Pilot Gold Confirms Gold at a New Target, Sub Parallel to the Main Zone at Goldstrike, Utah

PGS135: 21.3m Grading 0.82 g/t Au and PGS147: 10.7 m Grading 0.80 g/t Au

VANCOUVER, B.C. – Pilot Gold Inc. (PLG - TSX) ("Pilot Gold" or the "Company") is pleased to announce drill results from the newly tested Peg Leg target at the 100% controlled Goldstrike Project in southwestern Utah. The primary target at Goldstrike is shallow, Carlin-style, oxide gold mineralization within the 14 km2 “Historic Mine Trend”, between and down-dip of historic open pits. The Peg Leg target is 1500 metres long and is located southwest of the Main Zone near the historic Covington and Hamburg Pits.

Highlights from this new target include:

- 0.43 g/t Au over 32.0 m in PGS130

- 0.82 g/t Au over 21.3 m in PGS135

- 0.57 g/t Au over 13.7 m and 0.47 g/t Au over 6.1 m and 0.58 g/t over 3.0 m in PGS145

- 0.80 g/t Au over 10.7 m in PGS147

- 0.54 g/t Au over 25.9 m and 0.75 g/t Au over 10.7 m in PGS149

- 0.80 g/t Au over 7.6 m in PGS151

* Please note that due to having two drills on the property, assay results are not necessarily received in sequence.

There are 3 historical RC drill holes in the Peg Leg target.

- Drill hole 90-035: 0.82 g/t Au over 24.4 m

- Drill hole 91-078: 0.67 g/t Au over 27.4 m, starting from 82.3 m downhole.

- Drill hole 91-077: 0.43 g/t Au over 4.6 m and 0.57 g/t Au over 10.7 m, starting from 18.3 m down hole.

KEY POINTS

- The Peg Leg target covers an area approximately 1.5 km long and up to 250 m wide southwest of the Main Zone where Pilot Gold drilled over 100 drill holes in 2016.

- Pilot Gold tested a 1 km-long portion of Peg Leg with 15 widely spaced drill holes drilled from 11 drill sites. Of these, 12 contained gold mineralization and only three yielded no significant results.

- Hole PGS149 is located along the southern Peg Leg margin, and is believed to lie along the same fault that hosts mineralization in the historic Covington pit, located 650 m to the west, and the historic Moosehead pit, located an additional 1 km further to the west.

- Follow-up drilling in the Peg Leg target will focus on areas of mineralization identified in the first-pass drilling, particularly the southern, graben-bounding, Covington Fault.

For a complete table of drill results for the current holes, please click here: http://libertygold.ca/sites/default/files/GS_Intercepts12312016.pdf

For a complete table of results for all drilling by Pilot Gold at Goldstrike in 2015 and to date in 2016, click here: http://libertygold.ca/sites/default/files/GS_Intercepts2015to12312016.pdf

For a map of drill collars and traces for the current release, click here: http://libertygold.ca/sites/default/files/GoldStrike_PR2017-01.jpg

For a map showing the areas of new drilling and the location of historic pits at Goldstrike, click here: http://libertygold.ca/sites/default/files/GoldstrikeFutureDrilling.jpg

ABOUT GOLDSTRIKE

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada border, and is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike represents part of a growing number of Carlin-type systems located off the main Carlin and Cortez trends in largely underexplored parts of the Great Basin.

Goldstrike is an early-stage exploration projects and does not contain any mineral resource estimates as defined by National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”). The potential quantities and grades disclosed herein are conceptual in nature and there has been insufficient exploration to define a mineral resource for the targets disclosed herein. It is uncertain if further exploration will result in these targets being delineated as a mineral resource.

Further information on Goldstrike is available in the technical report entitled "Technical Report on the Goldstrike Project, Washington County, Utah, U.S.A.", effective April 1, 2016 and dated October 7, 2016, prepared by Michael M. Gustin, C.P.G. and Moira Smith, Ph.D., P.Geo., available on the Company’s website at www.pilotgold.com or under Pilot Gold’s SEDAR profile at www.sedar.com.

KINSLEY PROJECT UPDATE

A helicopter-borne MAG-VTEM survey has been completed over the 10 km2 Kinsley Project, in order to better define drill targets on a regional scale. In 2014, Pilot Gold discovered the Western Flank gold deposit in the Secret Canyon Shale and outlined an indicated gold resource of 284,000 ounces grading 6.04 g/t and an additional inferred resource of 39,000 ounces of gold grading 2.41 g/t (using multiple cut-offs1). In 2016, one drill target southwest of the Kinsley Main historic pit was tested with four holes, with no significant gold intercepts. Twelve new target areas, some of which have been confirmed to be gold bearing based on compilation of historical drill results, have been selected for potential future drill programs. The airborne survey will be used to assist in locating drill holes for these future programs.

(1) Cut-off grades at Kinsley assume an open-pit mining scenario, using a pit floor elevation generated using Whittle software, reasonable assumptions for mining and milling costs, and a US$1,300/oz gold price.

The Company holds approximately 79.1% of Kinsley. Intor Resources Corporation ("Intor"), a subsidiary of Nevada Sunrise Gold Corp., is the Company's joint venture partner at Kinsley. Further information on Kinsley is available in the technical report entitled “Updated Technical Report and Estimated Mineral Resources for the Kinsley Project, Elko and White Pine Counties, Nevada, U.S.A.”, effective October 15, 2015, dated December 16, 2015 and prepared by Michael M. Gustin, CPG, Moira Smith, Ph.D., P.Geo. and Gary Simmons, B.Sc. MMSA, available on the Company’s website at www.pilotgold.com or under Pilot Gold’s SEDAR profile at www.sedar.com.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Pilot Gold, is the Company's designated Qualified Person for this news release within the meaning of NI 43-101 and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by AAS. Metallic screen techniques may be employed where the presence of coarse free gold is suspected. Approximately 1000 grams of coarse reject material are pulverized and screened. Two splits of the fine fraction are assayed, as well as all material that does not pass through the screen (the coarse fraction). The final gold assay reported is a weighted average of the coarse and fine fractions.QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards aonnd blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT PILOT GOLD

Pilot Gold is led by a proven technical and capital markets team that continues to discover and define high-quality assets. Our core projects are Goldstrike in Utah, Black Pine in Idaho and Kinsley Mountain in Nevada. The Company also holds important interests in two Turkish assets, Halilaga and TV Tower, and has a pipeline of Western US projects characterized by large land positions and district-wide potential that can meet our growth needs for years to come.

For more information, visit www.pilotgold.com or contact:

Evelyn Cox, Director Corporate Communications

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Pilot Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licences and permits and obtaining required licences and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, timing and likelihood of deployment of additional drill rigs, successful delivery of results of metallurgical testing, the release of an initial resource report, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Pilot Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 17, 2016 in the section entitled "Risk Factors", under Pilot Gold’s SEDAR profile at www.sedar.com.

Although Pilot Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Pilot Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. There is also no certainty that these inferred mineral resources will be converted to measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied. The mineral resource estimates referenced in this press release use the terms “Indicated Mineral Resources” and “Inferred Mineral Resources”. While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission (“SEC”). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Pilot Gold is not an SEC registered company.

Pilot Gold Successfully Drills Two New Target Areas (Dip Slope & Warrior) Goldstrike Oxide Gold Project - Utah

PGS170: 32.0 m grading 0.72 g/t Au and PGS188: 22.9 m grading 0.86 g/t Au

VANCOUVER, B.C. – Pilot Gold Inc. (PLG - TSX) ("Pilot Gold" or the "Company") is pleased to announce additional drill results from the Main and Aggie zones, as well as from the new Dip Slope and Warrior zones, located north and west respectively, of the Main Zone, at the 100% controlled Goldstrike Project in southwestern Utah. The primary target is shallow Carlin-style, oxide gold mineralization within the 14 km2 “Historic Mine Trend”, between and down-dip of historic open pits.

Highlights from the New Dip Slope Zone include:

- 0.51 grams per tonne gold (g/t Au) over 41.1 metres (m) including 1.24 g/t over 6.1 m in PGS142

- 1.14 g/t Au over 6.1 m in PGS144

- 0.58 g/t Au over 21.3 m in PGS153

- 2.81 g/t Au over 3.0 m in PGS161

Highlights from the New Warrior Zone include:

- 0.59 g/t Au over 25.9 m in PGS166

- 0.86 g/t Au over 22.9 m including 1.45 g/t Au over 4.6 m in PGS188

- To date, a total of three holes have been drilled in the Warrior Zone. The discovery hole, PGS126, returned 0.84 g/t Au over 10.7 m and 0.83 g/t Au over 10.7 m.

Highlights from the existing Main and Aggie Zones include:

- 0.53 g/t Au over 22.9 m including 1.03 g/t over 4.6 m in PGS131

- 0.63 g/t Au over 10.7 m in PGS165

- 0.48 g/t Au over 24.4 m in PGS168

- 0.72 g/t Au over 32.0 m including 2.07 g/t Au over 4.6 m in PGS170

- 0.84 g/t Au over 27.4 m including 1.55 g/t Au over 10.7 m in PGS175

* Note that due to having two drills on the property, assay results for the holes are not necessarily received in sequence.

KEY POINTS

- The 2017 drill program commenced today, with two drills on the property. Initially, the drills will focus on the Peg Leg, Warrior and Dip Slope targets in order to include these areas in a resource estimate, projected for completion in Q2, 2017.

- The Dip Slope target covers an area approximately 2.5 km long and up to 800 m wide directly north of the Main Zone. The Dip Slope area hosts several historic pits, as well as unmined gold intercepts in historic holes adjacent to the pits. Approximately 85% of the target area is still undrilled, or only very sparsely drilled.

- The objective of the 17-hole, first-pass test of the Dip Slope was to identify areas where the host basal Claron Formation extends beyond the immediate pit areas under shallow cover. The results suggest that significant additional drilling is warranted. Drill testing of outlying areas will commence following receipt of the Plan of Operations.

- The Warrior target is located in the western Goldstrike Graben approximately 350 m west of the Aggie Zone. To date, Pilot Gold has tested this new zone with three drill holes. All three holes contain significant thicknesses of oxide gold mineralization. Follow-up drilling in 2017 will be focused on extending this zone where it is open to the north and west.

- Results from five follow-up drill holes at Peg Leg and 12 holes from the Covington Pit area to the west, are still pending.

For a complete table of drill results for the current holes, please click here:

http://pilotgold.com/sites/default/files/GS_Intercepts02012017.pdf

For a complete table of results for all drilling by Pilot Gold at Goldstrike in 2015 and to date in 2016, please click here: http://pilotgold.com/sites/default/files/GS_Intercepts2015to02012017.pdf

For a map of drill collars and traces for the current release, please click here:

http://pilotgold.com/sites/default/files/GoldStrike_PR2017-02.jpg

For a map showing the areas of new drilling and the location of historic hits at Goldstrike, please click here:

http://pilotgold.com/sites/default/files/GoldstrikeFutureDrilling.jpg

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada border, and is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike represents part of a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Goldstrike Mine operated from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Pilot Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by AAS. Metallic screen techniques may be employed where the presence of coarse free gold is suspected. Approximately 1000 grams of coarse reject material are pulverized and screened. Two splits of the fine fraction are assayed, as well as all material that does not pass through the screen (the coarse fraction). The final gold assay reported is a weighted average of the coarse and fine fractions.QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

Goldstrike is an early-stage exploration project and does not contain any mineral resource estimates as defined by NI 43-101. The potential quantities and grades disclosed herein are conceptual in nature and there has been insufficient exploration to define a mineral resource for the targets disclosed herein. It is uncertain if further exploration will result in these targets being delineated as a mineral resource. Further information on Goldstrike is available in the technical report entitled "Technical Report on the Goldstrike Project, Washington County, Utah, U.S.A.", effective April 1, 2016 and dated October 7, 2016, prepared by Michael M. Gustin, C.P.G. and Moira Smith, Ph.D., P.Geo. found at the top of this page or under Pilot Gold's issuer profile in SEDAR (www.sedar.com).

ABOUT PILOT GOLD

Pilot Gold is led by a proven technical and capital markets team that continues to discover and define high-quality assets. Our core projects are Goldstrike in Utah, Black Pine in Idaho and Kinsley Mountain in Nevada. The Company also holds important interests in two Turkish assets, Halilaga and TV Tower, and has a pipeline of Western US projects characterized by large land positions and district-wide potential that can meet our growth needs for years to come.

For more information, visit www.pilotgold.com or contact:

Evelyn Cox, Director Corporate Communications

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Pilot Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licences and permits and obtaining required licences and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, timing and likelihood of deployment of additional drill rigs, successful delivery of results of metallurgical testing, the release of an initial resource report, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Pilot Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 17, 2016 in the section entitled "Risk Factors", under Pilot Gold’s SEDAR profile at www.sedar.com.

Although Pilot Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Pilot Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Pilot Gold reports results from follow-up drilling at Peg Leg and Covington Pit areas, Goldstrike Oxide Gold Project - Utah

PGS179: 29.0 m grading 1.78 g/t Au, PG187: 18.3 m grading 1.33 g/t Au and

PGS 191: 6.1 m grading 1.57 g/t Au and 7.6 m grading 4.10 g/t Au

VANCOUVER, B.C. – Pilot Gold Inc. (PLG - TSX) ("Pilot Gold" or the "Company") is pleased to announce additional drill results from 17 drill holes in the Peg Leg and Covington Pit areas, located south and west respectively, of the Main Zone, at the 100% controlled Goldstrike Project in southwestern Utah. The primary target is shallow Carlin-style, oxide gold mineralization within the 14 km2 “Historic Mine Trend”, between and down-dip of historic open pits.

Highlights from the Peg Leg Zone (5 drill holes) include:

- 1.78 grams per tonne gold (g/t Au) over 29.0 metres (m) including 3.54 g/t over 12.2 m in PGS179

- 0.90 g/t Au over 6.1 m and 0.76 g/t Au over 33.5 m including 1.47 g/t over 6.1 m in PGS183

- 1.33 g/t Au over 18.3 m in PGS187

- One of the remaining two drill holes intercepted 0.41 g/t Au over 12.2 m (PGS186), with 1 hole missing the target.

Following the widely-spaced proof-of-concept drill holes released last month, including 0.51 g/t Au over 41.1 m in PGS142 and 0.54 g/t Au over 25.9 m and 0.75 g/t Au over 10.7 m in PGS149 (refer to news release dated January 10, 2017), these additional results from the new 1.5 km-long Peg Leg area continue to demonstrate that additional drilling is warranted.

Highlights from the Covington Pit area (12 drill holes) include:

- 1.57 g/t Au over 6.1 m and 4.10 g/t Au over 7.6 m including 6.32 g/t Au over 4.6 m in PGS191

- 1.15 g/t Au over 10.7 m in PGS182

- 0.83 g/t Au over 3.0 m and 7.36 g/t Au over 1.5 m in PGS178

- 0.74 g/t Au over 6.1 m in PGS 185

- Three of the remaining eight drill holes intercepted narrow widths including 0.23 g/t Au over 4.6 m and 0.83 g/t Au 3.0 m. Five drill holes were lost due to ground conditions or crossed the south graben-bounding fault before intersecting the target basal Claron Formation. New drilling will be carried out at steeper angles in order to intercept the target.

- Four of the holes confirmed that higher grade mineralization is hosted in an east-west striking mafic dike located immediately north of the Covington Pit.

There are currently two drills operating on the project in the Aggie area and on the new Warrior Zone target. All 2016 drill results have been released.

For a complete table of drill results for the current holes, please click here: http://pilotgold.com/sites/default/files/GS_Intercepts08022017.pdf

For a complete table of results for all drilling by Pilot Gold at Goldstrike in 2015 and to date in 2016, please click here: http://pilotgold.com/sites/default/files/GS_Intercepts2015to08022017.pdf

For a map of drill collars and traces for the current release, please click here: http://pilotgold.com/sites/default/files/GoldStrike_PR2017-03.jpg

For a map showing the areas of new drilling and the location of historic pits at Goldstrike, please click here: http://pilotgold.com/sites/default/files/GoldstrikeFutureDrilling.jpg

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada border, and is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike represents part of a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Goldstrike Mine operated from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Pilot Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations, but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by AAS. Metallic screen techniques may be employed where the presence of coarse free gold is suspected. Approximately 1000 grams of coarse reject material are pulverized and screened. Two splits of the fine fraction are assayed, as well as all material that does not pass through the screen (the coarse fraction). The final gold assay reported is a weighted average of the coarse and fine fractions.QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

Goldstrike is an early-stage exploration project and does not contain any mineral resource estimates as defined by NI 43-101. The potential quantities and grades disclosed herein are conceptual in nature and there has been insufficient exploration to define a mineral resource for the targets disclosed herein. It is uncertain if further exploration will result in these targets being delineated as a mineral resource. Further information on Goldstrike is available in the technical report entitled "Technical Report on the Goldstrike Project, Washington County, Utah, U.S.A.", effective April 1, 2016 and dated October 7, 2016, prepared by Michael M. Gustin, C.P.G. and Moira Smith, Ph.D., P.Geo. found at the top of this page or under Pilot Gold's issuer profile in SEDAR (www.sedar.com).

ABOUT PILOT GOLD

Pilot Gold is led by a proven technical and capital markets team that continues to discover and define high-quality assets. Our core projects are Goldstrike in Utah, Black Pine in Idaho and Kinsley Mountain in Nevada. The Company also holds important interests in two Turkish assets, Halilaga and TV Tower, and has a pipeline of Western US projects characterized by large land positions and district-wide potential that can meet our growth needs for years to come.

For more information, visit www.pilotgold.com or contact:

Evelyn Cox, Director Corporate Communications

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Pilot Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licences and permits and obtaining required licences and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, timing and likelihood of deployment of additional drill rigs, successful delivery of results of metallurgical testing, the release of an initial resource report, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Pilot Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 17, 2016 in the section entitled "Risk Factors", under Pilot Gold’s SEDAR profile at www.sedar.com.

Although Pilot Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Pilot Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Pilot Gold’s Latest Acquisition Shows Exceptional Potential – Black Pine Oxide Gold Project, Idaho

VANCOUVER, B.C. – Pilot Gold Inc. (PLG - TSX) ("Pilot Gold" or the "Company") is pleased to report on the compilation and interpretation of historic data at the recently acquired Black Pine Project in southeastern Idaho. Black Pine is a past-producing heap leach gold mine that contains a large, shallow, oxidized, district scale Carlin-style gold system, similar in nature and target size to Pilot Gold’s Goldstrike Property in Utah. The high priority target area, as confirmed by historical mining records, drilling and surface sampling, covers a 12 square kilometer area, within a larger claim block covering nearly 32 square kilometres.

While the Company’s focus is on drilling and building a resource at Goldstrike, the addition of Black Pine provides us with another opportunity to advance and define a large, Carlin-style oxide gold resource in the Great Basin of the United States. Target generation at Black Pine is currently underway, in advance of a drill program expected later in 2017.

Pilot Gold acquired 100% of the Black Pine Property from Western Pacific Resources Corporation on June 16, 2016, and began an intensive data compilation effort in order to generate a 3D interpretive model and high-priority drill targets. Pilot Gold has locational, geology and assay data from 1,866 shallow holes, totaling 191,481 metres and has identified three broad target types for drill testing, including: 1) down-dip extensions of gold mineralization from mined pits under shallow cover; 2) unmined bodies of mineralization identified by previous operators; and 3) undrilled, high priority gold-in-soil anomalies.

Key Points:

- Drill program planned for Q3/Q4 2017.

- An existing Plan of Operations allowing for drilling activity in selected areas came with the project acquisition.

- Mineralization controls are both structural and stratigraphic. The average, historic life-of-mine head grade was 0.63 g/t Au, with gold mined from 7 separate pits. There was significant variability in mined head grade, with 30% of production coming from 3 pits averaging 1.2 g/t gold. This is reflected in high grades obtained during drill definition of the historic mineralization in these pits, including:

- 14.66 g/t Au over 19.8 metres

- 19.13 g/t Au over 24.4 metres

- 7.15 g/t Au over 32.0 metres

- 2.56 g/t Au over 88.8 metres

- 4.69 g/t Au over 44.2 metres

- A large number of holes contain unmined gold intercepts proximal to and below the historical 7 mined pit areas, including:

- 1.80 g/t Au over 50.3 metres

- 2.85 g/t Au over 22.9 metres

- 3.63 g/t Au over 16.8 metres

- 6.88 g/t Au over 10.7 metres

- 1.16 g/t Au over 60.9 metres

- 1.91 g/t Au over 42.7 metres

- Twelve targets have been identified for drill testing. Many of these targets remain untested owing to the historic nature of drilling, which was largely shallow and production driven in a sub-US$400 gold environment, as evidenced by key statistics extracted from the database:

- 257 of 1,866 drill holes (14%) ended in > 0.2 g/t Au and 92 (5%) ended in >0.5 g/t Au.

- 93 metres is the median drill hole depth, with only 31 drill holes (<2%) over 200 metres.

- Of the 1,866 historical drill holes, 787 holes, or nearly 42%, have unmined gold intercepts of > 1.5 metres grading > 0.30 g/t Au.

- As-mined topographic maps, blast hole data, block models and other data are being used to build an accurate model of geology and remaining gold mineralization pursuant to drill targeting.

- Pilot Gold has recently staked an additional 55 claims on the south and southeast corner of the claim block bringing the total to 400 federal lode claims covering 31.7 km2. These claims were staked after the recovered database revealed historical drill holes with mineralized intercepts located outside of the acquired claim block.

For more details about the Black Pine Property, including location, geology & geochemistry maps and past production and target figures, please click here: http://www.pilotgold.com/images/Presentations/2017/BlackPineFeb2017.pdf

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Pilot Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

About Black Pine

The Black Pine property is located in southeastern Idaho, northwest of Snowville, Utah, between Utah State highway 30 and Interstate highway 15. The property includes 400 federal lode claims, covering 31.7 km2. The mineralized zone was extensively drilled in the immediate pit areas, with mining carried out by Pegasus Gold Corp. from 7 shallow pits over a 6-year period from 1992 to 1997 in a run of mine heap leach operation. The mining operation produced 435,000 ounces of gold from ore averaging 0.63 g/t gold, with a reported recovery of 65%.

Black Pine is an early-stage exploration project and does not contain any mineral resource estimates as defined by NI 43-101. There has been insufficient exploration to define a mineral resource for any of the targets disclosed herein.

Some of the data presented herein, includes legacy data developed by previous operators of the Black Pine property prior to the introduction of NI43-101. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals are unknown. Production data sourced from Pegasus internal yearly statements on production and remaining Reserves and Mineralized material. Pilot Gold is providing this legacy data for informational purposes only, and gives no assurance as to its reliability and relevance to the Company’s current results and proposed exploration program at Black Pine. Pilot Gold has not completed any quality assurance program or applied quality control measures to the legacy data, nor has a Qualified Person done sufficient work to verify the source of the legacy data. Accordingly, the legacy data should not be relied upon. While Pilot Gold plans to verify some or all of the legacy data, the anticipated timing and results of that data verification cannot be ascertained at this time. Confirmation work may produce results that differ substantially.

ABOUT PILOT GOLD

Pilot Gold is led by a proven technical and capital markets team that continues to discover and define high-quality assets. Our core projects are Goldstrike in Utah, Black Pine in Idaho and Kinsley Mountain in Nevada. The Company also holds important interests in two Turkish assets, Halilaga and TV Tower, and has a pipeline of Western US projects characterized by large land positions and district-wide potential that can meet our growth needs for years to come.

For more information, visit www.pilotgold.comor contact:

Evelyn Cox, Director Corporate Communications

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Pilot Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licences and permits and obtaining required licences and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, timing and likelihood of deployment of additional drill rigs, successful delivery of results of metallurgical testing, the release of an initial resource report, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Pilot Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 17, 2016 in the section entitled "Risk Factors", under Pilot Gold’s SEDAR profile at www.sedar.com.

Although Pilot Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Pilot Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Pilot Gold Reports Year-End Financial and Operating Results

VANCOUVER, B.C. – Pilot Gold Inc. (PLG - TSX) ("Pilot Gold" or the "Company") is pleased to announce its financial and operating results for the year ended December 31, 2016, and to provide an outlook on 2017.

Our exploration activities and budget in 2017 will continue to focus on our three significant US gold projects, all of which are past producing, open pit, heap leach, Carlin-style gold mines. Our Goldstrike project in Utah, Black Pine project in Idaho, and Kinsley Mountain project in Nevada are cornerstone assets that are extremely well located and have the potential for significant resource growth.

All amounts are presented in United States dollars unless otherwise stated.

Company highlights through and subsequent to December 31, 2016:

- Continued to report encouraging gold results at Goldstrike at multiple targets, including results from new targets: Peg Leg, Dip Slope, Covington and Warrior, with ongoing infill and resource drilling at the Main and Aggie Zones.

- Continued data compilation, modelling and drill targeting at the historic Black Pine heap leach gold mine. Black Pine was acquired in 2016 from Western Pacific Resources as part of our continuing effort to identify and secure shallow, oxidized Carlin-style gold systems, similar in nature and target size to Kinsley and Goldstrike. (See press releases of June 16, 2016 and February 21, 2017)

- Completed a bought deal financing of C$14.42 million (the "2016 Bought-Deal") (See press release of November 16, 2016)

Goldstrike, Utah

The program objective for 2016 was to advance the property to an initial mineral resource estimate in 2017, incorporating new and historical drill hole data over a broad area. The 2016 program was successful in delineating vast areas of new shallow, oxide gold mineralization between, adjacent to, and under the historic open pits. Results from this program continued to expand the area of known mineralization, yielding encouraging gold results from several new target areas: Aggies, Covington, Dip Slope, Peg Leg, and Warrior.

For the year ended December 31, 2016, expenditures, including non-cash items, capitalized to Goldstrike were $4.59 million (year ended December 31, 2015: $1.03 million), including: drilling and assaying ($2.47 million), salaries ($0.91 million), property-related payments ($0.48 million), and analyses and surveys ($0.36 million).

The initial 2017 exploration program and budget at Goldstrike is $5.98 million. The 2017 RC drilling program began on February 1, 2017 and is set to continue through to November, for a total of 42,500m of drilling. Areas of focus are located to the north and west of the Main Zone, and include the Peg Leg Graben, over an area one km-long and up to 250 m wide, and the 4 km2 Dip Slope zone, host to several historic pits.

Metallurgical testing is underway using material derived from 10 large-diameter core holes drilled in 2016, with final results expected during Q2 2017. Metallurgical testing encompasses bottle rolls, column testing and comminution test work, in order to provide sufficient data for modeling and prediction of gold recovery over a wide range of mineralization types and feed sizes.

The Company is operating under a Notice of Intent ("NOI"), which has been amended and increased four times to date, allowing for up to 9.76 acres of disturbance for access and drill sites. In February 2017, the Company applied for an additional NOI for a further 1.8 acres of disturbance in the property’s Mineral Mountain area. We expect to receive approval on a full Plan of Operations ("PoO") by the end of Q2 2017, which will allow access for drilling over a large number of targets property-wide.

The Company also expects to report a first-time mineral resource estimate at Goldstrike in a revised technical report in mid Q2 2017.

Kinsley, Nevada

On December 17, 2015, the Company reported a first-time mineral resource estimate at Kinsley that includes the delineation of a significant high-grade zone at the Western Flank zone, containing an indicated resource of 284,000 ounces grading 6.0 g/t gold (See press release, November 4, 2015), and technical report entitled "Updated Technical Report and Estimated Minerals Resources for the Kinsley Project", effective October 15, 2015 and dated December 16, 2015, prepared by Michael M. Gustin, C.P.G., with Mine Development Associates, Inc. (MDA) of Reno, Nevada; Gary Simmons, BSc, Metallurgical Engineering, of G L Simmons Consulting, LLC; and Dr. Moira Smith, Ph.D. on SEDAR at http://www.sedar.com.); the Western Flank deposit, is one of the highest-grade resources announced in Nevada in the last 5 years.

The 2016 exploration program, including surface work, 3D modeling, a small drill program and airborne magnetics and VTEM, generated several high priority targets confirming our belief in the potential of a much larger gold system. In the year ended December 31, 2016, approximately $0.69 million in expenditures were capitalized at Kinsley (year ended December 31, 2015, $1.70 million), including Intor’s 20.9% share (recognized in the Annual Financial Statements as a component of Non-Controlling Interest). Expenditures through December 31, 2016 included drilling and assaying ($0.25 million), land and lease payments ($0.15 million), and salaries ($0.06 million).

The identification of multiple untested targets with the same attributes as the Western Flank underscores the Company’s belief in the potential of Kinsley. The 2017 exploration program contemplates a limited drill program along the Western Flank’s eastern extension and in an area southeast of the historical Main Pit. The Company’s share of budgeted expenditures at Kinsley for the 2017 program is $0.42 million.

Black Pine, Idaho

Consistent with management’s plan to enhance the Company’s US gold portfolio, on June 14, 2016 Pilot Gold acquired the Black Pine property, a past-producing, Carlin-style, oxide gold mine located in southeastern Idaho. Surface oxide gold mineralization at Black Pine is present over a 12 km2 area in historic soil and rock samples. The property database contains over 1,866 historic drill holes, including a large number of unmined intervals of gold mineralization.

The Company anticipates further data compilation and surface geologic activities through early 2017, in advance of a potential late 2017, validation drilling program. A current PoO allows access to a number of areas on the property for drilling; a new PoO will be submitted in Q2 to permit drilling over a wider area, including a number of undrilled targets. The 2017 budget for Black Pine is approximately $0.39 million.

Moira Smith, Ph.D., P.Geo., Vice President Exploration and Geosciences, Pilot Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the scientific and technical information contained in this release is accurate.

The resource estimate at Kinsley’s Western Flank, effective October 15, 2015, was determined using a 1.0 g/t Au cut-off grade over 1,461,000 tonnes of Secret Canyon Shale-hosted sulphide and transitional mineralization. The cut-off grade used assumes an open-pit mining scenario, using a pit floor elevation generated using Whittle software, reasonable assumptions for mining and milling costs, and a US$1,300/oz gold price.

Goldstrike, Kinsley and Black Pine are early stage exploration projects; the potential quantities and grades disclosed herein are conceptual in nature and, except for the mineral resource estimate at the Western Flank deposit at Kinsley, there has been insufficient exploration to define a mineral resource for other targets disclosed herein. It is uncertain if further exploration will result in these targets being delineated as a mineral resource. The potential to define an additional mineral resource at Kinsley or a resource at Goldstrike or Black Pine is conceptual in nature and there has been insufficient exploration to define a mineral resource thereat.

SELECTED FINANCIAL DATA

The following selected financial data is derived from our consolidated financial statements and related notes thereto for the years ended December 2016, 2015 and 2014, as prepared in accordance with International Financial Reporting Standards.

These documents can be found on the Company’s website (www.pilotgold.com) or on SEDAR at www.sedar.com.

|

Twelve months ended |

|||||

| 2016 | 2015 | 2014 | |||

| Attributable to shareholders: | |||||

| Loss for the period | $5,576,830 | $6,974,976 | $6,709,098 | ||

| Loss and comprehensive loss for the year | $4,895,227 | $12,989,681 | $10,535,641 | ||

| Basic and diluted loss per share | $0.04 | $0.07 | $0.07 | ||

| As at December 31, | |||

| 2016 | 2015 | 2014 | |

| Cash and short-term investments | $12,468,891 | $7,912,417 | $17,870,785 |

| Working capital | $12,399,183 | $8,215,220 | $17,768,551 |

| Total assets | $104,546,476 | $93,729,943 | $86,846,581 |

| Current liabilities | $897,297 | $477,128 | $1,620,799 |

| Non-current liabilities | $1,241,886 | $604,359 | $115,640 |

| Shareholders’ equity | $79,392,102 | $69,609,115 | $81,372,291 |

Total assets comprise primarily exploration properties and deferred exploration expenditures of $83.68 million and cash, cash equivalents and short term investments of $12.47 million. The 40% share of TV Tower owned by Teck is included as a component of the $23.02 million non-controlling interest on the Company’s statement of financial position. Total assets also include $0.83 million in receivables, and prepayments, and $5.42 million in value recorded for the Company’s 40% interest in the PEA-stage Halilaga copper-gold project in Turkey.

The increase since year end 2015 in working capital reflects the $3.30 million net proceeds from the 2016 Private Placement (See press release of March 4, 2016) and, $9.91 million from the 2016 Bought Deal (See press release of November 16, 2016), as well as $0.80 million in net reimbursements pursuant to the replacement of certain bonding deposits in the United States. These cash inflows were offset by costs incurred toward the 2016 exploration programs of $6.26 million (2015: $5.08 million), and cash outflows for operating expenditures of $3.52 million (2015: $3.86 million).

Total liabilities at December 31, 2016, 2015 and 2014 primarily reflect accounts payable and accruals recorded at period end arising from ongoing activities. The 2016 balance also includes a deferred tax liability of $1.16 million (2015: $0.47 million) arising from the impact of foreign exchange differences on the carrying value of TV Tower. The significant overall increase over the prior year is a reflection of increased exploration activities at year end compared to 2015.

The most significant contributors to the losses in the twelve months ended December 31, 2016 were, the cost of wages and benefits of $1.79 million (2015: $1.72 million, 2014: $1.82 million) and office and general costs of $1.17 million (2015: $1.14 million, 2014: $1.21 million), as well as non-cash stock based compensation of $1.01 million (2015: $0.99 million, 2014: $1.22 million). The year ended December 2015 included impairments of $2.09 million. The loss per share decreased to $0.04 in 2016 compared to $0.07 for 2015 and 2014.

The net other comprehensive income attributable to shareholders for the year ended December 31, 2016, was $0.68 million compared to losses of $6.01 million and $3.83 million in 2015 and 2014 respectively, driven by exchange differences on translation of foreign currency subsidiaries. The impact from exchange differences will vary from period to period depending on the rate of exchange; in the period between January 1, 2016 and December 31, 2016, the United States dollar depreciated 4% relative to the Canadian dollar (2015 and 2014: appreciated 15% and 8.3% respectively).

APPOINTMENT OF JOANNA BAILEY AS CFO

The Company is also pleased to announce the appointment of Dr. Joanna Bailey as Chief Financial Officer and Corporate Secretary, effective April 4, 2017.

Dr. Bailey is a Chartered Accountant (ICAS) with over 10 years of experience in accounting and financial reporting in Canada and the UK. After completing a Ph.D. in Chemistry at the University of Cambridge, UK, Dr. Bailey joined PricewaterhouseCoopers LLC in 2004 specializing in statutory reporting audits across a variety of industries including mining, retail, production and services. In 2009, Dr. Bailey joined the accounting team at Fronteer Gold and has been the Corporate Controller at Pilot Gold since its inception in 2011. Dr. Bailey is a member of the Institute of Chartered Accountants of Scotland.

Dr. Bailey will replace Mr. John Wenger who is leaving the Company to pursue other opportunities. The Board wishes to extend its gratitude to Mr. Wenger for his years of service to Pilot Gold and wishes him all the best in his future endeavours.

ABOUT PILOT GOLD

Pilot Gold is led by a proven technical and capital markets team that continues to discover and define high-quality assets. Our core projects are Goldstrike in Utah, Black Pine in Idaho and Kinsley Mountain in Nevada. The Company also holds important interests in two Turkish assets, Halilaga and TV Tower, and has a pipeline of Western US projects characterized by large land positions and district-wide potential that can meet our growth needs for years to come.

For more information, visit www.pilotgold.com or contact:

Evelyn Cox, Director Corporate Communications

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This email address is being protected from spambots. You need JavaScript enabled to view it.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Pilot Gold within the meaning of applicable securities laws, potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans the release of an initial resource report at Goldstrike, and the successful delivery of results of metallurgical testing and positive results thereof. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, copper, silver and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time; obtaining renewals for existing licences and permits and obtaining required licences and permits, labour stability, stability in market and geo-political conditions, availability of equipment, accuracy of any mineral resources, the amenability of mineralization to produce a grade or quality of concentrate sufficient to be economic (as there can be no assurances as to the results of the metallurgical testing and no inferences should be drawn therefrom), the accuracy of any metallurgical testing completed to date, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Pilot Gold and there is no assurance they will prove to be correct.

Such forward-looking information involves known and unknown risks and uncertainties, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, the timely receipt of regulatory approvals; risks related to the interpretation of results and/or the reliance on technical information provided by our joint venture partner or other third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company or its joint venture partners; labour disputes and other risks of the mining industry; the uncertainty of negotiating with foreign governments, expropriation or nationalization of property without fair compensation, adverse determination or rulings by governmental authorities delays in obtaining governmental approvals, government regulation of exploration and mining operations, and the application thereof in accordance with the rule of law, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2017 in the section entitled "Risk Factors", under Pilot Gold’s SEDAR profile at www.sedar.com.

Although Pilot Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Pilot Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. There is also no certainty that these inferred mineral resources will be converted to measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied. The mineral resource estimates referenced in this press release use the terms “Indicated Mineral Resources” and “Inferred Mineral Resources”. While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission (“SEC”). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Pilot Gold is not an SEC registered company

Pilot Gold Reports Weighted Average of 85.9% For Column Leach Gold Recoveries from Goldstrike

Rapid Recoveries Insensitive To Crush Size Support Run Of Mine Heap Leach Process

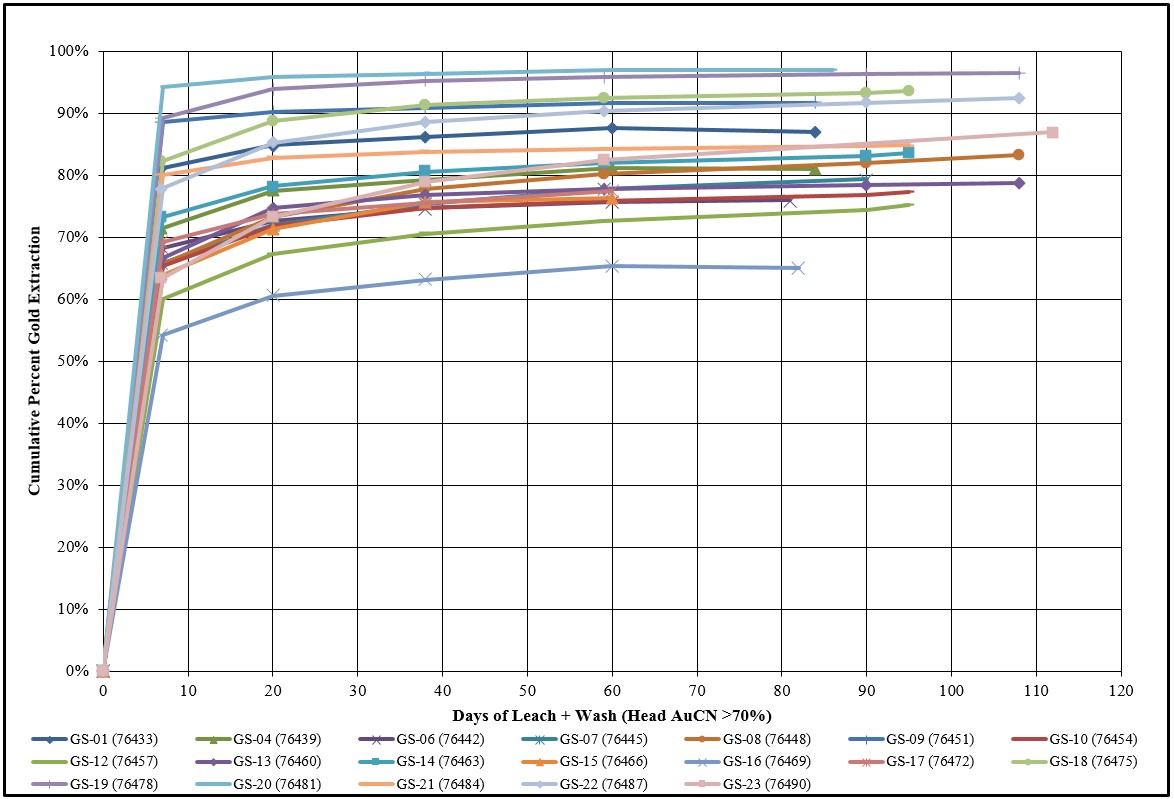

VANCOUVER, B.C. – Pilot Gold Inc. (PLG - TSX) ("PilotGold" or the "Company") is pleased to report that results from metallurgical testing of oxide material from its Goldstrike Project, in southwestern Utah, provide unequivocal support for a simple heap leach mining scenario. Gold recoveries from 19 of the 20 column tests were rapid and > 80% complete within 10 days, with final column leach recoveries ranging from 65% to 97%. Importantly, gold extraction has proven relatively insensitive to particle size, and can be projected out to 150 millimetres (mm) (6 inch) particle size, simulating run of mine conditions, without significant loss of gold recovery.

Samples for this study were collected from 10 large diameter diamond drill holes from a wide range of locations and ore types within the Main Zone of the Historic Mine Trend. The Main Zone represents approximately 10% of the Goldstrike Property in terms of size, and has been the focus of our drilling for the past 18 months. Pilot Gold has drilled 226 holes into the Main Zone thus far, with approximately 90% of the holes intersecting oxide gold mineralization.

The historic Goldstrike Mine operated as a heap leach operation from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au. The Company has been successful in demonstrating that there is a significant amount of near surface oxide gold mineralization remaining within the 22km2 property that is owned/controlled 100% by Pilot Gold.

Metallurgical testwork included fine and coarse bottle rolls and 12.5 mm (0.5 inch) and 25 mm (1 inch) column tests. In total, 48 bottle rolls (twenty-four 200 mesh and twenty-four 10 mesh) and 20 column tests were carried out on 24 composites.

Highlights include:

- 20 Column leach tests produced a weighted average* 85.9% extraction.

- Gold extraction is rapid, with >80% of the extractable gold recovered within the first 10 days of column leaching. Click here for graph of recovery curve.

- Gold extraction is relatively insensitive to particle size, and can be projected out to 80% passing 150 mm (6 inch) particle size, simulating run of mine conditions, without significant loss of gold recovery.

- Twenty-four coarse bottle roll tests (target 80% passing 10 mesh or 1.7 mm particle size) produced a weighted average* 78.6% gold extraction.

- If only the column test set of 20 composites is considered, the weighted average* for coarse bottle rolls is 83.6%.

- Twenty-four fine bottle roll tests (target 80% passing 200 mesh or 75 micron particle size) produced a weighted average* 84.2% gold extraction.

Graph of recovery curves for 19 column tests (sulphide sample GS-03 not shown)

*Weighted average gold extraction is obtained using the following equation: (composite head grade (g/t) x extraction (%) for all head grades)/sum of all head grades. Using arithmetic averages tend to over-represent low grade composites and under-represent high grade composites. The arithmetic average of the 24 coarse bottle rolls is 77.5%. The arithmetic average of the 20 column tests is 81.3%.

“The Goldstrike oxide gold system has district scale implications based on historical and current drill results, covering over a 22 square kilometre target area. Finding the gold and building ounces is only one part of the equation. Getting the gold out of the rock efficiently is just as important.” says Cal Everett, Pilot Gold President & CEO. “The metallurgical results are exceptional and support our belief that a high percentage of the gold can be rapidly recovered in a simple, low cost, run of mine, heap leach operation”.

For a table showing actual and modeled data for bottle roll and column testing, please click here:

https://libertygold.ca/images/news/2017/Goldstrike_metPRtable.pdf

For a map showing locations of drill holes used for metallurgical testing, please click here:

https://libertygold.ca/images/news/2017/Goldstrike_metPRchart.jpg

| Gold Extraction Data for Goldstrike composite samples | ||||||||

| Kappes, Cassiday & Associates (KCA) Test Results | ||||||||

| Composite ID | Location | Material Type | Head Assay Au (g/t) | Gold Extraction % | ||||

| Cyanide Solubility AuCN %1 | 200 mesh (75 µ) bottle roll | 10 mesh (1.7 mm) bottle roll | 12.5 mm (1/2 inch) column | 25 mm (1 inch) column | ||||

| GS-01 | Basin Pit | oxide | 0.54 | 91.0 | 88.8 | 88.0 | 88.0 | |

| GS-02 | Basin Pit | oxide | 0.76 | 95.5 | 92.3 | 88.0 | ||

| GS-04 | Basin Pit | oxide | 0.37 | 99.0 | 77.8 | 76.0 | 81.0 | |

| GS-06 | Basin Pit | oxide | 0.30 | 76.2 | 80.4 | 75.0 | 78.0 | |

| GS-07 | Basin Pit | oxide | 0.35 | 90.6 | 90.2 | 75.0 | 80.0 | |

| GS-08 | Basin Pit | oxide | 0.41 | 94.0 | 92.9 | 86.0 | 83.0 | |

| GS-09 | Basin Pit | oxide | 0.65 | 98.2 | 95.8 | 91.0 | 92.0 | |

| GS-10 | Octopad | oxide | 2.84 | 84.4 | 78.1 | 74.0 | 77.0 | |

| GS-12 | Octopad | oxide | 0.81 | 77.9 | 73.6 | 69.0 | 75.0 | |

| GS-13 | Hamburg Pit | oxide | 1.28 | 94.6 | 80.6 | 73.0 | 79.0 | |

| GS-14 | Hamburg Pit | oxide | 0.71 | 93.4 | 92.9 | 84.0 | 84.0 | |

| GS-15 | Hamburg Pit | oxide | 0.51 | 92.6 | 91.4 | 86.0 | 76.0 | |

| GS-16 | Octopad | oxide | 0.33 | 73.7 | 70.8 | 62.0 | 65.0 | |

| GS-17 | Aggie Zone | oxide | 0.37 | 92.7 | 80.7 | 77.0 | 78.0 | |

| GS-18 | Aggie Zone | oxide | 1.08 | 99.7 | 94.9 | 92.0 | 94.0 | |

| GS-19 | Aggie Zone | oxide | 2.71 | 102.5 | 97.3 | 93.0 | 97.0 | |

| GS-20 | Aggie Zone | oxide | 2.26 | 96.5 | 97.6 | 97.0 | 97.0 | |

| GS-21 | Aggie Zone | oxide | 1.97 | 98.1 | 88.7 | 83.0 | 85.0 | |

| GS-22 | Aggie Zone | oxide | 2.42 | 98.5 | 94.2 | 87.0 | 92.0 | |

| GS-23 | Aggie Zone | oxide | 3.17 | 100.5 | 93.4 | 86.0 | 87.0 | |

| GS-24 | Aggie Zone | oxide | 0.35 | 85.0 | 90.4 | 86.0 | ||

| GS-03 | Basin Pit | Sulphide | 0.52 | 38.1 | 64.8 | 38.0 | 38.0 | |

| GS-05 | Basin Pit | sulph/trans | 0.25 | 64.8 | 52.9 | 52.0 | ||

| GS-11 | Octopad | sulph/trans | 2.65 | 40.8 | 35.8 | 42.0 | ||

1 Data from KCA/ALS analysis of composite head samples.

The work was supervised by independent consulting metallurgist Gary Simmons, formerly the Director of Metallurgy and Technology for Newmont Mining Corp. He has managed or supervised a significant number of metallurgical testing programs on similar deposits throughout the Great Basin. According to Mr. Simmons, “Data from metallurgical testing to date at Goldstrike point to rapid leaching and relatively high gold recoveries, and suggest that simple, run of mine heap leaching may be the preferred process option at Goldstrike”.

Metallurgical Program

10 large diameter diamond drill holes were drilled in 2016 to sample a range of locations and ore types in the Main Zone at Goldstrike. From these, 24 composites were created for metallurgical testing, with gold grades ranging from 0.25 to 3.10 g/t gold. Of these, 21 were dominantly oxide, with cyanide soluble gold content of >70%, with three sulphide/transitional composites. Additional drilling, sampling, metallurgical testing and modeling will be carried out in the future to fully assess the relative proportions of different ore types in the mineralized zone.

Composites were sent to Kappes, Cassiday and Associates in Reno, Nevada for metallurgical testing, comprising bottle rolls, column testing, load permeability testing and ore characterization including; comminution testing, sulphur and carbon speciation, preg-rob analysis, ICP geochemical assays and whole rock analysis.

Twenty of the composites were leached in either 100 mm (4 inch) or 150 mm (6 inch) diameter columns at low strength, 0.50 g/l of sodium cyanide (NaCN) solution. Total leach, plus column wash/rinse time, varied between 81 and 112 days. One of the columns samples (Composite GS-03) required agglomeration with cement due to high clay content. This sample was predominantly sulfide and is not likely to be incorporated into any oxide heap leach resource.

Samples for bottle roll testing were crushed/pulverized to 80% passing 200 mesh (75 microns) and 80% passing 10 mesh (1.7 mm) particle size. The samples were rolled/agitated in bottles in a dilute cyanide solution for 72 hours (for 200 mesh) or 144 hours (for 10 mesh).

Organic carbon values are low. Preg-robb analysis indicates that two (8%) of the composites may be mildly preg robbing. This preliminary result suggests that organic carbon will not be an issue in recovery.

Samples were subjected to SMC drop weight testing to generate data for SAG Mill, Crushing and HPGR comminution evaluation by JKTech and Bond Abrasion index (Ai) testing at Hazen Research in Golden, Colorado. Samples can be characterized as soft to relatively hard and moderately abrasive, although these factors are more important if significant crushing is anticipated.

Three of the 20 column leach composites failed load permeability testing, at 25 m height, and may require a coarse crush and agglomeration or, if low tonnage, may be blended with other materials before heap leaching. However, one of these failed composites is the same GS-03 sulfide composite that will most likely not be part of any oxide heap leach resource. Only a small percentage of this material has been encountered in drilling to date.

About Goldstrike

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada border, and is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike represents part of a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Goldstrike Mine operated from 1988 to 1994, with 209,000 ounces of gold produced from 12 shallow pits, at an average grade of 1.2 g/t Au.