Liberty Gold Expands Discovery 2 Zone of High-Grade Oxide Carlin-Style Mineralization at the Black Pine Project, Idaho, USA, With 2.10 g/t Oxide Gold Over 61.0 Metres, Including 6.33 g/t Au Over 10.7 Metres

Liberty Gold Expands Discovery 2 Zone of High-Grade Oxide Carlin-Style Mineralization at the Black Pine Project, Idaho, USA, With 2.10 g/t Oxide Gold Over 61.0 Metres, Including 6.33 g/t Au Over 10.7 Metres

Drilling Extends Discovery 2 Zone in Three Directions

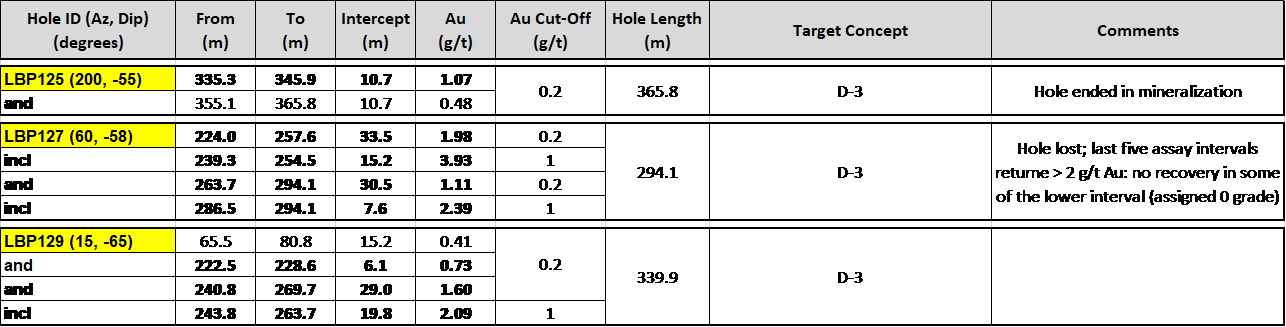

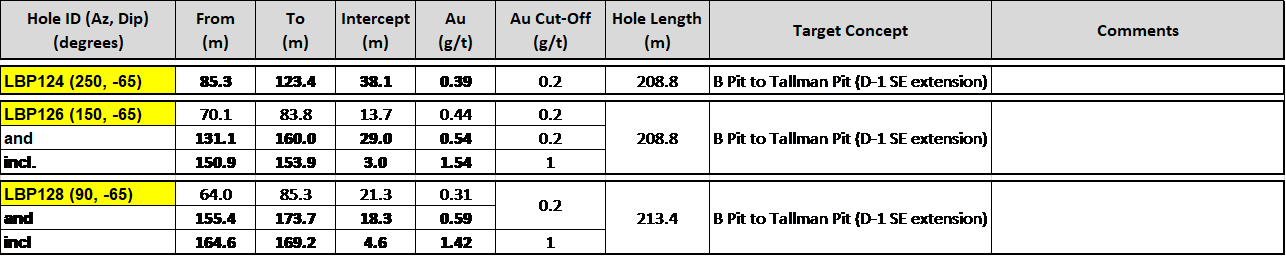

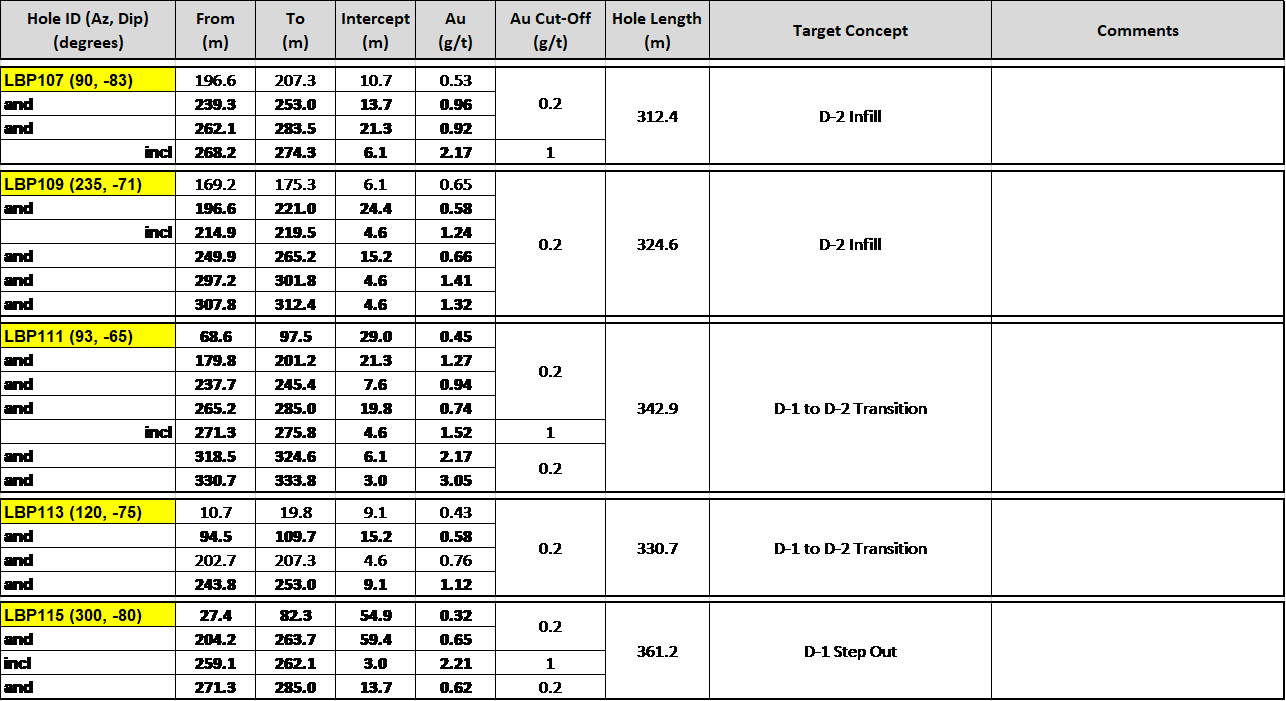

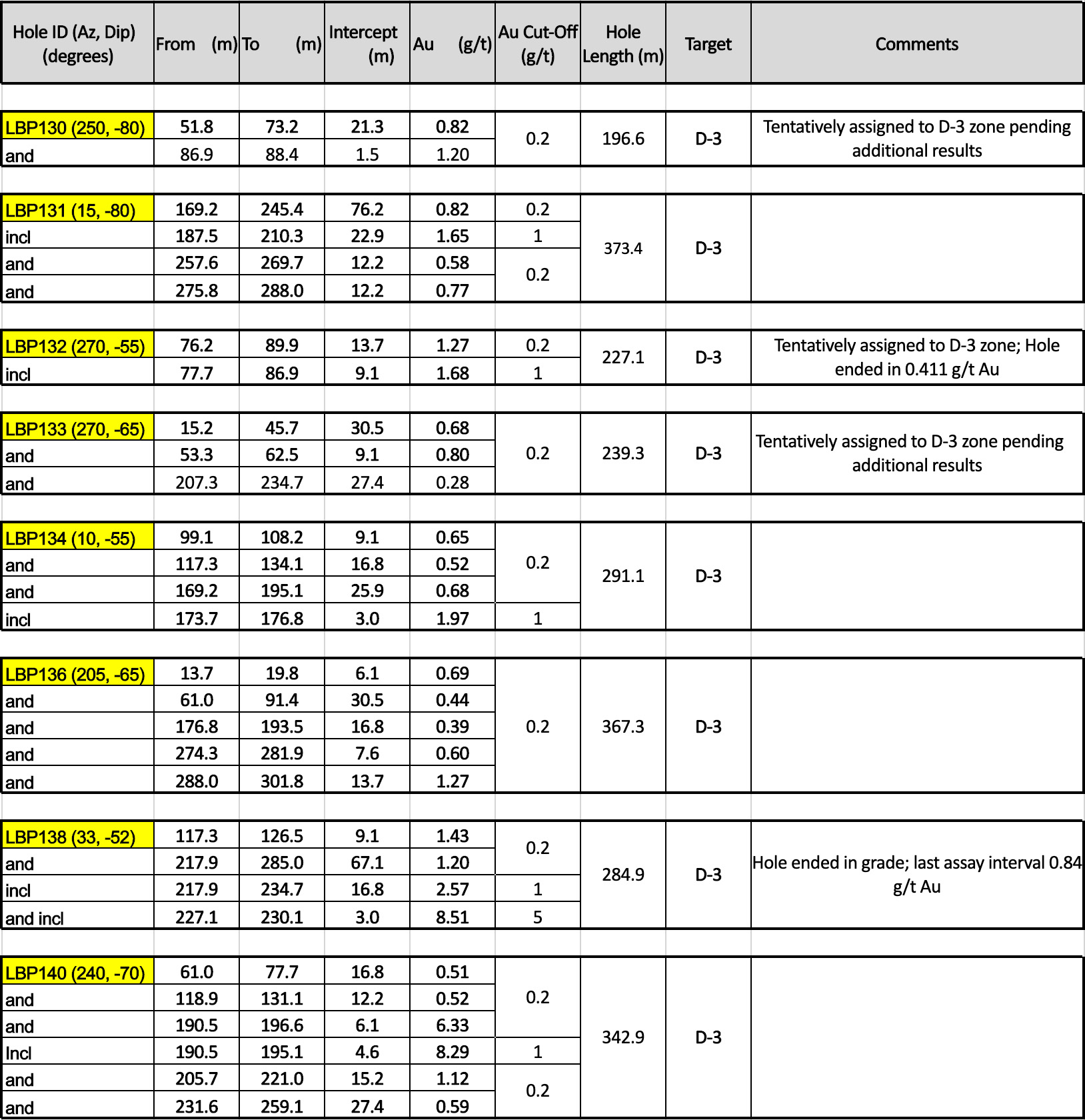

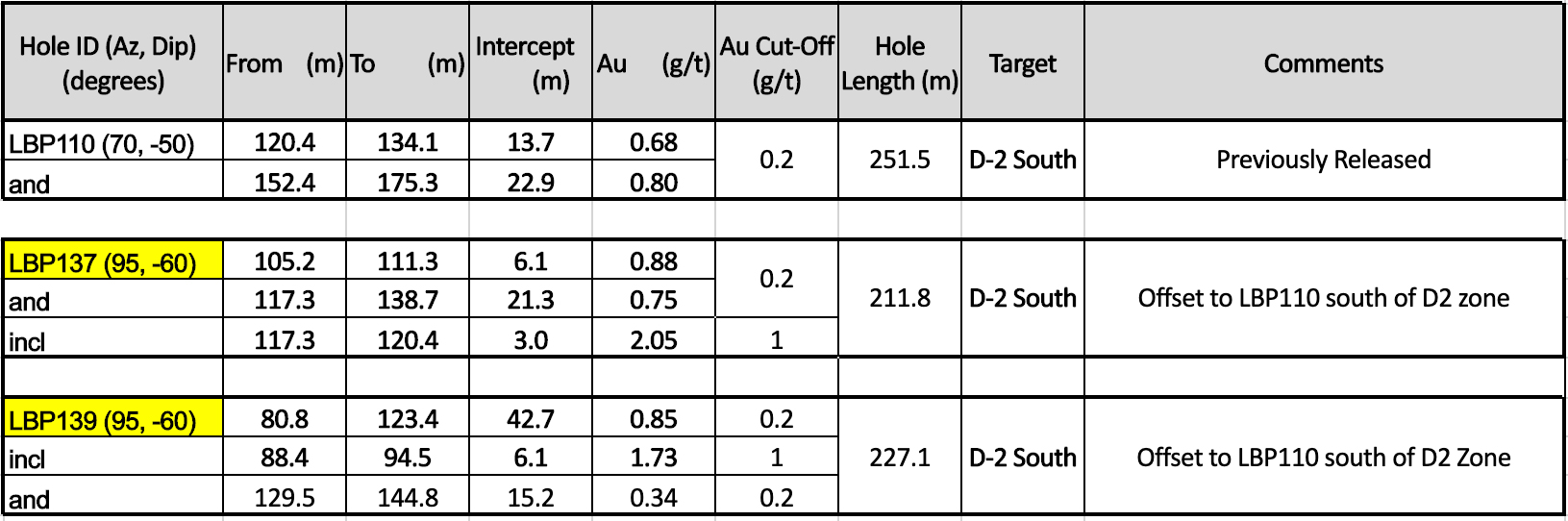

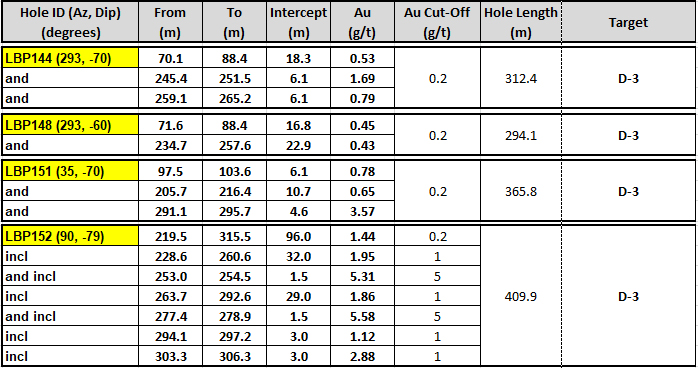

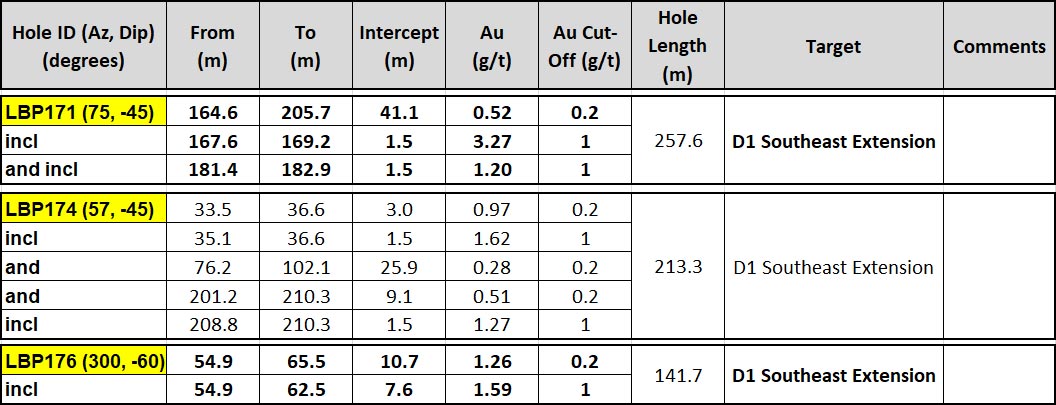

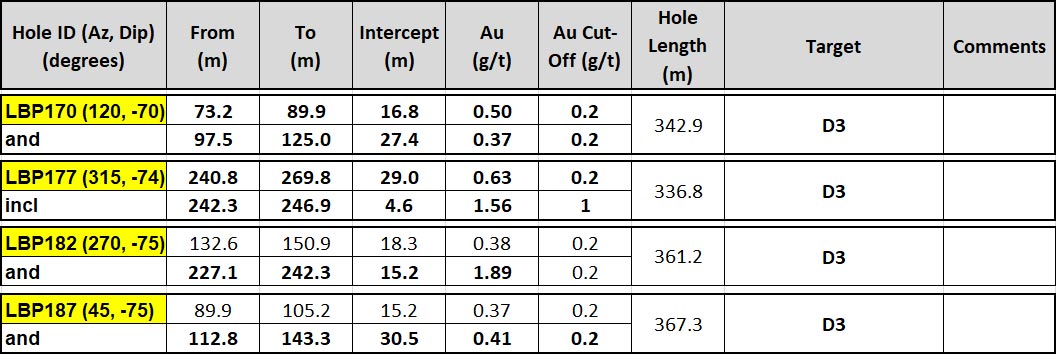

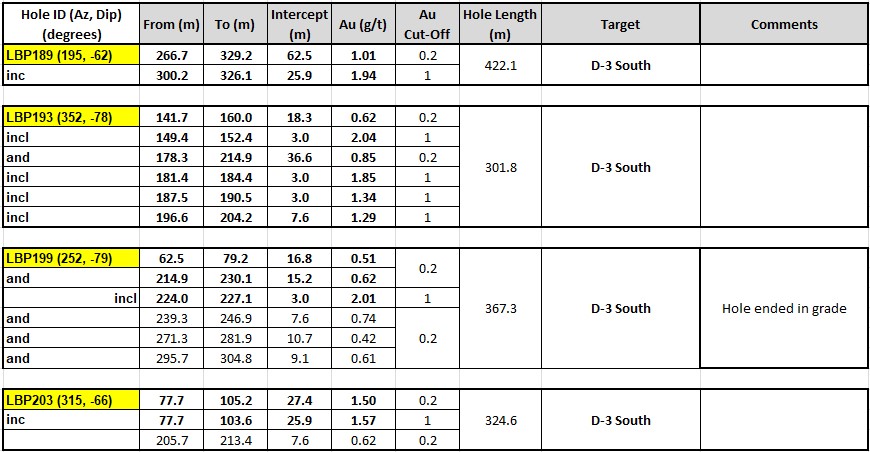

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce additional drill results from its Carlin-style Black Pine Property in southern Idaho, USA. Reverse Circulation (“RC”) drilling at Black Pine continues to return thick, high-grade intervals of Carlin-style oxide gold mineralization. New results reflect step-out drilling on all sides of the Discovery 2 Zone that has increased the size of the zone to 600 metres (“m”) in a northeast-southwest direction, merging with the Discovery 1 Zone, and up to 400 m in a northwest-southeast direction. Exploratory holes were also drilled to the south, east and west of the Discovery 1 and 2 Zones.

Based on the consistency of the high-grade results in the initial focus area, the 2020 Black Pine exploration program has been increased to 45,000 m of RC and Core drilling using up to three drills. The Company is fully funded and may further accelerate the exploration program going forward.

Fourteen of the 17 RC drill holes reported below in the highlight table contain a significant interval of oxide gold mineralization above 1 gram per tonne gold (“g/t Au”).

DISCOVERY 2 ZONE DRILL HIGHLIGHTS INCLUDE1:

| Hole ID (Az, Dip) (degrees) |

From (m) |

To (m) |

Intercept (m) |

Au (g/t) |

Au Cut-Off (g/t) |

Hole Length (m) |

Comments |

| LBP071 (355, -73) | 120.4 | 132.6 | 12.2 | 1.08 | 0.2 | 251.5 | Discovery 2 Zone |

| and | 160.0 | 172.2 | 12.2 | 0.82 | |||

| and | 199.6 | 204.2 | 4.6 | 1.62 | |||

| including | 199.6 | 202.7 | 3.0 | 2.21 | 1 | ||

| LBP072 (70, -75) | 57.9 | 94.5 | 36.6 | 0.62 | 0.2 | 306.3 | Discovery 2 Zone |

| and | 277.4 | 288.0 | 10.7 | 1.96 | |||

| including | 278.9 | 281.9 | 3.0 | 5.45 | 1 | ||

| LBP077 (0, -70) | 167.6 | 181.4 | 13.7 | 0.90 | 0.2 | 274.3 | Discovery 2 Zone |

| and | 187.5 | 190.5 | 3.0 | 2.34 | |||

| and | 202.7 | 216.4 | 13.7 | 0.67 | |||

| LBP079 (350, -58) | 166.1 | 175.3 | 9.1 | 0.48 | 0.2 | 243.8 | Discovery 2 Zone |

| and | 211.8 | 224.0 | 12.2 | 0.60 | |||

| LBP081 (025, -62) | 195.1 | 208.8 | 13.7 | 1.09 | 0.2 | 275.8 | Large step-out to the south of Discovery 2 Zone |

| including | 202.7 | 207.3 | 4.6 | 2.44 | 1 | ||

| and | 214.9 | 230.1 | 15.2 | 0.88 | 0.2 | ||

| including | 214.9 | 224.0 | 9.1 | 1.17 | 1 | ||

| and | 237.7 | 246.9 | 9.1 | 1.39 | 0.2 | ||

| including | 240.8 | 245.4 | 4.6 | 2.27 | 1 | ||

| LBP084 (110, -70) | 155.4 | 173.7 | 18.3 | 0.66 | 0.2 | 257.6 | Large step-out to the south of Discovery 2 Zone |

| and | 227.1 | 236.2 | 9.1 | 0.96 | |||

| LBP085 (65, -82) | 51.8 | 68.6 | 16.8 | 0.70 | 0.2 | 257.6 | Discovery 2 Zone |

| and | 143.3 | 184.4 | 41.1 | 1.31 | |||

| including | 172.2 | 182.9 | 10.7 | 2.22 | 1 | ||

| LBP086 (270, -65) | 149.4 | 160.0 | 10.7 | 0.74 | 0.2 | 257.6 | Discovery 2 Zone |

| and | 178.3 | 192.0 | 13.7 | 2.25 | |||

| including | 181.4 | 185.9 | 4.6 | 5.49 | 1 | ||

| LBP088 (75, -73) | 237.7 | 239.3 | 1.5 | 2.21 | 0.2 | 327.7 | Discovery 2 Zone |

| and | 257.6 | 318.5 | 61.0 | 2.10 | |||

| including | 257.6 | 268.2 | 10.7 | 6.33 | 1 | ||

| and including | 257.6 | 260.6 | 3.0 | 16.2 | 5 | ||

| LBP089 (155, -75) | 41.1 | 79.2 | 38.1 | 0.86 | 0.2 | 260.6 | Discovery 2 Zone |

| incl | 59.4 | 70.1 | 10.7 | 2.20 | 1 | ||

| LBP090 (35, -80) | 175.3 | 216.4 | 41.1 | 0.56 | 0.2 | 312.4 | Discovery 2 Zone |

| and | 222.5 | 259.1 | 36.6 | 1.03 | |||

| including | 222.5 | 228.6 | 6.1 | 4.25 | 1 | ||

| LBP091 (260, -81) | 4.6 | 25.9 | 21.3 | 0.56 | 0.2 | 243.8 | Discovery 2 Zone |

| and | 141.7 | 163.1 | 21.3 | 2.22 | |||

| including | 144.8 | 161.5 | 16.8 | 2.70 | 1 | ||

| and | 181.4 | 182.9 | 1.5 | 1.22 | 0.2 | ||

| LBP092 (205, -80) | 61.0 | 106.7 | 45.7 | 0.66 | 0.2 | 295.7 | Discovery 2 Zone |

| and | 201.2 | 208.8 | 7.6 | 0.79 | |||

| LBP094 (115, -68) | 189.0 | 224.0 | 35.1 | 0.92 | 0.2 | 304.8 | Discovery 2 Zone |

| including | 207.3 | 213.4 | 6.1 | 3.58 | 1 | ||

| LBP095 (260, -82) | 157.0 | 201.2 | 44.2 | 1.14 | 0.2 | 285.0 | Joins Discovery 2 Zone with Discovery 1 Zone |

| including | 193.5 | 196.6 | 3.0 | 1.77 | |||

| and | 217.9 | 240.8 | 22.9 | 2.83 | 0.2 | ||

| including | 219.5 | 234.7 | 15.2 | 4.03 | 1 | ||

| and including | 227.1 | 231.6 | 4.6 | 5.99 | 5 | ||

| and | 257.6 | 269.7 | 12.2 | 0.57 | 0.2 | ||

| LBP096 (160, -70) | 167.6 | 170.7 | 3.0 | 0.94 | 0.2 | 274.3 | Discovery 2 Zone |

| and | 178.3 | 216.4 | 38.1 | 0.72 | |||

| including | 211.8 | 214.9 | 3.0 | 1.18 | 1 | ||

| and | 227.1 | 256.0 | 29.0 | 1.87 | 0.2 | ||

| including | 228.6 | 239.3 | 10.7 | 4.41 | 1 | ||

| and including | 230.1 | 233.2 | 3.0 | 7.95 | 5 | ||

| LBP097 (45, -75) | 137.2 | 167.6 | 30.5 | 1.05 | 0.2 | 213.4 | Discovery 2 Zone |

| including | 147.8 | 160.0 | 12.2 | 1.86 | 1 |

1A number of mineralized intervals were omitted from this table for brevity. Please refer to the full table at the link below for complete results. Grams per Tonne Gold abbreviated as “g/t Au”.

For a cross section of drill collars and traces for the current release, please click here: https://libertygold.ca/images/news/2020/january/BlackPine_NR01072020CS.pdf

For a long section of drill collars and traces for the current release, please click here: https://libertygold.ca/images/news/2020/january/BlackPine_NR01072020LS.pdf

For a map of drill collars and traces for the current release, please click here: https://libertygold.ca/images/news/2020/january/BlackPine_NR01072020Map.pdf

For a complete table of drill results from all Liberty Gold drill holes at Black Pine, please click here: https://libertygold.ca/images/news/2020/january/BP_Intercepts01072020.pdf

Click here for a list of the top 500 unmined gold intercepts at Black Pine: https://libertygold.ca/images/news/2020/january/BlackPine_NR01072020HH.pdf

In addition to drilling on the Discovery Zones, drilling targeted areas to the west, south and east. Drill holes encountered oxide gold which warrants further follow-up drilling for discovery of additional high-grade corridors similar to the Discovery Zones. In particular, LBP100 and LBP102 extend gold mineralization up to 200 m to the west of the Discovery 1 Zone, and LBP084 extends mineralization 150 m to the south of the main Discovery 2 NE-SW corridor toward the historic B Pit, with an average historical mined grade of 1.38 g/t Au.

Key Points

- The Discovery 2 Zone continues to deliver thick, high-grade oxide gold intercepts in drill holes.

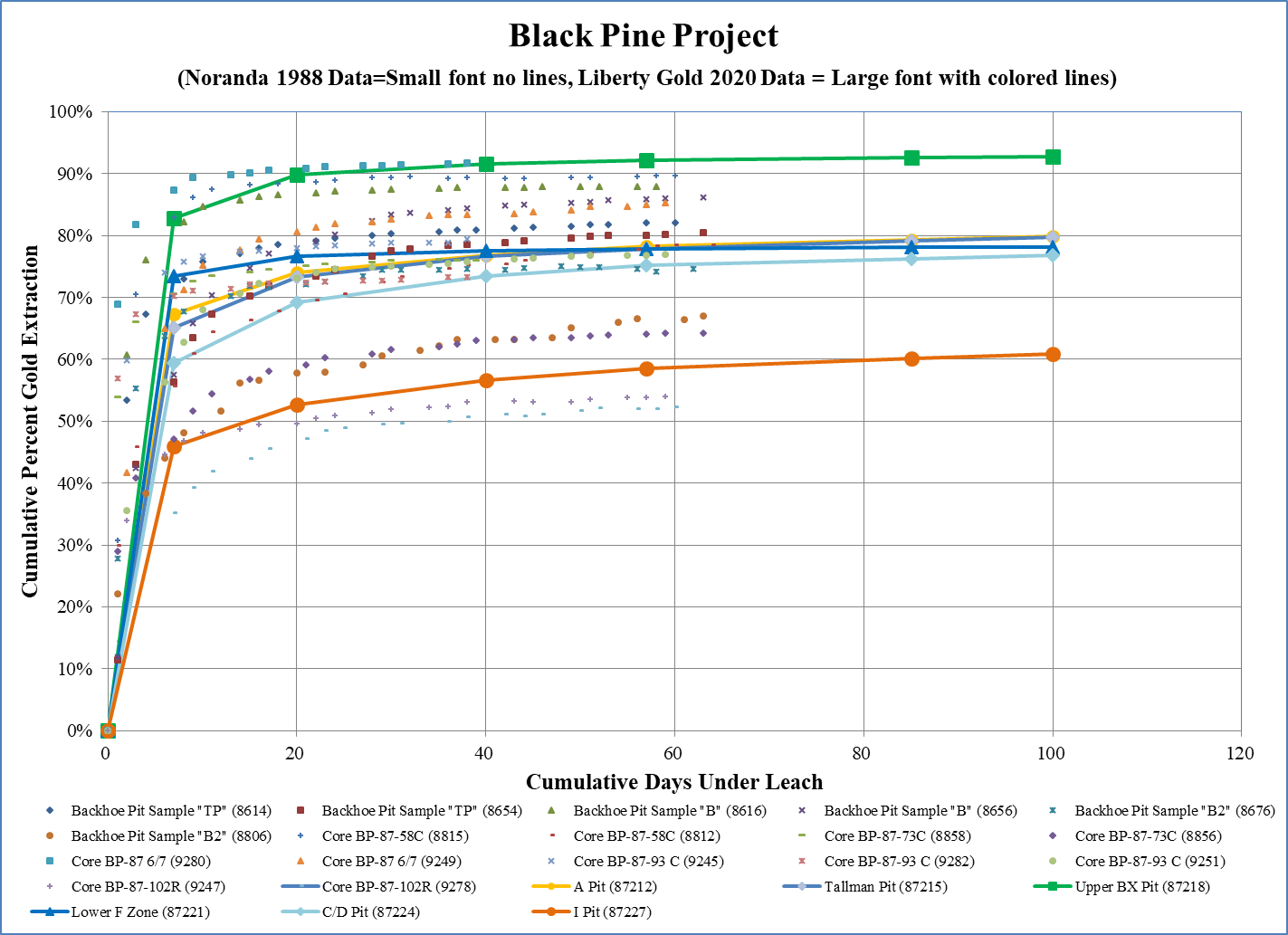

- Most highlight intercepts to date are oxide. Weighted average cyanide solubility for the primary high-grade interval in LBP088 is 92%, for LBP090, 86%, and for LBP095, 85%.

- The new drill results highlight the NE – SW structural control on the Discovery 2 Zone, with LBP088, LBP085, LBP089 and LBP091 and LBP095 extending mineralization to the west of previous drilling and merging with the Discovery 1 Zone.

- LBP081, LBP084 and LBP103 expand mineralization to the south of the Discovery 2 structural corridor corridor by up to 200 m. This area is still sparsely drilled, with more drilling planned in 2020.

- LBP100 and LBP102 expand mineralization up to 200 m to the west of the Discovery 1 Zone.

- 8 of the top 10 unmined intercepts on the Black Pine Property have been drilled by Liberty Gold.

- Drilling is completed for 2019, with a total of 20,900 m drilled in 87 RC and 6 core holes. Core drilling results are pending and drilling is anticipated to commence in mid-March.

- Approximately 60% of the 1 square kilometer (“km2”) Focus Area has been drill tested to date, out of a gold system estimated to span 12 km2.

“Our 2019 drill program at Black Pine was an unqualified success by any measure,” stated Cal Everett, President and CEO of Liberty Gold. “We are now updating the geological model and planning a program for 2020 that is over double the size of 2019’s. With mineralization in the Discovery 2 Zone still open to the south, the Discovery 1 Zone open to the northwest and southeast, and a host of other targets to test, we look forward to continued success and the release of a resource estimate in 2020.”

Core drilling at Black Pine was recently completed. The large-diameter core program obtained material to fulfill several goals, including: Phase 1 metallurgical column testing; specific gravity measurements; gold deportment studies; validation of RC drilling data; and collection of structural, stratigraphic and alteration information. Assays are pending from six diamond core holes.

RC drilling, with 2 drill rigs in a 1 km2 Focus Area between the historic A Pit, B Pit and A Basin target, was recently completed as well. Weather permitting, drilling will resume at Black Pine in mid-March. The 2020 drill program will continue to build on the discovery in the Focus Area and also test new targets.

About Black Pine

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. It is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Newmont’s Long Canyon deposit, Black Pine represents a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, during a period of historically low gold prices, with 435,000 ounces of gold produced from five composite, shallow pits, at an average grade of 0.63 g/t Au and average recovery of approximately 65%.

A virtual site tour and 3D model of Black Pine property, including details about the geology and mineralization, is available on the homepage of the Company’s website, www.libertygold.ca.

A Technical Report is also available on the Company website: https://libertygold.ca/images/pdf/BlackPine_NI43-101_2018.pdf

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold Intersects 2.92 g/t Oxide Gold Over 55.9 Metres, Including 5.64 g/t Au Over 22.1 Metres in Metallurgical Core Drilling Program at the Black Pine Project, Idaho, USA

Liberty Gold Intersects 2.92 g/t Oxide Gold Over 55.9 Metres, Including 5.64 g/t Au Over 22.1 Metres in Metallurgical Core Drilling Program at the Black Pine Project, Idaho, USA

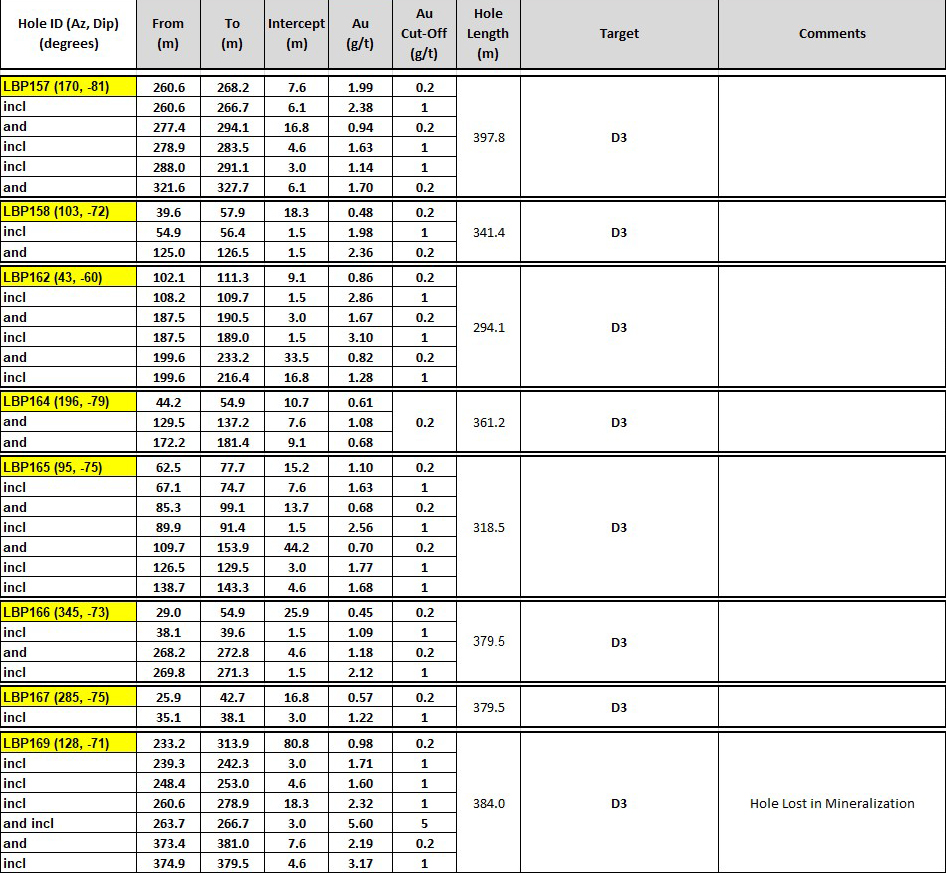

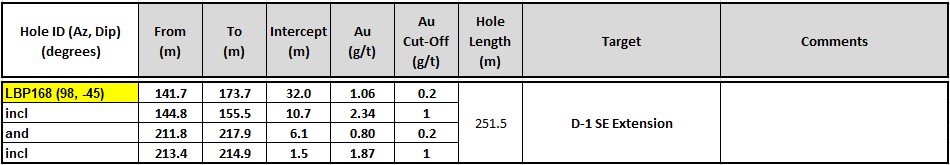

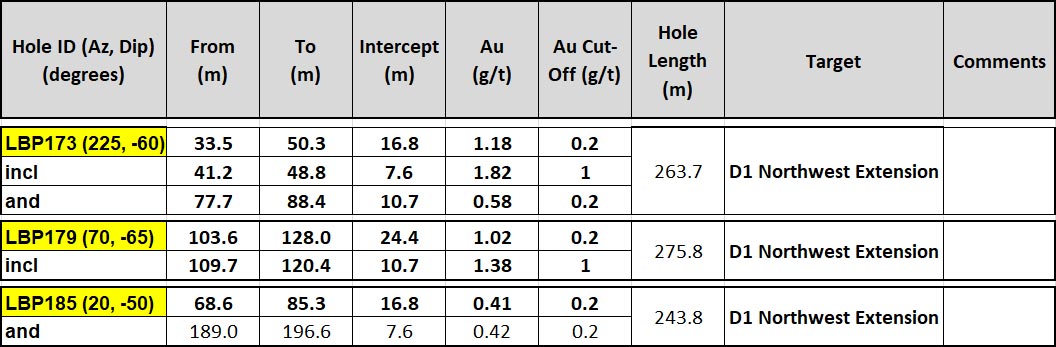

Core Drilling Confirms RC Results and Tests New Rangefront Target

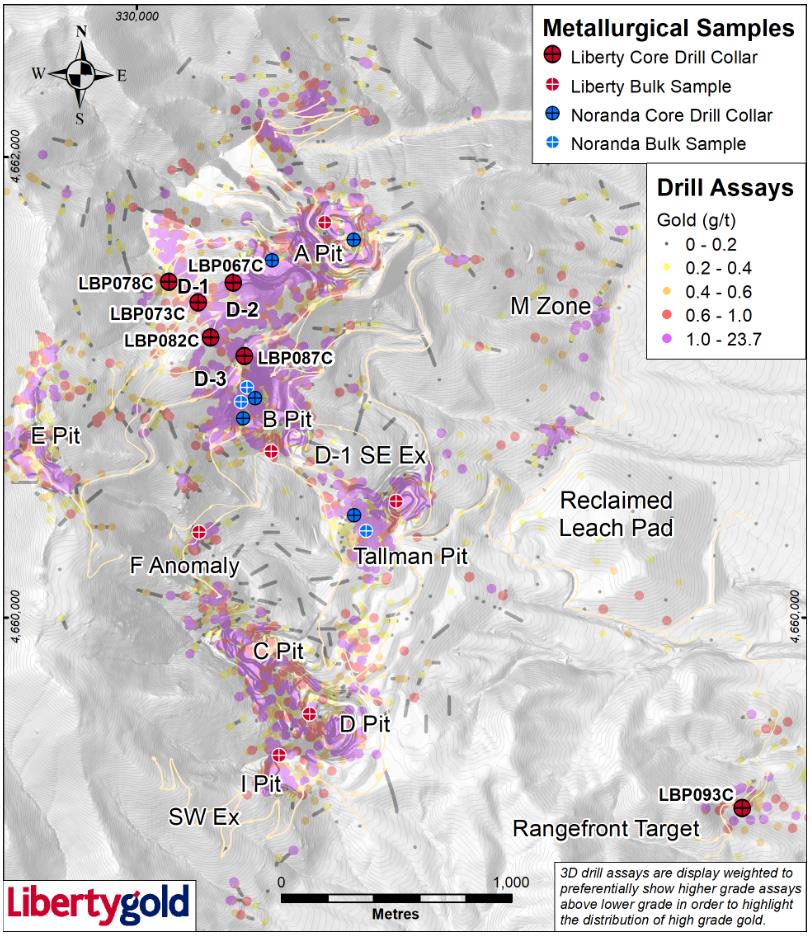

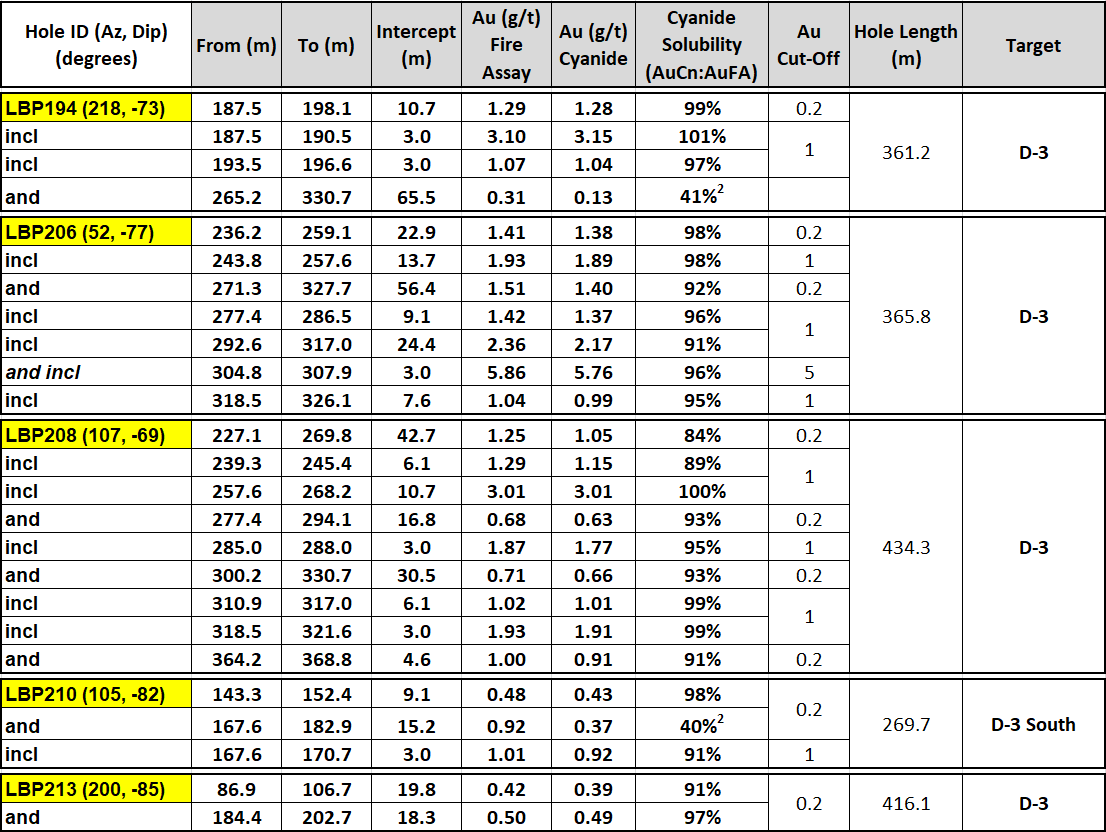

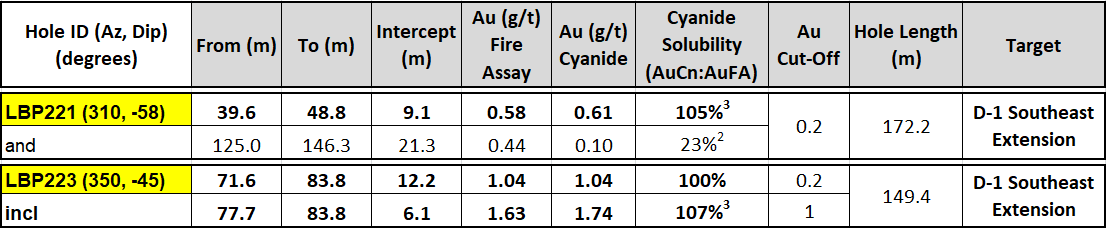

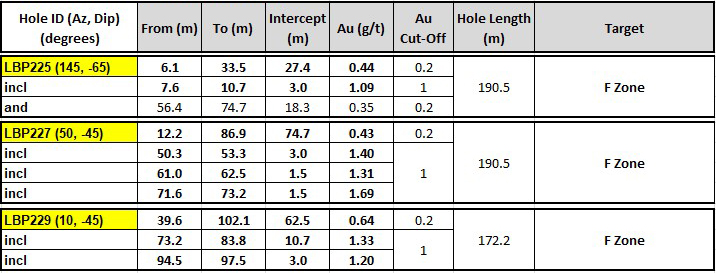

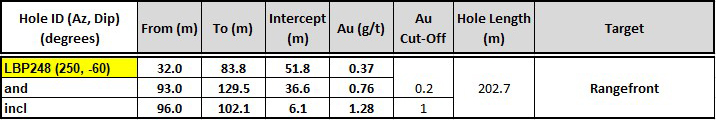

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce core drilling results from its Carlin-style Black Pine Property in southern Idaho, USA. Six large diameter (PQ) holes were drilled to collect material for: Phase 1 metallurgical column testing; specific gravity measurements; gold deportment studies; validation of Reverse Circulation (“RC”) drilling data; and collection of structural, stratigraphic and alteration information.

All holes returned thick intervals of high grade oxide gold mineralization.

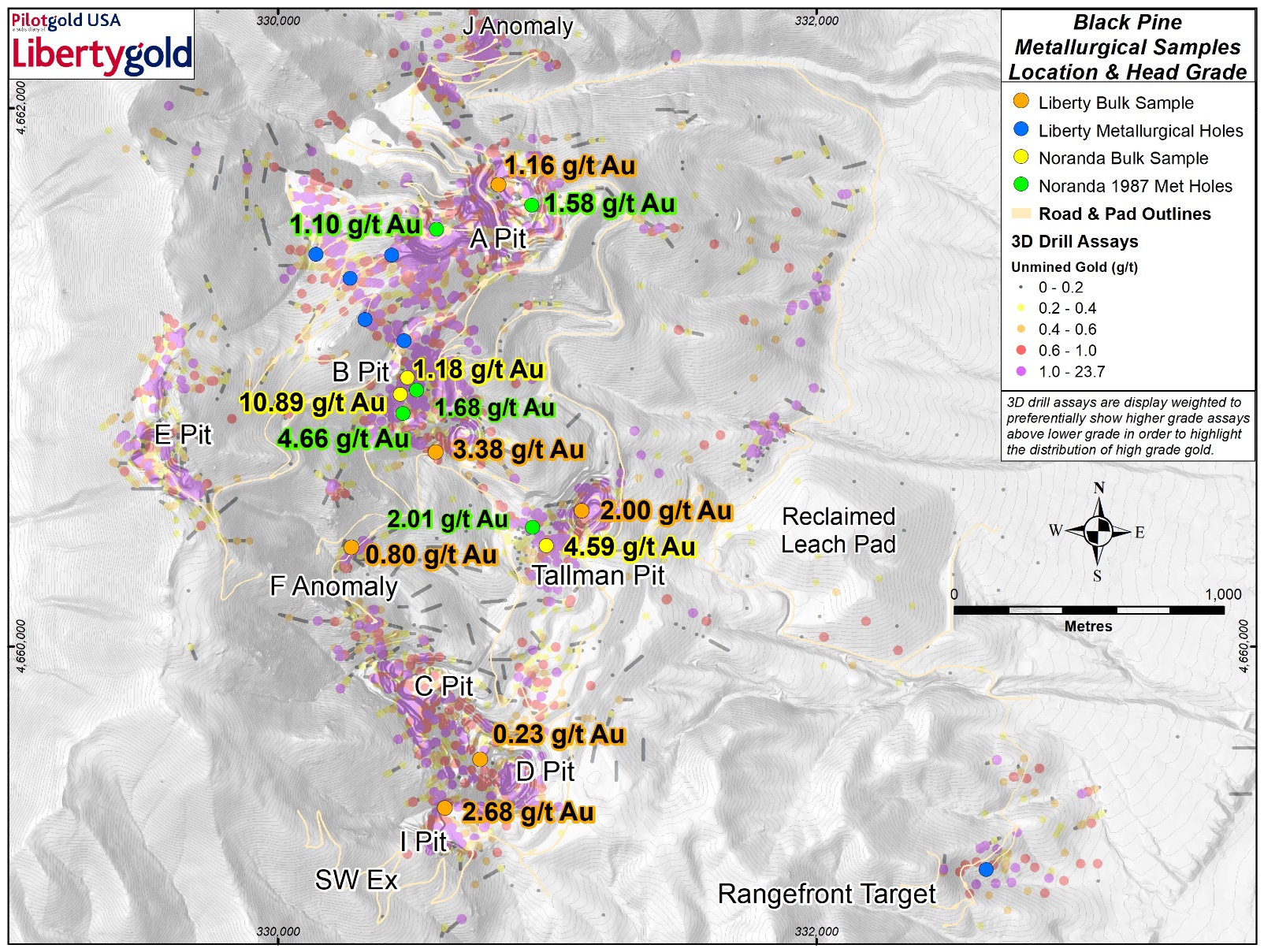

One hole (LBP093C) confirmed the presence of oxide gold mineralization in the Rangefront Target, located 3.1 kilometres (“km”) to the southeast of the Discovery 1 and 2 zones described in previous press releases (see press releases: January 7, 2020; November 5, October 15, October 1, September 12, July 31, July 15 and June 19, 2019). The Rangefront Target, identified in historical drilling, is on-trend with mineralization located to the northwest, but separated from it by a 1.5 km-wide area of shallow cover rocks. Future drilling in the covered area will be focused on linking the Rangefront Target with the large area of mineralization represented by the Discovery 1 and 2 zones.

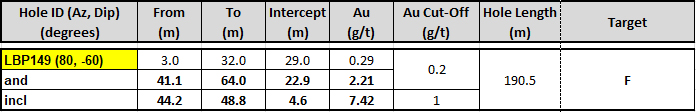

CORE DRILLING DISCOVERY 1 AND 2 REPORTABLE INTERCEPTS1:

| Hole ID (Az, Dip) (degrees) | From (m) | To (m) | Intercept (m) |

Au (g/t) | Au Cut-Off |

Hole Length (m) |

Target | Comments | g/t x m |

| LBP067C (104, -66) | 11.6 | 34.6 | 23.0 | 0.38 | 0.2 | 273.7 | Discovery Zone 2 | Near Twin of LBP043 | 185.2 |

| and | 78.6 | 81.7 | 3.0 | 1.03 | |||||

| and | 170.9 | 185.2 | 14.2 | 0.70 | |||||

| and | 188.7 | 244.5 | 55.9 | 2.92 | |||||

| including | 195.1 | 217.2 | 22.1 | 5.64 | 1 | ||||

| and including | 203.9 | 211.2 | 7.3 | 12.4 | 5 | ||||

| LBP073C (144, -81) | 43.9 | 50.4 | 6.5 | 0.28 | 0.2 | 212.8 | Discovery Zone 1 | 50.4 | |

| and | 70.0 | 79.9 | 9.9 | 0.25 | |||||

| and | 94.1 | 100.4 | 6.4 | 0.34 | |||||

| and | 165.5 | 168.3 | 2.8 | 0.50 | |||||

| and | 183.5 | 206.7 | 23.2 | 1.84 | |||||

| including | 185.6 | 199.3 | 13.7 | 2.79 | 1 | ||||

| LBP078C (48, -52) | 3.7 | 15.2 | 11.6 | 0.83 | 0.2 | 194.2 | Discovery Zone 1 | Near Twin of LBP002 | 55.7 |

| and | 22.4 | 41.8 | 19.3 | 0.43 | |||||

| and | 178.6 | 194.2 | 15.5 | 2.43 | |||||

| including | 186.5 | 192.6 | 6.1 | 5.56 | 1 | ||||

| and including | 188.1 | 191.1 | 3.0 | 8.10 | 5 | ||||

| LBP082C (15, -82) | 24.8 | 38.1 | 13.3 | 0.34 | 0.2 | 264.6 | Discovery Zone 1 | 42.4 | |

| and | 55.5 | 57.0 | 1.5 | 0.77 | |||||

| and | 65.8 | 82.5 | 16.7 | 0.30 | |||||

| and | 183.8 | 189.7 | 5.9 | 0.24 | |||||

| and | 196.8 | 216.6 | 19.7 | 0.70 | |||||

| including | 200.6 | 205.1 | 4.6 | 1.50 | 1 | ||||

| and | 231.0 | 235.6 | 4.6 | 0.25 | 0.2 | ||||

| and | 240.2 | 264.6 | 24.4 | 0.63 | |||||

| including | 251.2 | 253.9 | 2.7 | 1.35 | 1 | ||||

| LBP087C (120, -80) | 15.2 | 22.2 | 6.9 | 0.23 | 0.2 | 186.5 | Discovery Zone 1 | 42.2 | |

| and | 34.4 | 36.9 | 2.4 | 0.40 | |||||

| and | 84.7 | 87.8 | 3.0 | 0.37 | |||||

| and | 100.0 | 103.8 | 3.8 | 0.49 | |||||

| and | 142.2 | 171.3 | 29.1 | 1.26 | |||||

| including | 162.5 | 171.3 | 8.8 | 1.77 | 1 |

1A number of mineralized intervals were omitted from this table for brevity. Please refer to the full table at the link below for complete results. Grams per Tonne Gold abbreviated as “g/t Au”. Metres abbreviated as “m”.

Key Points

- The core holes were designed to sample a wide range of grades and rock types, primarily within the Discovery 1 Zone, with one hole in the Discovery 2 Zone and one testing historical drilling in the Rangefront Target, located 3.1 km southeast of the Discovery 1 and 2 zones.

- The core holes encountered thick oxide gold intercepts in all drill holes.

- Weighted average cyanide solubility for the primary high-grade interval in LBP067C is 95%, and for LBP087C, 94%.

- With all holes now reported, 9 of the top 10 unmined intercepts on the Black Pine Property have been drilled by Liberty Gold. Please see the Black Pine Unmined Intervals chart below. Drill holes highlighted in yellow were drilled by Liberty Gold:

| Black Pine Unmined Intervals | ||||||

| Rank | Hole ID | From metres | To metres | Interval metres | Au g/t | Au gXm |

| 1 | LBP043 | 208.8 | 262.1 | 53.3 | 4.39 | 234.0 |

| 2 | LBP064 | 112.8 | 175.3 | 62.5 | 3.38 | 211.3 |

| 3 | LBP067C | 188.7 | 244.5 | 55.9 | 2.92 | 163.3 |

| 4 | LBP062 | 129.5 | 173.7 | 44.2 | 3.14 | 138.9 |

| 5 | LBP088 | 257.6 | 318.5 | 61.0 | 2.10 | 128.3 |

| 6 | LBP002 | 111.3 | 189.0 | 77.7 | 1.49 | 116.1 |

| 7 | LBP029 | 166.1 | 207.3 | 41.1 | 2.56 | 105.1 |

| 8 | LBP051 | 131.1 | 172.2 | 41.1 | 2.51 | 103.5 |

| 9 | 89-417 | 67.1 | 117.4 | 50.3 | 1.98 | 99.7 |

| 10 | LBP054 | 248.4 | 349.0 | 100.6 | 0.95 | 95.1 |

| 11 | 87-169 | 79.3 | 121.9 | 42.7 | 2.10 | 89.6 |

| 12 | LBP069 | 160.0 | 217.9 | 57.9 | 1.52 | 88.1 |

| 13 | LBP023 | 204.2 | 253.0 | 48.8 | 1.78 | 86.9 |

| 14 | 88-357 | 61.0 | 121.9 | 61.0 | 1.40 | 85.3 |

| 15 | LBP021 | 189.0 | 236.2 | 47.2 | 1.78 | 84.3 |

| 16 | 92BP-078 | 21.3 | 76.2 | 54.9 | 1.50 | 82.1 |

| 17 | 88-366 | 74.7 | 86.9 | 12.2 | 6.66 | 81.2 |

| 18 | LBP066 | 173.7 | 243.8 | 70.1 | 1.15 | 80.6 |

| 19 | 92BX-18 | 1.5 | 68.6 | 67.1 | 1.18 | 79.2 |

| 20 | LBP055 | 190.5 | 266.7 | 76.2 | 0.99 | 75.6 |

CORE DRILLING RANGEFRONT TARGET REPORTABLE INTERCEPT:

| Hole ID (Az, Dip) (degrees) |

From (m) | To (m) | Intercept (m) |

Au (g/t) | Au Cut-Off |

Hole Length (m) |

Target | Comments | g/t x m |

| LBP093C (0, -90) | 21.8 | 25.3 | 3.5 | 0.41 | 0.2 | 119.8 | Rangefront Target | Hole ended in grade | 31.4 |

| and | 26.8 | 32.8 | 5.9 | 0.23 | |||||

| and | 46.2 | 101.5 | 55.3 | 0.49 | |||||

| incl | 93.2 | 96.9 | 3.7 | 1.80 | 1 | ||||

| and | 113.7 | 119.8 | 6.1 | 0.28 | 0.2 |

Rangefront Target Key Points

- LBP093C in the Rangefront Target encountered a total of 74.5 m of above cut-off oxide mineralization at shallow depth, including 55.3 m grading 0.49 g/t Au starting at a depth of 46.2 m.

- Approximately 65% of LBP93C is above the cut-off grade for reporting of 0.2 g/t Au. The drill hole bottomed in above cut-off grade material and will be extended in future drilling.

- Average cyanide solubility for above cut-off material in LBP93C is 93%.

- Host rocks for gold mineralization at the Rangefront Target include fine sandstone and calcareous siltstone which are the same host rocks at the Discovery 1 and 2 zones.

For a map of drill collars, bulk sample locations and regional cross section for the current release, please click here: https://libertygold.ca/images/news/2020/january/BlackPine_NR01162020Map.pdf

For a complete table of drill results from all Liberty Gold drill holes at Black Pine, please click here: https://libertygold.ca/images/news/2020/january/BP_NR01162020Intercepts.pdf

For highlight core photos, please click here: https://libertygold.ca/images/news/2020/january/BlackPine_NR01162020Corephotos.pdf

Click here for a list of the top 500 unmined gold intercepts at Black Pine: https://libertygold.ca/images/news/2020/january/BlackPine_NR01162020HH.pdf

Core from the six holes will be used to carry out a Phase 1 metallurgical column testing and characterization program. In addition, six bulk samples (~1000 kilograms) were collected with a backhoe from historic pits for column testing, with head assays ranging from 0.23 to 4.06 g/t gold. The head grades highlight the tenor of gold mineralization left behind in the historic pit walls. Results are expected in early Q3.

Drilling and assaying are completed for 2019, with a total of 20,900 m drilled in 87 RC and 6 core holes.

“With our 2019 field program now complete, we will spend the next two months working toward implementing a much larger drill program in 2020, commencing in mid-March,” stated Moira Smith, Vice President, Exploration and Geoscience for Liberty Gold. “We are now updating the model, designing the metallurgical program, and amending our permit to allow drilling in a new, 3 km2 area between the main permit area and the Rangefront Target, where we expect to link mineralization between the two outcropping zones under shallow sandstone cover. Given the grade and tenor of oxide gold encountered at Black Pine in the initial 1 km2 Focus Area, our pre-drilling, 2 to 4 million ounce property-scale estimate of gold endowment now appears to be conservative. Only 5% of the 12 km2 overall target has been drill verified by Liberty Gold to date.”

About Black Pine

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. It is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Newmont’s Long Canyon deposit, Black Pine represents a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, during a period of historically low gold prices, with 435,000 ounces of gold produced from five composite, shallow pits.

A virtual site tour and 3D model of Black Pine property, including details about the geology and mineralization, is available on the homepage of the Company’s website, www.libertygold.ca.

A Technical Report is also available on the Company website: https://libertygold.ca/images/pdf/BlackPine_NI43-101_2018.pdf

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike inUtah, both past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold’s VP Exploration and Geoscience, Dr. Moira Smith, Receives The 2019 AME Colin Spence Award for Her Essential Contribution to the Discovery of the Long Canyon Gold Deposit, Nevada

Liberty Gold’s VP Exploration and Geoscience, Dr. Moira Smith, Receives The 2019 AME Colin Spence Award for Her Essential Contribution to the Discovery of the Long Canyon Gold Deposit, Nevada

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce that Dr. Moira Smith is the recipient of the Association for Mineral Exploration 2019 Colin Spence Award for her role in the discovery and delineation of the high-grade Long Canyon gold deposit in Nevada, U.S.

The Colin Spence Award is a prestigious Canadian Mining industry award, recognizing Excellence in Global Mineral Exploration. It is awarded to those who have made a significant contribution to enhance the mineral resources within Canada or in foreign countries through the original application of prospecting techniques or other geoscience technology.

“We are thrilled to see Dr. Moira Smith receive this exciting award. Very few teams make a mineral discovery that becomes an operating mine especially one as high grade as Long Canyon,” stated Dr. Mark O’Dea, Chairman of Liberty Gold and former CEO of Fronteer Gold Inc. “Moira, as the technical leader of Fronteer Gold’s Long Canyon team, countered conventional thinking to advance a project long ignored because the location and geology were considered wrong. Focused on geological first principles, Moira created a new geological model for this part of eastern Nevada that guided the full discovery and delineation of the multi-million ounce, high-grade, Carlin-style Long Canyon, gold deposit, which recently completed its third year of commercial production by Newmont.”

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

Barbara Womersley Joins the Liberty Gold Board of Directors

Barbara Womersley Joins the Liberty Gold Board of Directors

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce that Barbara Womersley (CPHR) has been appointed to the Board of Directors effective February 24, 2020.

Ms. Womersley is a Chartered Professional in Human Resources and brings over 20 years of experience in a variety of industries with a focus on the mining industry, including previous senior roles at Barrick Gold Corp, Lundin Mining Corp and Yukon Zinc Corp.

Ms. Womersley runs a human resources consultancy, leading projects such as leadership coaching and advising, compensation system review and implementation, recruitment for senior roles, HR policy and project management plan development, and performance management system development and implementation.

Mark O’Dea, Chairman of Liberty Gold, commented, “On behalf of the Board of Directors and of our shareholders, we welcome Barbara to Liberty Gold. She joins us at an exciting time for the Company and her extensive experience in Human Resources is extremely relevant at this stage in our Company’s evolution. We are aggressively advancing the Black Pine gold project and we look forward to building out our team in order to place us in the best position for our future development.”

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

Liberty Gold Corp. Closes Sale of Net Profit Interest on the Regent Gold Project, Nevada, USA to Ely Gold Royalties Inc.

Liberty Gold Corp. Closes Sale of Net Profit Interest on the Regent Gold Project, Nevada, USA to Ely Gold Royalties Inc.

Griffon Project Sale Completed to Fremont Gold Ltd. and Receipt of C$3,728,525 from Early Exercise of Warrants.

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce that it closed the sale of its Net Profit Interest (“NPI”) in the Regent Hill Property, Nevada, to Ely Gold Royalties, Inc. (“Ely Gold”).

Liberty Gold has also closed the sale of the Griffon Property, Nevada, to Fremont Gold Ltd. (“Fremont”) through a purchase-option agreement (the “Option Agreement”).

Terms of the Regent Hill Property NPI Sale include:

- US$800,000 - received

- 2,000,000 two-year purchase warrants for Ely Gold common shares, exercisable at C$0.43 per warrant.

Terms of the Griffon Property Option Agreement include:

- US$25,000 upon executing the Option Agreement (the “Execution Date”) – received.

- US$25,000 and 2,500,000 Fremont common shares to be issued to Liberty following TSX Venture Exchange approval of the Agreement– received.

- US$50,000 and the number of Fremont common shares that will bring Liberty Gold’s total ownership of Fremont’s issued and outstanding common shares to 9.9% on the first anniversary of the Execution Date.

- US$50,000 on the second anniversary of the Execution Date.

- US$75,000 on the third anniversary of the Execution Date.

- US$100,000 on the fourth anniversary of the Execution Date.

- 1% NSR which may be repurchased by Fremont for US$1,000,000.

The Company also wishes to announce that since July 2019 to the date of this press release it has received a total of C$3,327,150 and C$401,375 from the early exercise of Liberty Gold share purchase warrants (“Warrants”) issued pursuant to the bought deal financings that closed on October 2, 2018 and January 26, 2018 respectively; the Warrants are exercisable for C$0.60 and C$0.65 respectively for a period of three years from issue.

With the sale of Liberty Gold’s 40% interest in the Halilağa copper gold Project in Turkey (see press release of November 18, 2019); the pending sale of the Kinsley Mountain project in Nevada (see press release of December 2, 2019); and the monetization of the Regent project NPI and the Griffon project, the Company can focus its exploration efforts on its core projects, the Black Pine oxide gold discovery in Idaho and the Goldstrike oxide gold deposit in Utah. The Company’s intent is to continue to lower non-core project obligations and maximize exploration expenditures with no equity dilution to shareholders.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the receipt of staged payments. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

LIBERTY GOLD REPORTS Q4 2019 FINANCIAL AND OPERATING RESULTS

LIBERTY GOLD REPORTS Q4 2019 FINANCIAL AND OPERATING RESULTS

VANCOUVER, B.C. – Liberty Gold Corp. (LGD - TSX) ("Liberty Gold" or the "Company"), is pleased to announce its financial and operating results for the year ended December 31, 2019. All amounts are presented in United States dollars unless otherwise stated.

Liberty Gold is focused on advancing a pipeline of Carlin-Style gold deposits in the Great Basin, U.S.A., a mining-friendly jurisdiction that is home to large-scale oxide gold systems ideal for open-pit mining. The Great Basin covers portions of the states of Nevada, Utah and Idaho. The Company has a proven track-record in discovery and building value in this region.

In November 2019, we received $4 million as part consideration for the sale of the Halilağa porphyry copper gold deposit in Turkey (“Halilağa”). On July 12, 2019 we, along with our joint venture partners, signed a definitive agreement to sell Halilağa to Cengiz Holdings A.Ș for total consideration of $55 million. In accordance with our 40% interest in Halilağa, we will receive a total of $22 million over a three-year period. Closing of the final agreement and a second payment of $6 million is scheduled for August 15, 2020, to be followed by two additional bank guaranteed payments of $6 million each on August 15, 2021 and 2022.

In December 2019, we signed a definitive agreement to sell our interest in the Kinsley Mountain Gold deposit to Barrian Mining Corp. (the “Kinsley Agreement”) for aggregate gross proceeds of approximately $7.5 million to be received in 3 stages over 2 years.

In March 2020, we sold our 15% net profit interest in the Regent property in Nevada, to Ely Gold Royalties Inc. (“Ely”), for a total consideration of $800,000 and 2,000,000 warrants to purchase common shares in Ely with an exercise price of C$0.43.

Since July 2019, to the date of this press release, the Company has received a total of C$3,327,150 and C$401,375 from the early exercise of Liberty Gold share purchase warrants (“Warrants”) issued pursuant to the bought deal financings that closed on October 2, 2018 and January 26, 2018 respectively; the Warrants are exercisable for C$0.60 and C$0.65 respectively for a period of three years from issue.

In September 2019, the Company completed a bought deal financing, including the exercise of the overallotment in full, for C$15.8 million.

In February 2020 we announced the appointment of a new director Barbara Womersley.

Liberty Gold has $15 million in cash as at today’s date and expects to be fully funded for the 2020 exploration program.

Exploration highlights

At Black Pine, our 100% owned project in Idaho, we:

- Drill confirmed two new discoveries. “Discovery 1” was made in a 500 metre (“m”) wide gap between an area of known gold mineralisation and a historic pit with flanking gold mineralization, and “Discovery 2” occupies a large area between Discovery 1 and another historic pit to the northeast. At present, the Discovery 1 zone measures 1 kilometre (“km”) long and 150 m wide, and the Discovery 2 zone measures 600 m long and 400 m wide. Both zones are open in several directions.

- Drilled exceptional grades and widths of gold mineralisation. Completed a 19,650 m reverse circulation (“RC”) drill program and a 1,250 m large diameter core drilling program which returned nine out of 10 of the strongest (as defined by grade multiplied by thickness) unmined gold intercepts on the property, all in the new discovery zones, including:

- 4.39 grams per tonne gold (“g/t Au”) over 53.3 m, including: 5.76 g/t Au over 38.1 m and 12.05 g/t Au over 12.2 m, in LBP043,

- 3.40 g/t Au over 62.5 m, including: 5.01 g/t Au over 33.5 m and 6.21 g/t Au over 21.3 m, in LBP064,

- 3.14 g/t Au over 44.2 m, including: 6.53 g/t Au over 16.8 m and 11.3 g/t Au over 7.6 m, in LBP062.

The six core holes, drilled primarily for metallurgical testing, each encountered thick oxide gold intercepts Highlights include:

- 2.92 g/t Au over 55.9 m including: 5.64 g/t Au over 22.1 m and 12.4 g/t Au over 7.3 m in LBP067C,

- 2.43 g/t Au over 15.5 m including: 5.56 g/t Au over 6.1 m and 8.10 g/t Au over 3 m in LBP078C, and

- 1.84 g/t Au over 23.2 m including 2.79 g/t Au over 13.7 m in LBP073C.

- Demonstrated high cyanide solubility. Including 92% in LBP088, 97% in LBP043, and 94% in LBP045.

- Increased the potential size of the project. In January 2020 we staked 94 additional federal lode claims, primarily to the south and east of the original property. The Black Pine project currently covers a 38.6 square kilometer area.

- Received a new Plan of Operations. Received a new Plan of Operations in February 2019 allowing for 141 acres of disturbance and 351 drill sites over a 7.3 km3 project area.

- Will continue to add value. The 2020 fully funded, 28,800 m RC drilling exploration program, will commence on March 31, 2020.

At Goldstrike, our 100% controlled project in Utah, we:

- Demonstrated that mineralization in the resource model is open to extension.

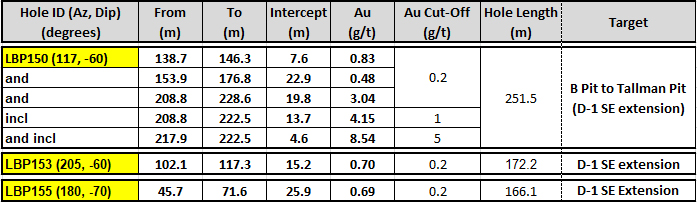

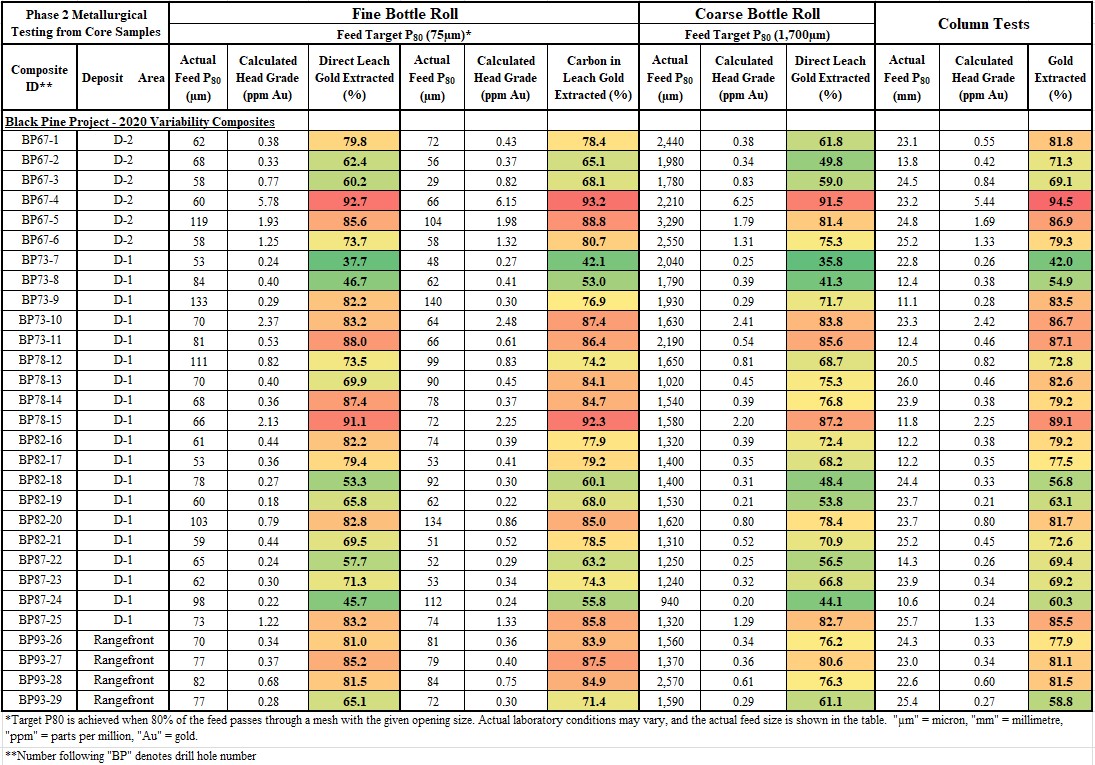

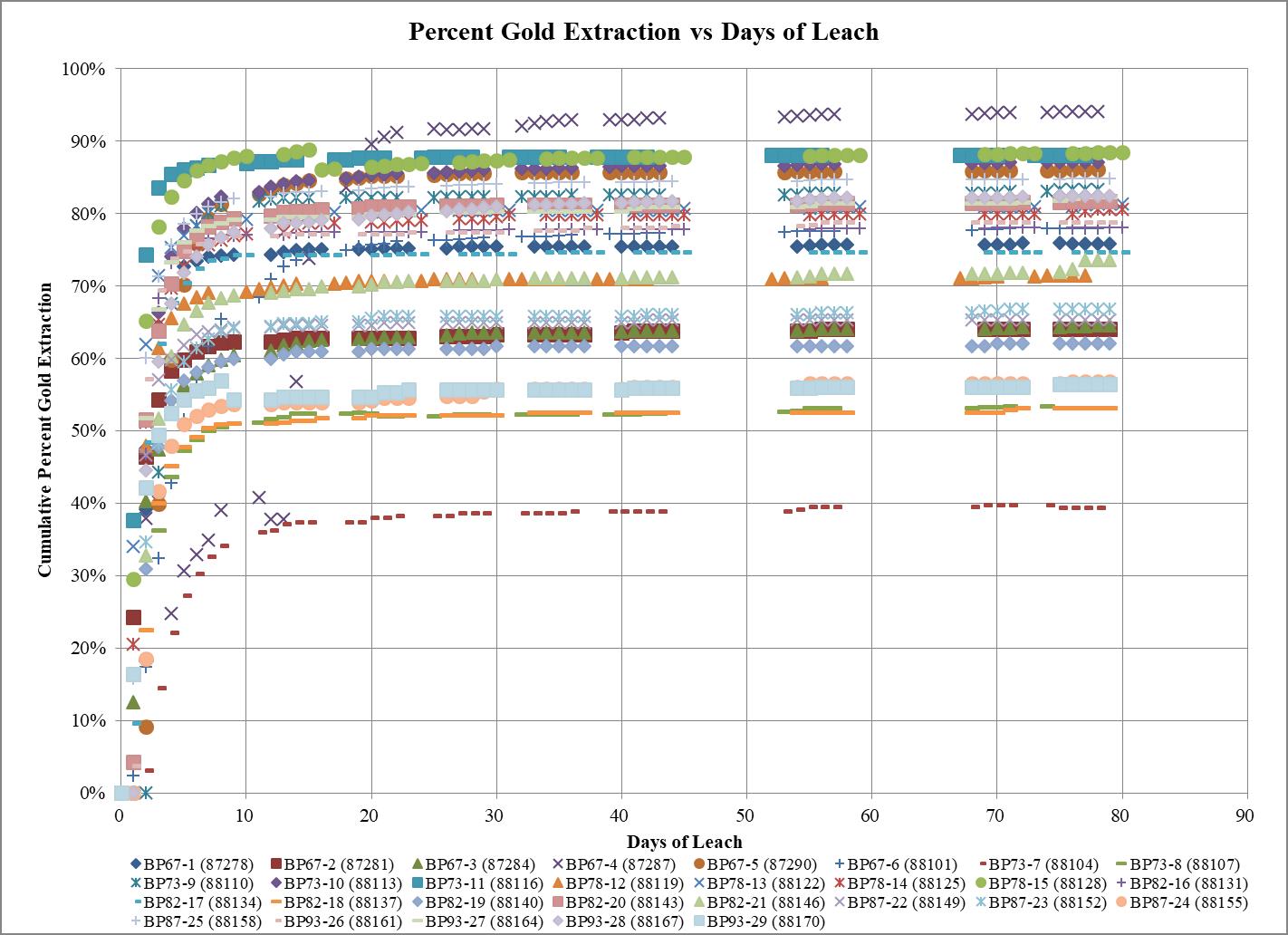

- Continued to add value. In May 2019 we reported results from a phase 2 metallurgical testing providing additional support for a simple heap leach mining scenario. Gold extractions from 29 column tests were rapid, and greater than 80% of the leachable gold was extracted within 10 days, with final column leach gold extractions up to 95%.

- Announced drill results from the 2019 drill program, focused on extensions to gold mineralization in three portions of the resource area, the Western, Main and Dip Slope Zones for the purpose of further resource delineation. Highlights include:

- 1.40 g/t Au over 19.8 m including 2.79 g/t Au over 9.1 m in PGS713,

- 1.15 g/t Au over 27.4 m including 3.39g/t Au over 6.1 m in PGS733.

SELECTED FINANCIAL DATA

The following selected financial data is derived from our Annual Financial Statements and related notes thereto (the “Annual Financial Statements”) for the year ended December 31, 2019 as prepared in accordance with International Accounting Standards. A copy of the Annual Financial Statements is available on the Company’s website at www.libertygold.ca or on SEDAR at www.sedar.com.

The information in the tables below is presented in $000s except per share data:

|

Year ended December 31, |

||||

|

|

2019 |

2018 |

2017 |

|

|

Attributable to shareholders: |

||||

|

Loss for the period |

$11,583 |

$11,169 |

$12,709 |

|

|

Loss and comprehensive loss for the period |

$11,421 |

$12,340 |

$12,125 |

|

|

Basic and diluted loss per share |

$0.05 |

$0.06 |

$0.08 |

|

|

As at December 31, |

|||

|

2019 |

2018 |

2017 |

|

|

Cash and short-term investments |

$14,464 |

$7,878 |

$2,266 |

|

Working capital |

$11,493 |

$7,477 |

$1,510 |

|

Total assets |

$42,109 |

$35,081 |

$30,009 |

|

Current liabilities |

$5,281 |

$612 |

$972 |

|

Non-current liabilities |

$1,998 |

$1,535 |

$703 |

|

Shareholders’ equity |

$26,192 |

$24,169 |

$19,006 |

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past-producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, including any impacts due to the recent pandemic of the novel coronavirus (COVID-19), obtaining governmental approvals and any financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; including any restrictions due to the recent pandemic of the novel coronavirus (COVID-19), possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, or in the completion of exploration, as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2020 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold Announces Commencement of 2020 Drill Program - Black Pine Oxide Gold Project, Idaho, USA

Liberty Gold Announces Commencement of 2020 Drill Program - Black Pine Oxide Gold Project, Idaho, USA

Increased 2020 Exploration Program to Advance Resource Definition and District Scale Drill Testing of Nine Priority Regional Targets

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce the start of the 2020 exploration season at its Carlin-style Black Pine oxide gold property in southern Idaho, USA.

On March 25, 2020, pursuant to the COVID-19 containment process, Idaho Governor Brad Little issued a statewide stay-at-home directive that excludes certain essential services, with mining having been designated as an “Essential Infrastructure Service”. As such, Liberty Gold commenced drilling on the Black Pine gold project on March 31, 2020.

“The Company’s intent is to safely advance the Black Pine Project with full recognition of the COVID-19 pandemic and, if necessary, we will alter our exploration strategy as warranted or directed,” commented Cal Everett, President and CEO. “As a Company, we recognize the effect on individuals, local communities, states, countries and financial markets as a result of the coronavirus pandemic as announced by the World Health Organization on March 11, 2020, and we have established strict internal and external protocols for our employees, contractors and associates at Black Pine.”

Liberty Gold adopted a work from home and no-fly policy for its office employees in early March. Our USA-based geological team live within driving distance of the Black Pine Project. Canada-based geologists will remain in-country and will focus on data interpretation, digital modelling, and drill hole targeting. Social distancing policies have been established for the Black Pine Project, inclusive of a one person per vehicle policy, daily personal temperature checks, and on-site separation mandate between and amongst employees and contractors. The Black Pine Project is located 100 kilometers from the closest community with medical facilities.

In 2019, drilling at Black Pine was focused in a one square kilometer (“km2”) area of a shallow oxide gold system estimated to cover over 12 km2. Drilling resulted in two discoveries of high-grade oxide gold mineralization beneath the limit of shallow historical drilling. The Discovery 1 zone measures approximately 1 kilometer (“km”) by 150 metres (“m”), trending in northwest (“NW”) direction. The Discovery 2 zone measures approximately 600 m by 400 m, trending in a northeast (“NE”) direction. Both zones remain open for extension in several directions.

For a complete table of drill results from all Liberty Gold drill holes, including 2019 drill results, at Black Pine, please click here: https://libertygold.ca/images/news/2020/april/BP_NR04012020Intercepts.pdf

The 2020 drill program is fully funded, with the ability to further expand the exploration program subject to results.

Liberty Gold’s intent is to significantly increase the amount of drilling to well over the 21,000 metres drilled last year, and greatly expand the target area to be tested.

For a map of gold distribution, 2020 drill targets, Phase 1 drill sites and permit amendment areas, please click here: https://libertygold.ca/images/news/2020/april/BlackPineNR04012020Map.pdf

Key Points

- The 2020 Black Pine drill program is split between continued drilling of the high grade oxide gold discoveries from 2019 and a regional test of the surrounding district, selected by compilation of historical drill results, surface and pit wall mapping and soil geochemistry. The initial target area covers approximately 12 km2.

- Nine regional drill targets have been selected based on 3D modeling of potential NW and NE trending feeder fault corridors.

- Two drills are on site. Drill operations are on a single shift basis. If there is a delay of the exploration program, the drills can be double-shifted when drilling resumes in order to complete the 2020 drill program.

- Metallurgical column testing on six bulk samples with head assays ranging from 0.23 to 4.06 grams per tonne gold (“g/t Au”) and 29 composites from large diameter core is ongoing, with results expected in Q3.

- An amendment to the Plan of Operations has been submitted to the US Forest Service to increase the size of the permitted project area from 7.3 to 11.9 km2, including a large area between the main permit area and the Rangefront target to the southeast, where drilling in late 2019 encountered 55.3 m grading 0.49 g/t Au. Additional Phase 2 drilling in this area will be carried out when the permit is approved.

- Discussions are underway with the US Bureau of Land Management regarding access to land located to the east of the project area for infrastructure and historic mine well access.

- Additional project de-risking activities are underway, including preliminary engineering and baseline studies.

- A strategy for obtaining access to process water is being developed.

About Black Pine

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. It is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Newmont’s Long Canyon deposit, Black Pine represents a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, during a period of historically low gold prices, with 435,000 ounces of gold produced from five composite, shallow pits.

A virtual site tour and 3D model of Black Pine property, including details about the geology and mineralization, is available on the homepage of the Company’s website, www.libertygold.ca.

A Technical Report is also available on the Company website: https://libertygold.ca/images/pdf/BlackPine_NI43-101_2018.pdf

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, the 2020 drill program being fully funded and the Company’s ability to further expand the exploration program, the Company’s ability to increase the amount of drilling and the target area to be tested, and the results of testing and timing thereof. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the impact from the pandemic of the novel coronavirus (COVID-19), availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry, including impacts from the pandemic of the novel coronavirus (COVID-19); delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2020 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold Announces Amendment to the Definitive Agreement to Sell its Share of the Kinsley Mountain Gold Deposit, Nevada

VANCOUVER,B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) has signed an amendment (the “Amendment”) to the definitive purchase option agreement (the “Agreement”) for the sale of its 79.99% interest in the Kinsley Mountain Gold project (“Kinsley”), located in northwest Nevada, to Barrian Mining Corp. (BARI-TSX.V) (“Barrian”).

Pursuant to the terms of the Agreement, as amended by the Amendment, Liberty Gold will receive for its interest Kinsley an aggregate of US$6,250,000 in cash and share value plus a 9.9% interest in Barrian post-consolidation1 (the “Transaction”).

Amended Terms of the Agreement:

Closing of the Transaction is subject to completion of a financing by Barrian and other customary conditions including approval by the TSX Venture Exchange (the “TSXV”).

The purchase price will be paid in 3 stages over a 2-year period as follows:

- US$1,250,000 on the closing date plus Barrian common shares totalling 9.9% of the issued and outstanding common shares of Barrian on a post-consolidation1 basis (subject to a contractual 12 month hold period).

- US$2,500,000 on or before the 1st anniversary of the final approval of the Transaction by the TSXV.

- US$2,500,000 in common shares of Barrian on or before the 2nd anniversary of the final approval of the Transaction by the TSXV. (subject to a 4 month statutory hold period).

- A 1% Net Smelter Return Royalty (“NSR”) on the acquired interest in Kinsley: where Barrian, at its sole discretion has the right to re-purchase up to one-half percent (0.5%) of the NSR royalty upon payment of US$500,000.

- Cal Everett, President, CEO and Director of Liberty Gold is to act as senior financial advisor to Barrian which will also include advising on adding to the Barrian management and exploration team.

1Prior to closing the Transaction, Barrian intends to complete a consolidation on the basis of two pre-consolidation shares for one post-consolidation share.

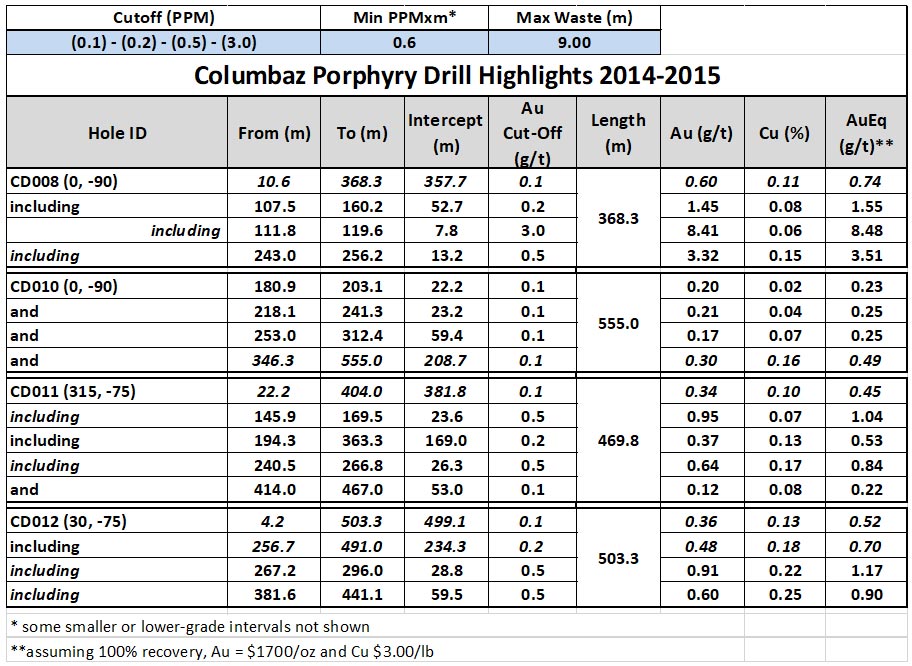

Kinsley is a Carlin-Style gold project located 80 kilometres (“km”) south of the Nevada Gold Mines LLC Long Canyon gold mine. Historical production at Kinsley was sourced in the Dunderberg Shale, with 138,000 ounces (“oz”) averaging 1.4 grams per tonne of gold (“g/t Au”) produced from a run of mine oxide heap leach operation during a period of historically low gold prices. Near surface oxide gold targets remain in this target horizon. Liberty Gold discovered high-grade mineralization in an underlying unit, the Secret Canyon Shale, which yielded exceptional drill results as detailed below.

Secret Canyon Shale Target

Historical drill results from the Western Flank Zone hosted by in the Secret Canyon/Clarks Spring Shale unit include:

|

Hole ID (Az, Dip) |

From |

To |

Interce |

Au |

Au Cut- |

Hole |

Zone |

Host Rock |

|

PK091CA (090, -70) |

159.0 |

161.8 |

2.9 |

1.46 |

0.2 |

291.7 |

Western Flank |

Dunderberg |

|

and |

231.5 |

233.8 |

2.3 |

0.71 |

0.2 |

|||

|

and |

255.1 |

291.7 |

36.6 |

8.53 |

0.2 |

Secret Cyn Shale |

||

|

including |

276.5 |

284.0 |

7.6 |

29.4 |

5.0 |

|||

|

PK127C2 (090, -66) |

137.8 |

140.4 |

2.6 |

0.57 |

0.2 |

389.2 |

Western Flank |

Dunderberg |

|

and |

233.8 |

236.8 |

3.0 |

0.37 |

0.2 |

Secret Cyn Shale |

||

|

and |

268.8 |

270.4 |

1.5 |

0.68 |

0.2 |

|||

|

and |

276.5 |

318.1 |

41.7 |

6.85 |

0.2 |

|||

|

incl |

282.5 |

287.1 |

4.6 |

8.50 |

5.0 |

|||

|

incl |

301.0 |

309.5 |

8.5 |

16.3 |

5.0 |

|||

|

incl |

314.6 |

318.1 |

3.6 |

20.5 |

5.0 |

|||

|

PK131C (110, -72) |

229.2 |

232.3 |

3.0 |

0.36 |

0.2 |

398.4 |

Western Flank |

Secret Cyn Shale |

|

and |

247.5 |

249.0 |

1.5 |

0.68 |

0.2 |

|||

|

and |

262.7 |

305.4 |

42.7 |

10.5 |

0.2 |

|||

|

incl |

276.5 |

299.3 |

22.9 |

18.3 |

5.0 |

|||

|

PK132C (-90) |

172.8 |

174.3 |

1.5 |

1.46 |

0.2 |

456.9 |

Western Flank |

Secret Cyn Shale |

|

and |

249.6 |

303.0 |

53.3 |

7.53 |

0.2 |

|||

|

incl |

257.3 |

259.5 |

2.3 |

18.1 |

5.0 |

|||

|

incl |

269.4 |

292.3 |

22.9 |

14.9 |

5.0 |

|||

|

and |

324.3 |

331.9 |

7.6 |

4.67 |

0.2 |

|||

|

incl |

327.1 |

328.9 |

1.8 |

13.7 |

5.0 |

|||

|

PK133C (270, -77) |

206.3 |

210.9 |

4.6 |

0.46 |

0.2 |

413.6 |

Western Flank |

Dunderberg |

|

and |

246.0 |

247.5 |

1.5 |

0.67 |

0.2 |

Secret Cyn Shale |

||

|

and |

310.0 |

340.0 |

30.0 |

10.6 |

0.2 |

|||

|

incl |

322.2 |

338.6 |

16.5 |

16.1 |

5.0 |

|||

|

PK137C** (120 -80) |

253.9 |

282.9 |

29.0 |

21.3 |

0.2 |

282.8 |

Western Flank |

Secret Cyn Shale |

|

incl |

259.7 |

264.6 |

4.9 |

46.4 |

5.0 |

|||

|

incl |

270.5 |

281.9 |

11.4 |

32.7 |

5.0 |

|||

|

PK137CA3 (120,-80) |

253.3 |

292.0 |

38.7 |

15.6 |

0.2 |

346.9 |

Western Flank |

Secret Cyn Shale |

|

incl |

259.4 |

281.3 |

21.9 |

26.2 |

5.0 |

|||

|

PK175CA (255, -78) |

189.6 |

197.2 |

7.6 |

0.54 |

0.2 |

398.4 |

Western Flank |

Hamburg |

|

and |

241.4 |

244.4 |

3.0 |

0.75 |

0.2 |

Secret Canyon |

||

|

and |

287.1 |

332.8 |

45.7 |

6.19 |

0.2 |

|||

|

including |

299.9 |

319.1 |

19.2 |

13.8 |

5.0 |

|||

|

PK186C (030, -79) |

212.4 |

226.5 |

14.0 |

1.53 |

0.2 |

422.8 |

Western Flank |

Dunderberg |

|

and |

252.4 |

256.6 |

4.3 |

0.36 |

0.2 |

|||

|

and |

273.4 |

313.0 |

39.6 |

10.1 |

0.2 |

Secret Cyn Shale |

||

|

incl |

283.8 |

305.4 |

21.6 |

17.4 |

5.0 |

|||

|

PK187C (145, -81) |

133.8 |

140.5 |

6.7 |

3.09 |

0.2 |

364.8 |

Western Flank |

Dunderberg |

|

and |

252.1 |

258.2 |

6.1 |

0.43 |

0.2 |

Secret Cyn Shale |

||

|

and |

262.7 |

293.2 |

30.5 |

6.05 |

0.2 |

|||

|

incl |