Liberty Gold Announces Results of Additional Infill and Step Out RC Drilling along the Southern Margin of the Main Goldstrike Deposit, Great Basin, USA

2.95 g/t Au over 18.3 m

0.85 g/t Au over 7.6 m and 1.29 g/t Au over 36.6 m including 2.82 g/t Au over 9.1 m

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce results from its 2018 Reverse Circulation (“RC”) drilling program at the Goldstrike Project, the flagship of its three principal gold projects located in the prolific Great Basin of the United States. Located in southwestern Utah, Goldstrike is a past-producing oxide - heap leach gold mine that contains a large, shallow, district-scale, Carlin-style gold system.

As a follow-up to encouraging drill results along the southern margin of the Main Goldstrike Deposit (see press releases dated October 24, 2018 and November 15, 2018), Liberty Gold drilled additional holes to extend mineralization in two areas.

Drill Highlights include:

SOUTHERN MAIN GOLDSTRIKE DEPOSIT (PEG LEG ZONE)

- 2.95 grams per tonne gold (g/t Au) over 18.3 metres (m) in PGS670

- 0.70 g/t Au over 24.4 m in PGS668

- 1.00 g/t Au over 13.7 m in PGS669

SOUTHERN MAIN GOLDSTRIKE DEPOSIT (HAMBURG EXTENSION)

- 0.85 g/t Au over 7.6 m and 1.29 g/t Au over 36.6 m, including 2.82 g/t Au over 9.1 m in PGS677

- 1.18 g/t Au over 6.1 m and 1.17 g/t Au over 9.1 m in PGS676

- 0.83 g/t Au over 12.2 m in PGS678

KEY POINTS

- Drilling in the southern Main Goldstrike Deposit (Peg Leg Zone) continues to expand mineralization in this area as originally reported in October 2018, which included highlight intercepts of 1.17 g/t Au over 67.1 m and 0.99 g/t Au over 51.8 m.

- The objective is to connect zones of previously-identified oxide mineralization to form a larger, single pit.

- Mineralization encountered in the latest drill holes is higher-grade than the average grade of the deposit, and relatively shallow.

- Drilling in the southern Main Goldstrike Deposit (Hamburg Extension) area continues to expand mineralization to the west along the Hamburg Fault, as originally reported in November 2018, including highlight intercepts of 0.62 g/t Au over 61.0 m and 0.97 g/t Au over 33.5 m.

- Mineralization in this area is higher-grade than the average grade of the deposit, relatively shallow, and is located in an embayment in the Preliminary Economic Assessment (“PEA”)1 pit.

- 2018 results from all areas will be incorporated into an updated resource estimate in 2019.

“With the recent receipt of two amendments to our Plan of Operations and improved access for drilling, we are now focusing on low-risk infill and step-out drilling in areas where widely-spaced drill holes indicate that gold mineralization is present just beyond the limits of the resource and PEA pits,” commented Moira Smith, V.P of Exploration and Geoscience for Liberty Gold. “With this strategy, we hope to use areas of previously identified mineralization as leverage to quickly and economically define more ounces and we look forward to seeing these results reflected in an expanded resource in 2019.”

For a complete table of drill results from the current holes, please click here: http://libertygold.ca/images/sites/default/files/GS_Intercepts01142019.pdf

For a map of drill collars and traces for the current release, please click here: http://libertygold.ca/images/sites/default/files/Goldstrike_NR01142019.pdf

Liberty Gold drilled a total of 24,716 m in 200 RC and 15 diamond core holes in 2018. The objective of the drilling reported below was to continue to push the pit-constrained resource outward and downward, to grow the resource and convert Inferred resources to Indicated resources.

Liberty Gold met its project enhancement goals in 2018, commencing with a maiden resource estimate released in February2. A PEA is based on this resource, which includes drill results through the end of 2017. The 2018 reverse circulation program was completed on November 1, 2018. The program focused on 1) infill and expansion of the resource; 2) testing of the historic heap-leach, stockpile and waste dump areas that are largely situated within the PEA pit and counted as waste in the model (see press release dated August 16, 2018); and 3) testing of new targets property-wide.

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada border, and is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike represents part of a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Goldstrike Mine operated from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au and an average recovery of approximately 75%.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by AAS. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Goldstrike, Black Pine and Kinsley Mountain, all of which are past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, expected capital costs at Goldstrike, expected gold and silver recoveries from the Goldstrike mineralized material, potential additions to the resource through additional drill testing, potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for silver resources at Goldstrike and intentions to pursue a silver resource study and beliefs regarding gold resources being contained within a larger property area. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2018 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law

[1] See press release dated July 16, 2018

[2] See press release dated February 8, 2018

Liberty Gold Announces Receipt Approval of Plan of Operations, Black Pine Project, Great Basin, USA

Liberty Gold Announces Receipt Approval of Plan of Operations, Black Pine Project, Great Basin, USA

Permit Allows for Comprehensive Drilling Over the Core Project Area

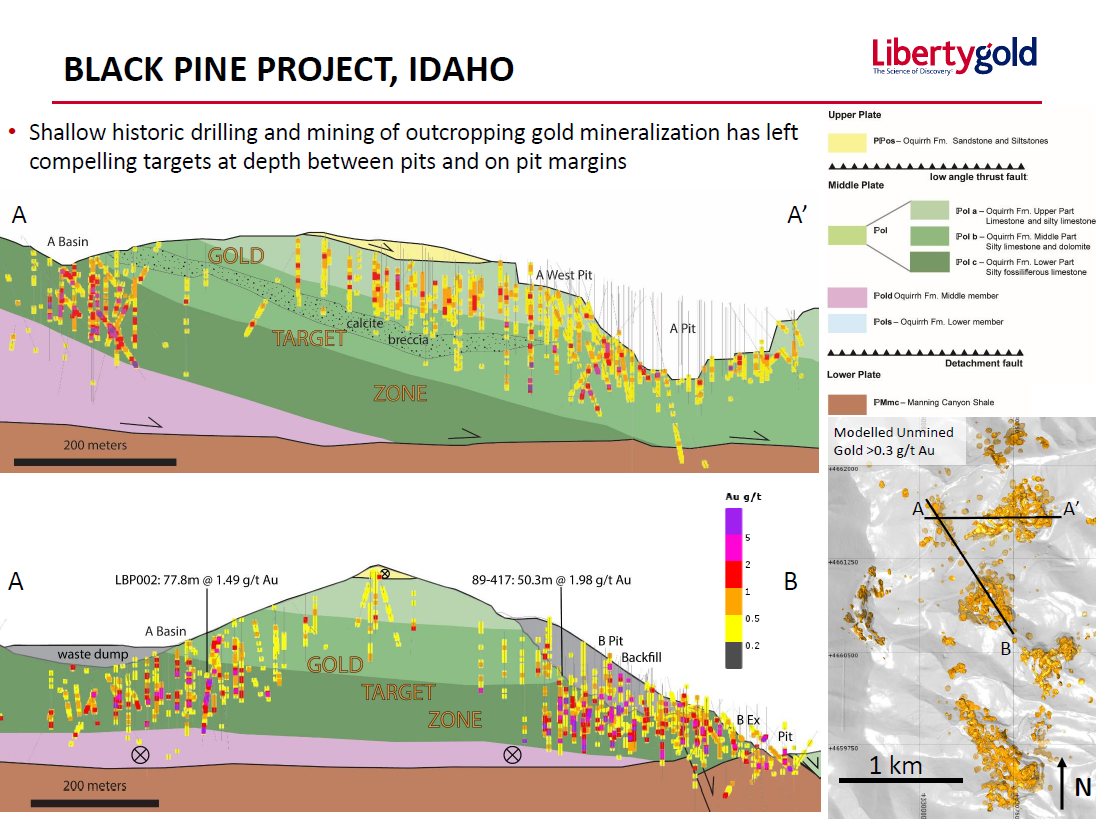

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce the approval of a Plan of Operations at the Black Pine Project, one of its three principal gold projects located in the prolific Great Basin of the United States. Located in southern Idaho, Black Pine is a past-producing, run-of-mine, oxide-heap leach gold mine that contains a large, shallow, district-scale, Carlin-style sedimentary rock-hosted gold system.

The Plan of Operations will allow Liberty Gold comprehensive access to the 7.3 square kilometer (“km2”) core of an estimated 12 km2 gold system. A total of up to 141 acres (0.57 km2) can be disturbed under the permit, including up to 49 km of new roads and 370 drill pads, subject to a staged annual reclamation plan. The main gold zone encompassing the historic Black Pine Mine is not subject to seasonal closures and can be accessed year-round, weather and road conditions permitting. A previously-granted Plan of Operations allows Liberty Gold access to an additional 71 drill sites.

Liberty Gold’s Vice President of Exploration and Geoscience, Moira Smith stated, “We are thrilled to have this permit in hand. This is the largest permit we have obtained in terms of size and scope, and we are excited about the prospect of a comprehensive drill test of the Black Pine gold system starting in Q2 2019. We were impressed with the timeliness and professionalism of the US Forest Service Sawtooth National Forest - Minidoka Ranger District throughout the process of producing the Environmental Assessment and adhering to all of the timelines and milestones necessary to permit this project. There are very few opportunities left in the Great Basin with multi-kilometer-scale oxide gold targets containing hundreds of gold-bearing drill holes, surrounded by undrilled gold-in-soil anomalies.”

To review the Black Pine Project data compilation pre-drilling, see the Black Pine Virtual Tour found on the homepage of the Company’s website at www.libertygold.ca.

Liberty Gold acquired Black Pine in 2016 and has spent over 2 years compiling data from 1,874 shallow drill holes, blast holes and other data pursuant to putting together a comprehensive 3D model of remaining gold mineralization at the property. It carried out a small, proof of concept drill program under an existing permit in late 2017. The data compilation identified a 12 km2 oxide gold system in a receptive carbonate package up to 300 metres (“m”) thick. No sulphides have been identified to date in the system. Most of the drill holes extend only 92 m from surface, and a large proportion end in gold mineralization.

In May 2017, Liberty Gold submitted an application for a new Plan of Operations to the US Forest Service (“USFS”) and worked diligently with the US Forest Service and Stantec Consulting Services, Inc. to complete wildlife, archaeological and other surveys to assist in producing a new Plan of Operations and comprehensive Environmental Assessment. The Plan of Operations and accompanying Environmental Assessment were subject to rigorous inter-agency and public review. The USFS issued a Finding of No Significant Impact on December 12, 2018, and approved Plan of Operations POO-2017-072046 on February 12, 2019.

Weather and snow conditions permitting, drilling is expected to commence in Q2 2019, and continue through early November. Approximately 16,000 to 20,000 m of reverse circulation drilling in 80 to 100 holes is planned.

To view a map of the new Plan of Operations, please click here: https://libertygold.ca/images/sites/default/files/BP_PoO_2019_disclaimer.pdf

ABOUT BLACK PINE

The Black Pine property is part of the Great Basin and located in southeastern Idaho and covers 31.7 km2. The mineralized zone was extensively drilled in the immediate pit areas, with mining carried out by Pegasus Gold Corp. from 7 shallow pits over a 6-year period from 1992 to 1997 in a run of mine heap leach operation. The mining operation produced 435,000 ounces of gold from ore averaging 0.63 g/t gold, with a reported recovery of 65%.

Liberty Gold is in possession of data from 1,874 shallow holes, totaling 191,500 m and has identified three broad target types for drill testing, including: 1) down-dip extensions of gold mineralization from mined pits under shallow cover, as evidenced by data suggesting that 19% of the historic holes bottomed in gold mineralization; 2) unmined bodies of mineralization identified by previous operators and verified by Liberty’s drilling to date; and 3) undrilled, high priority gold-in-soil anomalies.

For more details about the Black Pine Property, including location, geology & geochemistry maps and past production and target figures, please click here: https://www.libertygold.ca/images/Presentations/2019/feb/BlackPine_February_2019.pdf

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

Some of the data presented herein, includes historic data developed by previous operators of the Black Pine property. Historic drill intersections are reported as drilled thicknesses. True widths of individual mineralized intervals are unknown at this time, although trends in mineralization suggest that true thicknesses range between 40 and 90% of drilled thicknesses. Production data is sourced from Pegasus internal yearly statements on production and remaining Reserves and Mineralized material. Moira Smith, Ph.D., P.Geo, Vice President, Exploration and Geoscience, Liberty Gold, and Qualified Person under NI 43-101, has, to the extent possible, verified that the historic data herein, including the results of drilling, sampling, and assaying by previous operators, is reliable.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Goldstrike, Black Pine and Kinsley Mountain, all of which are past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans,. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be

Liberty Gold Reports Q4 2018 Financial And Operating Results

Liberty Gold Reports Q4 2018 Financial And Operating Results

VANCOUVER, B.C. – Liberty Gold Corp. (LGD - TSX) ("Liberty Gold" or the "Company"), is pleased to announce its financial and operating results for the year ended December 31, 2018. All amounts are presented in United States dollars unless otherwise stated.

Liberty Gold is focused on advancing a pipeline of Carlin-Style gold deposits in the Great Basin, U.S.A., a mining-friendly jurisdiction that is home to large-scale oxide gold systems ideal for open-pit mining. The Great Basin covers portions of the states of Nevada, Utah and Idaho. The Company has a proven track-record in discovery and building value in this region.

In October 2018, the Company completed a bought-deal financing, including the exercise of the over-allotment in full, of CDN$11.56 million, providing the financial strength to continue unlocking the full value of our key projects, all of which feature sediment-hosted, shallow, oxide gold targets with district scale potential.

In 2018, we defined the initial size and preliminary value of Goldstrike, our flagship project, while expanding its working footprint and potential. We also made positive strides in advancing our Black Pine project in Idaho.

2018 highlights

At our 100%-controlled Goldstrike project in Utah we:

- Announced a maiden, independent resource estimate. The Classified Mineral Resource was subsequently revised to reflect a cut-off grade of 0.20 grams per tonne gold (“g/t Au”) as a result of economic considerations discussed in the Preliminary Economic Assessment (“PEA”) and now consists of: an indicated resource of 925,000 ounces of gold at an average grade of 0.50 g/t Au (57,846,000 tonnes); and an inferred resource of 296,000 ounces of gold at an average grade of 0.47 g/t Au (19,603,000 tonnes).

- Completed a PEA. We released a PEA that generates an after-tax Net Present Value at a 5% discount rate and Internal Rate of Return of $129.5 million and 29.4%, respectively, with a 2.3-year payback of initial capital. It provides a strong, base case economic scenario upon which to expand the scope and scale of the project with ongoing drilling. The PEA mined 915,516 ounces and produced 713,000 recoverable ounces over a 7.5-year mine life. The PEA confirms the potential for a low capital intensity, low operating cost, open-pit, run-of-mine, heap-leach operation, with highly attractive economics.

- Continued growing the system. Drilling in the northern Main Goldstrike Deposit (Dip Slope Zone) area continues to expand mineralization with higher-grade intervals located along west-northwest-striking faults. Additional gold mineralization was discovered in the southern Main Goldstrike Deposit, Peg Leg area and Western Zone. We also demonstrated above cut-off oxide gold grades at the historical leach pads and backfill.

- Secured an Amendment to the Plan of Operations. As reported in November, we received expanded access along the main deposit trend of a contiguous 8.66 square kilometres (“km2”) area. Within this area, we are no longer restricted to operating on site-specific roads and drill pads with fixed locations. The amended permit will allow us enhanced flexibility for road and pad placement for infill and step-out drilling in and around all of the zones in the current resource. In particular, the expanded permit will help infill and expand the Dip Slope zone along the northern margin of the deposit, where drill holes on fixed, widely spaced pads do not adequately test the shallowly buried mineralization, and where access to many other areas was previously unavailable.

- Created a clear vision for 2019. Receipt of this important upgrade to our Plan of Operations will help address our goal of increasing the total recoverable gold ounces in the deposit to more than one million ounces and a projected mine life of 10 years or greater.

At the 100%-owned Black Pine project in southern Idaho, we:

- Opened the door to discovery. Subsequent to year-end in February 2019, we secured approval of a Plan of Operations at Black Pine that provides comprehensive access to the 7.3 km2 core of an estimated 12 km2oxide gold system. A total of up to 141 acres (0.57 km2) can be disturbed under the permit, including up to 49 km of new roads and 370 drill pads, subject to a staged annual reclamation plan. The main gold zone encompassing the historic Black Pine Mine is not subject to seasonal closures and can be accessed year-round, weather and road conditions permitting.

- In September 2018, we released a National Instrument 43-101 Technical Report on Black Pine and reported in the associated press release that: “On the basis of this validation drill program, compilation of 1,874 historic holes, past production figures, new geological modelling and comparison to the size and grade of other nearby sediment-hosted deposits, Liberty Gold is targeting a two to four million ounce oxide gold deposit (60-200 million tonnes grading between 0.4 and 1.5 g/t Au) in the main area of alteration and historic mining.” Black Pine is being prepared for its first extensive drill program in 2019 since historical mine closure in 1997. Approximately 16,000 to 20,000 m of reverse circulation drilling in 80 to 100 holes is planned.

SELECTED FINANCIAL DATA

The following selected financial data is derived from our Annual Financial Statements and related notes thereto (the “Annual Financial Statements”) for the year ended December 31, 2018 as prepared in accordance with International Accounting Standards. A copy of the Annual Financial Statements is available on the Company’s website at www.libertygold.ca or on SEDAR at www.sedar.com.

The information in the tables below is presented in $000s except per share data:

|

Year ended December 31, |

||||

|

|

2018 |

2017 |

2016 |

|

|

Attributable to shareholders: |

||||

|

Loss for the period |

$11,169 |

$12,709 |

$11,162 |

|

|

Loss and comprehensive loss for the period |

$12,340 |

$12,125 |

$10,607 |

|

|

Basic and diluted loss per share |

$0.06 |

$0.08 |

$0.09 |

|

|

As at December 31, |

|||

|

2018 |

2017 |

2016 |

|

|

Cash and short-term investments |

$7,878 |

$2,266 |

$12,468 |

|

Working capital |

$7,477 |

$1,510 |

$12,399 |

|

Total assets |

$35,081 |

$30,009 |

$40,881 |

|

Current liabilities |

$612 |

$972 |

$897 |

|

Non-current liabilities |

$1,535 |

$703 |

$585 |

|

Shareholders’ equity |

$24,169 |

$19,006 |

$29,840 |

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Goldstrike, Black Pine and Kinsley Mountain, all of which are past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, expected capital costs at Goldstrike, expected gold and silver recoveries from the Goldstrike mineralized material, potential additions to the resource through additional drill testing, potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for silver resources at Goldstrike and intentions to pursue a silver resource study and beliefs regarding gold resources being contained within a larger property area. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law

Liberty Gold Announces Commencement of Drilling of the Black Pine and Goldstrike Projects, Great Basin, USA

Liberty Gold Announces Commencement of Drilling of the Black Pine and Goldstrike Projects, Great Basin, USA

Concurrent drilling of Two District-Scale, Carlin-Style Oxide Gold Systems

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce the start of 2019 drilling programs at its Black Pine and Goldstrike properties in Idaho and Utah, respectively. Both properties contain shallow, district-scale, Carlin-style oxide gold deposits that were past-producing heap leach gold mines operating at low gold prices during the 1990s. Both were acquired with extensive historical exploration and mining databases and large land holdings covering broad target areas over a district scale.

At Black Pine, one reverse circulation (“RC”) drill has been deployed to drill an estimated 16,000 metres (m) in 80 to 100 holes to provide a comprehensive test of the core of an oxide gold system estimated at over 12 square kilometres in size. Extensive data compilation, involving over 1800 historic drill holes, thousands of surface soil and rock samples and 7 shallow pits, suggests that a large volume of rock under and adjacent to zones of previously drill-tested gold mineralization contains highly prospective stratigraphy and favourable structural settings.

Drilling will commence near Liberty Gold drill hole LBP002, drilled in late 2017, which returned 36.6 m grading 0.58 grams per tonne gold (g/t Au) and 15.2 m grading 1.10 g/t Au and 77.8 m grading 1.49 g/t Au, and will test a 500 m gap between it and historic hole 89-417, which returned 50.3 m grading 1.98 g/t Au.

To view the Black Pine Cross Section below, use this link:

http://libertygold.ca/images/sites/default/files/Black_Pine_Cross_Section.pdf

A virtual site tour and 3D model of the Black Pine Project is available on the homepage of the Company’s website: www.libertygold.ca

At Goldstrike, one RC drill has been deployed to carry out an estimated 9,600 m of RC drilling pursuant to expanding the existing resource, which includes an indicated 925,000 ounces (57.8 million tonnes grading 0.50 g/t Au) and an Inferred 296,000 ounces (19.6 million tonnes grading 0.47 g/t Au). This resource generated an after-tax Net Present Value (5% discount) of $US129.5 million dollars and an Internal Rate of Return at $US1350 gold price of 29.4% in a recently completed Preliminary Economic Assessment (“PEA”) see press release dated July 16, 2018.

The current resource does not include 24,716 m of drilling carried out in 2018. Areas along the northern, southern and western margins of the deposit will comprise the focus of 2019 drilling, with a resource update expected in Q4, 2019. The Company’s drill plan at Goldstrike is focused on expanding the current gold resource with a 2,000,000 ounces target.

A virtual tour and 3D model of the Goldstrike Project is available on the homepage of the Company’s website: www.libertygold.ca

“We are thrilled to be back in the field again and drilling at both Black Pine and Goldstrike,” said Cal Everett, President & CEO of Liberty Gold. “Large, shallow oxide gold systems are extremely rare in the Great Basin and we have two district-scale gold systems that are already substantially de-risked through previous exploration and mining activities, as well as through our own efforts. We are targeting multi-million ounce deposits at both properties and we expect to be well on our way to achieving this goal by the end of the year.”

2018 DRILL RESULTS

Liberty Gold is also pleased to announce the remaining results from its 2018 RC drilling program at the Goldstrike Project. As a follow-up to discovery of new gold mineralization on the west end of the Goldstrike Deposit (see press release dated November 5, 2018), Liberty Gold drilled additional infill and step-out holes in the area, known as the Beavertail West extension. The Beavertail West extension remains open to the west and south. The Beavertail deposit was also tested with one additional hole, and it remains open to the south.

Drill Highlights include:

WEST GOLDSTRIKE DEPOSIT (BEAVERTAIL)

• 1.49 g/t Au over 16.8 m including 3.37 g/t Au over 6.1 m in PGS690 (from surface)

• 1.45 g/t Au over 15.2 m including 3.92 g/t Au over 4.6 m in PGS687

• 0.83 g/t Au over 12.2 m in PGS681

• 0.54 g/t Au over 44.2 m in PGS659 (from surface)

KEY POINTS

• Additional drilling in the southern West Goldstrike Deposit (West Beavertail) continues to expand mineralization in this area, building on drill intercepts reported in November 2018, including highlight intercepts of 0.98 g/t Au over 15.2 m and 0.81 g/t Au over 27.4 m.

• Mineralization is higher than average grade and starts from surface.

• PGS690 extends mineralization over 400 m west from the western edge of the historic Beavertail Pit.

• Controls on mineralization are not well understood at this early stage. Additional drilling is planned in 2019 to better understand the controls on mineralization, as well as the size of the system, which is open to the south and west.

MOOSEHEAD STOCKPILE

Five drill holes tested a low grade stockpile or waste dump located immediately west of the historic Moosehead Pit and approximately 300 m north of the Beavertail target. Highlights include:

• 0.52 g/t Au over 12.2 m in PGS663

• 0.31 g/t Au over 18.3 m in PGS664

• 0.29 g/t Au over 24.4 m in PGS666

• 0.28 g/t Au over 7.6 m and 0.36 g/t Au over 3.0 m in PGS665

KEY POINTS

• All intercepts start at surface

• All intercepts consist of strongly oxidized, unconsolidated material

• This material is located within the PEA pit and is currently classified as waste

• Additional drill testing is warranted.

For a complete table of drill results from the current holes, please click here: http://libertygold.ca/images/sites/default/files/GS_Intercepts052019.pdf

For a complete table of results for all drilling from 2015 to the current holes, please click here: http://libertygold.ca/images/sites/default/files/GS_Intercepts2015tocurrent.pdf

For a map of drill collars and traces for the current release, please click here: http://libertygold.ca/images/sites/default/files/Goldstrike_NR052019.pdf

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. Goldstrike is located in the southeastern Great Basin, immediately adjacent to the Utah/Nevada border. Both are Carlin-style gold systems, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Newmont’s Long Canyon deposit, Black Pine and Goldstrike represent a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, with 435,000 ounces of gold produced from 7 shallow pits, at an average grade of 0.63 g/t and average recovery of approximately 66%. The historic Goldstrike Mine operated from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au and an average recovery of approximately 75%.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by AAS. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Goldstrike, Black Pine and Kinsley Mountain, all of which are past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, expected capital costs at Goldstrike, expected gold and silver recoveries from the Goldstrike mineralized material, potential additions to the resource through additional drill testing, potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for silver resources at Goldstrike and intentions to pursue a silver resource study and beliefs regarding gold resources being contained within a larger property area. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold Reports Q1 2019 Financial and Operating Results

LIBERTY GOLD REPORTS Q1 2019 FINANCIAL AND OPERATING RESULTS

VANCOUVER, B.C. – Liberty Gold Corp. (LGD - TSX) ("Liberty Gold" or the "Company"), is pleased to announce its financial and operating results for the three months ended March 31, 2019. All amounts are presented in United States dollars (“USD”) unless otherwise stated.

Liberty Gold is focused on advancing a pipeline of Carlin-Style gold deposits in the Great Basin, U.S.A., a mining-friendly jurisdiction that is home to large-scale oxide gold systems ideal for open-pit mining. The Great Basin covers portions of the states of Nevada, Utah and Idaho. The Company has a proven track-record in discovery and building value in this region.

Recent Highlights

At Black Pine we:

- Announced the commencement of our 16,000 metre (“m”) Reverse Circulation (“RC”) drill program in 80 to 100 holes, designed to test an oxide gold system estimated at over 12 square kilometres (“km2”) in size.

- Received approval of a Plan of Operations (“PoO”) on February 19, 2019 that provides comprehensive access to the 7.3 km2 core of the gold system.

At Goldstrike we:

- Announced the beginning of our 9,600 m RC drill program pursuant to expanding the existing resource that is included in a recently completed Preliminary Economic Analysis (“PEA”)1

- Secured an Amendment to the PoO2 and received expanded access along the deposit trend, from a fragmented area of approximately 5.11 square kilometres (“km2”), to a contiguous 8.66 km2 area.

- Announced the remaining drill results from the 2018 RC drill program and showed continued southern expansion of the mineralisation in the West Goldstrike Deposit3:

- Including highlight intercepts of 0.98 g/t Au over 15.2 m and 0.81 g/t Au over 27.4 m,

- demonstrating mineralization is higher than average grade, and starts from surface,

- extending mineralization over 400 m west from the western edge of the historic Beavertail Pit with intercepts of 1.49 g/t Au over 16.8 m including 3.37 g/t Au over 6.1 m in PGS690.

- Continued to demonstrate the potential of areas currently classified as waste stockpiles within the PEA pit, with the results at Moosehead showing intercepts starting at surface, consisting of strongly oxidized, unconsolidated material. Highlights include 0.52 g/t Au over 12.2 m in PGS663 and 0.31 g/t Au over 18.3 m in PGS664.

SELECTED FINANCIAL DATA

The following selected financial data is derived from our unaudited condensed interim financial statements and related notes thereto (the “Interim Financial Statements”) for the three months ended March 31, 2019 as prepared in accordance with International Accounting Standards – IAS 34: Interim Financial Statements.

A copy of the Interim Financial Statements is available on the Company’s website at www.libertygold.ca or on SEDAR at www.sedar.com.

The information in the tables below is presented in $000s in USD except per share data:

|

Three months ended March 31, |

||||

|

|

2019 |

2018 |

||

|

Attributable to shareholders: |

||||

|

Loss for the period |

$1,416 |

$2,411 |

||

|

Loss and comprehensive loss for the period |

$1,288 |

$2,792 |

||

|

Basic and diluted loss per share |

$0.01 |

$0.01 |

||

|

As at March 31, |

As at December 31, |

|

|

2019 |

2018 |

|

|

Cash and short-term investments |

$6,809 |

$7,878 |

|

Working capital |

$6,225 |

$7,477 |

|

Total assets |

$34,797 |

$35,081 |

|

Current liabilities |

$867 |

$612 |

|

Non-current liabilities |

$2,123 |

$1,535 |

|

Shareholders’ equity |

$23,040 |

$24,169 |

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Goldstrike, Black Pine and Kinsley Mountain, all of which are past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, expected capital costs at Goldstrike, expected gold and silver recoveries from the Goldstrike mineralized material, potential additions to the resource through additional drill testing, potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for silver resources at Goldstrike and intentions to pursue a silver resource study and beliefs regarding gold resources being contained within a larger property area. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law

[1] See press release dated July 10, 2018

[2] See press release dated November 29, 2018.

[3] See press release dated May 6, 2019.

Liberty Gold Reports Weighted Average 84.2% Extraction in Phase 2 Column Testing at Goldstrike Project, Great Basin, USA

Liberty Gold Reports Weighted Average 84.2% Extraction in Phase 2 Column Testing at Goldstrike Project, Great Basin, USA

High and Rapid Recoveries Insensitive to Crush Size Continue to Support Simple Heap Leach Process

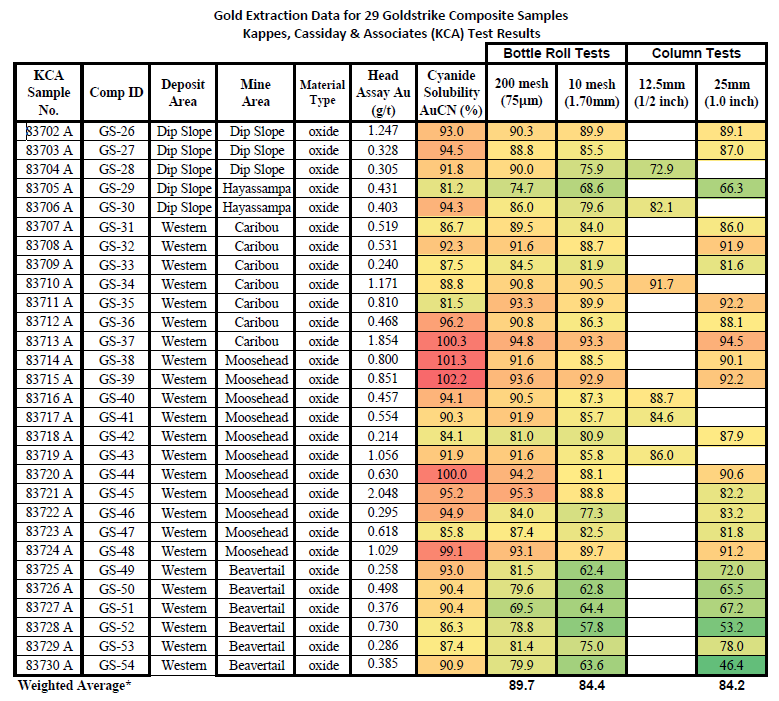

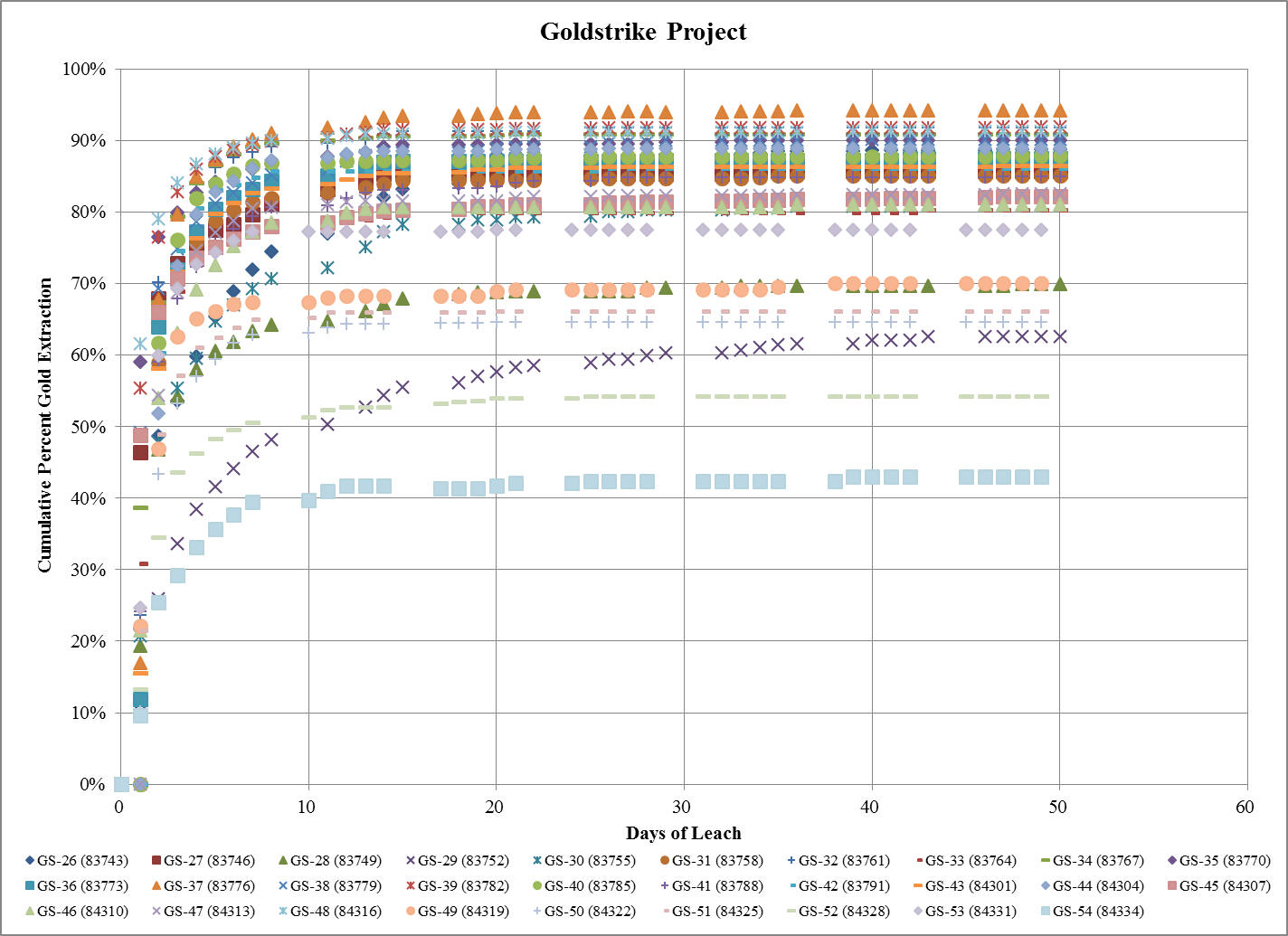

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to report results from Phase 2 metallurgical testing on oxide material from its Goldstrike Project, in southwestern Utah, providing additional support for a simple heap leach mining scenario. Gold extractions from 29 column tests were rapid, and >80% of the leachable gold was extracted within 10 days, with final column leach gold extractions ranging up to 95%.

Metallurgical testwork included fine and coarse bottle rolls and 12.5 millimeters (“mm”) (0.5 inch) and 25 mm (1 inch) column tests. In total, 58 bottle rolls (twenty-nine 200 mesh and twenty-nine 10 mesh) and 29 column tests were carried out on 29 composites from the Dip Slope Zone immediately north of the Main Zone (subject to Phase 1 testing) and the Western Zone. Metallurgical testing now extends to all areas within the footprint of the Resource Estimate and Preliminary Economic Assessment (“PEA”).

Results and conclusions are consistent with those generated from Phase 1 metallurgical testing (see press release dated April 3, 2017), which were used to underpin recovery assumptions and run-of-mine (“ROM”) flow sheet for the PEA (see press release dated July 10, 2018). The Phase 2 metallurgical testing brings the total number of oxide column tests for the property to 49. A slight drop in overall extraction for Phase 2 results (84.2%) relative to Phase 1 results (85.9%) can be attributed to an average grade of 0.669 grams per tonne gold (“g/t Au”) for the 2019 composites, compared to 1.196 g/t Au for the 2017 composites. This difference is the result of a deliberate attempt to match the composite grades to the average grades of the geographical areas tested, in order to be able to more closely predict expected mine recoveries in these areas.

Highlights include:

- 29 Column leach tests produced a weighted average 84.2% gold extraction (See below for a table of results or link: https://libertygold.ca/images/news/2019/may/Gold_Extraction_Data.pdf)

- Gold extraction was rapid, with >80% of the leachable gold extracted within the first 10 days of column leaching. Columns were deactivated after 50 days instead of the usual 90 day leach cycle because leaching was essentially complete. (See below for a graph of extraction curves or link: https://libertygold.ca/images/news/2019/may/Cumulative_Leach_Curves.pdf).

- Twenty-nine coarse bottle roll tests (target 80% passing 10 mesh or 1.7mm particle size) produced a weighted average 84.4% gold extraction.

- Twenty-nine fine bottle roll tests (target 80% passing 200 mesh or 75 micron particle size) produced a weighted average 89.7% gold extraction.

- Gold extraction is relatively insensitive to particle size, except for five composites from the Beavertail area. All other composites can be projected to coarse particle sizes without significant loss of gold extraction.

- Weighted average modeled extraction for the 29 column tests at a 200mm particle size (8 inches, meant to simulate ROM conditions) is 81.3%.

*Weighted average gold extraction is obtained using the following equation: (composite head grade (g/t) x extraction (%) for all head grades)/sum of all head grades. Using arithmetic averages tends to over-represent low grade composites and under-represent high grade composites. The arithmetic average of the 29 coarse bottle rolls is 81.0%. The arithmetic average of the 29 column tests is 81.5%.

Cumulative Leach Curves, Phase 2 Metallurgical Testing

“We are extremely pleased with the Phase 2 metallurgical results,” says Cal Everett, Liberty Gold President & CEO. “The results are exceptional and continue to support our belief that a high percentage of the gold can be rapidly recovered in a simple, low cost, heap leach operation. Consistent results have now been confirmed along the initial 7 kilometers of strike of the Goldstrike oxide gold system.”

The work was supervised by independent consulting metallurgist Gary Simmons, formerly the Director of Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has managed or supervised a significant number of metallurgical testing programs on similar deposits throughout the Great Basin. According to Mr. Simmons, “Data from metallurgical testing to date at Goldstrike point to rapid leaching and relatively high gold recoveries and suggest that a combination ROM and coarse crush/agglomeration heap leaching may be the preferred process option at Goldstrike.”

Metallurgical Program

Samples for this study were collected from 13 large diameter (PQ) diamond drill holes from the Western Zone of the Goldstrike Deposit as well as two areas near the Main Zone, intended to expand the scope of testing initiated with Phase 1, which focused entirely on the Main Zone.

For a map showing locations of drill holes used for metallurgical testing, please click here:

http://libertygold.ca/images/news/2019/may/Goldstrike_metPRmap.pdf.

13 large diameter diamond drill holes were drilled in 2018 to sample a range of locations and material types in the Main and Western Zones at Goldstrike. From these, 29 composites were created for metallurgical testing, with gold grades ranging from 0.214 to 2.048 g/t Au. All composites were dominantly oxide, with cyanide soluble gold content of >80%.

Composites were sent to Kappes, Cassiday and Associates in Reno, Nevada for metallurgical testing, comprising bottle rolls, column testing and metallurgical characterization including; gold and silver assays, cyanide solubility, sulphur and carbon speciation, preg-robb analysis, ICP geochemical assays and whole rock analysis.

Column composites were leached in either 100 mm (4 inch) or 150 mm (6 inch) diameter columns at low strength, 0.50 grams per litre of sodium cyanide (“NaCN”) solution. Five of the columns sampleswere agglomerated with 2.0 kg/t of cement due to elevated clay content.

Samples for bottle roll testing were crushed/pulverized to 80% passing 200 mesh (75 microns) and 80% passing 10 mesh (1.7 mm) particle size. The samples were rolled/agitated in bottles in a 1.0 g/l dilute cyanide solution for 72 hours (for 200 mesh) or 144 hours (for 10 mesh).

Organic carbon values are low. Results to date suggest that organic carbon will not be an issue in recovery.

About Goldstrike

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada border, and is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike represents part of a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Goldstrike Mine operated from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au.

A virtual site tour and 3D model of Goldstrike is available on the homepage of the Company’s website: www.libertygold.ca.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Goldstrike, Black Pine and Kinsley Mountain, all of which are past producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, expected capital costs at Goldstrike, expected gold and silver recoveries from the Goldstrike mineralized material, potential additions to the resource through additional drill testing, potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for silver resources at Goldstrike and intentions to pursue a silver resource study and beliefs regarding gold resources being contained within a larger property area. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, the availability of drill rigs, the accuracy of a preliminary economic assessment, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 27, 2019 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Liberty Gold Announces First 2019 Drill Results from the Black Pine Oxide Gold Property, Great Basin, USA

Liberty Gold Announces First 2019 Drill Results from the Black Pine Oxide Gold Property, Great Basin, USA

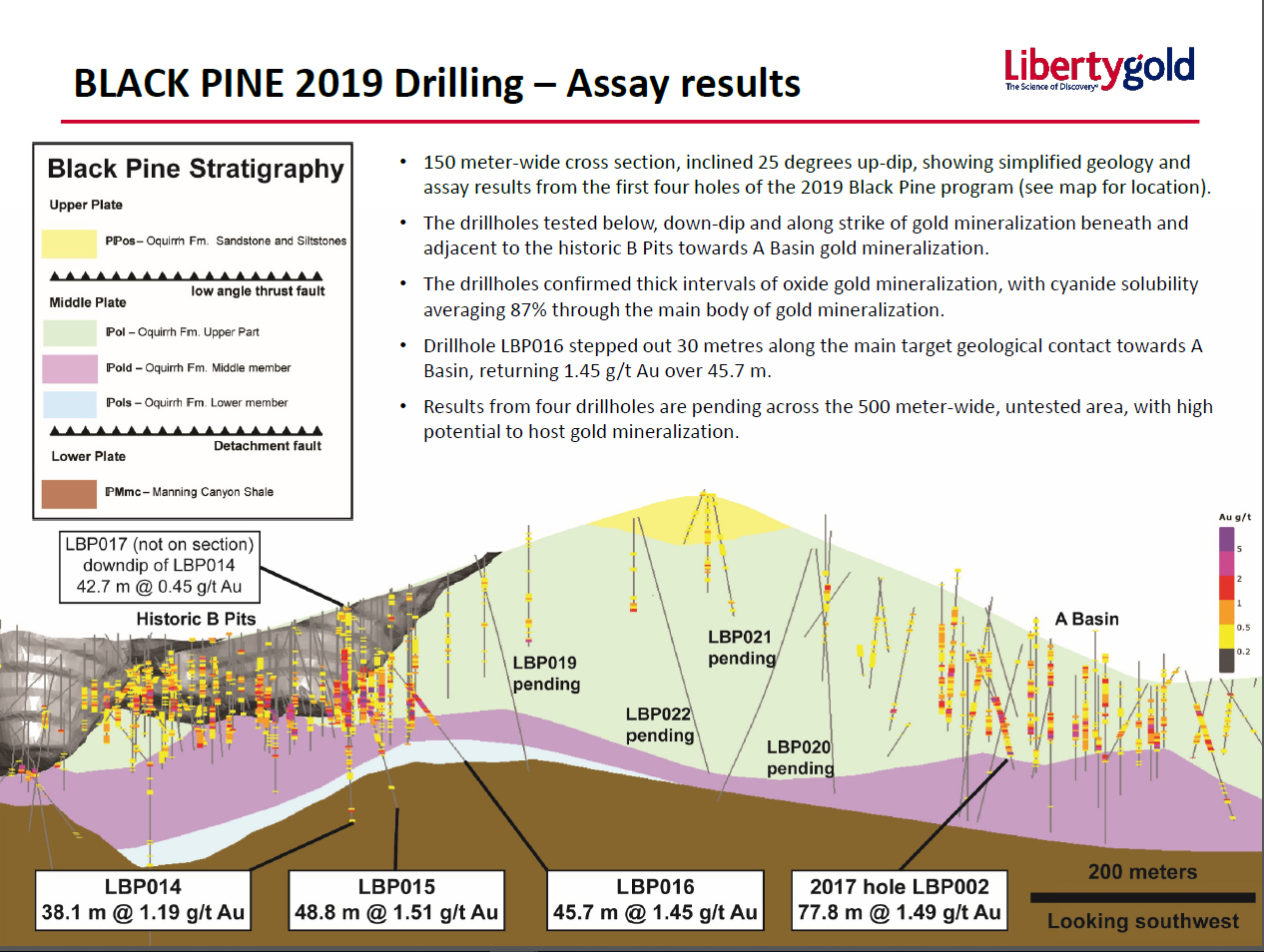

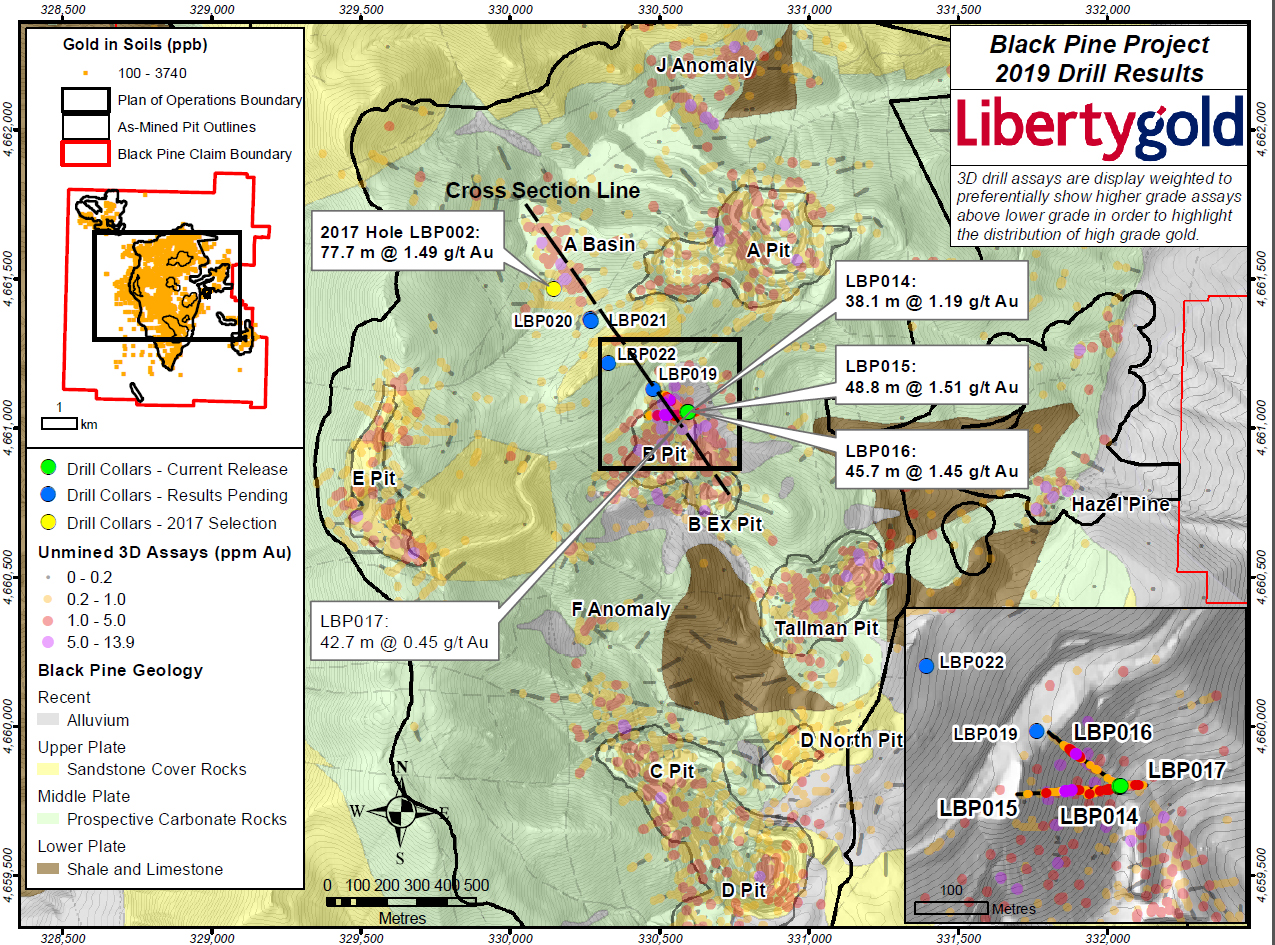

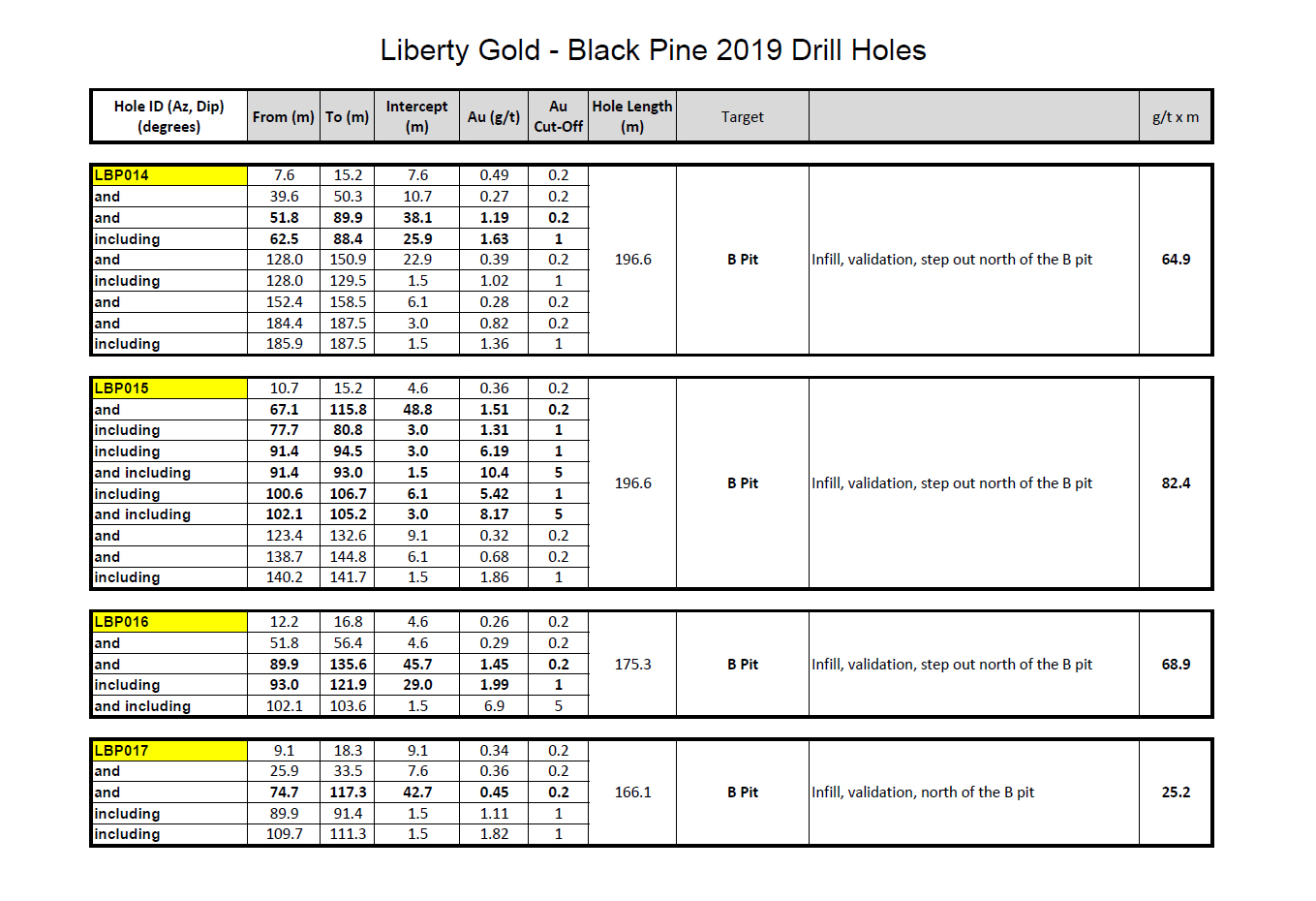

1.51 g/t Au over 48.8 metres, 1.45 g/t Au over 45.7 metres and 1.19 g/t Au over 38.1 metres

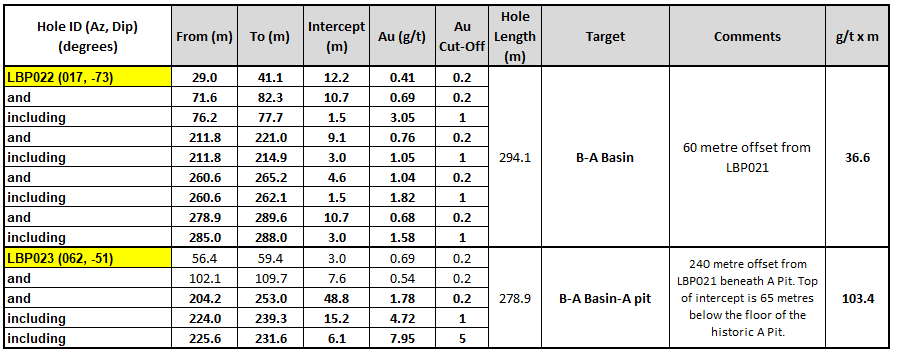

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce assay results from the first four reverse circulation (“RC”) holes at its Black Pine Property in Idaho. The drill holes were designed for infill, validation of historical results, and to extend historically drilled gold mineralization into a highly prospective, 500-metre-wide gap in historical drilling. Three of four drill holes hit significant widths of high-grade, oxide gold mineralization, extending gold mineralization deeper and along strike into the untested section. Drill hole LBP016 intersected 1.45 grams per tonne gold (“g/t Au”) over 45.7 metres (“m”), extending mineralization northward into an area with no existing drill holes for 475 m toward the A Basin target, where Liberty Gold drilling in 2017 intersected 0.58 g/t Au over 39.6 m and 1.10 g/t Au over 15.2 m and 1.49 g/t Au over 77.8 m of in LBP002 (see January 5, 2018 press release). Current drilling is now testing the extent of gold mineralization on this section, with results pending.

For a cross section of drill collars and traces for the current release, please click here: BlackPineSection_NR05292019

For a map of drill collars and traces for the current release, please click here: BlackPine_NR05292019

For a complete table of drill results from the current holes, please see below or click here: BP_Intercepts05292019

Key Points:

- Drill holes LBP014 through LBP017 were drilled north of the historic B Pit on a section between the B Pit and A Basin zone, located approximately 500 m apart.

- Much of the area between the B Pit and A Basin, and east toward the historic A Pit, has not been tested by drilling. 3D modeling of geology and historic drill holes suggests that mineralization may extend the full length and width of this corridor at depth.

- Cyanide-soluble assay results on intervals with >0.20 g/t Au by fire assay show approximately 87% cyanide solubility across most composite intervals, highlighting the oxidized nature of mineralization.

- Drill holes LBP014, 015 and 016 are similar to hole LBP002 in that they represent some of the best unmined intercepts drilled to date on the property, by any operator.

Highlights include:

| Hole ID (Az, Dip) (degrees) |

From (m) |

To (m) |

Intercept (m) |

Au (g/t) | Au Cut-Off |

Hole Length (m) |

Target | g/t x m |

| LBP014 (264, -80) | 7.6 | 15.2 | 7.6 | 0.49 | 0.2 | 196.6 | B Pit | 64.9 |

| and | 39.6 | 50.3 | 10.7 | 0.27 | 0.2 | |||

| and | 51.8 | 89.9 | 38.1 | 1.19 | 0.2 | |||

| including | 62.5 | 88.4 | 25.9 | 1.63 | 1 | |||

| and | 128.0 | 150.9 | 22.9 | 0.39 | 0.2 | |||

| including | 128.0 | 129.5 | 1.5 | 1.02 | 1 | |||

| and | 152.4 | 158.5 | 6.1 | 0.28 | 0.2 | |||

| and | 184.4 | 187.5 | 3.0 | 0.82 | 0.2 | |||

| including | 185.9 | 187.5 | 1.5 | 1.36 | 1 | |||

| LBP015 (266, -46) | 10.7 | 15.2 | 4.6 | 0.36 | 0.2 | 196.6 | B Pit | 82.4 |

| and | 67.1 | 115.8 | 48.8 | 1.51 | 0.2 | |||

| including | 77.7 | 80.8 | 3.0 | 1.31 | 1 | |||

| including | 91.4 | 94.5 | 3.0 | 6.19 | 1 | |||

| and including | 91.4 | 93.0 | 1.5 | 10.4 | 5 | |||

| including | 100.6 | 106.7 | 6.1 | 5.42 | 1 | |||

| and including | 102.1 | 105.2 | 3.0 | 8.17 | 5 | |||

| and | 123.4 | 132.6 | 9.1 | 0.32 | 0.2 | |||

| and | 138.7 | 144.8 | 6.1 | 0.68 | 0.2 | |||

| including | 140.2 | 141.7 | 1.5 | 1.86 | 1 | |||

| LBP016 (306, -46) | 12.2 | 16.8 | 4.6 | 0.26 | 0.2 | 175.3 | B Pit | 68.9 |

| and | 51.8 | 56.4 | 4.6 | 0.29 | 0.2 | |||

| and | 89.9 | 135.6 | 45.7 | 1.45 | 0.2 | |||

| including | 93.0 | 121.9 | 29.0 | 1.99 | 1 | |||

| and including | 102.1 | 103.6 | 1.5 | 6.9 | 5 | |||

| LBP017 (084, -77) | 9.1 | 18.3 | 9.1 | 0.34 | 0.2 | 166.1 | B Pit | 25.2 |

| and | 25.9 | 33.5 | 7.6 | 0.36 | 0.2 | |||

| and | 74.7 | 117.3 | 42.7 | 0.45 | 0.2 | |||

| including | 89.9 | 91.4 | 1.5 | 1.11 | 1 | |||

| including | 109.7 | 111.3 | 1.5 | 1.82 | 1 |