Black Pine |

Owner and operator

In June 2016, Liberty Gold acquired the Black Pine Property from Western Pacific Resource Corporation for US$800,000 cash, 300,000 shares of Liberty Gold and a 0.5% NSR reserved to Western Pacific. At the time of acquisition, the project area totaled 12,749 acres/5,159 hectares and consisted of unpatented mining claims on USFS and BLM lands, an Idaho state minerals lease, private lands, and a majority interest in private mineral rights. The main gold zone encompassing the historic Black Pine mine is not subject to seasonal closures and can be accessed year-round, weather and road conditions permitting.

As a result of the sale, Liberty Gold acquired the data for 1,874 shallow (average depth of 93 meters) historic drill holes totaling 191,500 meters, as well as over 10,000 historic surface soil and rock samples, blast hole samples, and historic mining, engineering, and permitting data.

Geology

Black Pine is underlain primarily by strata of the Pennsylvanian to Permian Oquirrh Group, which overlies Devonian and Mississippian strata on a series of low-angle normal faults. The Oquirrh Group is divided into a 300 meter thick section of “middle plate” consisting of silty/sandy carbonate rocks within a system of interleaved, low-angle thrust and normal faults, overlain by an “upper plate” consisting primarily of limey sandstone. Oxidized, finely-disseminated gold mineralization has been discovered throughout the middle plate over an area of approximately 14 km2. The highest gold grades in drilling are associated with calcareous siltstone in proximity to large listric normal faults.

Drilling

From 2016 to late 2017, Liberty Gold compiled the extensive drill database and produced a 3D model of the mineralization in historic drill holes. In late 2017, twelve reverse circulation holes were drilled from five locations. The drilling validated historical results adjacent to a historical pit and more importantly, demonstrated exceptional upside beneath the limit of shallow historical drilling1.

1See: Technical Report of the Black Pine Gold Project, Cassia County, Idaho, USA” effective July 23, 2018 and signed September 7, 2018, prepared by prepared by Michael M. Gustin, CPG, of Mine Development Associates of Reno, Nevada, Moira T. Smith, Ph.D., P.Geo., Vice President, Exploration and Geoscience, Liberty Gold and William A. Lepore, M.Sc., P.Geo., Senior Project Geologist, Liberty Gold, available on SEDAR or on the Liberty Gold website.

A new Plan of Operations, received February 2019, opened up access to the entire 14 km2 area of anomalous surface geochemistry and historic gold in drill holes for comprehensive drill testing.

In 2019, the drill program was designed for infill and validation of historical results, and to test prospective areas adjacent to and beneath historical drilling. Drilling identified two new discoveries, named D-1 and D-2, extending gold mineralization along stratigraphic and structural corridors between the historic A and B pits and the A Basin target. The results from the 2019 drill program include some of the longest and highest-grade unmined intercepts drilled by any operator on the Black Pine property.

Highlights include[2]:

At D-1 and D-2:

- 1.78 grams per tonne of gold ("g/t Au") over 47.2 m, including: 3.24 g/t Au over 22.9 m, 9.99 g/t Au over 3.0 m and 5.73 g/t Au over 1.5 m, in LBP021.

- 2.56 g/t Au over 41.1 m, including: 4.47 g/t Au over 19.8 m and 8.76 g/t Au over 4.6 m, in LBP029.

- 4.39 g/t Au over 53.3 m, including: 5.76 g/t Au over 38.1 m and 12.05 g/t Au over 12.2 m, in LBP043.

- 3.40 g/t Au over 62.5 m, including: 5.01 g/t Au over 33.5 m and 6.21 g/t Au over 21.3 m, in LBP064.

- 3.14 g/t Au over 44.2 m, including: 6.53 g/t Au over 16.8 m and 11.3 g/t Au over 7.6 m, in LBP062.

Drilling in 2020 identified new zones of mineralisation, including: 1) the D-3 zone, located immediately west of and partially under the D-1 zone; 2) an extension of the D-1 zone to the southeast; and 3) extensions to the F-zone, located approximately 1 km to the south of D-3.

Highlights from the new D-3 zone include[3]:

- 1.98 g/t Au over 33.5 m, including 3.93 g/t Au over 15.2 m, and 1.11 g/t Au over 30.5 m in LBP127.

- 1.44 g/t Au over 96.0 m, including 1.95 g/t Au over 32.0 m and including 5.31 g/t Au over 1.5 m and 1.86 g/t Au over 29.0 m in LBP152.

- 1.43 g/t Au over 9.1 m and 1.20 g/t Au over 67.1 m, including 2.57 g/t Au over 16.8 m and including 8.51 g/t Au over 3.0 m in LBP138.

- 1.41 g/t Au over 22.9m, including 1.93 g/t Au over 13.7 m and 1.51 g/t Au over 56.4 m, including 2.36 g/t Au over 24.4 m and including 5.86 g/t Au over 3 m in LBP206.

- 1.01 g/t Au over 62.5 m, including 1.94 g/t Au over 25.9 m in LBP189.

- 1.50 g/t Au over 27.4 m and 0.62 g/t Au over 7.6 m in LBP203.

- 0.98 g/t Au over 80.8 m, including 2.32 g/t Au over 18.3 m and 2.19 g/t Au over 7.6 m in LBP169.

2See press release dated January 7 and January 16, 2020, and press releases in 2019 dated May 29, June 19, July 15, July 31, September 12, October 1, October 15, and November 5, for drill results from the 2019 drill program.

3See press releases issued in 2020 dated June 16, June 23, July 14, July 18, September 10, September 29, November 10, and December 2.

Drilling in 2020 also targeted the southeast extension of D-1, in a 400 m-long, undrilled area between the historic B and Tallman pits. This drilling successfully identified shallow oxide mineralization, exemplified by:

- 3.04 g/t Au over 19.8 m, including 8.54 g/t Au over 4.6 m in LBP150.

Continued drilling in 2021 showed the D-1, D-2 and D-3 zones coalesce into essentially one larger, continuous zone of mineralization with discrete zones of higher-grade mineralization now referred to as the “Discovery Zone”.

Following the approval of an expanded Plan of Operations in 2021 drilling began in the Rangefront target area south-east of the main Discovery Zone where shallow historic drilling indicated a potential deeper mineralized system. Initial drill holes indicated a thick section of receptive host rocks and widespread gold mineralization. Continued drilling began vectoring in on higher grade zones similar to the main Discovery Zone. This drilling eventually defined a 1 square kilometer zone of oxidized mineralization.

Some highlight drill intercepts include[4]:

- 0.91 g/t Au over 86.9 m, including 2.15 g/t Au over 22.9 m and 2.03 g/t Au over 21.3 m in LBP356.

- 1.37 g/t Au over 50.3 m including 2.37 g/t Au over 22.9 m and 1.27 g/t in hole LBP358

- 0.63 g/t Au over 112.8 m in hole LBP408

- 1.95 g/t Au over 41.1 m including 4.43 g/t Au over 10.8 m in hole LBP473

4See press release dated September 01, 2021

In February 2022, the Company announced that it had secured water rights in excess of 2,300 acre-feet per annum (“AFA”) intended for future use as process water supply and in September, approval for a new Plan of Operations was received which added 11.9 square kilometers, for a combined surface area of permitted operations at Black Pine of 24.3 square kilometers. In November, the company purchased and obtained registered title to two historical Black Pine water rights totalling 868.5 AFA, securing an aggregate of 3,202 AFA of process water supply, sufficient for any future large-scale mining operation.

Drilling in 2022 comprised of 318 reverse circulation holes for 66,381 m and 6 core holes for 1,118 m and focused on expanding the known smaller, near-surface satellite zones of mineralization (primarily the E, F, M, and Back Range zones), expansion and infill of the Rangefront Zone, and testing of reconnaissance targets, including Bobcat and South Rangefront. Drilling commenced in early January and continued through mid-December and encompassed:

- Infill and step-out drilling in the Rangefront Zone for resource upgrade and expansion purposes.

- Targeting areas of near-surface, above-average grade that might favourably impact the first few years of a mining operation. Target areas included the M, F, and Back Range zones.

- Amalgamation of zones consisting of two or more small resource pits defined by primarily shallow historical drilling. Target areas included the M, F, and Back Range zones.

- Expansion drilling along the margins of existing zones, including the western margins of the CD and E zones.

- Identifying and defining areas of mineralization associated with surficial deposits, including waste rock storage areas and historic pit backfill.

In 2023, our exploration program consisted of 27,461 m of drilling and continued to target resource expansion in the Discovery Zone, CD-Tallman Zone and Rangefront Zone and discovery of new mineralization, including several untested target areas. Some highlight drill intercepts include:

- 3.74 g/t Au over 21.3 meters (“m”) including 15.85 over 3.0 m in LBP906.

- 3.28 g/t Au over 10.7 m and 0.52 g/t Au over 51.8 m in LBP893.

- 2.13 g/t Au over 18.3 m including 10.3 g/t Au over 1.5 m in LBP793.

- 7.07 g/t Au over 18.3 m including 11.92 g/t Au over 10.7 m and including 46.7 g/t Au over 1.5 m in LBP813.

- 3.40 g/t Au over 32.0 m, including 6.74g/t Au over 9.1 m LBP945.

In July 2023, we announced a new discovery area “Rangefront South” located approximately two kilometres to the south of the main Rangefront Zone, with two reportable intercepts of oxide gold: 0.37 g/t Au over 9.1 m, and 0.31 g/t Au over 7.6 m in drill hole LBP931. (see press release dated July 24, 2023)

Funding for 2023 included exploration drilling, metallurgy, engineering studies, hydrologic studies, permitting and a range of de-risking activities, including identifying access to power and acquiring additional lands and mineral rights near Black Pine.

In mid-2024, we launched a 20,000-meter drill program, focused on seven new high-priority targets with the aim to significantly enhance the resource base and unlock new areas of oxide gold mineralization. Following an expanded permit from the U.S. Forest Service, the exploration area now covers close to 40 square kilometers, offering access to previously restricted regions with oxide gold potential, like South Rangefront and M Zone.

Metallurgy

Six phases of metallurgical testing have been completed on Black Pine oxide ores, using bulk samples and predominantly, large diameter PQ core. A total of six bulk samples and 174 variability composites have been tested at Kappes, Cassiday & Associates in Reno, Nevada and included extensive geo-metallurgical characterization, comminution testing, bottle roll and column leach testing and environmental characterization of head samples and column residues. The oxide ores respond very well to cyanide leaching with typically >80% of the leachable gold extracted in the first 10 days of laboratory column leaching. Modeling of column test data support ROM leaching as the preferred processing method, with a primary leach cycle of 90 days.

Commercial scale ROM gold and silver grade-recovery models have been developed for the geo-metallurgical oxide ore types, defined by gold cyanide solubility, location and lithology. The limited amount of mineralized carbonaceous material present at Black Pine has been extensively modelled and has been treated as waste rock.

Reserve & Resources Estimate

First Mineral Reserve

An independent mineral reserve estimate for Black Pine was announced in the Preliminary Feasibility Study (“PFS”) published in October 2024 (see press release dated October 10, 2024). The Mineral Reserve has an effective date of June 1, 2024, is reported to a cut-off grade of 0.10 g/t gold, is based on a gold price of US$1,650/oz and consists of:

- Probable mineral reserve of 3,110,000 ounces of oxide gold at an average grade of 0.32 g/t Au and totalling 299,400,000 tonnes.

Updated Mineral Resources

The PFS has updated the mineral resources estimate which have an effective date of June 1, 2024, and are reported within conceptual open pits estimated at a gold cut-off grade of 0.10 g/t using the PFS pit slope parameters, a long-term gold price of US$2,000/oz and consist of:

- Indicated mineral resource of 4,163,000 ounces of oxide gold at an average grade of 0.32 g/t Au and totalling 402,600,000 tonnes; and

- Inferred mineral resource of 712,000 ounces of oxide gold at an average grade of 0.23 g/t Au and totalling 97,700,000 tonnes.

Key changes relative to the previous Mineral Resource estimate (see press release dated February 15, 2024) are as follows:

- Updated metallurgical recovery model for gold,

- Change in resource cut-off grade,

- Increase in constraining pit shell value ($2,000/oz gold price), and

- Revision to low-grade (<0.2 g/t) block resource classification.

Black Pine Preliminary Feasibility Study

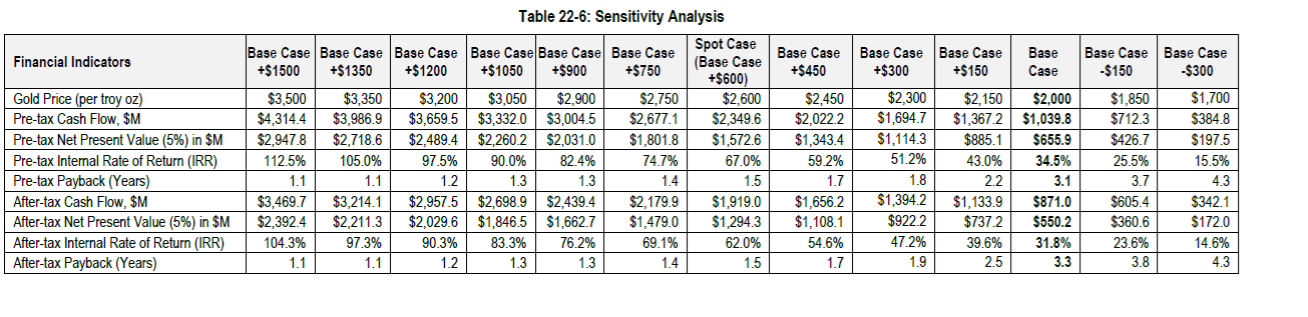

The results of PFS at Black Pine were released in October 2024 (see press release dated October 10, 2024) and highlighted the strong economic potential for a low-risk, sustainable and long-lived gold mining operation. The PFS supports a technically straight-forward, low capital intensity, open-pit, run-of-mine (no ore crushing, screening or agglomeration) heap-leach operation processing oxide gold ore, with attractive economic returns. The economic study incorporates geological, assay, hydrological, metallurgical, geotechnical, environmental and cultural information collected by Liberty Gold and its consultants and contractors, as well as extensive historic information captured from the previous mining operation on site. Important project metrics are presented in the following tables:

Table 1: Key Black Pine Project Metrics 1This is a non-GAAP financial measure. See “Non GAAP Financial Measures and Other Financial Measures”.

1This is a non-GAAP financial measure. See “Non GAAP Financial Measures and Other Financial Measures”.

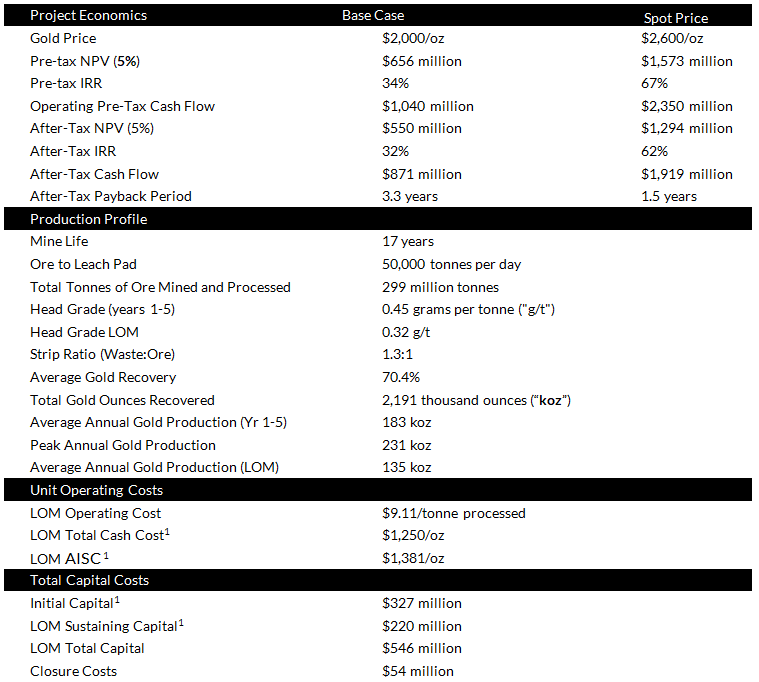

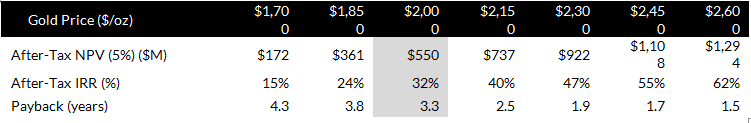

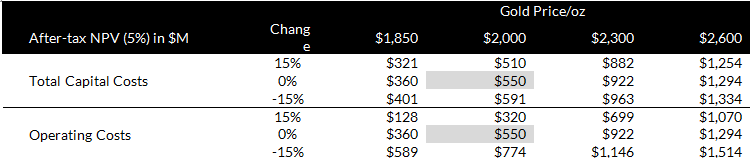

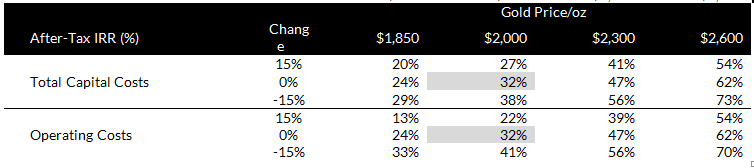

Project Economics Sensitivity Analysis

A sensitivity analysis was carried out on the after-tax financial metrics from the PFS base case to illustrate the Project’s sensitivity to commodity prices, initial capital and operating costs. Results are illustrated in Tables 2 and 3 (all figures in US dollar millions unless otherwise indicated).

Table 2: After-tax NPV (5%), IRR and Payback Sensitivity to Gold Price

Table 3: After-Tax NPV (5%) and IRR sensitivity to Changes in Project Parameters & Gold Price

Mining

The PFS utilizes open pit mining with mine planning based on economic pit shells generated by mine planning software. Ore feed to the leach pad is planned at 50,000 tonnes per day or 18.3 million tonnes per year for the estimated 17-year life of mine. There will be a 9-month pre-production period to provide access to higher grade ore horizons for early years processing. There are significant opportunities to improve mid-life production through resource growth and conversion ahead of the feasibility study. Lower-grade ores are stockpiled throughout the mine life and re-handled on to the heap to optimize gold production.

Total material movement averages 47 million tonnes per year over life of mine, with a peak at 55 million tonnes per year. Ore is sourced from two large multi-phase open pits, together with six smaller ‘satellite’ open pits. The strip ratio is favourably low at 1.3:1 (waste:ore), resulting from the extensive envelope of lower-grade oxide gold mineralization surrounding the higher-grade horizons and permeating through the mass of carbonate host rock units.

The open pit mining at Black Pine is designed as a conventional, owner-operated surface mining operation, where the owner is responsible for planning and executing direct mining and all mine fleet maintenance, equipment mobilization, supervision, labor, geology and grade control. Blasting would be performed as a contract service. The PFS mine plan proposes a blended mine fleet of 400 tonne-class hydraulic excavators, 100 tonne-class hydraulic excavators, 11.5 cubic metre bucket front end loaders, 136 tonne off-highway haul trucks and 64 tonne off-highway haul trucks.

For a 3D video of a run through of the site layout, click on this link: https://youtu.be/ScIQ4cF_QwE

Processing

Gold will be recovered using run-of-mine (no crushing, screening or agglomeration) heap leaching with material placed by mine haul truck stacking onto a single heap leach pad sited at the eastern extent of the Project. The pad is designed in four phases to contain up to 315 million dry tonnes of leachable material, with operational segregation of the oxide ore types in isolated cells on the leach pad to prevent commingling.

ROM-sized ore will be stacked in 10 metre (“m”) vertical lifts to a maximum heap height of 100 m. Lime will be added prior to truck dumping on the pad, ore will be ripped and subsequently leached with dilute cyanide solution using conventional irrigation. Leach solution will flow by gravity through the heap and be conveyed to the process solution tank. No surface ponds other than an emergency event pond are included in the PFS design.

Leached gold will be recovered from the solution using a 3-train, activated carbon adsorption circuit. The gold (and any silver) will then be stripped from carbon using a desorption process followed by electrowinning to produce a precipitate sludge, which is then refined on-site in a furnace to produce final doré bars.

Process water is drawn from five existing, active water wells, located within 5 kilometres from the processing facility. Power is grid supply over an existing 25 kV line to the mine gate.

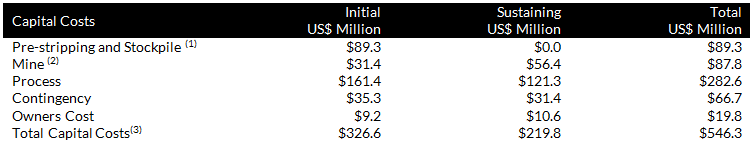

Cost Estimates

Capital and operating costs were estimated by M3 Engineering for the processing and general and administration components of the PFS costs estimate; all mining costs were estimated by AGP Mining.

The capital costs estimate presented in Table 4, is considered to have overall accuracy of -20% / +25%.

Table 4: Black Pine PFS Capital Cost Breakdown

1. 13 million tonnes of ore stockpiled during pre-stripping

2. Includes down payment for lease financing of mine equipment

3. Excludes reclamation and closure costs estimated at $54 million

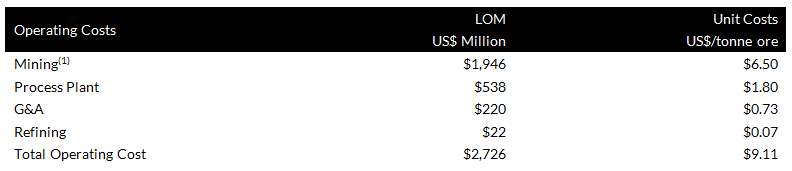

A summary of the operating costs estimate for Black Pine is presented in Table 5. Operating costs are based on ownership and owner’s direction of all mine and processing equipment and facilities. Reclamation and closure costs estimated from first principles at $54 million and validated with a Nevada Standardized Reclamation Cost Estimator model, are additional to sustaining capital costs illustrated in Table 4 and are included in the Project economic evaluation.

The mining costs are based on quotes for mining equipment and estimated owners’ costs. The PFS base case assumes the mine fleet is leased with the mine operating cost carrying the annual lease payment. Processing costs were estimated by M3 Engineering and NewFields, based on first principles, assuming the owner employs and directs all operations and maintenance for all site facilities. Labor costs were estimated using Idaho labor rates and specific staffing requirements. Unit consumption of materials, consumables, power and water were estimated from first principles.

Table 5: Black Pine Operating Cost Estimate

1. Assumes lease financing of mine equipment

Operating costs have an effective date of June 1, 2024, and are presented with no added contingency.

Sustainability

At Liberty Gold, sustainability is integral to our operations and decision-making, ensuring long-term value for stakeholders. Since 2021, we have published annual sustainability reports, reinforcing our commitment to transparency and accountability. At Black Pine, we engage regularly with stakeholders through updates, tours, and local events. We are deeply committed to preserving biodiversity, supporting sage grouse habitat restoration and funding a four-year mule deer migration study with Idaho Fish and Game. Sustainability initiatives included in the Black Pine PFS include renewable energy supply through local utility, no net increase in water draw, habitat mitigation, and waste rock backfill. We propose to explore mine fleet electrification and other key sustainable initiatives during feasibility to minimize our carbon and project footprint.

Sensitivity Analysis of the Key Economic Indicators to Changes in Gold Price

The Black Pine Project shows strong leverage to the gold price. The table below outlines the sensitivity of key economic indicators — including After-Tax NPV5%, IRR, and Payback Period — at gold prices above the $2,000/oz base case used in the PFS. As gold prices rise, the project’s returns and value increase significantly, highlighting Black Pine’s potential to deliver strong cash flow and shareholder value in a higher gold price environment.

Outlook

Further to the submission of the Pre-Plan of (Mine) Operations in the third quarter 2023, a Mine Plan of Operations is currently being drafted, with plans for submission to U.S. federal and cooperating agencies in the fourth quarter of 2024 to initiate formal mine permitting under the National Environmental Policy Act (“NEPA”).

Baseline studies required to support the mine permit applications are being advanced, while technical work continues to progress and de-risk the project toward feasibility level, extending into 2025.

We intend to conduct a feasibility study to establish the basis for a construction decision, with key areas of focus including resource upgrade and growth, evaluation of historic heap potential as a future ore supply, refinement of geo-metallurgical models, and completion of metallurgical testing. Additional critical studies will address groundwater sources and quality, collection and analysis of geotechnical data to design heap, pit slopes, and rock waste facilities, and feasibility-level rock geochemical characterization to support environmental studies.

Much of the gold system at Black Pine remains under-explored or incompletely tested, including areas along the southeastern, eastern and northeastern edge of the property. Our exploration drilling initiatives underscores our strategy to enhance Black Pine’s resource base and uncover new oxide gold mineralization.

Peter Shabestari P.Geo., VP Exploration, Liberty Gold, is the Company's designated Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained herein is accurate.

Non-GAAP Measures and Other Financial Measures

Alternative performance measures are furnished to provide additional information. These non-GAAP performance measures are included in this news release because these statistics are key performance measures that management uses to monitor performance, to assess how the Company is performing, to plan and to assess the overall effectiveness and efficiency of mining operations. These performance measures including Initial Capital Costs, Total Cash Costs, and All-In Sustaining Costs, do not have a standard meaning within International Financial Reporting Standards (“IFRS”) and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Initial Capital Costs

Initial Capital Cost is defined as capital required to develop, construct and to bring the Project to commercial production.

Total Cash Costs and Total Cash Costs per Gold Ounce

Total Cash Costs are reflective of the cost of production. Total Cash Costs reported in the PFS include mining costs, processing, on-site general & administrative costs, treatment & refining costs, and royalties. Total Cash Costs per Ounce is calculated as Total Cash Costs divided by total LOM payable gold ounces.

All-in Sustaining Costs (“AISC”) and AISC per Gold Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PFS includes Total Cash Costs, sustaining capital, closure costs and Idaho Mine License Tax. AISC per ounce is calculated as AISC divided by total LOM payable gold ounces.