Liberty Gold Extends the D-1 Zone to the Northwest, including 1.02 g/t Au over 24.4 m in LBP179 and 1.18 g/t Au over 16.8 m in LBP173

Drilling Resumes at TV Tower in Turkey, Targeting Columbaz Au-Cu Porphyry

VANCOUVER, B.C. – Liberty Gold Corp. (LGD-TSX) (“Liberty Gold” or the “Company”) is pleased to announce additional reverse circulation (“RC”) drill results from the 2020 drill program at its Carlin-style Black Pine oxide gold property in southern Idaho, USA (“Black Pine”). Liberty Gold identified nine regional oxide gold targets over a 7.3 square kilometre (“km2”) permit area. To date, six targets have been tested, with assay results back from four, resulting in the D-1 Southeast Extension, D-1 Northwest Extension, D-3, and F Zone discoveries.

“We continue to identify additional areas of oxide gold in our regional drilling program at Black Pine, with every target to date returning encouraging results and discoveries,” comments Cal Everett, President and CEO of Liberty Gold. “Following the successful sale of our 40% interest in the Halilağa porphyry gold – copper (“Au-Cu”) deposit in Turkey, Liberty Gold is assessing options with respect to how to crystallize value in our 60% ownership interest in the TV Tower project, located 13 km to the northwest of Halilağa. We are pleased to announce the resumption of drilling at TV Tower after a five-year exploration hiatus. We are testing a large Au-Cu porphyry target last drilled in 2014 which returned 499.1 metres grading 0.36 grams per tonne gold and 0.13% copper*. Core photographs from the first hole are shown in this release, a second hole is in progress. This is a limited budget drill test of a single target.”

*Liberty Gold news release dated February 6, 2015

D-1 NORTHWEST EXTENSION

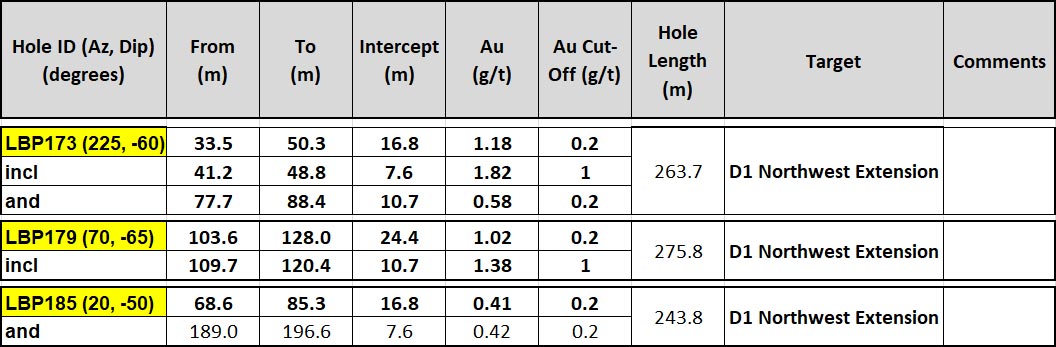

The 2 kilometre (“km”)-long D-1 zone is presently open to the northwest. Historic holes in this area were shallow and some ended in oxide gold mineralization. The open-ended D-1 Northwest Extension (“D-1NW”) is surrounded by a >1 square km area of strongly brecciated limestone with anomalous gold in soil and rock samples and shallow historic drill holes with gold mineralization. LBP179 is the first hole drilled by Liberty Gold in this area, returning 1.02 grams per tonne gold (“g/t Au”) over 24.4 metres (“m”). LBP173 tested an area to the west of the north end of the D1 Zone, opposite LBP002, returning 1.18 g/t Au over 16.8 m, and potentially opening up another largely untested area for exploration. Additional drill sites are under construction to expand the drilling effort in this new area.

D-1 NORTHWEST EXTENSION DRILL HIGHLIGHTS INCLUDE1:

1A number of mineralized intervals were omitted from this table for brevity. Please refer to the full table at the link below for complete results.

D-1 NORTHWEST EXTENSION KEY POINTS:

- The northwestern portion of the D-1 Zone remains open to the northwest and is situated in an area with widespread gold in surface soil and rock samples and widely-spaced shallow historic drill holes, most with gold mineralization.

- Based on initial drill results, additional drill holes are planned along strike for at least 300 m, and throughout the general area.

- Cyanide-soluble assays for LBP173 returned a weighted average 97% of fire assay, and LBP179 returned a weighted average 89% of fire assay, attesting to the thoroughly oxidized nature of mineralization in this area.

D-1 SOUTHEAST EXTENSION

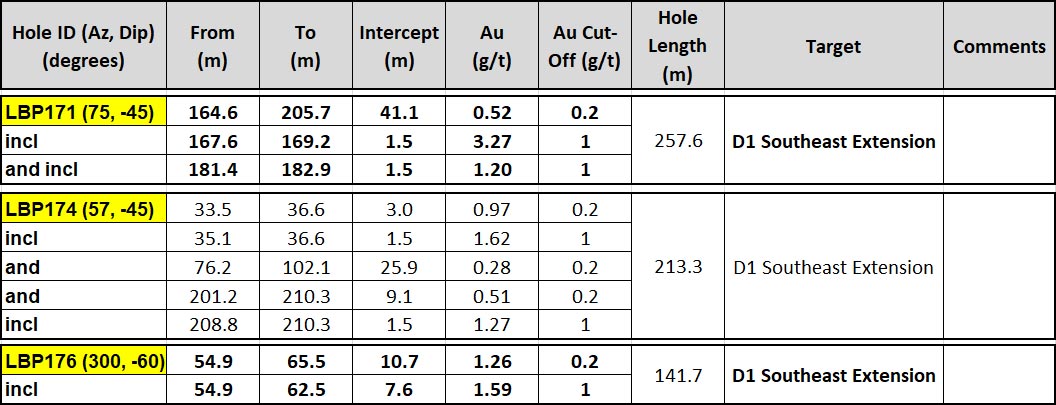

To date in 2020 Liberty Gold has reported 15 RC and one diamond core hole from the D-1 Southeast Extension (“D-1SE”), a 400-m-long gap in the D-1 zone between the main portion of the zone and the historic Tallman Pit. High-grade oxide gold was encountered in this area in drill holes LBP150 (3.04 g/t Au over 19.8 m) and LBP168 (1.06 g/t Au over 32 m). Additional results from three drill holes continue to build on the success of previous drilling. Additional drill sites have been constructed in order to continue infill and step-out drilling.

D-1 SOUTHEAST EXTENSION DRILL HIGHLIGHTS INCLUDE1:

1A number of mineralized intervals were omitted from this table for brevity. Please refer to the full table at the link below for complete results.

D-1 SOUTHEAST EXTENSION KEY POINTS:

- Ongoing drilling continues to demonstrate the potential for the D-1SE Zone to host high-grade oxide gold.

- Additional holes from newly-constructed drill sites are planned to expand upon recent drill results.

- Cyanide-soluble assays for the highlight interval in LBP171 return a weighted average of 75% of fire assay, attesting to the oxidized nature of gold mineralization.

D-3 ZONE

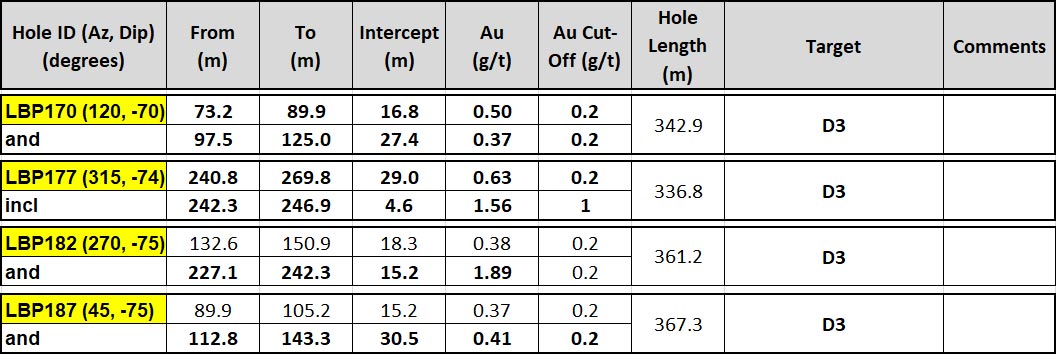

Liberty Gold’s third high-grade oxide gold discovery (the “D-3 Zone”) continues to deliver multiple thick intervals of oxide gold mineralization. D-3 lies beneath the limit of shallow historical drilling in a stratigraphic unit that is modeled to underlie most of the Black Pine gold system at depth. It is located immediately west of and approximately parallel to the D-1 Zone. Drilling is presently focused on step out drilling under the historic B pit, and infill drilling throughout the newly-defined zone.

D-3 DRILL HIGHLIGHTS INCLUDE1:

1A number of mineralized intervals were omitted from this table for brevity. Please refer to the full table at the link below for complete results.

D-3 KEY POINTS

- The new D-3 Zone continues to take shape as additional holes are added to it.

- Most of the holes drilled to date contain multiple intervals of gold mineralization from surface to over 300 metres. With reference to the complete table of results (link provided below), individual holes commonly contain 5 to 10 intervals above a 0.2 g/t Au cut-off grade.

- Cyanide-soluble assays for the highlight interval in LBP182 returned a weighted average of 83% of fire assay, attesting to the thoroughly oxidized nature of gold mineralization.

- Two drills are currently on the D-3 zone to advance infill and step-out drilling. It is still open to the south.

RC drilling is ongoing at Black Pine, with three RC drill rigs testing new targets, infilling newly-identified targets, and expanding on the focused drilling carried out in 2019.

For cross sections of drill collars and traces for the current release, please click here: https://libertygold.ca/images/news/2020/september/BlackPine_NR09292020CS.pdf

For a map of drill collars and traces for the current release, please click here: https://libertygold.ca/images/news/2020/september/BlackPine_NR09292020Map.pdf

For a complete table of drill results from all Liberty Gold drill holes at Black Pine, please click here: https://libertygold.ca/images/news/2020/september/BP_Intercepts09292020.pdf

REGIONAL DRILLING

As new targets are drilled, infill and step out drilling are carried out where new discoveries are made, as is the case at the D-3 and D-1SE zones. However, one or more RC drills at any given time is carrying out regional drilling, as part of Liberty Gold’s commitment to a comprehensive test of the 7.3 km2 permitted area of the Black Pine gold system in 2020.

Liberty Gold currently has a backlog of 33 drill holes awaiting assay results. The delays are due to a significant increase in exploration activities in the Great Basin, while at the same time, the laboratory must employ proper Covid-19 safety protocols. As a result, a number of targets are simultaneously being evaluated in order to assess targets in the most efficient way possible and not over-drill them prior to receipt of results.

Six holes tested a large area southwest of the historic CD Pit (Southwest Extension), with results pending. The Southwest Extension contains a large gold-in-soil anomaly, measuring over 1 km2 in size, which has never had a drill test. Portions of the holes drilled to date contain decalcified siltstone, breccias and iron oxide, which are indicators of gold mineralization elsewhere at Black Pine.

A drill is presently located in and around the M Zone in the northeastern portion of the gold system. Historic intercepts in shallow holes in the M zone include 1.70 g/t Au over 15.2 m in 93BX-82, and 1.33 g/t Au over 10.7 m and 0.98 g/t Au over 10.7 m in 93BX-36 (unpublished historical drill hole results), with a number of holes bottoming in gold mineralization.

Drill sites are also being readied in the J anomaly north of the historic A Pit, to the west of the D-3 Zone, in the north end of the D-1 Zone and in the Rangefront target.

Large diameter (PQ) core drilling for Phase 3 metallurgical testing is ongoing. The drill will be employed for exploration drilling when metallurgical drilling is completed.

In addition to RC drilling, Liberty Gold is expanding the permit area to include an additional 4.6 km2.

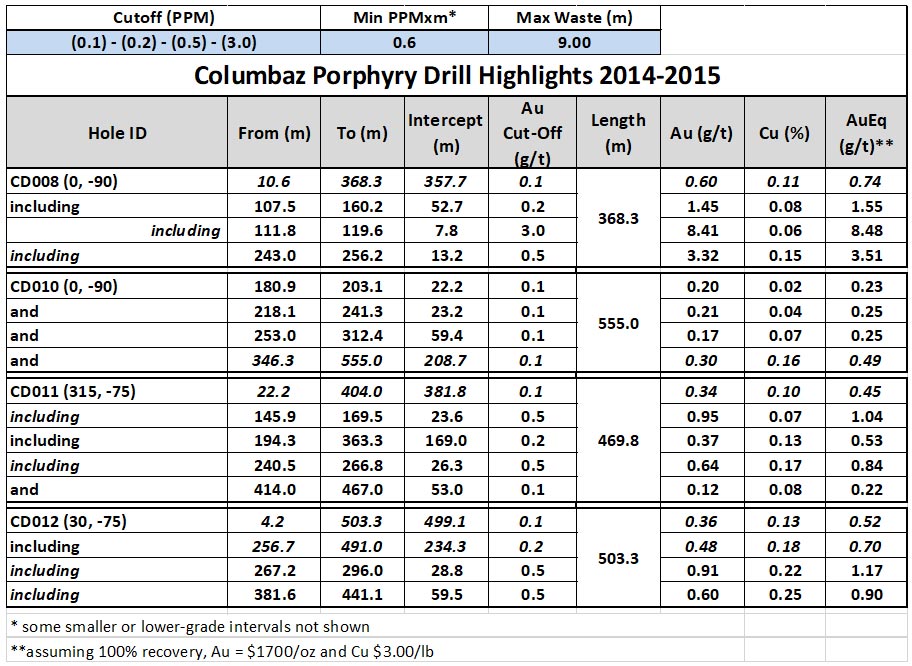

TV TOWER, TURKEY: COLUMBAZ Au-Cu PORPHYRY DRILL TEST

Liberty Gold is pleased to announce that it has commenced drilling at the TV Tower Property in western Turkey. Liberty Gold is the 60% owner and operator of the Property. One diamond core drill is testing the Columbaz porphyry Au-Cu target. It recently completed hole CD013, a 150 m step-out north of previous drill holes, to a depth of 642 m. A second hole, another 150 m step out, is in progress.

To date, Liberty Gold has discovered one high sulphidation Gold-Silver-Copper system (KCD deposit), two oxide gold systems (Kayali and Yumrudag) and three Au-Cu+/-Molybdenum porphyry systems (Valley, Hilltop and Columbaz), with a number of untested Au and Au-Cu porphyry targets present throughout the property. The KCD deposit has a current Indicated resource of 23.1 million tonnes grading 0.63 g/t Au (470,000 ounces), 27.6 g/t Silver (“Ag”) (20.5 million ounces), and 0.16% Cu (78.9 million pounds), and an Inferred 10.8 million tonnes grading 0.15 g/t Au (53,000 ounce), 45.7 g/t Ag (15.8 million ounces), and 0.06% Cu (14.8 million pounds) making it Turkey’s third largest silver deposit. (See 2012 through 2015 press releases on the Company’s website and 2014 KCD Technical Report for more details.)

The Columbaz porphyry Au-Cu target was previously tested with six drill holes in 2014 (for more information, see Liberty Gold press releases dated October 22, 2014 and February 6, 2015). Highlights included CD012, which returned 499.1 m grading 0.36 g/t Au and 0.11% Cu, and CD008, which returned 357.7 m grading 0.60 g/t Au and 0.10% Cu.

The system remains open in all directions. Post-discovery, a deep Induced Polarity geophysical survey was carried out at Columbaz, showing a chargeability high over a broad area to a depth of at least 300 m. CD013 is a step out approximately 150 m to the north of CD012. Visual inspection of the core suggests that the porphyry system is present in this drill hole, which progresses through phyllic altered intermediate volcanic rocks into intrusive rocks with phyllic and potassic (potassium feldspar) alteration and a stockwork of quartz veins with medial and axial chalcopyrite and pyrite (B veins) and quartz-magnetite veins (M veins). Deeper in the hole, potassic alteration with M veins and quartz-molybdenite-pyrite veins are dominant. Assays are pending for CD013.

For a map of the TV Tower property, a cross section of the Columbaz porphyry Au - Cu target area and drill core photographs, please click here: https://libertygold.ca/images/news/2020/september/TVTower_NR09292020MapCSCorePhotos.pdf

ABOUT BLACK PINE

Black Pine is located in the northern Great Basin, immediately adjacent to the Utah/Idaho border. It is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada’s Carlin trend. Like Newmont’s Long Canyon deposit, Black Pine represents a growing number of Carlin-style gold systems located off the main Carlin and Cortez trends in underexplored parts of the Great Basin. The historic Black Pine Mine operated from 1992 to 1997, during a period of historically low gold prices, with 435,000 ounces of gold produced from five composite, shallow pits.

A virtual site tour and 3D model of Black Pine property, including details about the geology and mineralization, is available on the homepage of the Company’s website, www.libertygold.ca.

A Technical Report is also available on the Company website: https://libertygold.ca/images/pdf/BlackPine_NI43-101_2018.pdf

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30 and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the impact from the pandemic of the novel coronavirus (COVID-19), availability of equipment, accuracy of any mineral resources, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry, including impacts from the pandemic of the novel coronavirus (COVID-19); delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2020 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

The mineral resource estimates referenced in this press release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Liberty Gold is not an SEC registered company. TV Tower is an early stage exploration project and, except for the mineral resources at the KCD deposit, as summarized herein, does not contain any mineral resource estimates as defined by NI 43-101. The potential to define a mineral resource at the copper-gold K2 zone of TV Tower is conceptual in nature and there has been insufficient exploration to define a mineral resource thereat. It is uncertain if further exploration at K2 will yield a mineral resource.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.