3,206,000 Indicated and 325,000 Inferred Gold Ounces

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to announce an update to the independent Mineral Resource Estimate (the “Resource” or “MRE”) at its Black Pine Oxide Gold Project (“Black Pine”) in southeastern Idaho.

-

The Resource is reported at a cut-off grade (“COG”) of 0.2 grams per tonne (“g/t”) gold (“Au”) and consists of:

-

Indicated resources of 3,206,000 oz Au at an average grade of 0.49 g/t Au and totalling 203.8 million tonnes (“Mt”); and

-

Inferred resources of 325,000 oz Au at an average grade of 0.42 g/t Au and totalling 24.1 Mt.

-

-

A high-grade subset of the Resource contained within the 0.2 g/t Au resource pit, applying a COG of 0.5 g/t Au and consists of:

-

Indicated resources of 1,765,000 oz Au at an average grade of 1.01 g/t Au and totalling 54.2 Mt; and

-

Inferred resources of 143,000 oz Au at an average grade of 0.91 g/t Au and totalling 4.9 Mt.

-

The updated MRE represents an increase of 593,000 Indicated gold ounces from the 2023 estimate (see press release dated February 7, 2023).

Jon Gilligan, President and COO of Liberty Gold stated, “This updated Mineral Resource Estimate represents an important milestone for the Black Pine project, passing 3 million gold ounces in the Indicated class. The new resource solidly underpins the Pre-Feasibility Study, which is on track for completion in the third quarter 2024”.

For maps, cross sections and a sensitivity analysis table of the Black Pine Mineral Resource block model, please click here: images/news/2024/Feb15/BlackPineMapSectionSensitivityAnalysis02152024.pdf

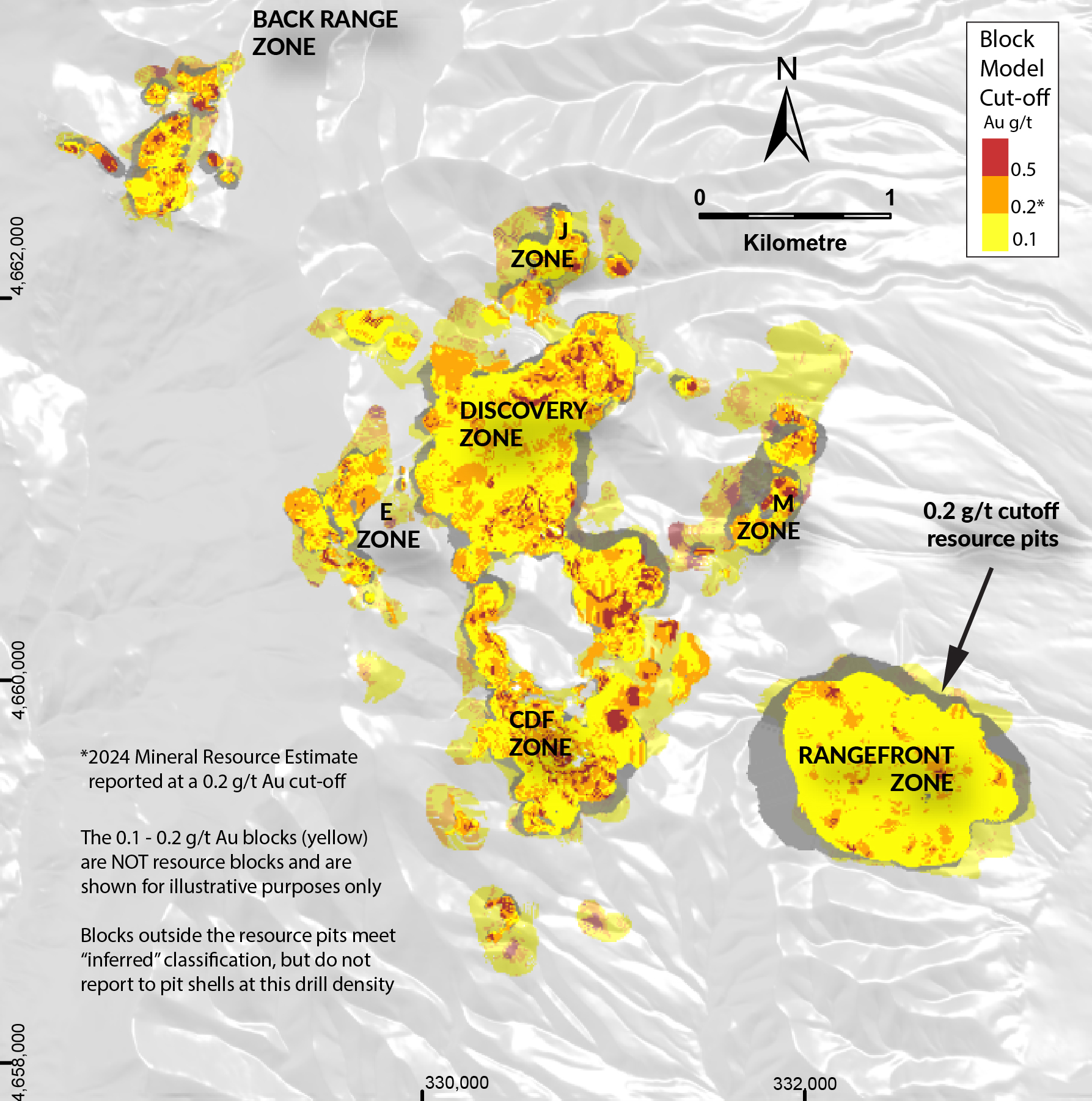

Image 1: Map of the Black Pine Mineral Resource Block Model

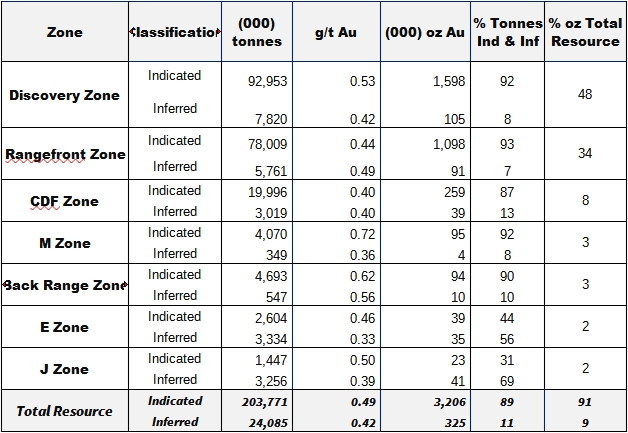

TABLE 1: BLACK PINE UPDATED MINERAL RESOURCE ESTIMATE BY ZONE

Notes:

-

CIM (2014) definitions were followed for Mineral Resources.

-

Mineral Resources are reported within conceptual open pits estimated at a gold cut-off grade of 0.20 g/t, using a long-term gold price of US$1,800 per ounce and a variable gold leach recovery model derived from extensive metallurgical studies.

-

Bulk density is variable by rock type.

-

There are no Mineral Reserves.

-

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

-

Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained gold content.

-

The effective date of the Mineral Resource estimate is February 15, 2024.

-

The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

-

The MRE was prepared by SLR Consulting (Canada) Ltd., Toronto, Canada (“SLR”).

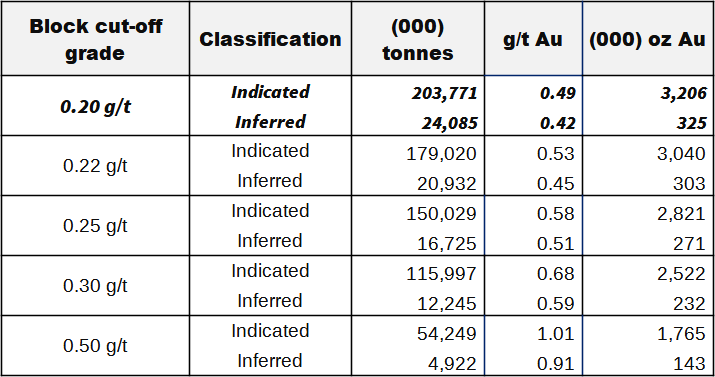

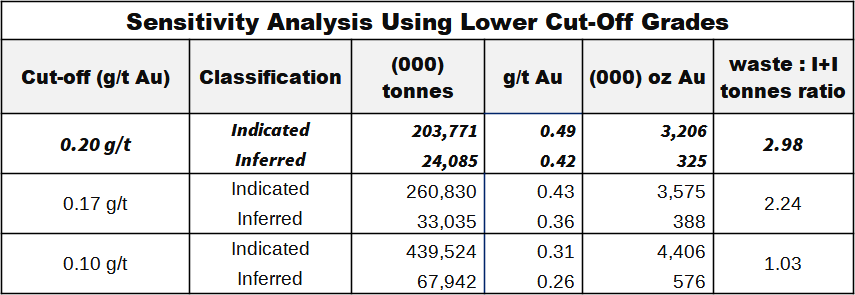

RESOURCE ESTIMATE – CUT-OFF GRADE SENSITIVITY

The average grade of the deposit within the limits of the 0.20 g/t Au resource pit shell reflects a wide range of block grades. At successively higher cut-off grades, a sizeable portion of the deposit remains (Table 2). At a block COG of 0.50 g/t Au, 1,765,000 Indicated ounces at an average grade of 1.01 g/t Au and 143,000 Inferred ounces at an average grade of 0.91 g/t Au remain. This higher-grade core of the mineralization continues to grow with additional drilling.

TABLE 2: RESOURCE GRADE DISTRIBUTION AT SUCCESSIVELY HIGHER CUT-OFF GRADES WITHIN THE 0.2 G/T AU REPORTING PIT*

*Please refer to the notes accompanying Table 1, above, for additional information. The Black Pine updated MRE is shown in bold and italic font.

TABLE 3: SENSITIVITY ANALYSIS USING LOWER CUT-OFF GRADES*

*Please refer to notes accompanying Table 1, above. The reporting MRE is shown in bold and italic font. Tonnes, grade and ounces are expressed within a series of nested pit shells generated at USD$1800/ounce gold whereby only the material above each cut-off grade is processed.

KEY POINTS

-

The 2023 work program resulted in a MRE increase of 593,000 Indicated gold ounces from the 2023 mineral resource estimate. The updated Indicated resource of 3,206,000 gold ounces will form the basis of the on-going Pre-Feasibility Study (“PFS”) being conducted on Black Pine. Work is progressing on track for a Q3, 2024 release.

-

An analysis of the mineralization at lower cut-off grades, suggests that significant upside potential exists for recovery of additional ounces in a future mine at Black Pine by applying operational cut-off grades similar to run-of-mine oxide operations in the Great Basin.

-

This Mineral Resource Update includes an additional 199 Reverse Circulation (“RC”) totaling 39,426 metres (“m”) drilled by Liberty Gold in late 2022 and in 2023. Combining historic and Liberty Gold drilling results in a total of 2,821 drill holes representing 422,142 m of drilling contributing to the new resource.

-

Based on exploration drilling costs for 2023, additional ounces added in this Mineral Resource update reflect a <$10/ounce discovery cost.

-

The updated MRE is supported by extensive metallurgical testing on 124 variability composites completed. (See press release dated March 22, 2023).

ESTIMATION METHODS

The resource estimate was completed by Valerie Wilson, M.Sc., P.Geo., Principal Resource Geologist at SLR. Ms. Wilson is an Independent Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The resource estimate was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. Estimation methods are summarized below:

-

The gold mineral resources at the Black Pine Project were modeled and estimated by:

-

Developing a geological model, in Leapfrog Geo reflecting low-angle fault control and stratigraphic control of mineralization hosted in receptive carbonate host rocks;

-

Evaluating the drill data statistically;

-

Interpreting low (0.1 g/t Au) and high-grade (0.3 g/t Au for Rangefront and 0.5 g/t Au for all other areas) gold-domains using Leapfrog Geo;

-

Compositing data to 3.048 metres (10 feet) within the gold domains;

-

Coding a unified block model comprised of 10 x 10 x 5 (x, y, z) metre blocks from seven 2.5 x 2.5 x 1.25 sub-blocked models;

-

Analyzing the modeled mineralization geostatistically to aid in the establishment of interpolation and classification parameters;

-

Interpolating gold grades using inverse distance cubed (ID3) and a three-pass interpolation strategy into the model blocks in Leapfrog Edge using the mineral domain coding to explicitly constrain the gold grade estimations; and,

-

Evaluating, statistically and visually, the resulting model in detail prior to finalizing the mineral resource estimation.

-

The Black Pine Deposit mineral resource has been constrained by optimized pit shells created using a gold price of USD$1,800/ounce and pit slopes ranging from 45 to 47 degrees. Additional inputs for the pit-optimizations include: Mining - $2.35/tonne mined, heap leaching - $2.00/tonne processed; and G&A cost of $0.80/tonne processed at an assumed 10 million tonnes per year processing rate. Gold recoveries are based on equations derived from metallurgical data and vary by grade and rock unit. A 0.5% net smelter return royalty was also applied.

-

The Company has concluded that a Technical Report update is not required with this new Mineral Resource and will include the resource estimate update into the Pre-feasibility Technical Report expected to be completed in Q3 2024.

The technical information contained in this news release has been reviewed and approved by Valerie Wilson, M.Sc., P.Geo, Principal Resource Geologist for SLR Consulting, an Independent Qualified Person as defined by NI 43-101. Ms. Wilson has verified the data disclosed including sampling, analytical, and test data underlying the drill results, using a variety of techniques including comparison against independently sourced assay certificates, site visit investigations, and digital based verification tests, and she consents to the inclusion in this release of said data in the form and context in which it appears. Ms. Wilson experienced no limitations with respect to data verification activities related to the Black Pine project.

ABOUT BLACK PINE

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. It is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Nevada Gold Mine’s Long Canyon deposit, Black Pine represents a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in under-explored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, during a period of historically low gold prices, with 435,000 ounces of gold produced from five composite, shallow pits, at an average grade of 0.63 g/t Au.

Gold mineralization at Black Pine is hosted in a 100 to 500 m-thick package of receptive, faulted carbonate rocks of the Pennsylvanian Oquirrh Formation. The rocks show evidence of extensive decalcification and clay alteration typical of Carlin-style gold deposits and are strongly oxidized over the entire extent of the 14 km2, exposed portion of the gold system.

Metallurgical column test results received to date indicate rapid gold recoveries, relatively insensitive to crush size, which support a simple, low-cost process.

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.10 g/t Au. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30% and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 50% to 90% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t Au were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.10 parts per million an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab listed on the scope of accreditation.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, the potential size of the mineralized zone, the proposed timing of exploration and development plans, proposed timing of a PFS, the expansion and future resource growth expected at Black Pine, expected capital costs at Black Pine, expected gold recoveries from the Black Pine mineralized material, the potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for future additions to the current mineral resource estimate, the 2024 work program and the results thereof, the timing and results of any resource updates and the planned development work at Black Pine. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any updated resources; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Cautionary Note for United States Investors

The information in this news release, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “probable mineral reserves”. Shareholders in the United States are advised that, while such terms are defined in and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.