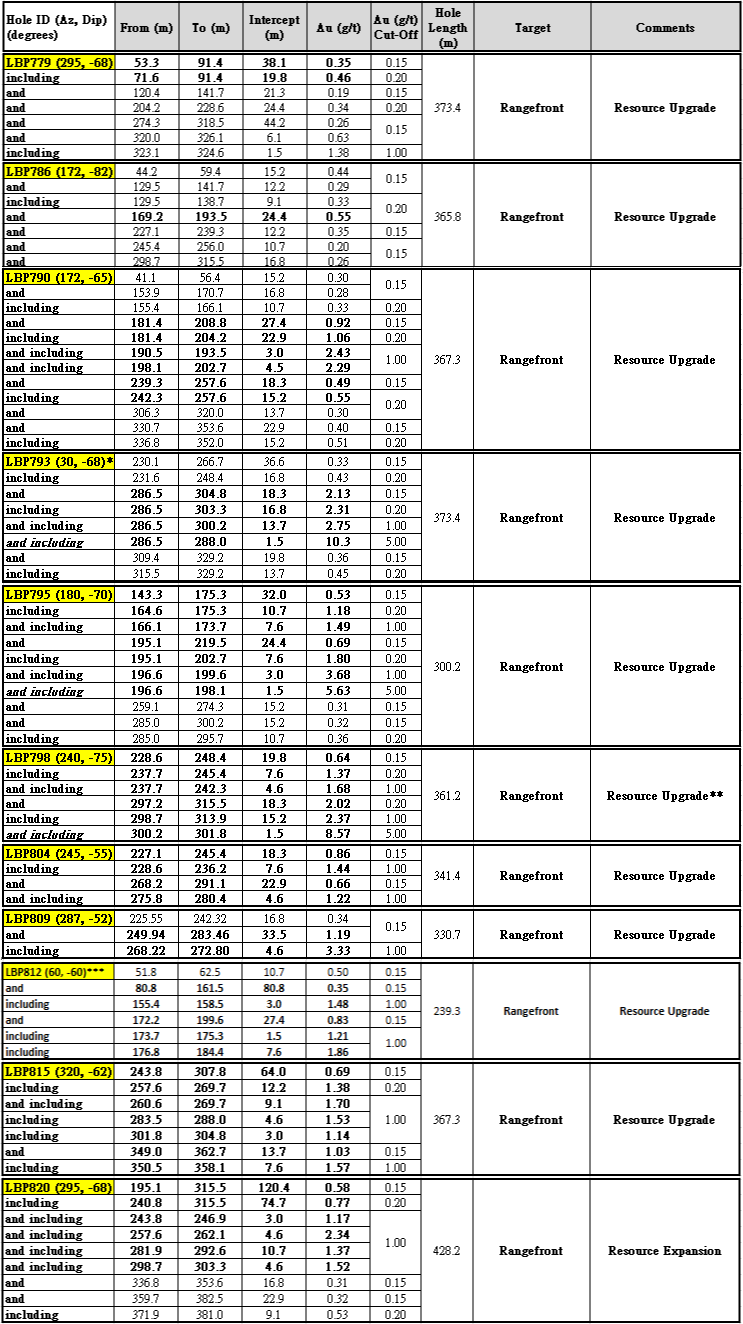

RANGEFRONT ZONE HIGHLIGHTS:

Drill results from 15 additional RC drill holes completed in the Rangefront Zone have been received with results confirming that the newly discovered extension to high-grade mineralization shows strong lateral continuity over a large area. These in-fill holes were drilled to convert currently classified inferred resource blocks to indicated resource blocks and to further define the thick, near surface zones of oxide gold mineralization discovered on the eastern margin of the Rangefront Zone earlier in the year (see press release dated September 7, 2023). This area remains open and is a key target for the next phase of resource expansion drilling in 2024.

Figure 2: Rangefront Zone Drill Hole Locations

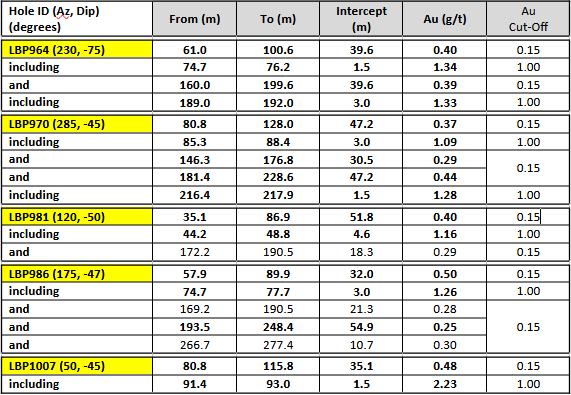

RANGEFRONT ZONE DRILL HIGHLIGHT TABLE*

* Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Some intercepts have zones of reduced cyanide solubility, please refer to the full table at the link above for complete results. Gold grades are uncapped. Au (g/t) = grams per tonne of gold.

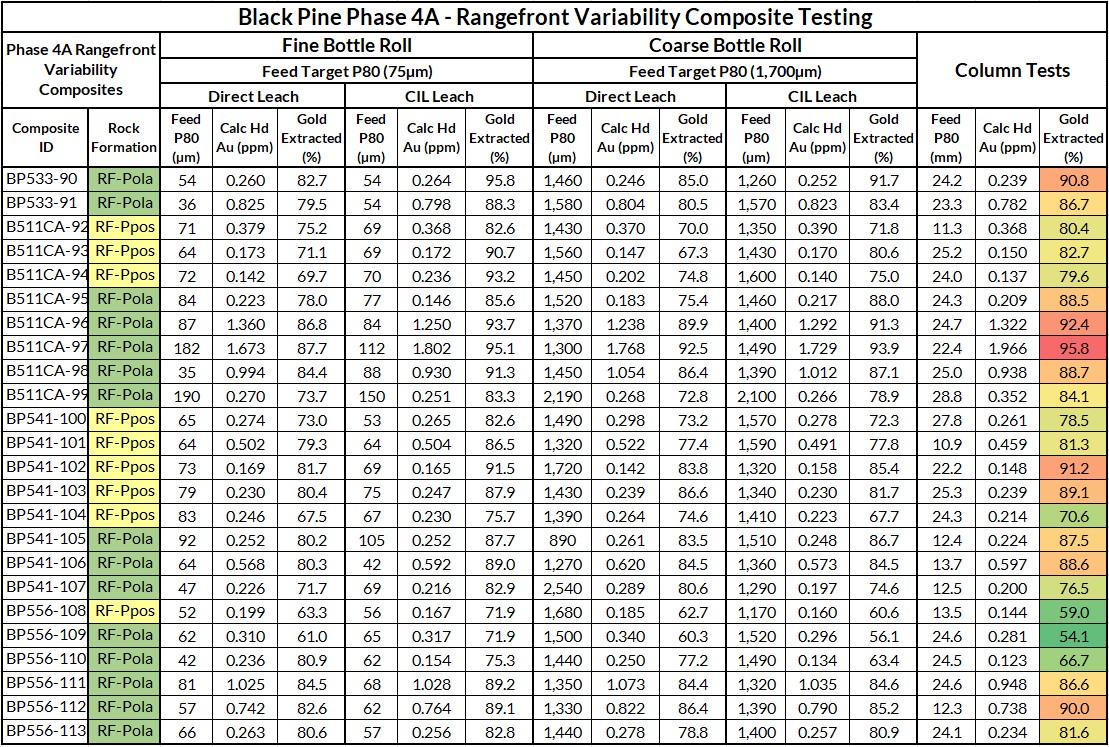

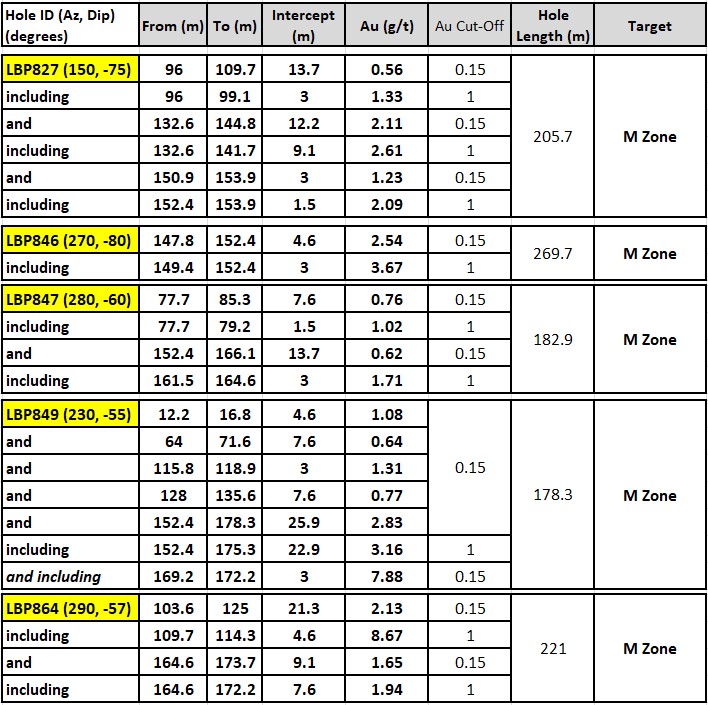

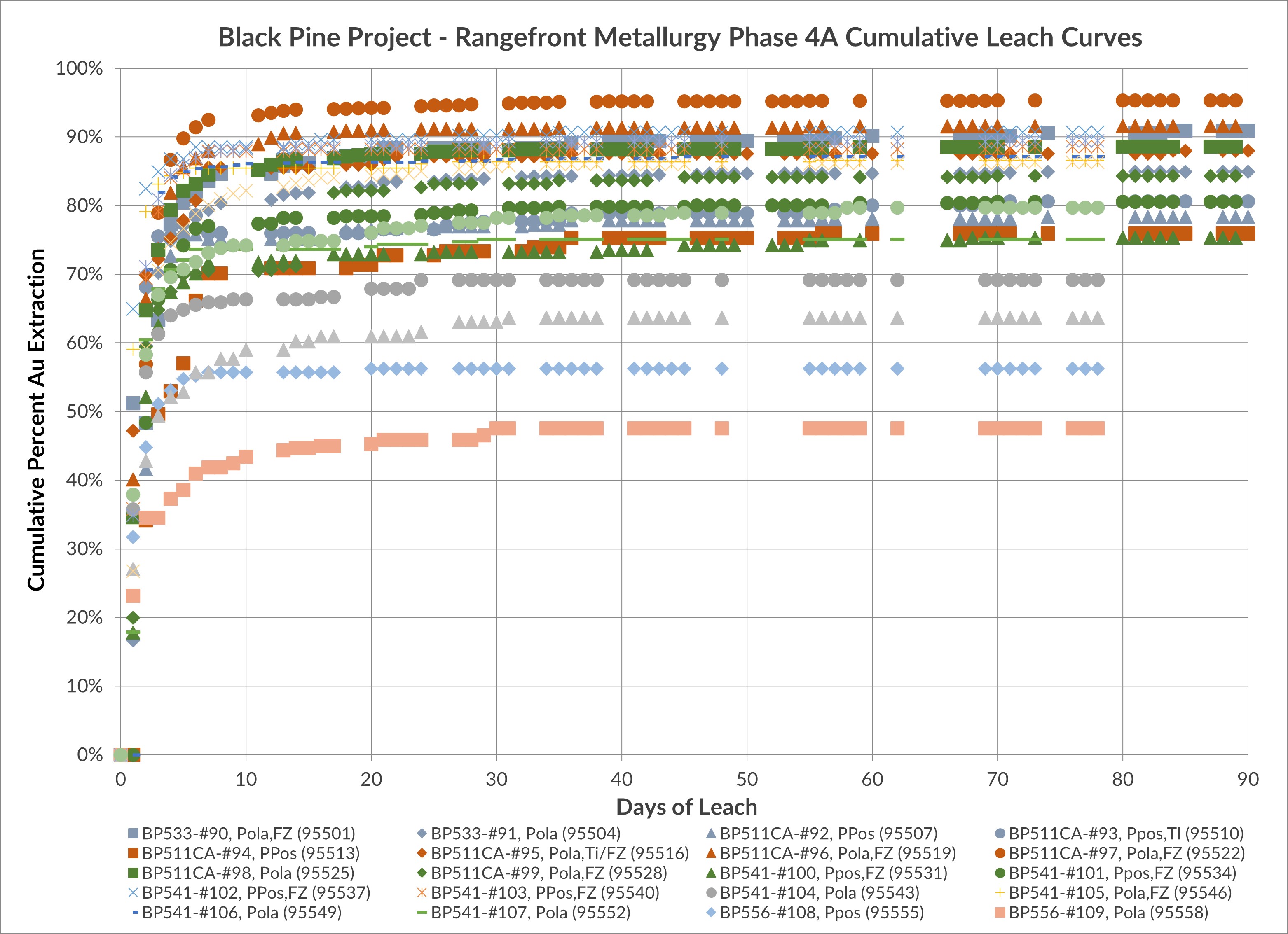

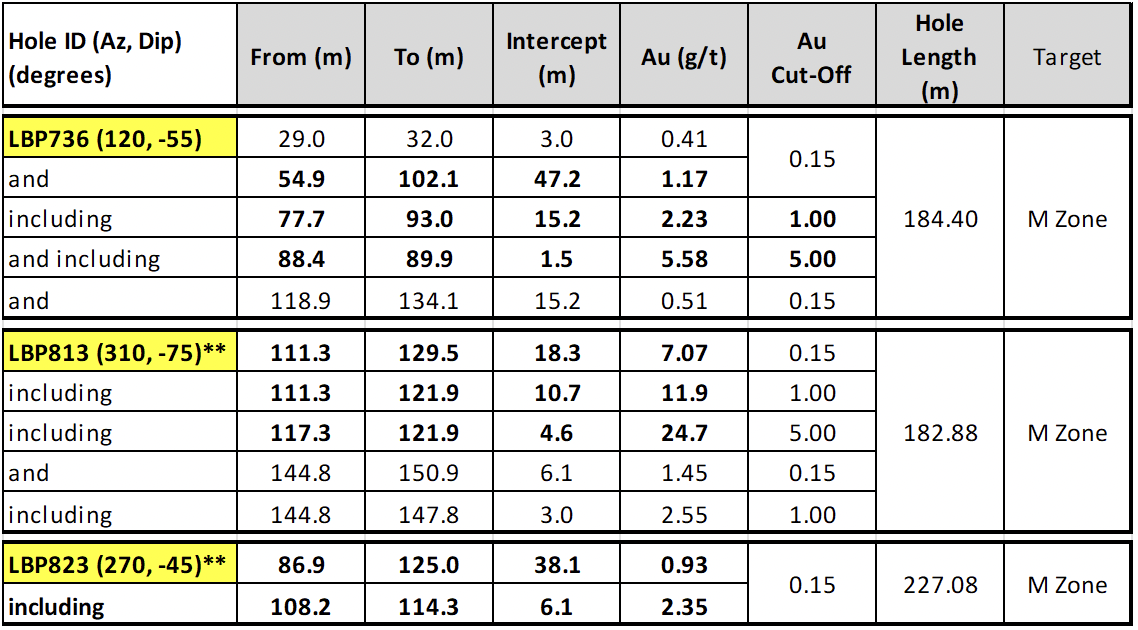

M ZONE HIGHLIGHTS:

Drill results for an additional 8 holes drilled in the M Zone have been received. Holes were drilled for infill/resource conversion and to expand mineralization adjacent to the two new discoveries made in the M Zone earlier in the year (see press release dated February 21, 2023); two holes were drilled as RC pre-collars for metallurgical core holes. These results now confirm that the M Zone mineralization has a minimum footprint of 800 m long by 400 m wide and remains open to the north and west. Mineralization continues to exhibit gold grades above the resource average, which combined with its location close to a preferred site for a future heap leach pad, make the M Zone a strong candidate for early metal production in a future oxide gold mining operation. For a map showing the location of M Zone Drill Hole Highlights, refer to Figure 1 above.

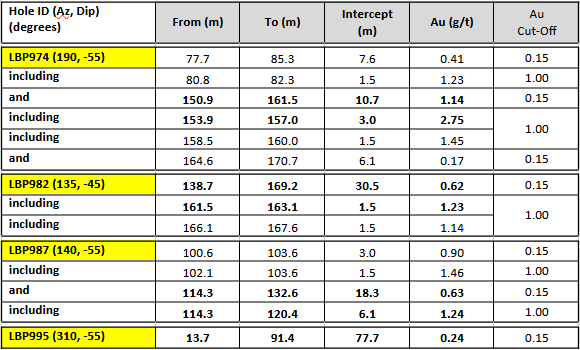

M ZONE DRILL HIGHLIGHT TABLE*

* Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Some intercepts have zones of reduced cyanide solubility, please refer to the full table at the link above for complete results. Gold grades are uncapped. Au (g/t) = grams per tonne of gold.

For the maps and cross sections showing locations of drill holes in this release click here.

For a table showing complete drill results for the current release click here.

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.15 g/t Au. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30% and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 50% to 90% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t Au were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.10 parts per million an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. All holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab listed on the scope of accreditation.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, the potential size of the mineralized zone, the proposed timing of exploration and development plans, the expansion and future resource growth expected at Black Pine, expected capital costs at Black Pine, expected gold recoveries from the Black Pine mineralized material, the potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for future additions to the current mineral resource estimate, the 2023 work program and the results thereof, the timing and results of any resource updates, pre-feasibility study and the planned development work at Black Pine. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any updated resources; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Cautionary Note for United States Investors

The information in this news release, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “probable mineral reserves”. Shareholders in the United States are advised that, while such terms are defined in and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

Liberty Gold Announces Closing of Royalty Transactions and US$5.7 Million Private Placement and Welcomes Wheaton Precious Metals as a Strategic Shareholder

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the “Company”) is pleased to announce the successful completion of the previously announced (see press release dated September 11, 2023) purchase and resale of a 0.5% Net Smelter Royalty (“NSR”) on the Company’s Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho transactions (the “Royalty Transactions”) as well as the closing of the non-brokered private placement raising proceeds of US$5.7 million (the “Offering”).

ROYALTY TRANSACTIONS

The Company has acquired the existing 0.5% NSR from a private company on certain claims at Black Pine by delivering US$3.5 million in cash consideration and 200,000 common shares of the Company. Concurrently, the Company has granted an affiliate of Wheaton Precious Metals Corp.(“Wheaton”) a new 0.5% NSR (the “Royalty”) covering all claims comprising Black Pine for which the Company has received cash consideration of US$3.6 million. The Company has been granted an option to repurchase 50% of the Royalty for US$3.6 million at any point in time up to the earlier of commercial production at Black Pine or January 1, 2030. An affiliate of Wheaton has also been granted a Right of First Refusal on any royalties, streams or pre-pays that include precious metals pertaining to Black Pine.

PRIVATE PLACEMENT FINANCING

Under the Offering, the Company sold 22.9 million shares at C$0.34 per share for proceeds to the Company of US$5.7 million. Wheaton subscribed to US$5 million of the Offering and existing shareholders, management and directors of the Company subscribed to US$0.7 million of the Offering.

The Company intends to use the proceeds of the Offering for exploration, development, economic studies and permitting programs for the Company's projects in the Great Basin and for general working capital.

Certain directors, management and insiders of the Company (collectively, the “Interested Persons”) purchased or acquired direction and control over an aggregate of 558,820 common shares under the Offering. The Interested Persons are each considered a “related party” of Liberty Gold and the sale of common shares under the Offering to the Interested Persons constitutes a “related party transaction” within the meaning of MI 61-101 – Protection of Minority Security Holders in Special Transactions.

The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S.

Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor will there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the timing and success of future plans and objectives in the areas of sustainable development, health, safety, environment, community development; successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Liberty Gold Announces Purchase and Resale of Black Pine Royalty Interest and US$5.7 Million Private Placement Financing with Strategic Investment from Wheaton Precious Metal

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the “Company”) is pleased to report that it has reached agreements on a series of transactions that will provide a future option to reduce the royalty interest from the current 0.5% Net Smelter Royalty (“NSR”) to a 0.25% NSR at the Company’s Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho on attractive financial terms. The Company is also pleased to announce a non-brokered private placement raising proceeds of up to US$5.7 million, anchored by a US$5 million strategic investment by Wheaton Precious Metals Corp. (“Wheaton”).

Jason Attew, President and CEO of Liberty Gold commented, “It is a rare occasion to have an opportunity to reduce the royalty interest of a mining project, particularly one as high quality and favourably located as Black Pine. This option further de-risks the future development of Black Pine and would result in more of the project economics being attributable to Liberty Gold’s shareholders. The Company is also pleased to welcome Wheaton to its share register and is thankful for the endorsement of Black Pine and Liberty Gold by Wheaton that these transactions represent.”

PURCHASE AND RESALE OF ROYALTY

The Company has reached an agreement to purchase the existing 0.5% NSR from a private company on certain claims at Black Pine for US$3.5 million in cash consideration and 200,000 common shares of the Company. The 0.5% NSR was part of the consideration paid when Liberty Gold acquired Black Pine back in 2016.

Concurrently, the Company has reached an agreement to grant an affiliate of Wheaton a new 0.5% NSR (the “Royalty”) for cash consideration of US$3.6 million covering all claims comprising Black Pine. As part of this transaction, the Company has been granted an option to repurchase 50% of the Royalty for US$3.6 million at any point in time up to the earlier of commercial production at Black Pine or January 1, 2030. An affiliate of Wheaton will also be granted a Right of First Refusal on any royalties, streams or pre-pays that include precious metals pertaining to Black Pine in the future.

PRIVATE PLACEMENT FINANCING

In addition, the Company is pleased to announce a non-brokered private placement of up to 22.9 million shares at C$0.34 per share for proceeds to the Company of up to US$5.7 million (the “Offering”). Wheaton has agreed to subscribe for US$5 million of the offering with existing shareholders, management and directors of the Company subscribing for up to US$0.7 million of the Offering.

The proceeds of the Offering will be used for exploration, development, economic studies and permitting programs for the Company's projects in the Great Basin and for general working capital.

The Offering and royalty transactions are scheduled to close on or about September 15, 2023, and are subject to a number of conditions including, but not limited to, receipt of all necessary approvals including the approval of the Toronto Stock Exchange and applicable securities regulatory authorities.

Certain directors, management, and insiders of the Company (collectively, the “Interested Persons”) are expected to purchase or acquire direction and control over an aggregate of 558,820 common shares under the Offering. The Interested Persons are each considered a “related party” of Liberty Gold and the sale of common shares under the Offering to the Interested Persons constitutes a “related party transaction” within the meaning of MI 61-101 – Protection of Minority Security Holders in Special Transactions.

The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor will there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, the potential size of the mineralized zone, the proposed timing of exploration and development plans, the expansion and future resource growth expected at Black Pine, expected capital costs at Black Pine, expected gold recoveries from the Black Pine mineralized material, the potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for future additions to the current mineral resource estimate, the 2023 work program and the results thereof, the timing and results of any resource updates and the planned development work at Black Pine. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any updated resources; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Cautionary Note for United States Investors

The information in this news release, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “probable mineral reserves”. Shareholders in the United States are advised that, while such terms are defined in and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

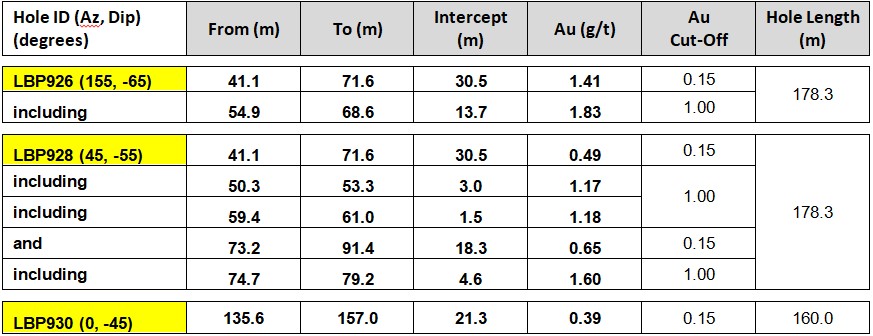

Liberty Gold Reports Additional Drill Results from the Rangefront Zone, Black Pine Oxide Gold Project, Idaho

0.61 g/t Au over 76.2 m including 2.47 g/t Au over 12.2 m

0.45 g/t Au over 73.2 m including 1.50 g/t Au over 3.0 m

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report the latest assay results from an additional 8 holes drilled in the Rangefront Zone with most holes focused on the eastern margin of the known deposit area. These results are part of the 2023 Reverse Circulation (“RC”) drill exploration program at its Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho.

RANGEFRONT ZONE HIGHLIGHTS:

-

0.61 grams per tonne (“g/t”) gold (“Au”) over 76.2 meters (“m”), including 2.47 g/t Au over 12.2 m in hole LBP941.

-

0.45 g/t Au over 73.2 m, including 1.50 g/t Au over 3.0 m in hole LBP954.

Drill results from 8 additional RC drill holes completed in the Rangefront Zone have been received with results showing the known mineralization continues to the east and becomes thicker with better grades than blocks in the current resource model. These holes were drilled on the eastern margin of the resource area and were planned to test for extensions to the modeled mineralization and to convert inferred resource blocks to indicated resource blocks as the area had only been sparsely tested with shallow historic drilling.

This drilling shows a large area of oxide mineralization, that is predominantly outside of the current pit constrained resource and is still open for expansion to the north and south. This area is roughly 200 m x 200 m in plan view and extends from near surface to a depth of about 200 meters. The area to the east is unconstrained by any drilling and the area to the south has only been tested by shallow historic drilling.

This new drilling pushes the known extents of mineralization at the Rangefront Zone to an area roughly 1000 m x 1000 m with room to grow the deposit to the east, north and south.

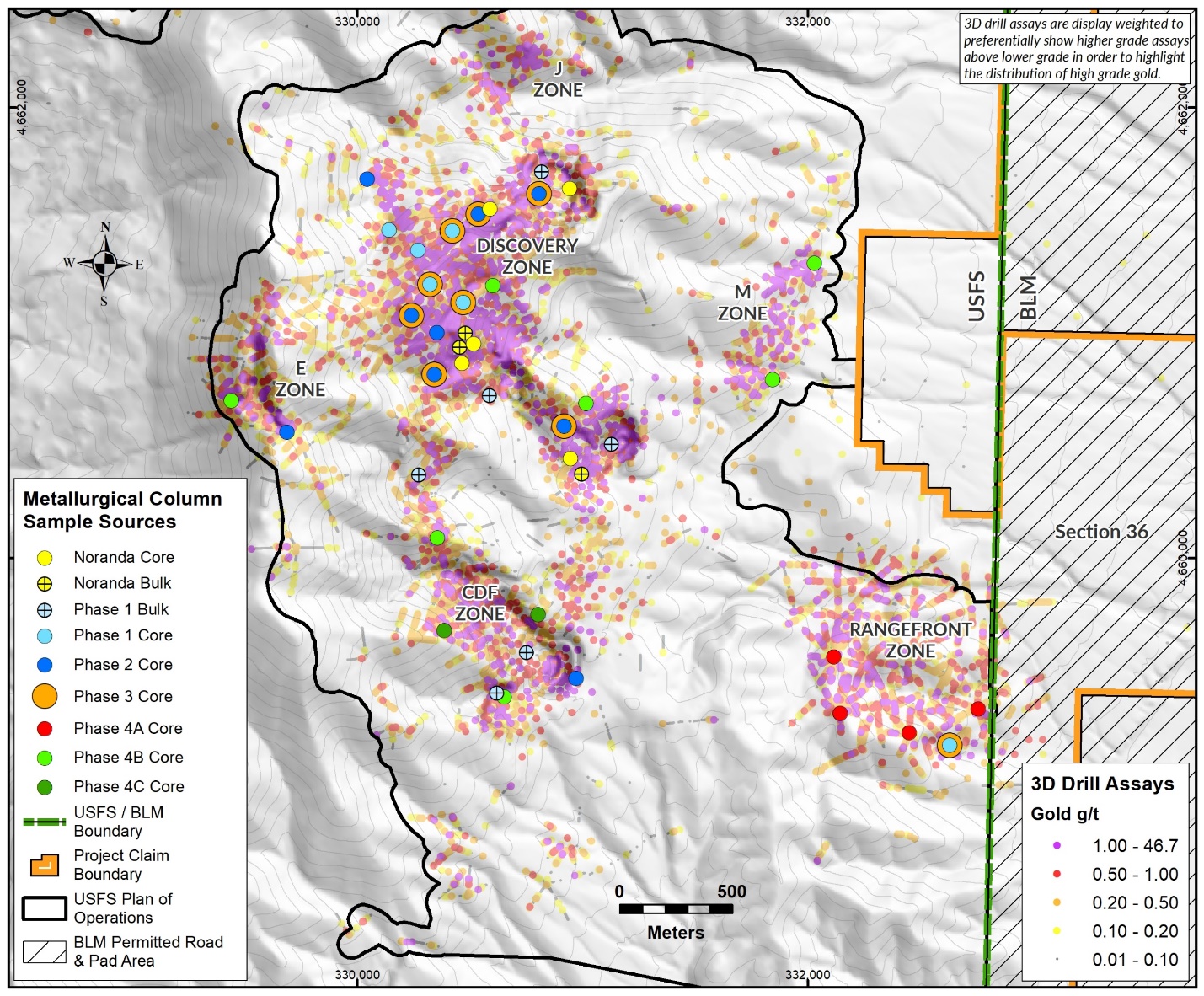

Figure 1: Rangefront Zone, Black Pine Oxide Gold Project

Jason Attew, President and CEO of Liberty Gold commented, “These new drill results from Rangefront highlight the ongoing discovery potential at Black Pine, we know when we see these thick, oxide mineralized zones that they can continue for quite some distance, and we look forward to additional drill testing in this area with the goal of expanding the existing resource pit substantially.”

RANGEFRONT ZONE HIGHLIGHT TABLE*

*Please refer to the full table at the link above for complete results. Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Gold grades are uncapped. Au (g/t) = grams per tonne of gold.

RANGEFRONT ZONE KEY POINTS

-

The eastern margin of Rangefront continues to show strong oxide mineralization that will be included in the resource estimate update to begin later this year.

-

Stronger grades and thickness of mineralization indicate that the preferential host rocks are increasing in thickness to the east.

-

Mineralization begins at or near surface in bedrock that is covered by a thin layer of post-mineral alluvium.

-

Newly discovered mineralization in the eastern margin of Rangefront is all oxide and above the water table.

For a map and cross section showing locations of drill holes in this release click here.

For a table showing complete drill results for the current release click here.

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.15 g/t Au. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30% and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 50% to 90% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t Au were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.10 parts per million an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. All holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab listed on the scope of accreditation.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, the potential size of the mineralized zone, the proposed timing of exploration and development plans, the expansion and future resource growth expected at Black Pine, expected capital costs at Black Pine, expected gold recoveries from the Black Pine mineralized material, the potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for future additions to the current mineral resource estimate, the 2023 work program and the results thereof, the timing and results of any resource updates and the planned development work at Black Pine. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any updated resources; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Cautionary Note for United States Investors

The information in this news release, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “probable mineral reserves”. Shareholders in the United States are advised that, while such terms are defined in and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

Liberty Gold Advances Black Pine Oxide Gold Project with the Submission of a Mining Pre-Plan of Operations to US Federal Agencies and the Selection of a Lead Engineer for the Pre-Feasibility Study

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the “Company”) is pleased to announce a significant milestone in the development of its Black Pine Project, located in Cassia and Oneida counties, Idaho. Pilot Gold (USA) Inc., a wholly owned subsidiary of Liberty Gold Corp., has prepared and submitted the mining Pre-Plan of Operations (“PPO”) for the Black Pine Oxide Gold Project (“Black Pine Project”), a critical step in the advancement of the project into the Federal and State permitting process and onwards, towards production.

The Black Pine deposit is situated approximately 5 miles south of Juniper, Idaho, within the United States Forest Service (“USFS”) Sawtooth National Forest and on adjacent lands administered by the U.S. Bureau of Land Management (“BLM”) from the Pocatello Field Office. The project encompasses a largely contiguous block of 622 unpatented federal lode claims, state minerals, and private properties hosting a multi-million ounce oxide gold mineral resource. Liberty Gold has been exploring the project since acquisition in 2016 and recently completed the major milestone of one thousand exploration holes drilled by the Company on the property. (See press release dated September 5, 2023)

Liberty Gold is dedicated to responsible, sustainable exploration and mining practices and has embarked on a comprehensive process of planning, engineering, and permitting in close collaboration with regulatory agencies to ensure environmentally sound and sustainable operations. The Company’s second annual ESG report was recently published (see press release dated September 5, 2023). The submission of the mining Pre-Plan of Operations for the Black Pine Project to the USFS (acting as lead Federal Agency), BLM and Idaho Governor’s Office of Energy and Mineral Resources, is a further critical step in advancing the project.

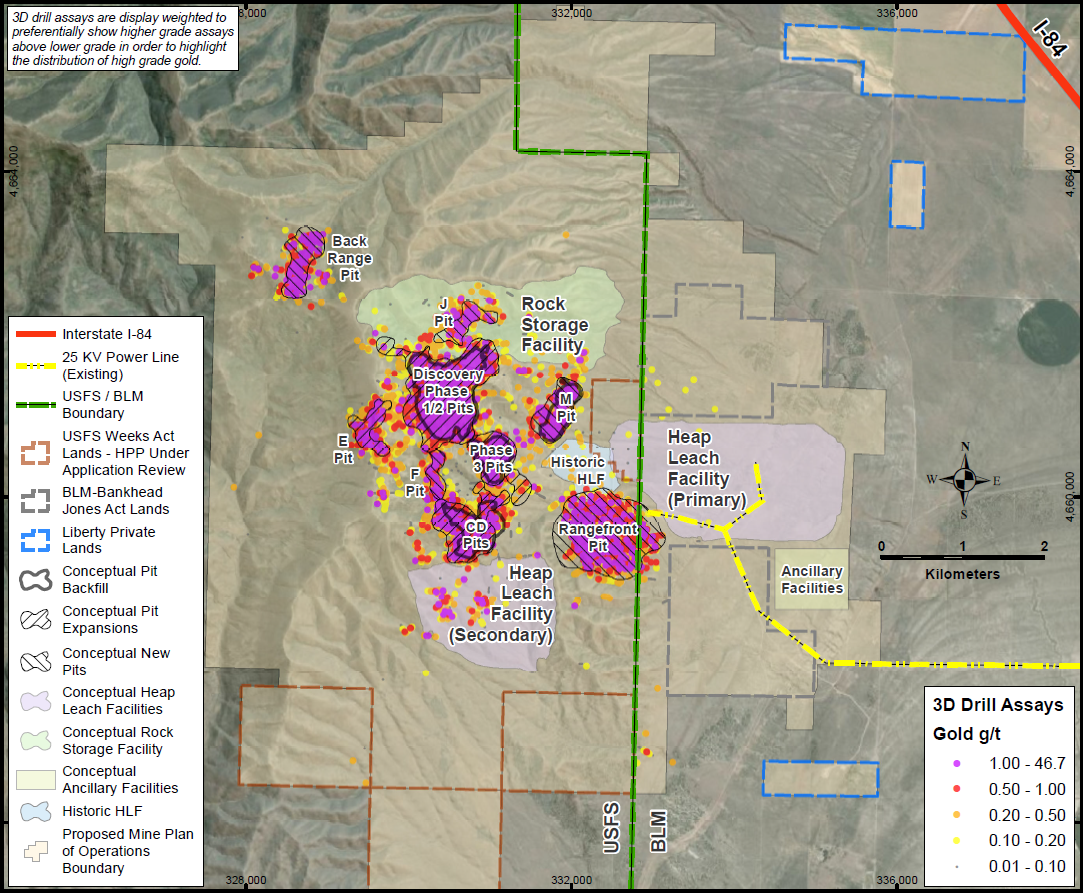

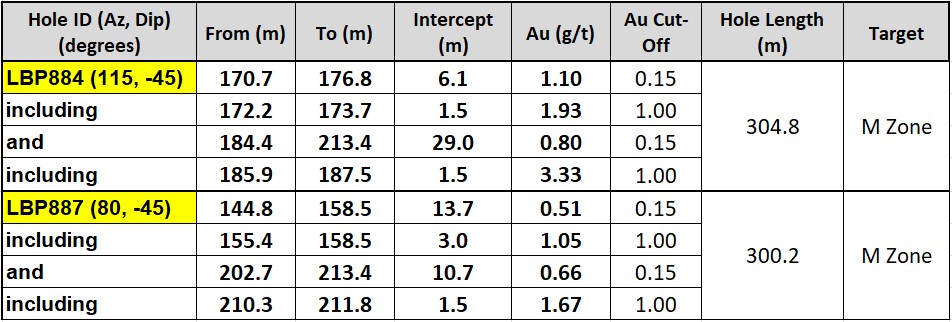

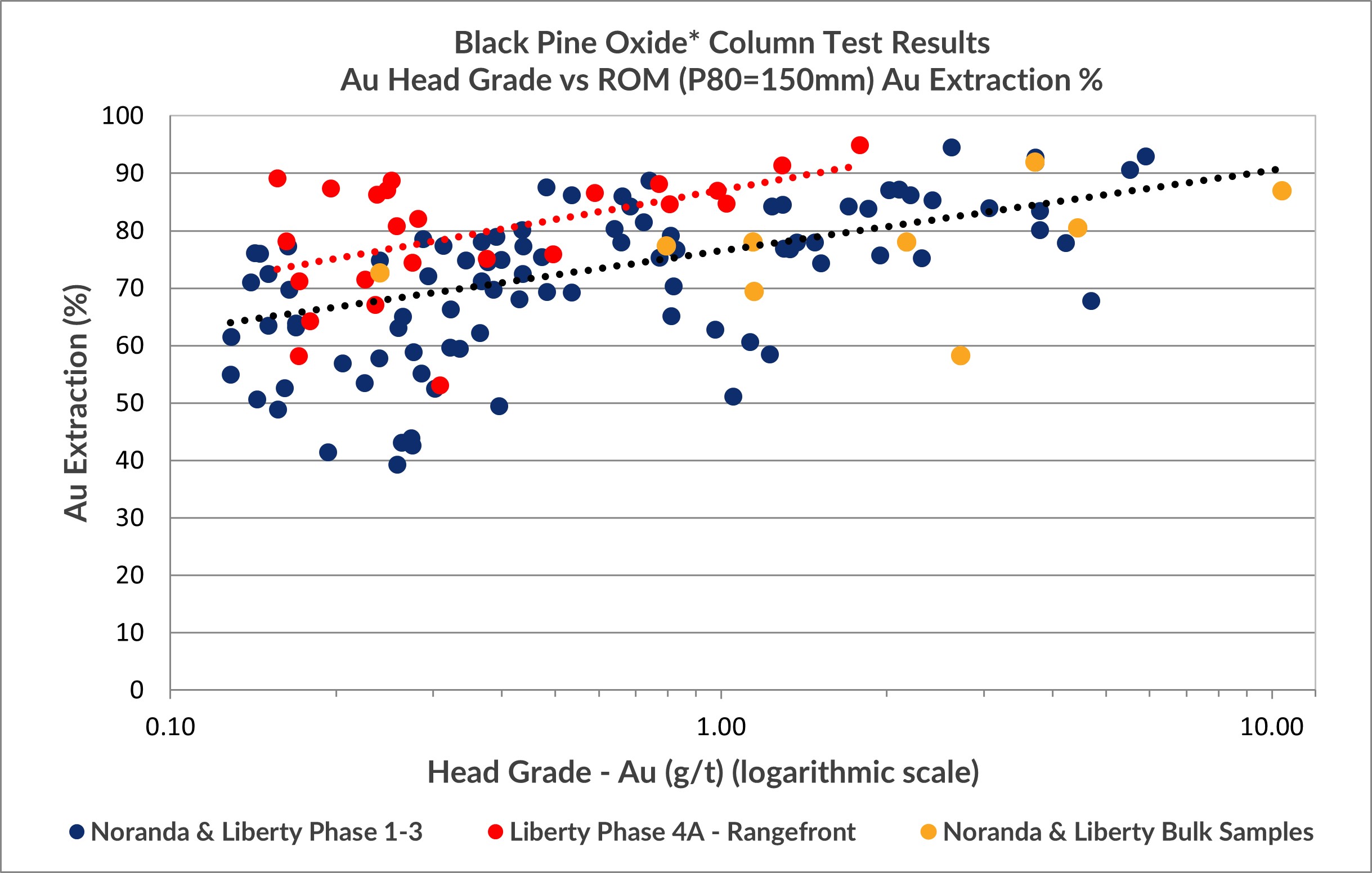

The conceptual project entails re-starting conventional open pit mining in pre-existing historical pits, expanding these pits, and developing new open pits in previously unmined areas. The extracted oxide gold mineralization would be processed using the well-established run-of-mine heap leaching method, with gold produced as dore bars on site. The Company is committed to maintaining the highest environmental standards and employing established metallurgical processes that have been used successfully at the Black Pine site and at many other mine sites.

Figure 1: Conceptual Site Layout, Black Pine Project

As part of its commitment to excellence, Liberty Gold is pleased to announce the selection of M3 Engineering, an international engineering firm with a wealth of experience in large-scale mining operations and environmental stewardship, as the Lead Engineer for the Black Pine Oxide Gold Project. The M3 Engineering team brings an impressive track record of success in designing, constructing, and overseeing multiple mining projects of a similar nature to that proposed at Black Pine, while prioritizing environmental sustainability and regulatory compliance.

"We are excited to take this significant step forward in the development of the Black Pine Project," stated Jason Attew, President and CEO of Liberty Gold. "The submission of the mining Pre-Plan of Operations reflects our dedication to responsible mining practices, our desire to engage with the regulatory authorities early in the permitting process in a transparent and inclusive manner and marks a pivotal moment in our journey towards realizing the project's full potential. We are equally thrilled to welcome M3 Engineering to our team. With their expertise and guidance, we are confident in our ability to develop and execute a world-class mining operation at Black Pine that aligns with our commitment to environmental stewardship and builds opportunity with local communities.”

Liberty Gold remains committed to collaboration with regulatory agencies, stakeholders, and local communities as the project advances to the permitting and development phases. The Company will continue to prioritize environmental studies, community engagement, and sustainable resource management as it progresses toward the formal submission of the Mine Plan of Operations expected in the second half of 2024.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the timing and success of future plans and objectives in the areas of sustainable development, health, safety, environment, community development; successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Liberty Gold Publishes Second Annual ESG Report: Developing Gold Deposits in a Responsible and Sustainable Manner

Liberty Gold Publishes Second Annual ESG Report: Developing Gold Deposits in a Responsible and Sustainable Manner

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the “Company”) is pleased to announce the release of the company’s second Environmental, Social and Governance (“ESG”) Report. The report underscores the company's commitment to environmental stewardship, social responsibility, and ethical governance as it continues to evolve and expand its operations.

"We are excited to share our progress and accomplishments in our second annual ESG Report," said Jason Attew, President and CEO of Liberty Gold. "This Report reflects our steadfast dedication to sustainability and our ongoing efforts to align our operations with the highest ESG standards. As we work towards responsible and sustainable mining operations, we remain committed to delivering long-term value to our stakeholders, protecting our environment, and making positive contributions to the communities where we operate."

The report includes both quantitative metrics and qualitative disclosures for our offices and site operations from January 1 to December 31, 2022. The report is aligned with the standards and framework of the Sustainability Accounting Standards Board (SASB). Liberty Gold will continue to report on our performance on an annual basis. As Liberty Gold continues its evolution as a mine development company, the report emphasizes the company's dedication to continual improvement and aligning with the evolving landscape of sustainability reporting standards.

Liberty Gold’s 2022 ESG Report is available for download at:

https://libertygold.ca/esg/reports.html

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the timing and success of future plans and objectives in the areas of sustainable development, health, safety, environment, community development; successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

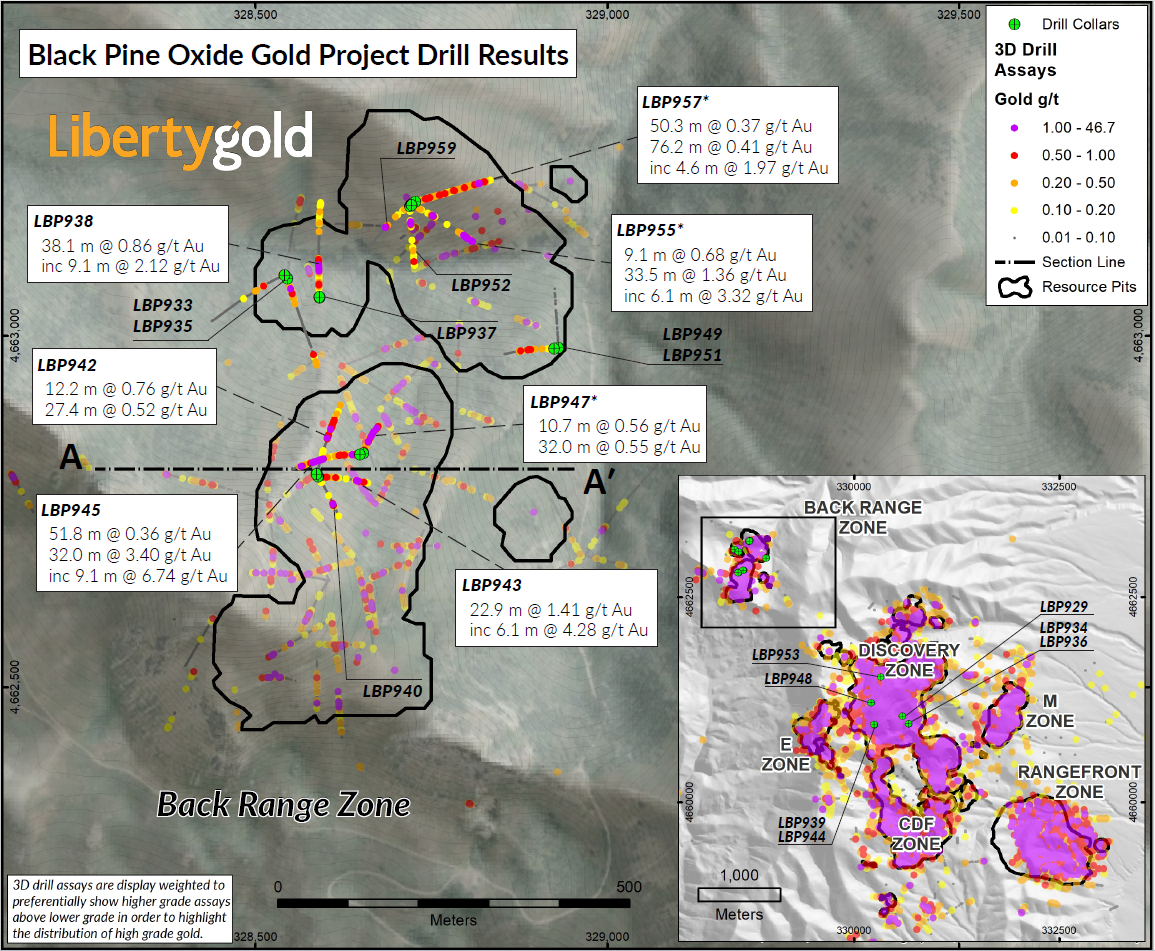

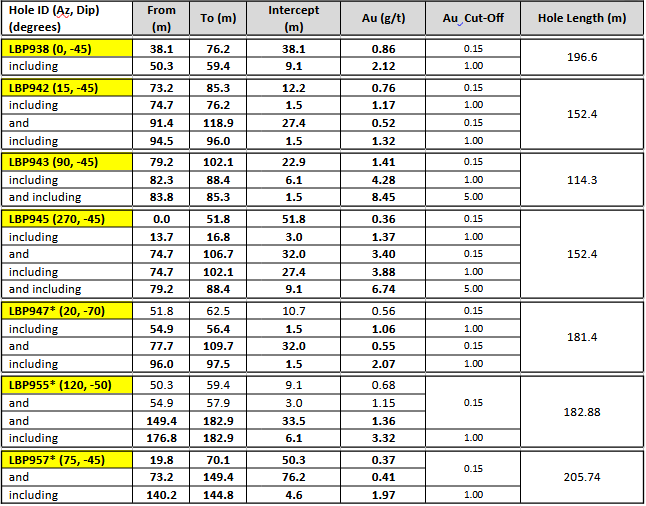

Liberty Gold Reports Additional Drill Results from the Black Pine Oxide Gold Project

3.40 g/t Au over 32.0 m including 6.74 g/t Au over 9.1 m and 1.41 g/t Au over 22.9 m including 4.28 g/t Au over 6.1 m in the Back Range Zone

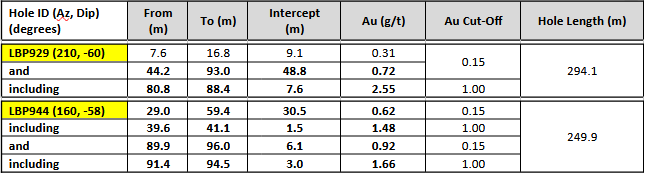

0.72 g/t Au over 48.8 m including 2.55 g/t Au over 7.6 m in the Discovery Zone

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report the latest assay results from a further 22 holes drilled in the Back Range Zone and the Discovery Zone. These results form part of the ongoing 2023 Reverse Circulation (“RC”) drill exploration program at its Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho.

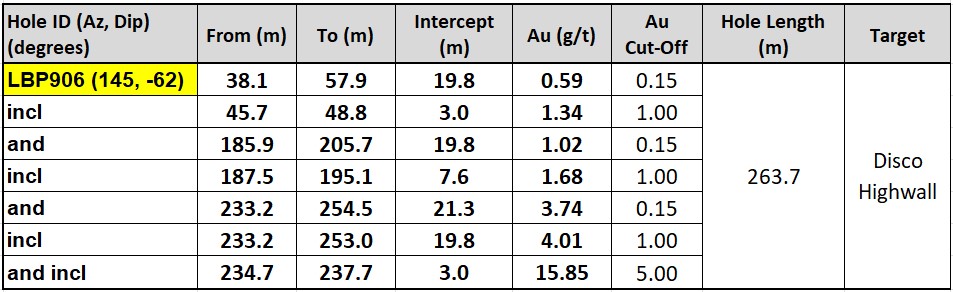

Exploration drilling continued in the third quarter with three RC rigs and one large diameter (“PQ”) core rig active in the main target areas across the project. The key focus for the 2023 program is to add high-grade, near-surface ounces to the existing resource base, collect additional variability samples for metallurgical testwork and upgrade inferred resources to the indicated category, ahead of a pre-feasibility study. Drilling is on schedule for a fourth quarter completion of the approximately 30,000 meters (“m”) planned for 2023.

BACK RANGE HIGHLIGHTS:

- 3.40 grams per tonne (“g/t”) gold (“Au”) over 32.0 m, including 6.74g/t Au over 9.1 m beginning from 74.7 m downhole in hole LBP945.

- 1.41 g/t Au over 22.9 m, including 4.28 g/t Au over 6.1 m beginning from 79.3 m downhole in hole LBP943.

Drill results are reported from 15 additional RC drill holes completed in the Back Range Zone, leaving 20 holes with pending assay results. Results clearly demonstrate the strong lateral continuity of gold mineralization at Back Range, especially within the shallow, higher-grade oxide zones. These mineralized zones form a series of stacked subhorizontal lenses dipping slightly to the north.

In particular, results for drill hole LBP945, located in the western margin of the resource area represent one of the best holes drilled to date in the Back Range Zone, with 3.40 g/t Au intercepted over 32 metres an approximate true width of 27 metres. Notably, this intercept was immediately adjacent to the 2023 Resource Pit. Mineralization along the western margin of the Back Range Zone is currently open and additional drill holes to offset the mineralization encountered in hole LBP945 have been completed with assays pending.

Drill results from the northern Back Range Zone confirm the presence of a shallow, ~130 metre thick section of lower-grade oxide gold starting approximately 20 metres below surface. This intercept is open to the north and indicates the significant potential to grow the resource laterally.

Figure 1: Location plan of Back Range Drill holes

Jason Attew, President and CEO of Liberty Gold commented, “These new drill results from Back Range highlight the ongoing growth potential for Black Pine. The Back Range Zone continues to deliver shallow, higher-grade results and remains open in at least two directions. With each new drill program, we are growing our understanding of the geologic controls on the massive gold mineralizing system at Black Pine. Liberty Gold has also recently collared hole number 1,000 at Black Pine. It is a huge accomplishment to have safely and sustainably completed that number of holes since commencing our work in 2017.”

BACKRANGE HIGHLIGHT TABLE*

*Please refer to the full table at the link below for complete results. Results are reported as drilled thicknesses, with true thicknesses approximately 50% to 90% of drilled thickness. Gold grades are uncapped. Au (g/t) = grams per tonne of gold. Back Range lies at the lowest structural level of the deposit such that carbonaceous material is frequently encountered at the base of the oxide zone leading to reduced cyanide solubility at depth.

DISCOVERY HIGHLIGHTS:

- 0.72 g/t Au over 48.8 m, including 2.55 g/t Au over 7.6 m in hole LBP929.

- 0.62 g/t Au over 30.5 m, and 0.92 g/t Au over 6.1 m in hole LBP944.