Liberty Gold Purchases Historic Black Pine Mine Water Rights, Securing an Additional Water Supply and Further De-Risking its Black Pine Oxide Gold Deposit, Idaho

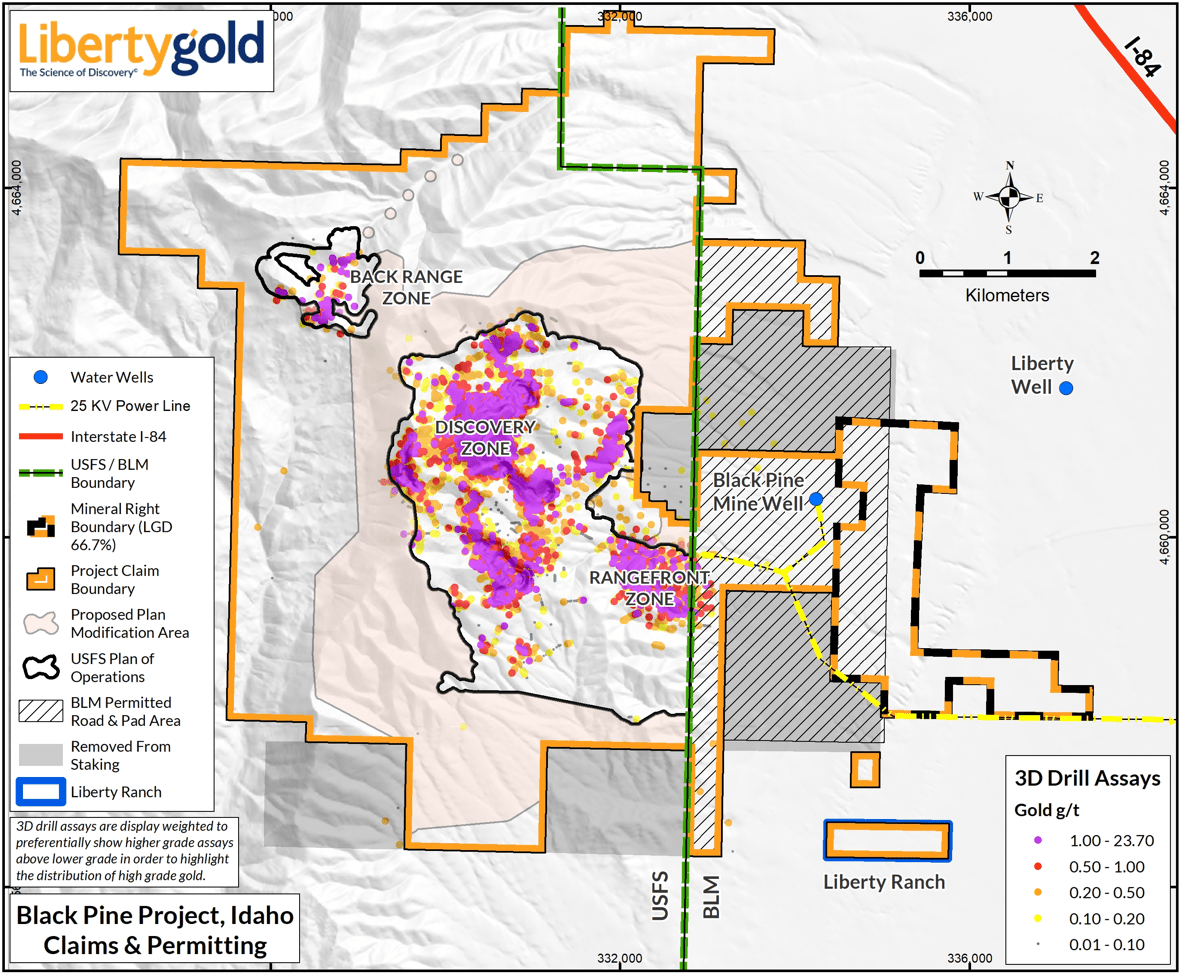

VANCOUVER, B.C. – Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to announce that it has purchased and obtained registered title to two historical Black Pine Mine water rights totalling 868.5 acre feet per annum (“AFA”) (~1 million cubic meters per year “m3/yr”). Both rights are registered to the Black Pine Mine Well immediately adjacent to the potential site of a future heap leach pad. Liberty Gold has now secured, through a combination of purchase and long-term lease, an aggregate of 3,202 AFA (~4 million m3/yr) of process water supply, sufficient for any future large-scale mining operation envisioned at Black Pine. This final piece in the Company’s proactive, early-stage water acquisition strategy materially de-risks the Black Pine project from a development perspective and also provides the Company with sufficient upside capacity in the event the deposit and current target areas continue to grow in scale.

The Company has also secured access to two other wells in the basin close to potential mining and processing operations, allowing it to manage the aquifer for a long-term, sustainable water supply. At mine closure, leased water rights would be returned to the owners, with the Black Pine Mine Well water rights available for future lease or sale to other potential users.

Jason Attew, President and CEO of Liberty Gold stated, “In this part of the world, I don’t think it is possible to overemphasize the importance of securing water rights pursuant to the future permitting and operation of a mine. The team has worked diligently over the last two years to acquire water rights, secure land and mineral rights and advance power agreements, which have significantly de-risked Black Pine’s future operations.”

In other de-risking activities, the Company has received a positive initial system impact study from Idaho Power Distribution Company on the supply of up to 10 megawatts of electrical power along a 25-kilovolt distribution line provided by Raft River Rural Electric Co-op Inc. that terminates at the Black Pine Mine gate. Further studies are on-going to refine transmission bottlenecks, system design constraints and cost estimates.

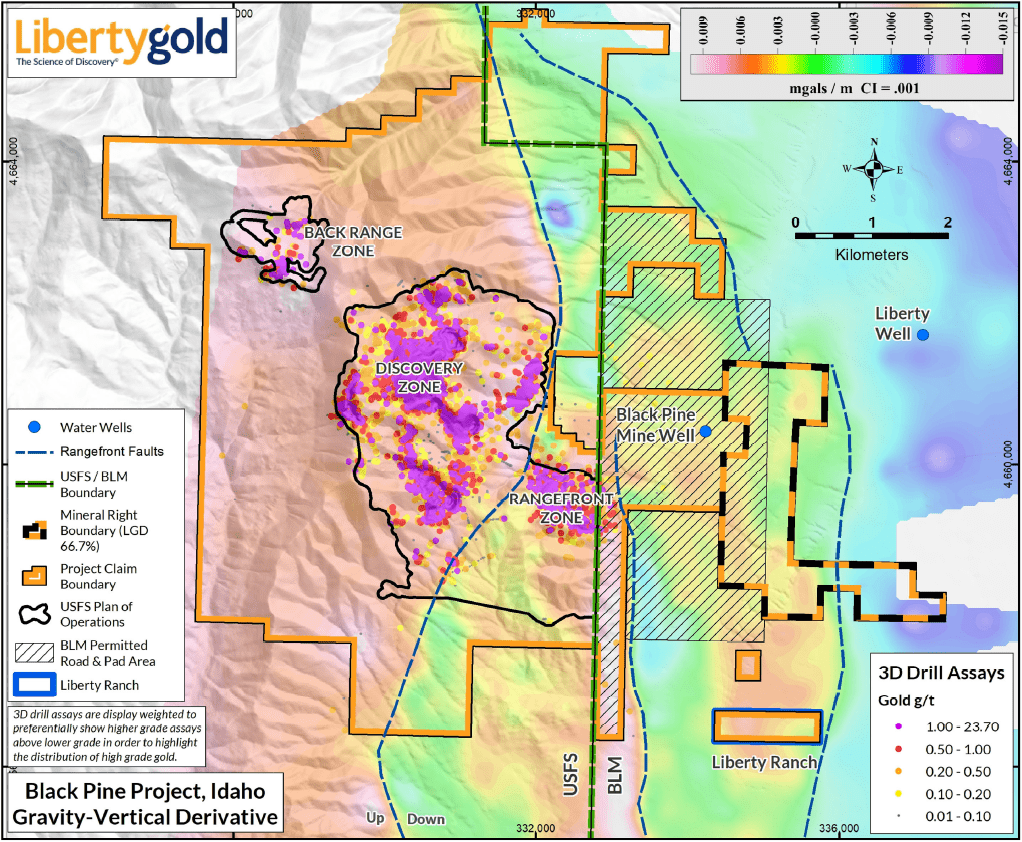

In parallel with the water rights acquisition, the Company has completed a property-scale ground gravity survey focused over the western margin of the basin along the eastern edge of the Black Pine deposit. The survey pin-pointed the location of basin-bounding faults that likely control sub-surface water storage and flow. The gravity survey also identified uplifted blocks of potentially mineralized basement rocks as a future target of exploration drilling. These data will support future hydrologic modelling of the aquifer and will also allow us to refine exploration and condemnation drilling in the area. Drilling has commenced to test the geophysical interpretations and explore for gold beyond the eastern margin of the drill-defined Black Pine gold system.

To facilitate the next stage of exploration activities the Company has submitted an application to the United States Forest Service (“USFS”) for a modification to its existing USFS Plan of Operations. This proposal would add peripheral drill sites to and expand the existing permit area, allowing the Company to test surrounding high-priority step-out and reconnaissance targets.

BLACK PINE ‘DE-RISKING’ LOCATION MAP

Claims & Permitting

Gravity-Vertical Derivative

For a link to these maps, click here: https://libertygold.ca/images/news/2022/November/BlackPine11282022LocationMap.pdf

ABOUT BLACK PINE

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. It is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Nevada Gold Mines’ Long Canyon deposit, Black Pine represents a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, during a period of historically low gold prices, with 435,000 ounces of gold produced from five composite, shallow pits, with an average head grade of 0.63 grams per tonne of gold (“g/t Au”).

A mineral resource estimate containing an indicated mineral resource of 1,715,000 ounces of gold at an average grade of 0.51 g/t Au and totalling 105,075,000 tonnes; and an inferred mineral resource of 370,000 ounces of gold at an average grade of 0.37 g/t Au and totalling 31,211,000 tonnes was released on July 13, 2021, with the resource technical report filed on SEDAR on August 19, 2021, and available on the Liberty Gold website.

A virtual site tour and 3D model of Black Pine property, including details about the geology and mineralization, is available on the Company’s website: libertygold.ca

QUALIFIED PERSON

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring and developing the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions,, availability of equipment, the availability of drill rigs, the timing of the publication of any updated resources, preliminary economic assessments or pre-feasibility studies, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; the timing of the publication of any updated resources, any preliminary economic assessments or pre-feasibility studies, successful, delays in obtaining governmental approvals, the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2022 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors Concerning Estimates of Mineral Disclosure

The mining and technical disclosure throughout this release is made in accordance with applicable Canadian law and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"). The Company's descriptions of its projects using applicable CIM terminology, which includes defined terms such as inferred, measured or indicated resources, may not be comparable to similar information about resource grades that would be made public by U.S. companies which are subject to the reporting and disclosure requirements under the United States federal securities laws.