Liberty Gold Reports Year-End 2022

Financial and Operating Results

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the “Company”), is pleased to announce its financial and operating results for the fiscal year ended December 31, 2022. All amounts are presented in United States dollars unless otherwise stated.

2022 and RECENT HIGHLIGHTS

At the Black Pine Project (“Black Pine”), we:

Announced an update to the independent mineral resource (the “Black Pine Resource”). The new Black Pine Resource[1] is reported using a constraining resource pit at a cut-off grade (“COG”) of 0.20 grams per tonne (“g/t”) gold (“Au”) and consists of:

- An indicated resource of 2,613,000 ounces of oxide gold at an average grade of 0.52 g/t Au and totalling 157,267,000 tonnes (“t”); and

- An inferred resource of 483,000 ounces of oxide gold at an average grade of 0.43 g/t Au and totalling 35,150,000 t.

Obtained registered title to two historical Black Pine Mine water rights totalling 868.5 acre feet per annum (“AFA”). Both rights are registered to the Black Pine Mine Well immediately adjacent to the potential site of a future heap leach facility. Liberty Gold has now secured, through a combination of purchase and long-term option/lease, an aggregate of 3,202 AFA of process water supply, sufficient for any future large-scale mining operation envisioned at Black Pine[2].

Discovered near-surface oxide gold in the F Zone confirming a 750 metre (“m”) long corridor, linking the CD and Discovery Zones. Oxide gold mineralization starts from surface or at shallow depth in all holes, linking several resource pits and demonstrating that as drill information/density increases, gold mineralization at Black Pine tends to coalesce into larger, continuous mineralized zones, with potentially greater amenability to bulk mining. Released reverse circulation (“RC”) drill results include the following highlights[3]:

- 1.01 g/t Au over 19.8 m including 2.07 g/t Au over 7.6 m from near surface in LBP666;

- 0.95 g/t Au over 18.3 m including 1.03 g/t Au over 16.8 m from surface in LBP657;

- 0.84 g/t Au over 36.6 m including 0.97 g/t Au over 30.5 m from surface in LBP662;

- 0.74 g/t Au over 38.1 m including 0.87 g/t Au over 30.5 m from surface in LBP660; and

- 0.48 g/t Au over 45.7 m including 1.11 g/t Au over 12.2 m and 1.56 g/t Au over 7.6 m from near surface in LBP672.

Published exploration RC results from other areas included[4]:

Rangefront Area:

- 1.95 g/t Au over 41.1 m, including 4.43 g/t Au over 10.8 m in LBP473;

- 1.49 g/t Au over 54.9 m in LBP554;

- 0.98 g/t Au over 85.3 m, including 1.56 g/t Au over 27.4 m in LBP514;

- 0.63 g/t Au over 94.5 m including 3.66 g/t Au over 6.1 m in LBP506; and

- 0.57 g/t Au over 51.8 m in LBP708.

M Zone:

- 7.07 grams g/t Au over 18.3 m including 11.92 g/t Au over 10.7 m and including 46.7 g/t Au over 1.5 m in LBP813;

- 1.40 g/t Au over 57.9 m from 76.2 m including 2.92 g/t Au over 21.3 m in LBP715;

- 1.17 g/t Au over 47.2 m from 54.9 m including 2.23 g/t Au over 15.2 m in LBP736; and

- 0.93 g/t Au over 38.1 m from 86.9 m including 2.35 g/t Au over 6.1 m in LBP823.

Back Range:

- 3.10 g/t Au over 27.4 m from 50.3 m including 4.33 g/t Au over 18.3 m in LBP796;

- 1.36 g/t Au over 15.2 m from 120.4 m including 3.79 g/t Au over 3.0 m in LBP774; and

- 0.78 g/t Au over 115.8 m from 15.2 m including 1.29 g/t Au over 25.9 m in LBP782.

On August 23, 2022, the Company completed the acquisition of a controlling interest in certain private mineral rights under Bureau of Land Management (“BLM”) controlled surface lands contiguous with the eastern margin of the existing project boundary, opening a significant area for exploration and, importantly, potentially facilitating utilization of the ground for future mine and processing infrastructure[5].

Released results from 14 large-diameter core holes for further metallurgical testing, with excellent results, including[6]:

- 3.98 g/t Au over 25.3 m including 8.55 g/t Au over 9.6 m in LBP499C in North Tallman;

- 4.80 g/t Au over 21.2 m including 11.0 g/t Au over 7.5 m in LBP508C in F Zone; and

- 1.09 g/t Au over 29.1 m in LBP530C in M Zone.

Continued column leach testing on 24 Rangefront drill core composites and submitted a further 25 drill core composites from across the Black Pine deposit areas for metallurgical column testing.

We received an approved Plan of Operations from the BLM granting us a permit to access and drill exploration/condemnation holes on a 11-kilometer square block of land directly to the east of our current Plan of Operations. This was important as the new permitted area is a potential site for future mine and processing infrastructure. A recently submitted modification to the United States Forest Service Plan of Operations, as well as a recently received BLM Plan of Operations will allow us to drill much of this area beginning in 2023.

[1] See press releases dated February 7, 2023 and 21 March, 2023 and “Technical Report on the Updated Mineral Resource Estimate at the Black Pine Gold Project, Cassia and Oneida Counties, Idaho, USA”, effective January 21, 2023, and signed March 10, 2023, prepared by Ryan Rodney, C.P.G of SLR International Corporation; Gary L. Simmons MMSA, of GL Simmons Consulting LLC both independent Qualified Persons under National Instrument 43-101; and Moira Smith of Liberty Gold Corp;

[2] See press release dated November 28, 2022. Press releases are available on www. Libertygold.ca and under Liberty Gold’s SEDAR profile at www.sedar.com.

[3] See press release dated August 30, 2022.

[4] See press releases dated January 18, 2022, April 12, 2022, November 8, 2022, February 21, 2023.

[5] See press release dated September 12, 2022.

[6] See press release dated August 2, 2022.

Outlook

The 2023 drill program at Black Pine commenced on January 7, 2023, in low elevation areas along the eastern margin of the deposit. The budget includes 32,000 m of RC drilling targeting resource upgrade and expansion over several areas of the deposit, as well as reconnaissance drilling in new areas along the northern, eastern and southern margins of the deposit.

In parallel with the drill program, development work is continuing, comprising:

- Phase 4 metallurgical column test work (61 columns),

- Geotechnical and hydrological studies,

- Environmental baseline work:

- a sage grouse monitoring program is planned for the second half of 2023,

- big game surveys,

- meteorological monitoring, and

- waste rock geochemical characterization studies.

- Land permitting activities.

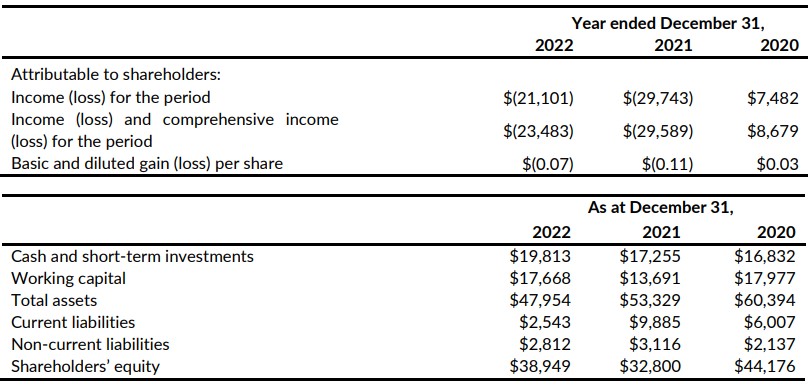

SELECTED FINANCIAL DATA

The following selected financial data is derived from our Annual Financial Statements and related notes thereto (the “Annual Financial Statements”) for the year ended December 31, 2022, as prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

A copy of the Annual Financial Statements is available on the Company’s website at www.libertygold.ca or on SEDAR at www.sedar.com.

The information in the tables below is presented in $000s except per share data:

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, the potential size of the mineralized zone, the proposed timing of exploration and development plans, the expansion and future resource growth expected at Black Pine, expected capital costs at Black Pine, expected gold recoveries from the Black Pine mineralized material, the potential upgrade of inferred mineral resources to measured and indicated mineral resources, the potential for future additions to the current mineral resource estimate, the 2023 work program and the results thereof, the timing and results of any resource updates and the planned development work at Black Pine. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any updated resources; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2023 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Cautionary Note for United States Investors

The information in this news release, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “probable mineral reserves”. Shareholders in the United States are advised that, while such terms are defined in and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.