Liberty Gold Receives US$6 million Payment for the Sale of Halilağa - Türkiye

Reports Q2 2021 Financial and Operating Results

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the “Company”) is pleased to announce the receipt of the second US$6.0 million payment as part of the consideration for the sale of its 40% interest in the Halilağa copper gold porphyry deposit (“Halilağa”), located in Biga Province, northwest Türkiye to Cengiz Holdings A.Ș. (the “Halilağa Sale Agreement”). Liberty Gold has received US$16.0 million to-date from the sale of Halilağa with a further US$6.0 million due to be received on August 11, 2022, and subject to a bank guarantee[1].

Additionally, from January 1, 2021, to the date of this news release, the Company received a total of C$2.16 million from the exercise of 3,594,300 Liberty Gold common shares purchase warrants (“Warrants”), issued pursuant to the bought deal financing that closed on October 2, 2018; the Warrants are each exercisable for C$0.60 and expire on October 2, 2021. If all remaining October 2018 warrants are exercised, Liberty Gold will receive a total of C$10.5 million in cash proceeds to further strengthen its treasury.

The Halilağa divestiture is consistent with Liberty Gold’s strategy of re-deploying capital from non-core assets into the high-quality oxide-gold projects in the Great Basin, USA. The Company has US$15.3 million in cash as of June 30, 2021, has received US$6.0 million on August 11, 2021, and expects a further US$8.4 million in proceeds by the end of 2021. We remain well funded to complete our 2021 exploration programs and end the year with a strong treasury to continue advancing the Black Pine and Goldstrike projects in 2022.

HIGHLIGHTS FOR Q2 2021 Financial and Operating Results:

- At Black Pine we announced the first modern mineral resource estimate (the “Mineral Resource”)[2]:

- The Mineral Resource has an effective date of May 1, 2021, is reported in a pit shell at a cut-off grade of 0.20 grams per tonne (“g/t”) gold (“Au”) and consists of:

- An indicated mineral resource of 1,715,000 ounces of gold at an average grade of 0.51 g/t Au and contained in 105,075,000 tonnes; and

- An inferred mineral resource of 370,000 ounces of gold at an average grade of 0.37 g/t Au and contained in 31,211,000 tonnes.

- A high-grade subset of the Mineral Resource using a cut-off grade of 0.5 g/t Au consists of:

- An indicated mineral resource of 1,020,000 ounces of gold at an average grade of 1.04 g/t Au and contained in 30,520,000 tonnes; and

- An inferred mineral resource of 134,000 ounces of gold at an average grade of 0.94 g/t Au and contained in 4,440,000 tonnes.

- The Mineral Resource has an effective date of May 1, 2021, is reported in a pit shell at a cut-off grade of 0.20 grams per tonne (“g/t”) gold (“Au”) and consists of:

- On-going 2021 drill program at Black Pine targeting step-out drilling on all of the resource zones; upgrading inferred portions of the resource to indicated for use in further economic studies; and discovery drilling throughout the 12 km2 permitted drill area.

- Commenced Preliminary Economic Assessment at Black Pine.

- A 15,000 m RC drill program at Goldstrike began in May with a goal to convert inferred gold ounces as classified in the current resource estimate to indicated.

- We appointed a new Chief Operating Officer, Jonathan Gilligan, a senior mining executive with over 35-years of multi-commodity, international experience across technical services, capital projects, open pit mine construction and operations[3].

- We appointed a new Vice President Business Development, Brian Martin, a mining finance professional with over 13 years of experience in mergers and acquisitions, corporate strategy, investor relations and capital markets[4].

- At TV Tower we announced maiden resource estimates for five gold and copper deposits[5] more than tripling the resource endowment.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

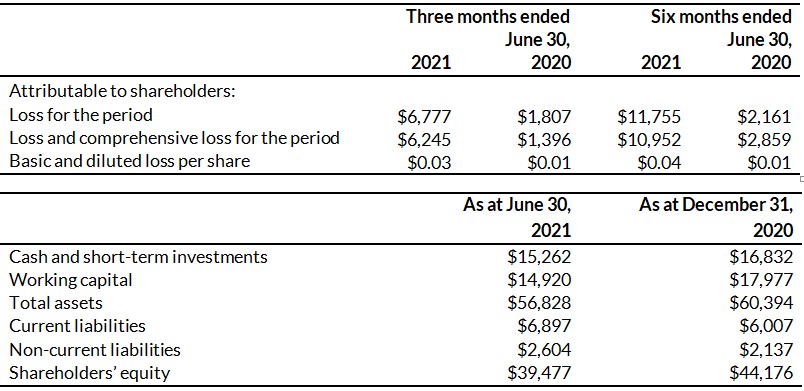

SELECTED FINANCIAL DATA

The following selected financial data is derived from our unaudited condensed interim financial statements and related notes thereto (the “Interim Financial Statements”) for the three and six months ended June 30, 2021, as prepared in accordance with International Accounting Standards – IAS 34: Interim Financial Statements.

A copy of the Interim Financial Statements is available on the Company’s website at www.libertygold.ca or on SEDAR at www.sedar.com.

The information in the tables below is presented in $000s except per share data:

----------------------------------------------------------------------------------------

[1] For transaction details see our press release dated November 18, 2019

[2] See press release dated July 13, 2021

[3] See press release dated June 29, 2021

[4] See press release dated May 17, 2021

[5] See press release dated April 6, 2021

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the receipt of staged payments pursuant to the Halilağa Sale Agreement, the impact from the pandemic of the novel coronavirus (COVID-19), availability of equipment, timing or results of the publication of any mineral resources or PEA, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources or PEAs; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry, including impacts from the pandemic of the novel coronavirus (COVID-19); the receipt of staged payments pursuant to the Halilağa Sale Agreement, delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2021 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information in this news release, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “probable mineral reserves”. Shareholders in the United States are advised that, while such terms are defined in and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC