Liberty Gold Strengthens Treasury with US$2.2 Million to Advance Black Pine

Vancouver, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) ("Liberty Gold" or the “Company”), is pleased to announce receipt of the first staged payment of US$2.2 million related to the previously announced sale of its interest in the TV Tower copper-gold project (“TV Tower” or the “Project”), located in Biga Province, northwest Türkiye (see press releases dated April 17, 2024 and October 7, 2024).

This non-core asset sale payment, which is non-dilutive for shareholders, forms part of the total consideration of US$8.5 million payable to Liberty Gold for the sale of its 72.1% interest in TV Tower. The Company has now received US$5.9 million to date, with the final staged payment of US$2.6 million due on October 4, 2026. These payments underpin corporate costs for Liberty Gold over the period, allowing the Company to channel new funding directly into project advancement.

Jon Gilligan, President and CEO of Liberty Gold, commented, “This non-dilutive staged payment further bolsters our treasury and underscores our strategy of channeling capital into our core oxide gold project. With Black Pine in Idaho moving through advanced studies and mine permitting, we remain focused on unlocking the value of Black Pine, the largest undeveloped oxide gold project in the Great Basin. In the medium-term we are looking to build a strong portfolio of substantial oxide assets positioned for future development.”

ABOUT LIBERTY GOLD

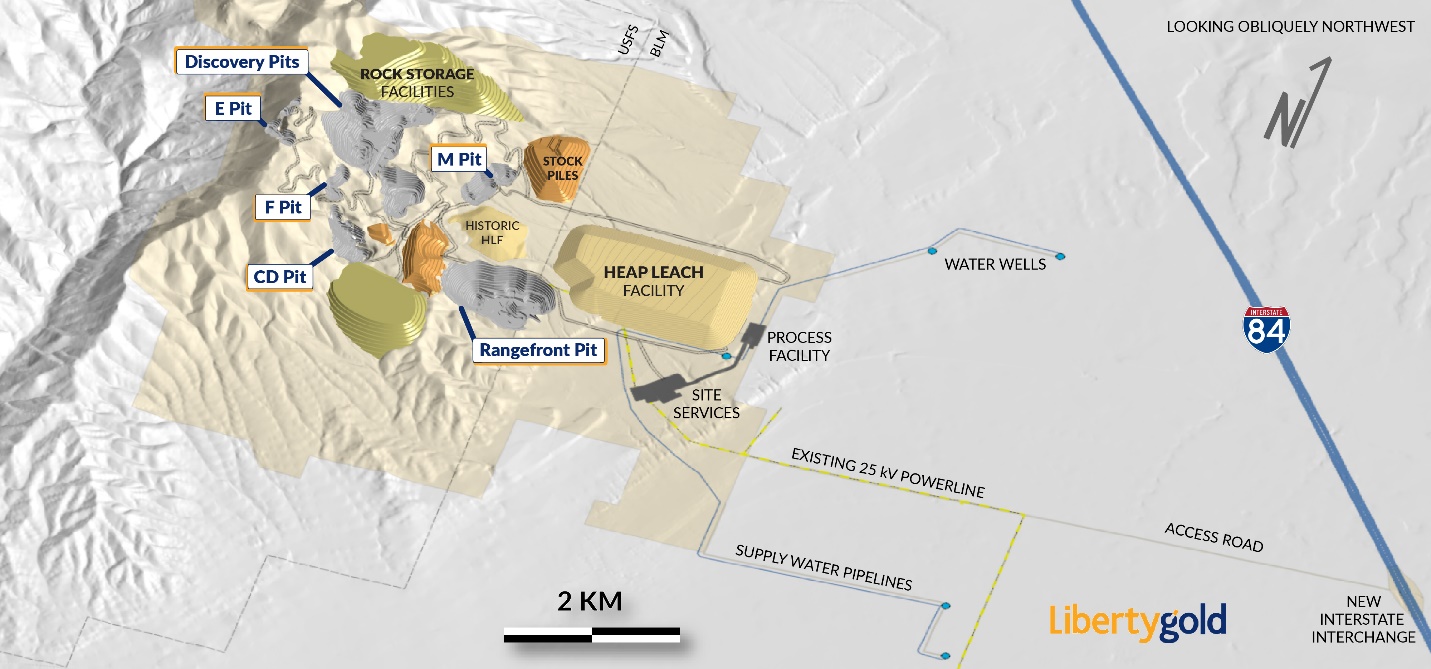

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource with strong economic potential that can be mined profitably as an open-pit/heap leach operation in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are “forward-looking information” with respect to Liberty Gold within the meaning of applicable securities laws. Forward-looking information is often, but not always, identified by the use of words such as, "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this press release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans; the achievement of future short-term, medium-term and long-term operational strategies and the receipt of future staged payments.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals, receipt of financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the timing and success of future plans and objectives in the areas of sustainable development, health, safety, environment and community development, availability of equipment, results of any mineral resources, mineral reserves, or pre-feasibility study, the availability of drill rigs, the timing of receipt of future staged payments from previous dispositions by Liberty Gold, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including risks that the future staged payments are not received, risks that Liberty Gold will not use the net proceeds of any staged payments as anticipated, risks related to obtaining all necessary TSX approvals, and risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to Liberty Gold’s mineral property interests, changes in project parameters as plans continue to be refined; current economic conditions, future prices of commodities; possible variations in grade or recovery rates, the costs and timing of the development of new deposits, failure of equipment or processes to operate as anticipated, the failure of contracted parties to perform; the timing and success of exploration activities generally, the timing or results of the publication of any mineral resources, mineral reserves or pre-feasibility studies, delays in permitting, possible claims against Liberty Gold, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of receipt of staged payments from previous dispositions by Liberty Gold, or in the completion of exploration as well as those factors discussed in the Annual Information Form of Liberty Gold dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable laws.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Liberty Gold Completes Strategic 9.9% Investment by Centerra Gold Inc.

Vancouver, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) ("Liberty Gold" or the “Company”), is pleased to announce that it has closed its previously announced private placement (the “Placement”) with Centerra Gold Inc. (“Centerra”), whereby Centerra will acquire 9.9% of the issued and outstanding common shares of the Company (the “Common Shares”).

Pursuant to the Placement, Centerra acquired 50,025,230 common shares of Liberty Gold at a price of C$0.56 per Common Share for gross proceeds of approximately C$28.01 million. The issue price represented a 10% premium to the 5-day volume weighted average price of the Common Shares as traded on the Toronto Stock Exchange (“TSX”) prior to announcement of the transaction.

The net proceeds from the Placement will be used to advance technical studies at Liberty Gold’s flagship Black Pine oxide gold project in Idaho and for general corporate purposes.

Jon Gilligan, President and CEO of Liberty Gold, commented: “The closing of this strategic investment marks an important milestone for Liberty Gold. Centerra’s endorsement underscores the strength of Black Pine and validates the progress we have made in de-risking and advancing the project. With their operational depth and regional experience, we are well-positioned to accelerate Black Pine towards feasibility and ultimately a construction decision.”

In connection with the Placement, Liberty Gold and Centerra have entered into an investor rights agreement dated September 29, 2025 (the “Investor Rights Agreement”), whereby, subject to conditions including time and ownership thresholds, Centerra has been granted customary rights, including financing participation rights, information rights, technical committee representation rights, and the right to nominate one director to the board of directors of Liberty Gold. A copy of the Investor Rights Agreement will be made available under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca

No finder’s fees or commissions were paid in connection with the Placement. All Common Shares issued pursuant to the Placement are subject to a statutory hold period of four months and one day, expiring on January 30, 2026, in accordance with applicable Canadian securities legislation.

On behalf of the Board of Directors

Liberty Gold Corp.

“Jon Gilligan”

Jon Gilligan Ph.D.,

President, CEO, and Director

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource with strong economic potential that can be mined profitably as an open-pit/heap leach operation in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are “forward-looking information” with respect to Liberty Gold within the meaning of applicable securities laws. Forward-looking information is often, but not always, identified by the use of words such as, "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this press release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans; the achievement of future short-term, medium-term and long-term operational strategies; the anticipated benefits of the partnership with Centerra; and the Company obtaining all necessary stock exchange approvals with respect to the Placement.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals, receipt of financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the timing and success of future plans and objectives in the areas of sustainable development, health, safety, environment and community development, availability of equipment, results of any mineral resources, mineral reserves, or pre-feasibility study, the availability of drill rigs, the timing of receipt of future staged payments from previous dispositions by Liberty Gold, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including risks that Liberty Gold will not use the net proceeds of the Placement as anticipated, risks related to obtaining all necessary TSX approvals, and risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to Liberty Gold’s mineral property interests, changes in project parameters as plans continue to be refined; current economic conditions, future prices of commodities; possible variations in grade or recovery rates, the costs and timing of the development of new deposits, failure of equipment or processes to operate as anticipated, the failure of contracted parties to perform; the timing and success of exploration activities generally, the timing or results of the publication of any mineral resources, mineral reserves or pre-feasibility studies, delays in permitting, possible claims against Liberty Gold, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of receipt of staged payments from previous dispositions by Liberty Gold, or in the completion of exploration as well as those factors discussed in the Annual Information Form of Liberty Gold dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable laws.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

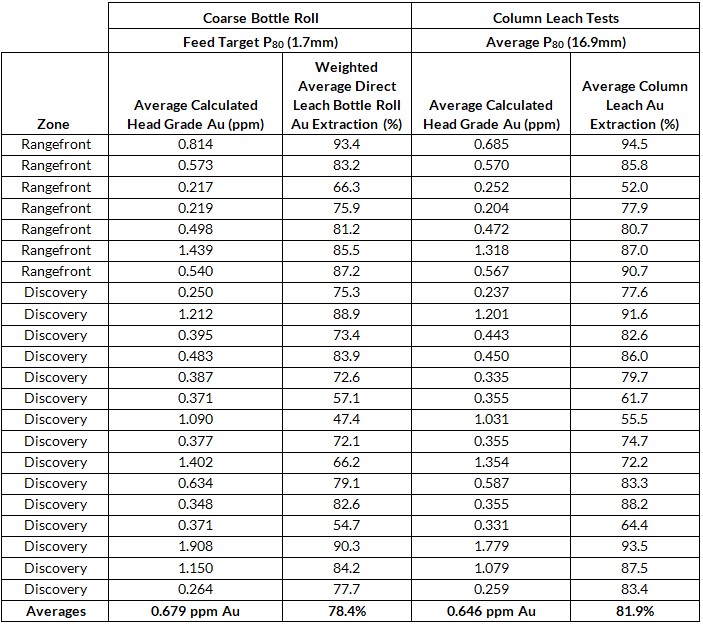

Liberty Gold Confirms Robust Gold Leach Recoveries at Black Pine

85.2% weighted average gold extraction in Rangefront Zone (7 columns)

80.5% weighted average gold extraction in Discovery Zone (15 columns)

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report results from its Phase 5B metallurgical program at the Company’s Black Pine Oxide Gold Project (“Black Pine”) in southeast Idaho. The new results confirm consistent, predictable gold recoveries across the primary ore bodies at Black Pine, further supporting a low cost, run-of-mine (“ROM”) heap leach processing flowsheet.

Highlights

- Consistent Gold Extractions and Leach Performance: Weighted average column leach gold extraction of 81.9% at an average head grade of 0.65 parts per million (“ppm”) gold (“Au”), with individual composites ranging from 52% to 94.5%. Phase 5B composites exhibit the typical Black Pine leach result of greater than 80% of the eventual gold extraction achieved in under 10 days.

- The feasibility recovery model has been updated with these new results and shows gold recoveries in line or slightly better than previous results across Rangefront and Discovery Zones.

- Corroborated Bottle Roll Data: Gold extractions from direct leach coarse crush bottle rolls (P80 of 1.68 millimeters (“mm”)) are aligned with column leach results (P80 of 16.9mm) at 78.4% vs 81.9%, respectively.

- This relationship further validates that gold leaching at Back Pine is highly insensitive to crush size.

- Confirmation of Recovery in Primary Mining Phases: Phase 5B testing focused on infill sampling within the primary mining phases of Rangefront and Discovery Zones.

- Feasibility level metallurgical work will be completed in H1, 2026. It is anticipated that with resource growth at Rangefront, additional test work may be required to achieve variability coverage.

See https://vrify.com/decks/20140 for a dynamic 3D view of the composite sample locations from the comprehensive metallurgical program across the Black Pine Oxide Gold Project.

Jon Gilligan, President and CEO, Liberty Gold, commented, “We are nearing completion of our comprehensive metallurgical program at Black Pine. Column gold extractions of 80 to 90 percent with rapid leach kinetics underscore the significant potential of this oxide gold asset. These results also confirm Rangefront as the premier leaching ore at Black Pine with up to a 10 percent recovery improvement over the Discovery zone. We look forward to further results from the bulk sample, large diameter columns and the ongoing work at Rangefront as it grows to potentially become the most significant gold mineralized zone at Black Pine.”

Phase 5B Metallurgical Test Summary

The Phase 5B program was designed to improve sample coverage in the main deposit areas and confirm consistency of gold extraction within the main rock types. Figure 1 below illustrates drill locations for the Phase 5B variability composite metallurgical core holes. Metallurgical composites were made up from PQ sized core drilled in 2023. A total of 22 column leach tests were completed in Phase 5B, under standard test conditions for Black Pine oxide gold material, with results summarized below in Table 1.

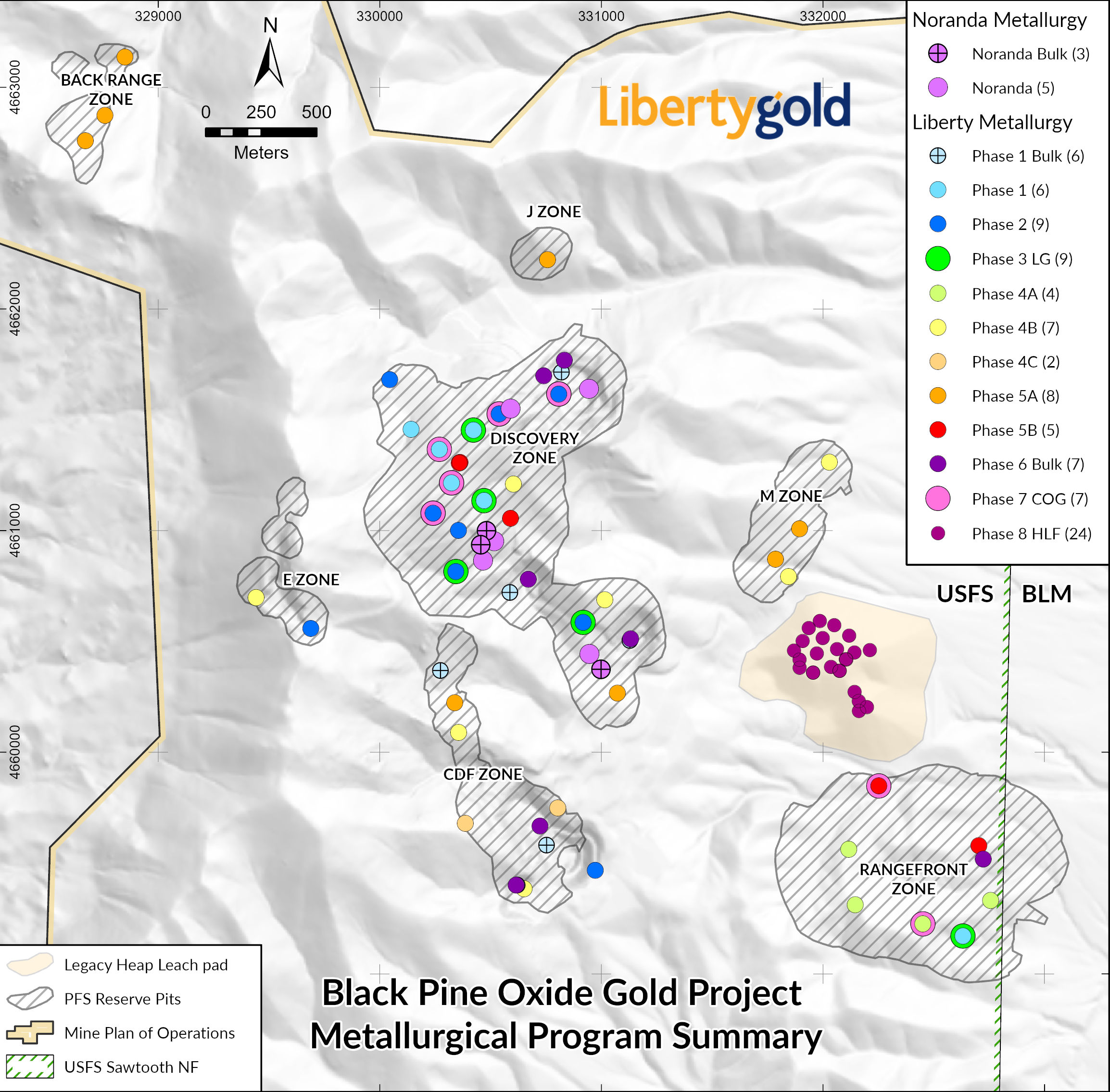

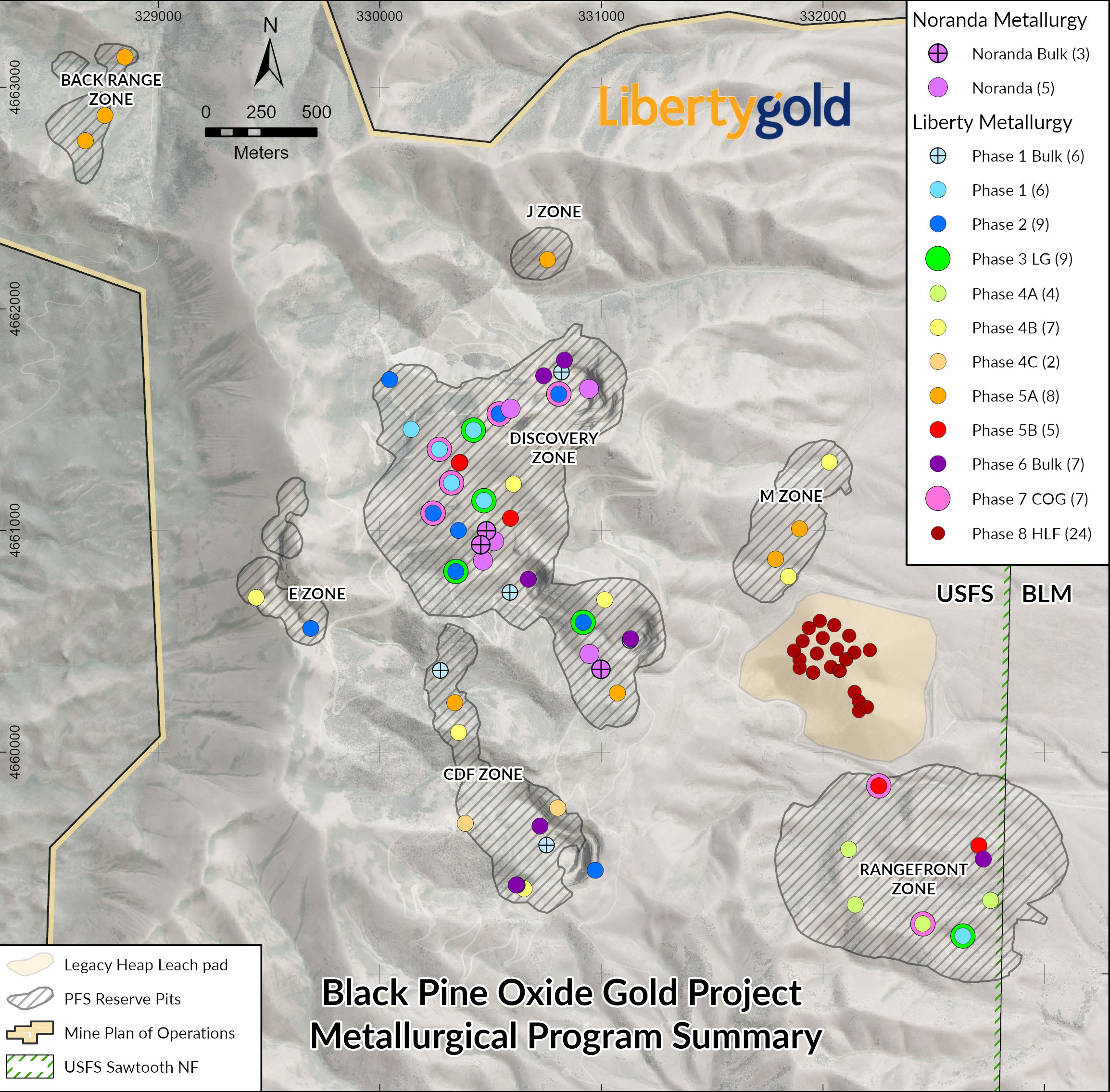

Figure 1 – Summary Map of Black Pine Metallurgical Program Sample Locations

Table 1 – Weighted Average Gold Extraction Results by Zone – Coarse Bottle Roll and Column Leach Tests

|

Coarse Bottle Roll |

Column Leach Tests |

|||

|

Feed Target P80 (1.7 mm) |

Average P80 (16.9 mm) |

|||

|

Zone |

Average Calculated Head Grade Au (ppm) |

Weighted Average Direct Leach Bottle Roll Au Extraction (%) |

Average Calculated Head Grade Au (ppm) |

Average Column Leach Au Extraction (%) |

|

Rangefront |

0.61 |

85.0% |

0.58 |

85.2% |

|

Discovery |

0.71 |

75.7% |

0.68 |

80.5% |

|

All Zones |

0.68 |

78.4% |

0.65 |

81.9% |

Notes: Average Calculated Head Grade is the average of the composite bottle roll or column head grades tested within each zone. Detailed sample-level results are provided in Table 2 below.

Silver

Column leach tests showed silver (“Ag”) extractions up to 68.1%, with an average of 19%. These silver grades and extractions are in line with previous results.

Interpretation

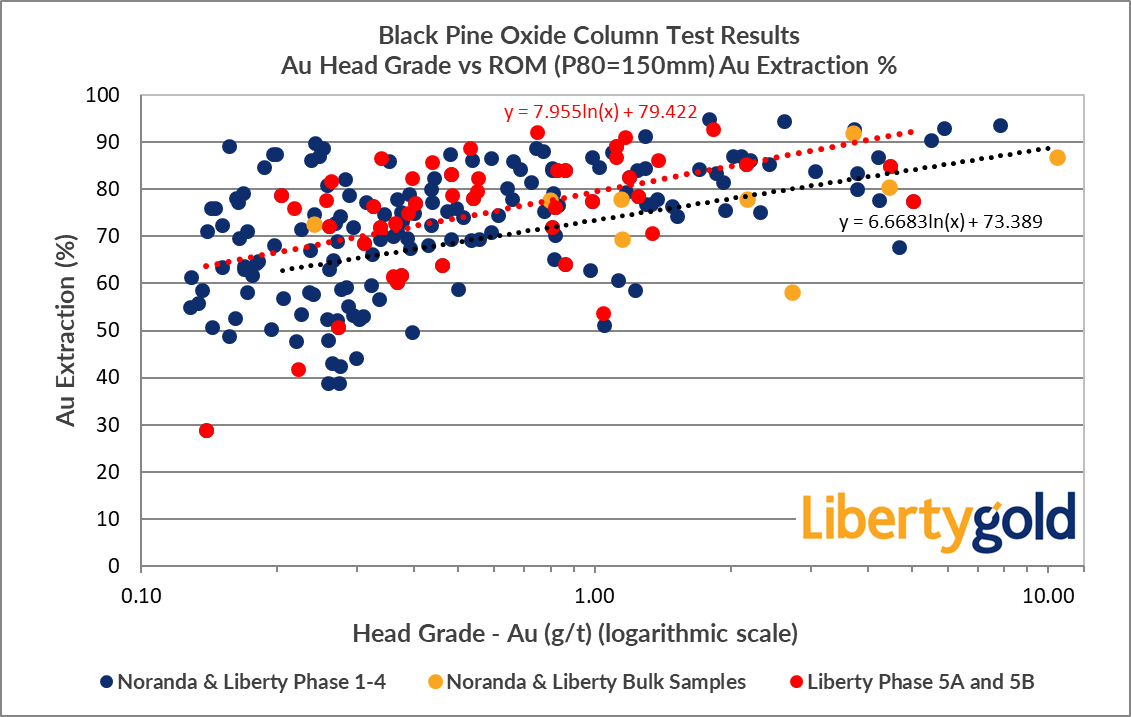

- Phase 5B gold extractions are in line with or slightly better than previous metallurgical testing results from both Discovery and Rangefront Zones, verifying strong recovery in the two largest mining phases at Black Pine (Figure 2).

Figure 2 – Grade vs. extraction for Phase 5A and 5B results

The consistent correlation between bottle roll and column leach data continues to reinforce that gold extraction is insensitive to particle size. This insensitivity supports the feasibility of low-cost, ROM leach processing for Black Pine oxide ores.

Ongoing Metallurgical Programs

Liberty Gold has an ongoing feasibility-level metallurgical program for Black Pine:

- Phase 6: Seven (Six in-pit and one surface) 20 tonne ROM surface bulk samples sourced from the main mineralized lithology types, are being tested in Pilot-Scale columns (4 feet diameter x 20 feet high) at Kappes, Cassiday & Associates (“KCA”) in Reno.

- Three bulk samples are currently under leach and the remaining four are in preparation. Results are expected in H1 2026.

- Phase 7: Nine cut-off grade variability composites currently under column leach. These tests are to verify gold extraction at the lowest end of the grade/recovery curve in the current recovery model.

- Leaching of these columns will be completed in September and reported in Q4, 2025.

- Phase 8: 24 sonic drill holes (~1,400 meters) have been completed in the legacy heap leach pad, with initial gold assays received. This material will be tested for the potential to act as over-liner material and also as direct leach feed.

- Metallurgical composites have been shipped to Newfields and Forte Dynamics and test work will begin late in Q3 2025.

These programs are designed to finalize predicted gold leach recoveries and optimize process design criteria as inputs to the Feasibility Study targeted for completion in Q4 2026. Additional phases of metallurgical work are being evaluated for improved recovery model precision going into detailed mine/process design and eventual production.

Table 2 – Phase 5B Gold Extraction Results

Footnote: ppm = parts per million or grams per tonne (g/t)

Footnote: ppm = parts per million or grams per tonne (g/t)

Quality Assurance – Quality Control

All metallurgical work at Black Pine was conducted at KCA Labs in Reno and is supervised by Gary Simmons, MMSA, formerly Director of Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has managed metallurgical programs on multiple Carlin-style oxide deposits in the Great Basin.

Richard Zaggle, SME-RM, Senior Director, Mining and Metallurgy for Liberty Gold, is the Qualified Person responsible for reviewing and approving the technical content of this release.

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the scalability of results of metallurgical testing, results or timing of any mineral resources, feasibility study, environmental impact studies, mineral reserves, or pre-feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; recoveries being inconsistent with metallurgical test results; the timing or results of the publication of any mineral resources, mineral reserves, environmental impact studies or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Liberty Gold Announces Strategic 9.9% Investment by Centerra Gold Inc.

Vancouver, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) ("Liberty Gold" or the “Company”), is pleased to announce that it has entered into a subscription agreement (the “Subscription”) with Centerra Gold Inc. (“Centerra”), whereby Centerra will acquire 9.9% of the issued and outstanding common shares of the Company (the “Common Shares”).

Jon Gilligan, CEO of Liberty Gold, commented: “We are thrilled to welcome Centerra as a strategic investor in Liberty Gold. Their investment is a strong endorsement of our progress and the compelling potential of our flagship US oxide gold project, Black Pine. With Centerra’s technical depth, operational experience and existing presence in Idaho, we see a clear path to unlocking value and de-risking Black Pine’s development timeline. We look forward to collaborating closely as we accelerate Black Pine towards feasibility and on to a construction decision.”

Paul Tomory, CEO of Centerra added: “We are pleased to support the Liberty Gold team with this strategic investment. Liberty Gold’s 2024 pre-feasibility study on Black Pine, combined with the recent drill results from the legacy heap and Rangefront, demonstrate the potential of the asset and highlight areas where future resource growth may be possible. As the project moves through development, we believe our regional and operational expertise can complement Liberty Gold’s efforts and create meaningful synergies to bring Black Pine into production.”

Under the Subscription, Centerra has agreed to purchase, by way of private placement, 50,025,230 Common Shares at a price of C$0.56 per share for gross proceeds of C$28.01 million. The issue price represents a 10% premium to the 5-day volume weighted average price of the Common Shares as traded on the Toronto Stock Exchange (“TSX”).

Proceeds from the strategic investment will be used to advance technical studies at Black Pine and for general corporate purposes. The Subscription is expected to close on or about October 1, 2025, subject to customary conditions including TSX approval.

In connection with the Subscription, Liberty Gold and Centerra intend to enter into a customary investor rights agreement at closing, pursuant to which, among other things and provided that Centerra maintains certain shareholding thresholds, Centerra will have financing participation rights, information rights, technical committee representation rights and the right to appoint one nominee to the Company’s board of directors, among other customary terms.

All Common Shares issued pursuant to the Subscription will be subject to a statutory hold period of four months and one day from the date of closing, in accordance with applicable Canadian securities legislation.

On behalf of the Board of Directors

Liberty Gold Corp.

“Jon Gilligan”

Jon Gilligan Ph.D.,

President, CEO, and Director

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource with strong economic potential that can be mined profitably as an open-pit/heap leach operation in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are “forward-looking information” with respect to Liberty Gold within the meaning of applicable securities laws. Forward-looking information is often, but not always, identified by the use of words such as, "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this press release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans; the achievement of future short-term, medium-term and long-term operational strategies; the terms of and anticipated benefits of the Subscription, including the Company’s ability to enter into definitive documentation with respect to the Subscription or complete the Subscription on the terms described herein by the closing date or at all; the anticipated benefits of the partnership with Centerra; and the Company obtaining all necessary stock exchange approvals with respect to Subscription.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals, receipt of financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the timing and success of future plans and objectives in the areas of sustainable development, health, safety, environment and community development, availability of equipment, results of any mineral resources, mineral reserves, or pre-feasibility study, the availability of drill rigs, the timing of receipt of future staged payments from previous dispositions by Liberty Gold, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including risks that the Subscription will not close on the anticipated timeline and terms, risks that Liberty Gold will not use the net proceeds of the Subscription as anticipated, risks related to obtaining all necessary TSX approvals, and risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to Liberty Gold’s mineral property interests, changes in project parameters as plans continue to be refined; current economic conditions, future prices of commodities; possible variations in grade or recovery rates, the costs and timing of the development of new deposits, failure of equipment or processes to operate as anticipated, the failure of contracted parties to perform; the timing and success of exploration activities generally, the timing or results of the publication of any mineral resources, mineral reserves or pre-feasibility studies, delays in permitting, possible claims against Liberty Gold, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of receipt of staged payments from previous dispositions by Liberty Gold, or in the completion of exploration as well as those factors discussed in the Annual Information Form of Liberty Gold dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable laws.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

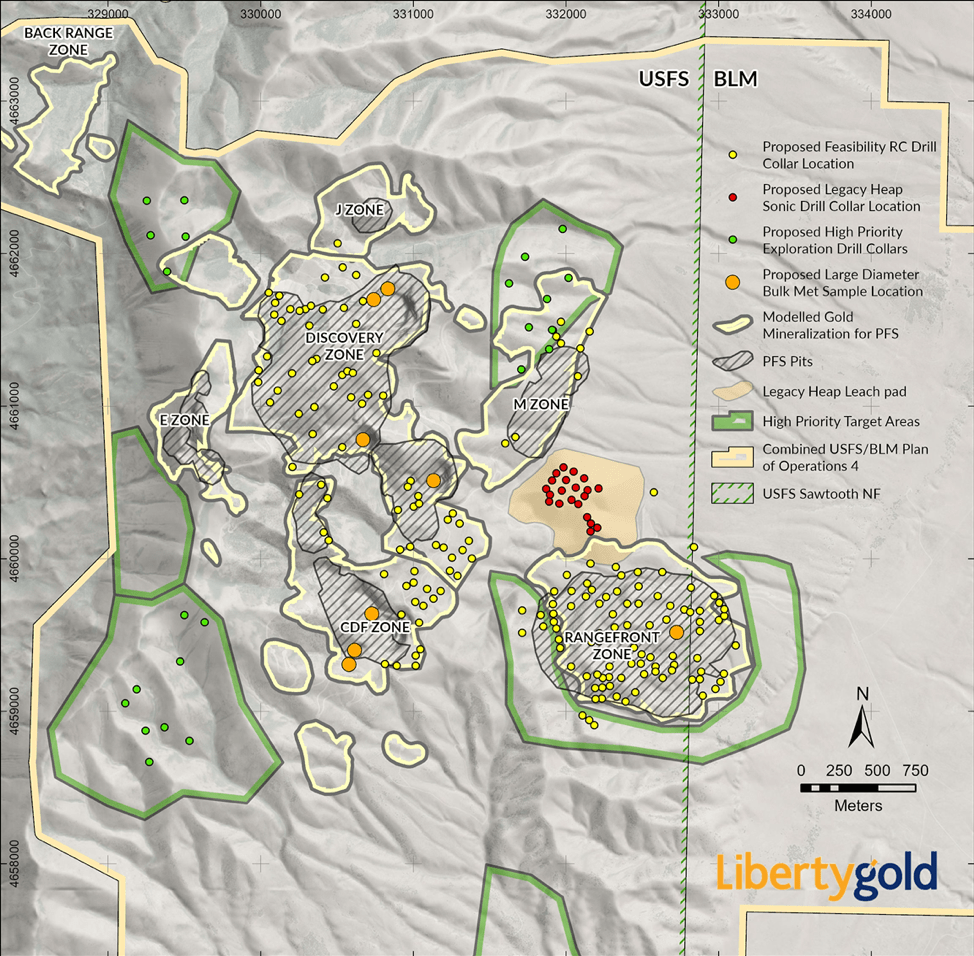

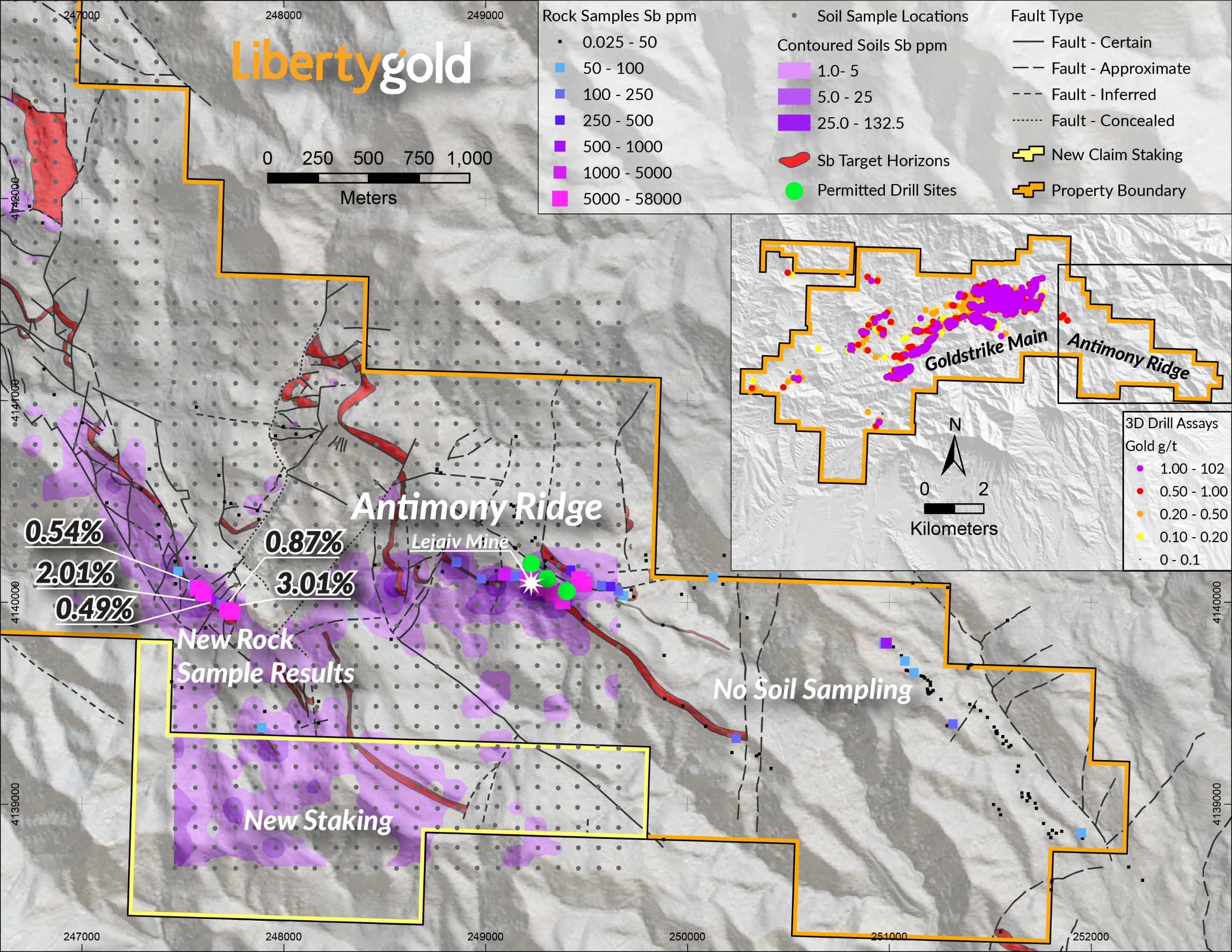

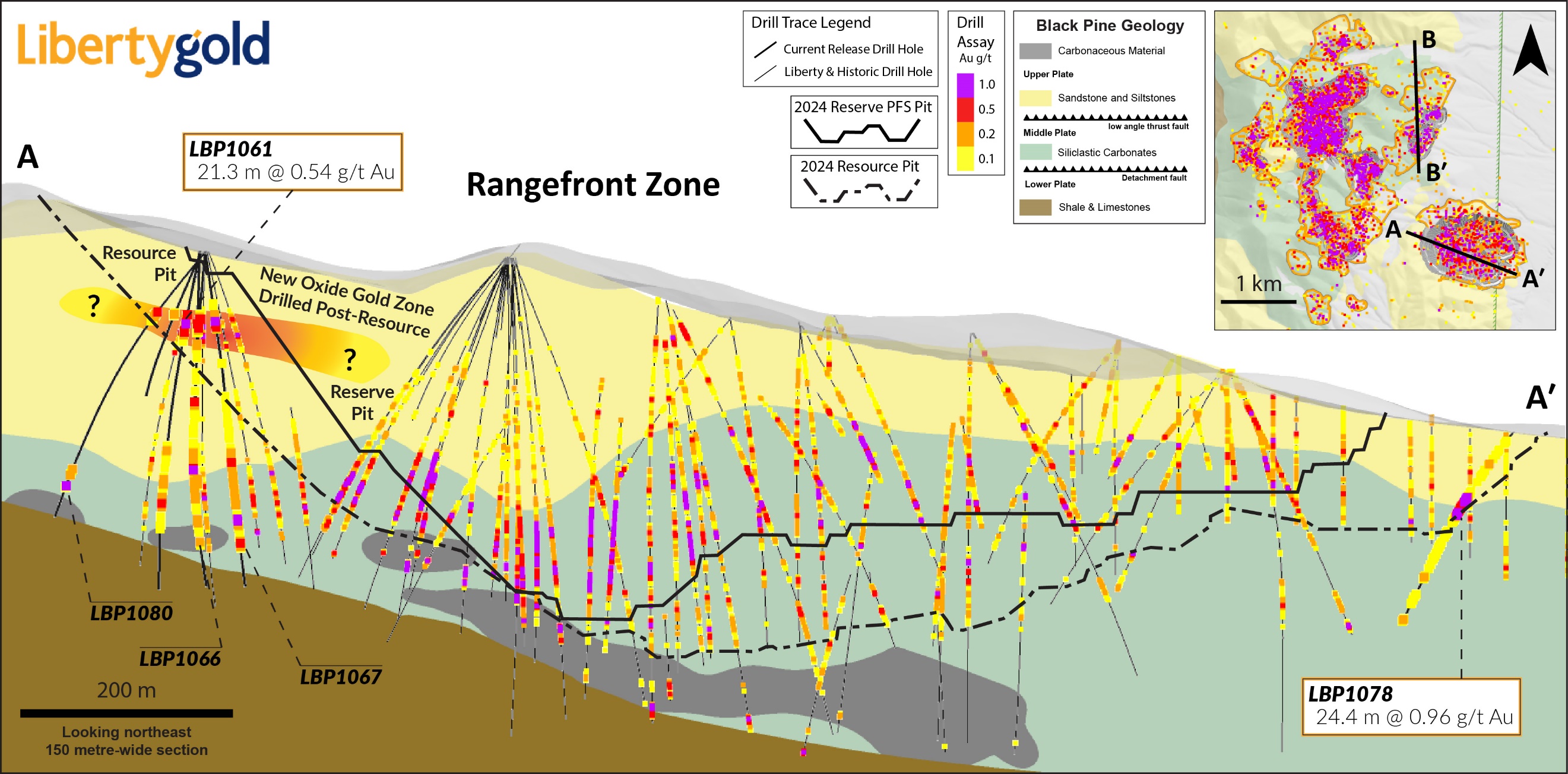

Black Pine Oxide Gold Project, Idaho - Liberty Gold’s Drill Success Signals Resource Growth Potential at Rangefront

Black Pine Oxide Gold Project, Idaho - Liberty Gold’s Drill Success Signals Resource Growth Potential at Rangefront

Drill intercepts include:

LBP1099 with 1.27 g/t Au over 22.9 meters outside the Resource pit

LBP1124 with 0.62 g/t Au over 53.3 meters outside the Reserve pit

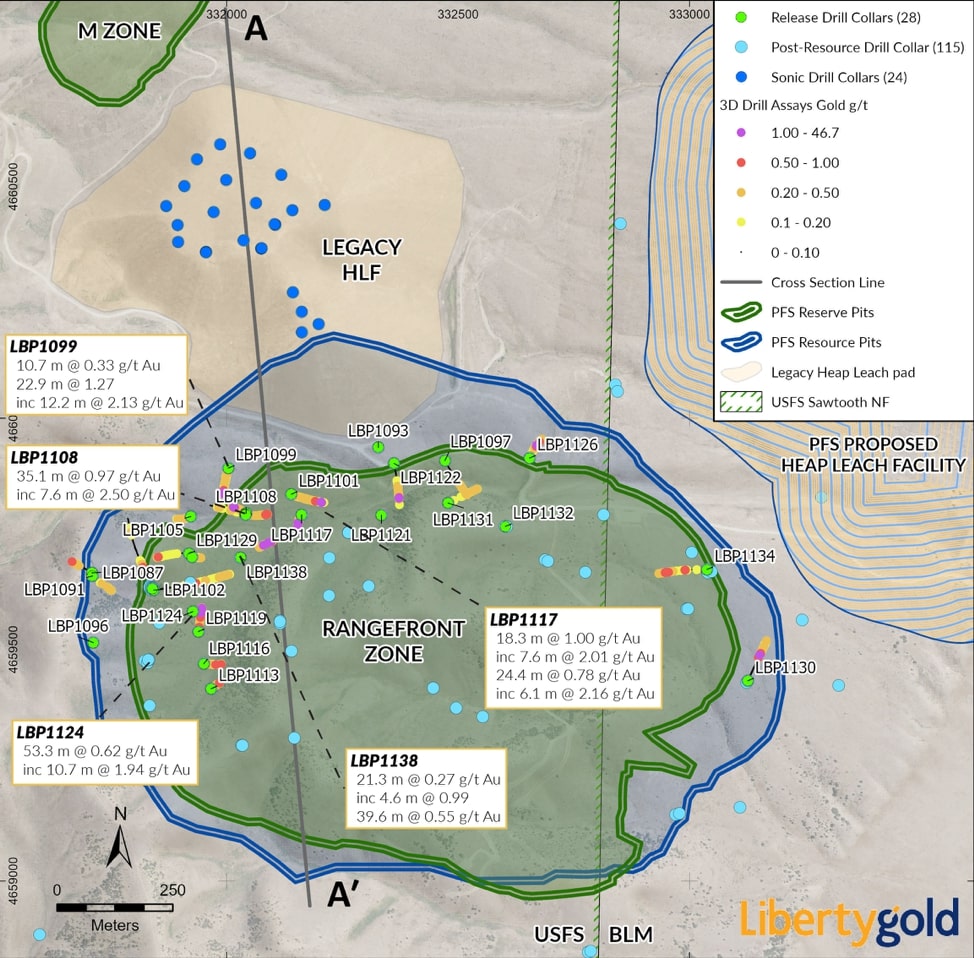

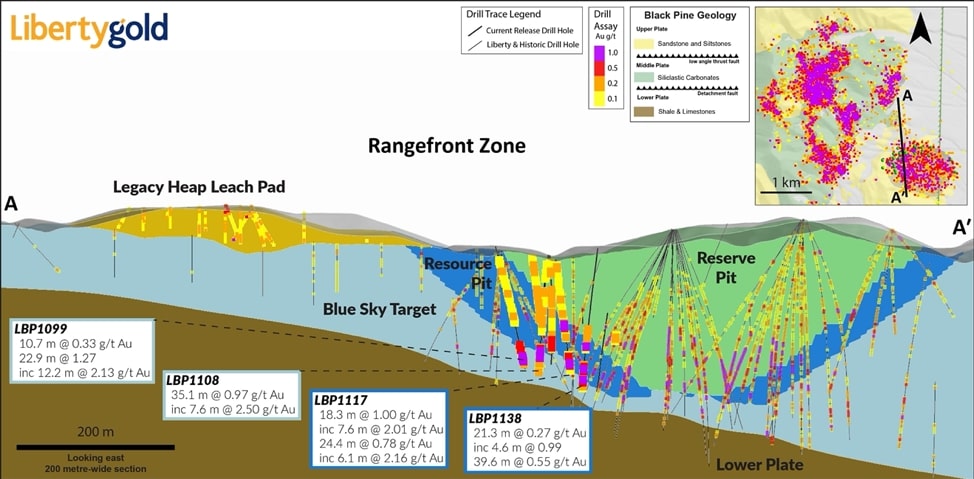

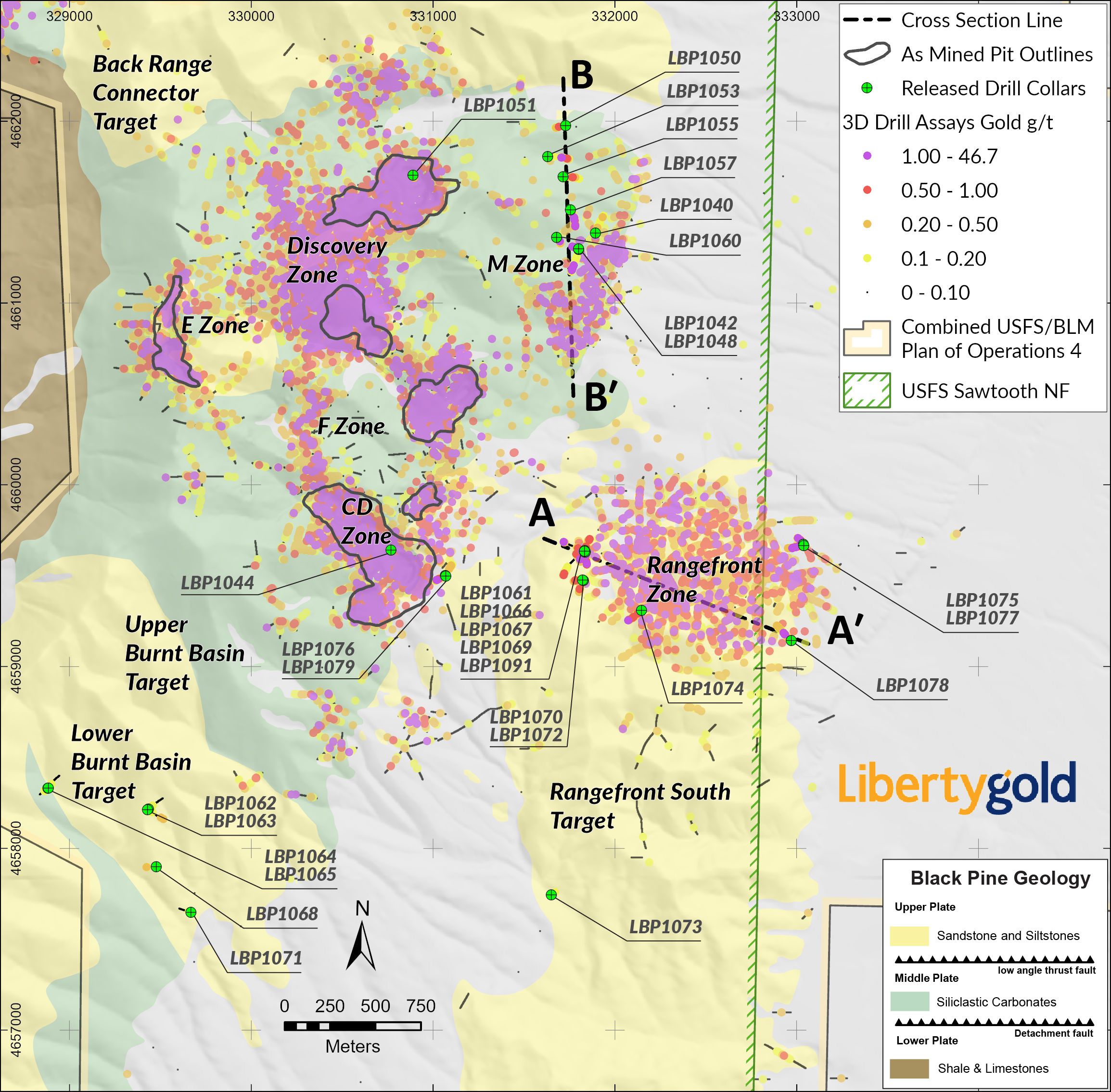

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report continued success from its 2025 drill program at the Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho. The initial reverse circulation (“RC”) assay results from the Rangefront zone build confidence in the continuity of oxide gold mineralization to the north, east and west of the current Resource pit. The feasibility drill program is demonstrating significant potential for both resource expansion and reserve conversion in the upcoming Feasibility Study.

Key Points:

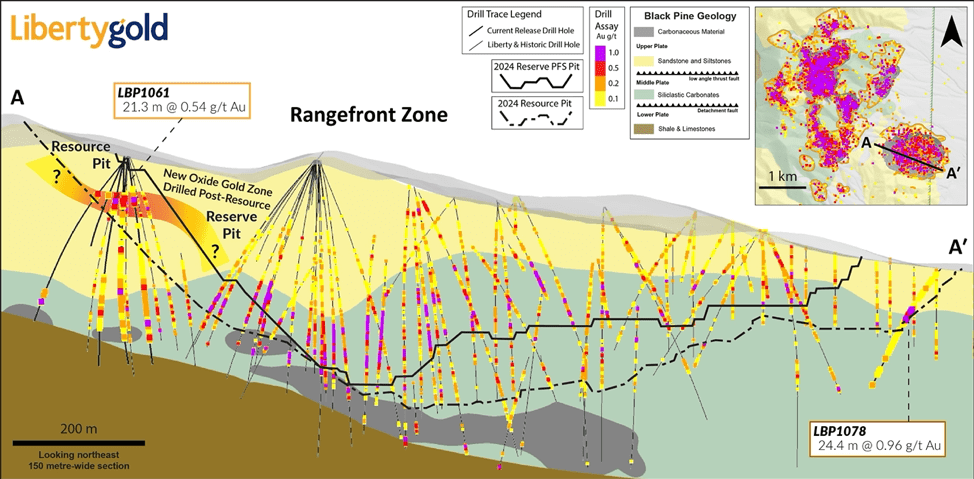

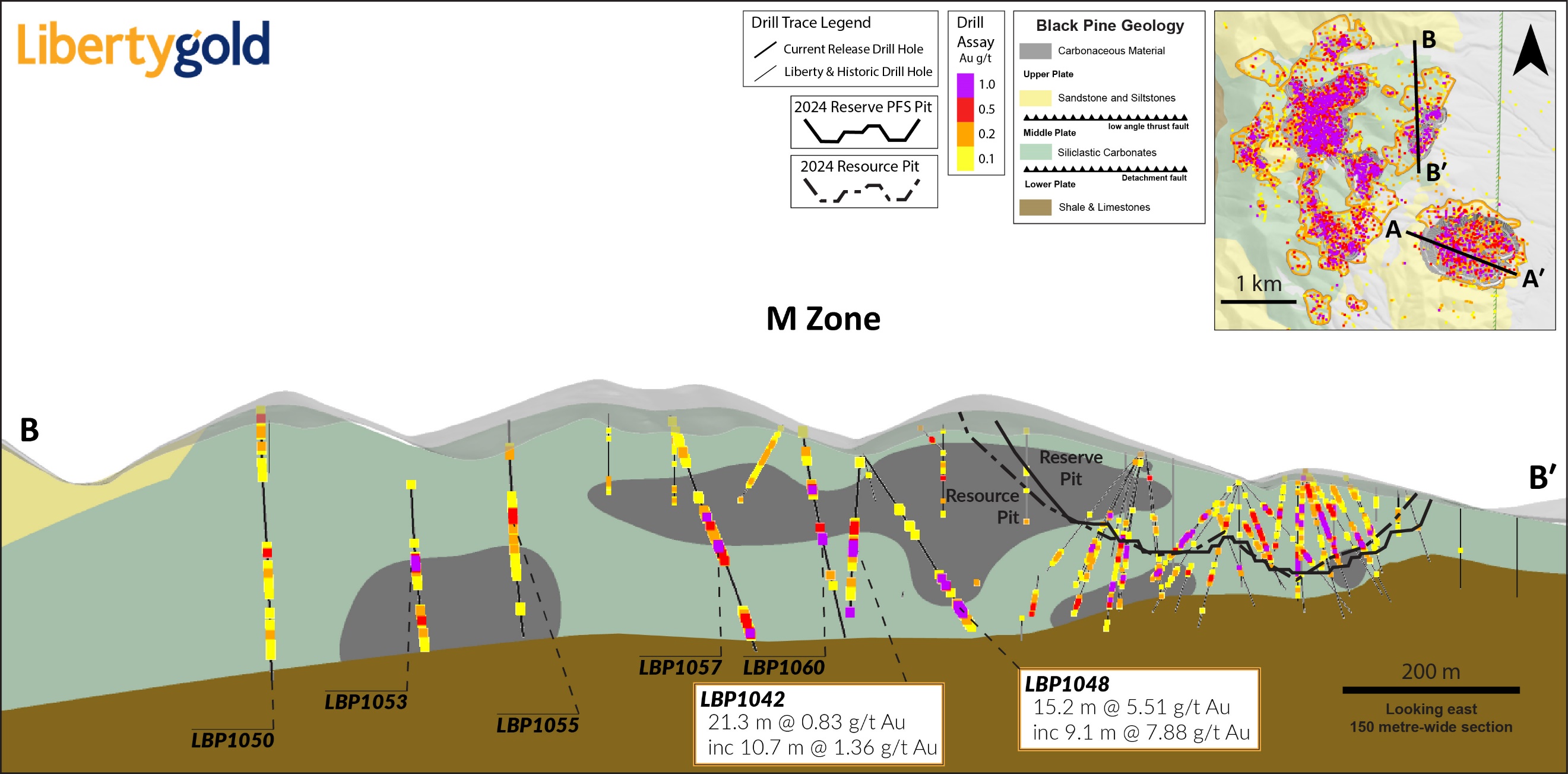

- Multiple stacked zonesof higher-grade oxide gold mineralization have been confirmed beyond the current Rangefront Resource Pit. Grades and widths are consistent with previous drilling (see Figure 2 below).

- The near surface high grade zone in the western Rangefront area remains open for expansion, with strong continuity to the northwest toward the heap leach pad and to the east. This is an area previously categorized as waste.

- New drill results bolster confidence in converting over 250,000 ounces of gold in Resources to Reserves currently locked by proximity to legacy heap, building on previously released sonic drilling that indicated reprocessing legacy heap material could unlock Reserve Pit design potential. (see press release August 27, 2025).

- Legacy heap leach pad reprocessingcould unlock ~1 square kilometer of new exploration potential and connect Rangefront mineralization to the main Discovery Area. (see Figure 1 below)

- Rangefront remains open in multiple directions and is emerging as a strategic starter pitfor future mining operations.

- ~50 additional RC holes and 12,000 meters (“m”) of drilling at Rangefront are planned for 2025.

See https://vrify.com/decks/19856 for a dynamic 3D view of drill results at Rangefront Zone and implications for potential Resource expansion and Reserve conversion.

Jon Gilligan, President and CEO, stated: “The latest assay results at Rangefront underscore the exceptional potential of the wider Rangefront - Leach Pad area to drive meaningful resource and reserve growth. With its exceptional leach performance, physical location at the base of the mountain directly adjacent to the proposed leach pad, Rangefront is growing, and we now see it as a 2 to 3 million ounce opportunity at Black Pine, likely larger than the Discovery Zone. It is becoming a very attractive starter location for initial mining operations. Paired with the recent implications from sonic drilling on the legacy heap, these results reaffirm the strategic significance of the Rangefront Area and position it as a key contributor to the future success of the Black Pine Project.”

Rangefront Area

Results from the first 28 RC holes in Rangefront, (6,506 m) represent the first RC assays of 2025 from an aggressive drill campaign that will continue into Q4. All 28 holes carry economic oxide gold mineralization. There are currently two RC drill rigs and one core rig operating at Rangefront. The drill program is focused on upgrading all resource categories in Rangefront as well as generating required data for metallurgical, hydrological, and geotechnical studies to support mine design and permitting. An additional 12,000 m of drilling in approximately 50 drill holes is planned for Rangefront in 2025.

The currently defined Rangefront Area is a 1,500 x 1,200 x 300 m thick zone of continuous oxide gold mineralization discovered by Liberty Gold in 2021. The Preliminary Feasibility Study resource estimate for Rangefront is 1,619,000 Indicated and 296,000 inferred ounces of gold1, this resource did not include any of the exploration drilling completed 2024, which expanded Rangefront significantly in size to the west and east. Rangefront mineralization also compromises the most leach-amenable oxide material at Black Pine with metallurgical column leach testing showing a weighted average gold extraction of 86.9%. (see press release dated March 22, 2023).

1See technical report “Black Pine Project NI 43-101 Technical Report, Oneida County, Idaho, USA”, effective June 1, 2024, and dated November 21, 2024, prepared by Valerie Wilson, P.Geo. SLR Consulting Ltd.; Todd Carstensen, RM-SME AGP Mining Consultants Inc.; Gary Simmons, MMSA GL Simmons Consulting, LLC; Nicholas T. Rocco, Ph.D., P.E. NewFields Companies LLC; Benjamin Bermudez, P.E. M3 Engineering & Technology Corp.; Matthew Sletten, P.E. M3 Engineering & Technology Corp.; John Rupp, P.E. Piteau Associates Ltd. ; Daniel Yang, P.Eng., P.E. Knight Piésold Ltd.; Richard DeLong, M.Sc. Westland Engineering & Environmental Services Inc. on the Company’s profile on SEDAR+ at www.sedarplus.ca and press release dated October 10, 2024.

Other Areas

One RC rig is working on resource conversion and focused, multi-purpose technical drill holes in the Discovery Zone and CD Pit areas, with assays results pending on 10 holes. A fifth RC drill rig for Black Pine is scheduled to arrive in mid-September to complete the hydrological program, drilling monitoring wells, piezometer holes and conducting pump tests. After that, the rig will move to finalize resource conversion drilling in Q4. The Feasibility Resource estimate is on track for a late Q4, and the Feasibility engineering will commence directly thereafter.

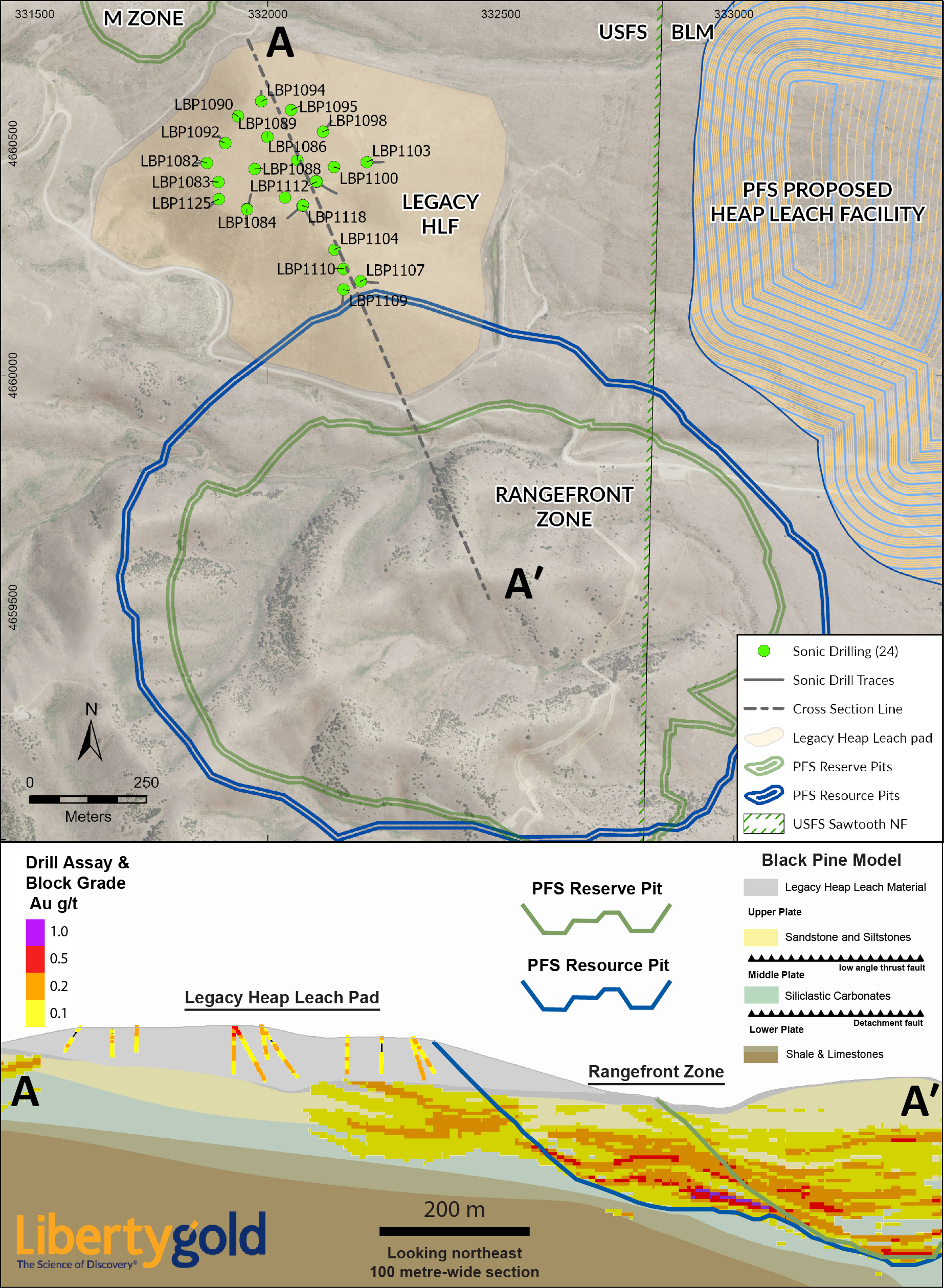

Figure 1: Plan Map of the Rangefront Area with current drill holes

Grams per tonne Gold = “g/t Au”

Figure 2: Cross Section through the Rangefront Area

Grams per tonne Gold = “g/t Au”

For a table showing complete drill results for the current release, see this link: https://libertygold.ca/images/news/2025/September/BP_Intercepts_20250904.pdf

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.15 g/t Au. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30% and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 50% to 90% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t Au were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.10 parts per million an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. All holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab listed on the scope of accreditation.

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, results or timing of any mineral resources, feasibility study, mineral reserves, or pre-feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources, mineral reserves or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

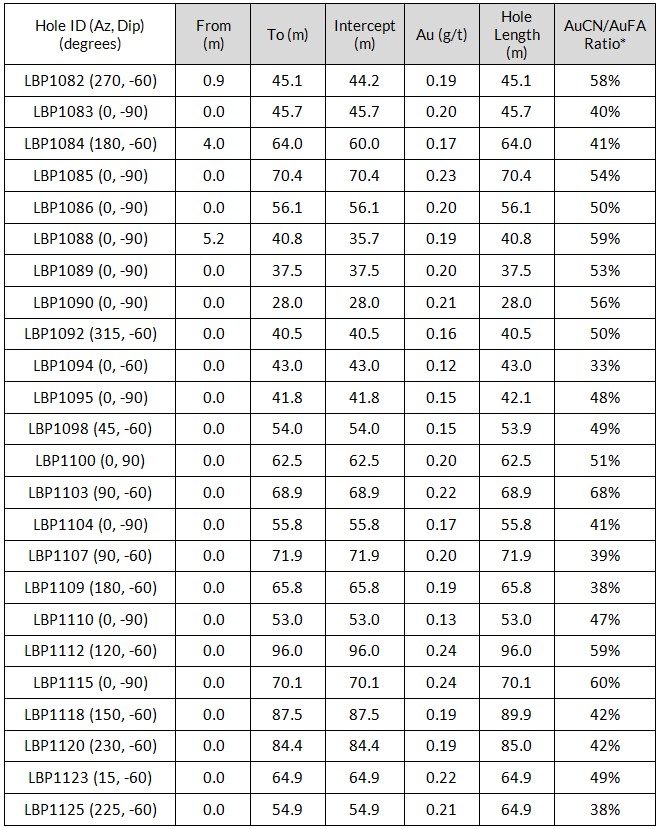

Liberty Gold Confirms Gold Recovery Opportunity in the Legacy Heap at the Black Pine Oxide Gold Project, Idaho

Unlocks Potential for Resource and Reserve Expansion

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report the results of the recently completed sonic drilling program on the legacy heap leach pad (“L-HLP”) at its flagship Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho.

Drill hole assays confirm the presence of residual, cyanide-soluble gold in the legacy heap, consistent with internal expectations. This highlights a dual opportunity to recover additional gold ounces, while re-purposing the legacy material for use in the construction of the new heap leach pad (“N-HLP”) at Black Pine.

The relocation of the legacy heap would also improve the Rangefront open pit design, which for the Preliminary Feasibility Study (“PFS”) included a 50-meter (“m”) setback from the toe of the L-HLP. Removing this setback limit may provide mining access to an estimated ~250,000 ounces of oxide gold mineralization currently defined as resource, on the northern margin of the Rangefront deposit. Furthermore, relocation of the L-HLP would generate an important near-pit exploration opportunity, where historic drilling results suggest oxide gold mineralization continues beneath the legacy heap. A resource estimate for the L-HLP is underway and samples are being prepared for metallurgical testing as part of the feasibility program.

See https://vrify.com/decks/19714 for a dynamic 3D view of sonic drill results and implications for significant value unlock.

Highlights:

- The 24-hole, 1,400 m sonic drilling program was completed across the ~31 million tonne legacy heap.

- Assay results indicate residual gold grades supportive of potential economic reprocessing, with individual samples ranging 0.06 to 1.18 grams per tonne (“g/t”) gold (“Au”) with the highest grades occurring near the surface.

- Potential for reducing construction capital by reuse of the legacy heap material, located close to the site of the N-HLP, as over-liner.

- The relocation of this material provides an important opportunity for near-pit Resource and Reserve growth at the Rangefront deposit.

Jon Gilligan, President and CEO, stated: “The results confirm the opportunity to turn a legacy mining feature into a strategic win for Liberty Gold and the Black Pine Project. Whilst the gold grades are naturally low due to previous processing, it appears there is sufficient recoverable gold to cover the costs of rehandling and reprocessing, which makes this a strong value proposition as we move the heap to unlock the resource and reserve potential below. Whether through incremental gold recovery, reduction in initial capital costs, expansion of our Resource potential, or the continuation of our cooperative agency relationships, this work exemplifies our commitment to responsible development and value creation.”

Next Steps

- Resource Estimation: preliminary work is underway for the L-HLP.

- Testwork: Metallurgical testing is underway to assess leach-recoverable gold from the L-HLP and access the material’s geotechnical suitability to act as an over-liner replacement.

- Mine Planning: Once the metallurgical test work is completed, and if it confirms expected leach characteristics, the Rangefront open pit optimization will be updated to remove the 50 m setback. Mine plans will be run for the L-HLP itself looking at a variety of mining and processing rates, costs and production. The objective will be to incorporate L-HLP material into overall feasibility production schedule to potentially add additional ounces into the reserves.

- Permitting: Continuation of discussions with relevant State & Federal agencies regarding both the ongoing L-HLP evaluation and the potential to relocate and incorporate L-HLP material as part of the N-HLP for residual processing, and ultimately reclamation and closure following cessation of mining.

Below is a plan map and cross section illustrating the location of the legacy heap in relation to the Black Pine oxide resource and the PFS mine plan, along with a photo of the legacy pad area.

Map and Cross Section: Sonic Drilling on the Legacy Heap Leach Pad at Black Pine

Photo 1: Looking west at a sonic drill rig on the Legacy Heap Leach Pad at Black Pine

Table 1: Heap Leach Fire Assay intervals and Cyanide Solubility data

* Note: Cyanide soluble Au (AuCN) assay result divided by fire assay gold (AuFA) assay result indicative to gold amenable to cyanide leach processes.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.15 g/t Au. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30% and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 50% to 90% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t Au were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.10 parts per million an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. All holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab listed on the scope of accreditation.

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, results or timing of any mineral resources, feasibility study, EIS, mineral reserves, or pre-feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources, mineral reserves EIS or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Liberty Gold Reports Strong Phase 5A Column Leach Metallurgical Results at Black Pine, Confirming Consistent Oxide Gold Recoveries Across Newly Tested Zones

80.6% weighted average gold extraction from 24 column leach tests

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report results from its Phase 5A metallurgical program at the Company’s Black Pine Oxide Gold Project (“Black Pine”) in southeast Idaho. The new results confirm consistent, robust gold recoveries across previously untested areas, supporting the feasibility development of a run-of-mine (“ROM”) heap leach processing flowsheet at Black Pine.

Highlights

- Consistent Gold Extractions and Leach Performance: Weighted average column leach gold extraction of 80.6%, with individual composites reaching up to 90.8%, demonstrating metallurgical continuity across multiple mineralized zones; all of the Phase 5A composites tested exhibit the typical Black Pine leach result of greater than 80% of the eventual gold extraction achieved in under 10 days.

- Corroborated Bottle Roll Data: Gold and silver extractions from coarse crush bottle roll tests strongly correlate with column leach results, 78.9% vs 80.6%, respectively, in line with previous metallurgical results.

- De-risking Project Development: Phase 5A column tests reinforce the suitability of ROM heap leach processing and provide key inputs into the ongoing feasibility study metallurgical model.

- Expanded Metallurgical Coverage: Phase 5A testing included composites from Back Range and J Zone, areas not previously tested and variability composites infilling previous sampling in the M Zone, Tallman and F zones.

- Ongoing Programs: Phase 5B (additional variability infill composites) results are expected in Q3, 2025, Phase 7 (cut-off-grade (“COG”) composites) results expected in Q4, 2025 and Phase 6 (bulk samples) and Phase 8 (legacy heap facility (“HLF”) sonic drilling composites) expected in early H1, 2026.

Jon Gilligan, President and CEO, Liberty Gold, commented, “These results further demonstrate that Black Pine’s oxide gold mineralization is highly amenable to ROM heap leaching, including areas outside the main deposit zones. As we advance toward the completion of our feasibility study, this growing metallurgical dataset will help optimize processing parameters, underpin robust project economics, and reduce technical risk.”

Phase 5A Metallurgical Test Summary

The Phase 5A program was designed to expand the metallurgical dataset into areas not previously tested and fill gaps in the main deposit areas, confirming consistency of recoveries across the broader mineralized footprint. See Figure 1 below for Phase 5A variability composite metallurgical drill core locations. Metallurgical composites were made from PQ sized core drilled in 2023. A total of 24 column leach tests were completed under standard test conditions for Black Pine oxide gold mineralized material, with results summarized below in Table 1.

Figure 1 – Summary map of Black Pine Metallurgical Program Sample Locations

Table 1 – Weighted Average Gold Extraction Results by Zone – Coarse Bottle Roll and Column Leach Tests

|

Zone |

Average Calculated Head Grade Au (ppm) |

Weighted Average Bottle Roll Gold Recovery (%) P80 |

Weighted Average Column Leach Gold Recovery (%) P80 |

|

Back Range Zone |

1.68 |

80.7% |

81.9% |

|

J Zone |

0.59 |

78.9% |

78.0% |

|

Tallman Zone |

0.63 |

75.8% |

81.1% |

|

M Zone |

0.58 |

77.3% |

81.1% |

|

F Zone |

0.42 |

67.0% |

67.3% |

|

All Zones |

78.9% |

80.6% |

Notes: Average Calculated Head Grade is the average of the composite column head grades tested within each zone. Detailed sample-level results are provided in Table 2 below.

Silver

Column leach tests also showed silver (“Ag”) extractions ranging from 13.7% to 72.3%. Silver grades and extractions in M-Zone and Back Range appear higher than other mineralized areas at Black Pine. Silver grades and extractions for J Zone, Tallman and F Zone are in line with results from previous metallurgical test phases. Historic production of silver was in the approximate ratio of ~0.4 ounces of silver for every ounce of gold. Liberty Gold is currently evaluating adding silver to the resource estimate in the feasibility study.

Interpretation

- Phase 5A gold extractions are in line with previous metallurgical testing across the main mineralized zones.

- The strong correlation between bottle roll and column leach data validates process predictability and supports a simple, low-cost ROM leach processing flowsheet for Black Pine oxide ores.

- These results further de-risk the processing strategy ahead of the feasibility study.

Ongoing Metallurgical Program

Liberty Gold has an active feasibility-level metallurgical program:

- Phase 5B: Twenty-one “infill” variability composites from Rangefront and Discovery Zone have completed column leaching and final results are expected in Q3, 2025.

- Phase 6: Seven (Six in-pit and one surface) 20 tonne ROM surface bulk samples sourced from the main mineralized lithology types, will be tested in Pilot-Scale columns (4 feet diameter x 20 feet high) at Kappes, Cassiday & Associates (“KCA”) in Reno. Three bulk samples are currently under leach and the remaining four are in sample collection and preparation. Results are expected in H1 2026.

- Phase 7: Nine cut-off grade variability composites currently under column leach.

- Phase 8: 24 sonic drill holes (~1,400 meters) have been completed in the legacy heap leach pad, with initial gold assays received. Metallurgical studies and composites are currently being planned. It is expected that test work will commence in late Q3, 2025. This material will be tested for the potential to act as over-liner material and also as direct leach feed.

These programs are designed to finalize gold leach recoveries and optimize process design criteria as inputs to the Feasibility Study targeted for completion in Q4, 2026.

Quality Assurance – Quality Control

All metallurgical work at Black Pine was conducted at KCA Labs in Reno and is supervised by Gary Simmons, MMSA, formerly Director of Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has managed metallurgical programs on multiple Carlin-style oxide deposits in the Great Basin.

Peter Shabestari, P.Geo., Vice President Exploration, Liberty Gold, is the Qualified Person responsible for reviewing and approving the technical content of this release.

Table 2 – Phase 5A Gold Extraction Results

| Sample ID | Test Area | Bottle Roll % Extraction | Calculated Head Grade Au (ppm) | Column Leach % Au Ext | Calculated Head Grade Au (ppm) |

| 98104 B | Backrange | 66.6 | 0.433 | 64.3 | 0.412 |

| 98105 A | Backrange | 83.9 | 2.143 | 85.5 | 2.107 |

| 98106 A | Backrange | 80.9 | 5.039 | 80.1 | 4.689 |

| 98107 B | Backrange | 86.8 | 1.167 | 89.6 | 1.116 |

| 98107 A | Backrange | 75.3 | 0.347 | 76.5 | 0.306 |

| 98108 B | Backrange | 64.1 | 0.381 | 61.8 | 0.340 |

| 98110 B | Backrange | 83.6 | 3.983 | 85.4 | 4.682 |

| 98111 B | Backrange | 75.4 | 1.372 | 79.6 | 1.355 |

| 98112 A | Backrange | 48.4 | 0.173 | 37.6 | 0.125 |

| 98113 A | J Zone | 78.6 | 0.562 | 81.2 | 0.527 |

| 98114 B | J Zone | 62.7 | 0.417 | 64.7 | 0.337 |

| 98115 A | J Zone | 79.9 | 1.057 | 81.0 | 0.919 |

| 98116 A | J Zone | 86.0 | 0.836 | column abandoned | |

| 98117 B | Tallman | 70.4 | 0.492 | 81.0 | 0.400 |

| 98118 B | Tallman | 65.6 | 0.342 | 71.0 | 0.276 |

| 98119 A | Tallman | 81.0 | 1.191 | 83.5 | 1.204 |

| 98120 A | M Zone | 64.2 | 0.735 | 73.6 | 0.747 |

| 98121 B | M Zone | 73.9 | 0.263 | 82.6 | 0.242 |

| 98122 A | M Zone | 83.4 | 0.509 | 86.6 | 0.461 |

| 98123 B | M Zone | 68.7 | 0.321 | 72.8 | 0.309 |

| 98124 B | M Zone | 82.2 | 0.859 | 77.5 | 0.883 |

| 98125 B | M Zone | 84.9 | 0.779 | 90.8 | 0.840 |

| 98126 B | F Zone | 69.3 | 0.849 | 67.3 | 0.837 |

| 98127 B | F Zone | 56.2 | 0.245 | 56.1 | 0.244 |

| 98128 A | F Zone | 71.6 | 0.165 | 81.8 | 0.187 |

| Averages | 78.9% | 0.986 ppm Au | 80.6% | 0.981 ppm Au | |

Footnote: ppm = parts per million or grams per tonne (g/t)

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, , the scalability of results of metallurgical testing, results or timing of any mineral resources, feasibility study, EIS, mineral reserves, or pre-feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.