Liberty Gold Announces Maiden Resource Estimates for Five Gold and Copper Deposits at the TV Tower Project, Türkiye

New Resources Triple Gold and Copper Endowment at TV Tower; Multiple Undrilled Targets Remaining to be Tested

VANCOUVER, B.C. – Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the "Company") is pleased to announce maiden independent Mineral Resource Estimates at its 92 square kilometer (“km2”), 62.9% owned and operated TV Tower Property (“TV Tower” or “the Property”) in western Türkiye. The resources encompass two primarily gold oxide deposits and three primarily gold-copper porphyry deposits. On a gold equivalent basis, these estimates more than triple the existing resource base at TV Tower, adding to that previously estimated for the KCD gold-silver-copper (“Au-Ag-Cu”) deposit, the third largest silver deposit in Türkiye1. In addition, the TV Tower Property contains a large number of undrilled gold, copper and silver targets. All dollar amounts are in US dollars.

The TV Tower Property is located in the Biga Peninsula, home to numerous epithermal gold and silver and gold-copper porphyry deposits, mines and development projects. The project is road accessible year-round and close to power generation facilities and deep-water ports.

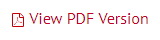

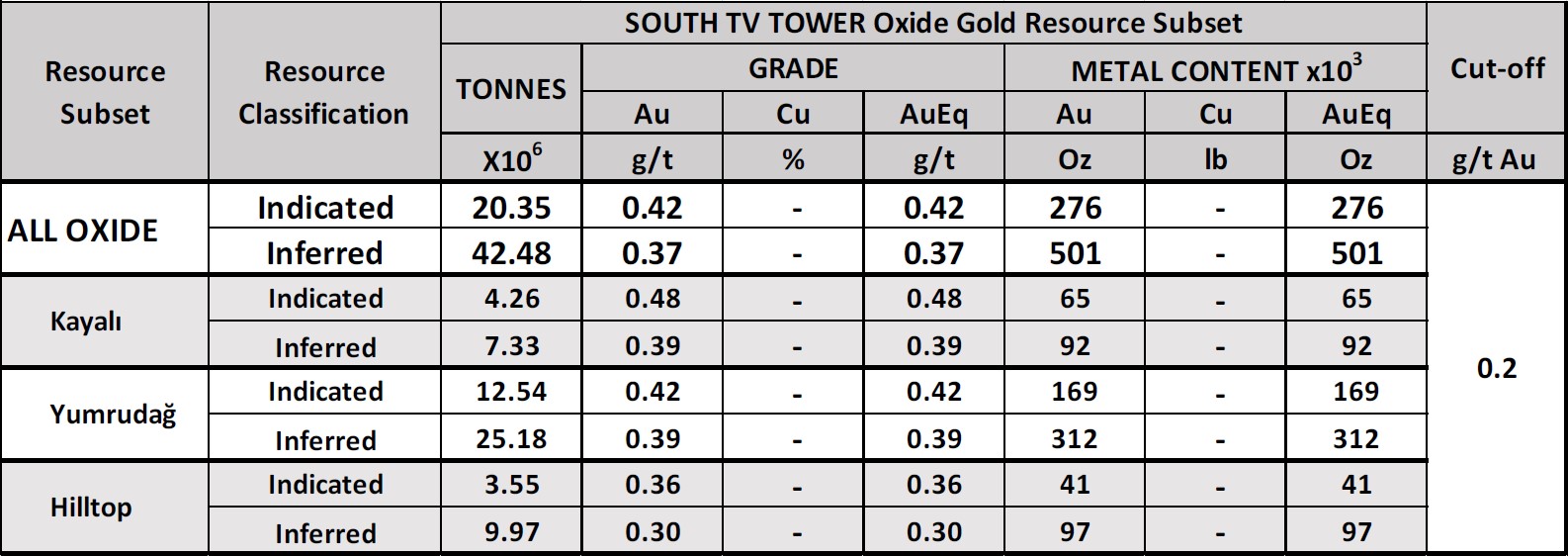

Table 1 is a summary of the mineral resource endowment for the TV Tower Property, with an additional breakdown of resource subsets in subsequent tables.

The TV Tower Property is divided into South (“South TVT”) and North (“North TVT”) resource areas. The South TVT resource area contains four geographically separate deposits (Kayalı and Yumrudağ oxide gold deposits and Hilltop and Valley Au-Cu porphyry deposits), all located within a 4 km2 area.

The North TVT resource area, located approximately 7 km north of the South TVT resource area, hosts two deposits: the Columbaz Au-Cu porphyry and the Küçükdağ high sulphidation epithermal (“HSE”) Au-Ag-Cu deposit (“North TVT KCD”). The former is comprised of two resource zones based on mineralogy and anticipated milling technique: North TVT Au-Cu Porphyry and North TVT Oxidized Porphyry. KCD was the subject of a 2014 resource estimate that is still current.

All deposits are open for extension laterally and to depth.

For maps and sections of the TV Tower Property and resource areas, please click here:https://libertygold.ca/images/news/2021/April/TVTower_NR040621MapandCS.pdf

1 Pirajno, F., Unlu, T, Donmez, C and Sahin, M.B., eds. (2019): Mineral Resources of Türkiye. Springer International Publishing, 749 p.

TABLE 1: TV Tower Resource Estimate Summary

1Current mineral resource estimate in 2014; details provided in the 2014 Technical Report filed under Liberty Gold’s profile on www.sedar.com

2Gold Equivalent (“AuEq”) for 2021 resource calculated using the following equation: Gold (“Au”) in grams per tonne (“g/t”) + Cu % / 0.6686 x 1.338. The gold equivalent formula was based on the following parameters: Cu price $3.40/lb, Au $1600/oz, Cu recovery: 87%, Au recovery:65%.

3AuEq calculated in 2014 using a ratio of Au:Ag of $1200:$20 at 75% recovery and Cu at $3.00/lb at 70% recovery.

For more details regarding the resource estimation, see below and notes under Table 3.

“While we are primarily focusing our pre-development efforts on oxide gold at Black Pine and Goldstrike in the Great Basin, it was deemed appropriate to raise the profile of the TV Tower Property now. Multiple gold, copper and silver deposits occur within this large land package,” commented Cal Everett, President and CEO of Liberty Gold. “The six deposits discovered to date remain open for extension laterally and to depth. When the discoveries were made, drilling stayed focused until another deposit was identified and drill tested. TV Tower is still in the early stages of exploration and discovery. We are now assessing our options to crystallize value for our shareholders.”

Moira Smith, V.P. Exploration and Geoscience for Liberty Gold, commented, “When we resumed operatorship of the TV Tower Property in 2012, it was with a vision that the property’s massive alteration zones contained multiple centres of epithermal gold and silver mineralization and porphyry Au-Cu mineralization that could give rise to multiple millions of gold-equivalent ounces. Today, we can provide proof of concept, and with multiple untested targets, we are confident that the resource endowment at TV Tower will continue to grow.”

MINERAL RESOURCE ESTIMATES FOR TV TOWER DEPOSITS

TV Tower is underlain by intermediate volcanic rocks and intrusive bodies. The highest elevations of the property are host to residual quartz ledges and ribs with oxidized HSE gold mineralization and/or unoxidized gold-silver-copper mineralization. Gold-copper porphyry systems lie immediately under or adjacent to the oxidized gold zones, often with a zone of supergene copper mineralization at the interface.

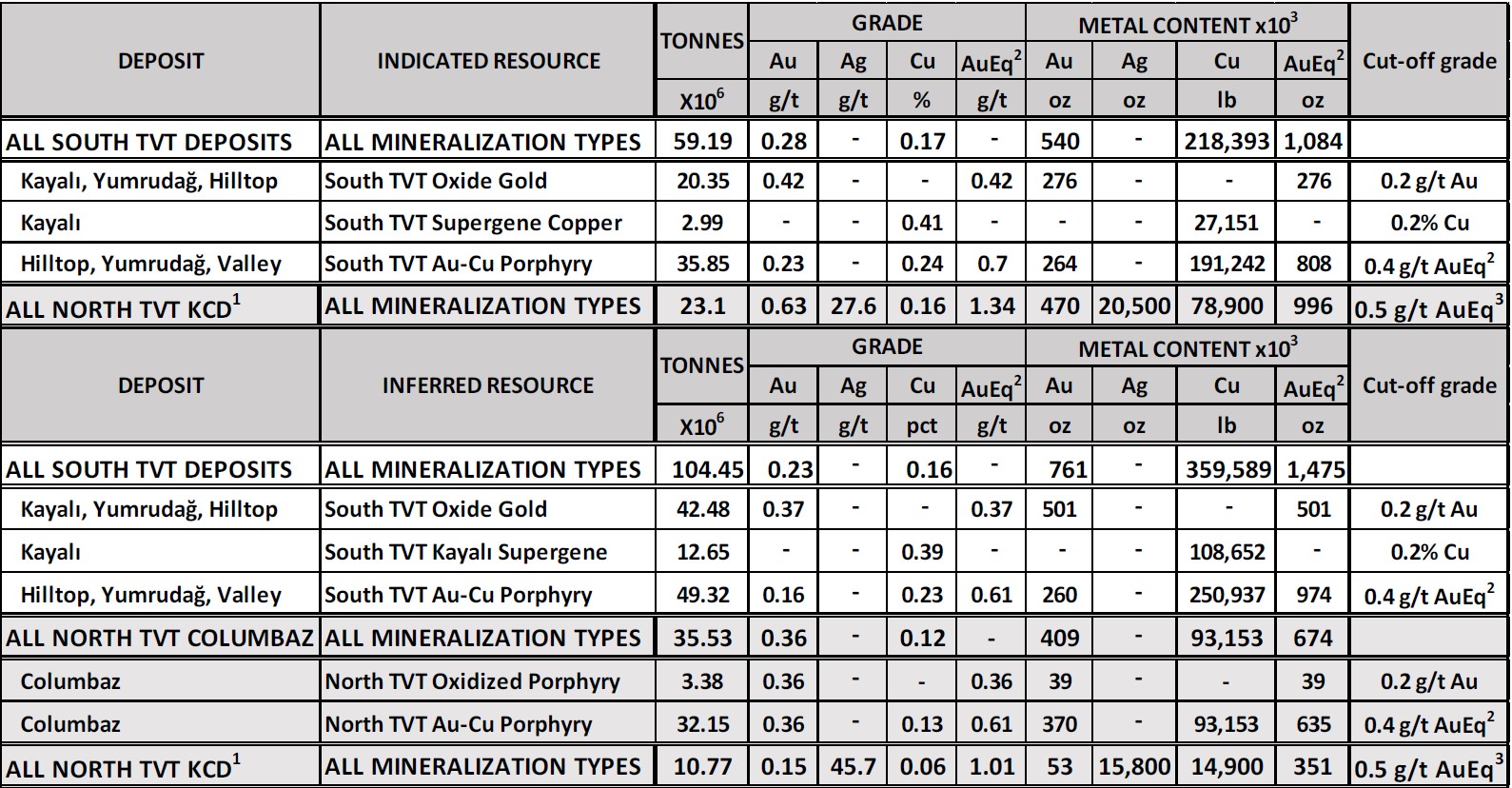

The four South TV Tower deposits contain multiple ore types and corresponding resource subsets by ore type and cut-off grade, with the breakdown illustrated in Table 2. These resource subsets comprise the South TVT Oxide Gold; South TVT Supergene Copper; and South TVT Au-Cu Porphyry subsets. The four deposits all lie within a 4 km-long trend, such that separate milling and heap leaching operations, managed as a single operation, would reasonably be expected to accommodate mineralized material from all of the deposits.

The two North TV Tower deposits contain three ore types and corresponding resource subsets (North TVT Au-Cu Porphyry, North TVT Oxidized Porphyry and North TVT KCD HSE Au-Ag-Cu resource subsets). The two deposits are located within 1.5 km of each other such that it is reasonable to expect that they would be developed using common infrastructure. However, without further analysis, it is uncertain at this time whether the North TV Tower and South TV Tower deposits would be developed using common infrastructure.

TABLE 2: Mineralization at TV Tower by Deposit and Resource Subset

1Current mineral resource estimate in 2014; details provided in the 2014 Technical Report filed under Liberty Gold’s profile on www.sedar.com

2AuEq for 2021 resource calculated using the following equation: Au g/t + Cu % / 0.6686 x 1.338. The gold equivalent formula was based on the following parameters: Cu price $3.40/lb, Au $1600/oz, Cu recovery: 87%, Au recovery:65%.

3AuEq calculated in 2014 using a ratio of Au:Ag of $1200:$20 at 75% recovery and Cu at $3.00/lb at 70% recovery.

For more details regarding the resource estimation, see below and notes under Table 3.

The resource estimate (other than that with respect to KCD) has an effective date of February 9, 2021, and was completed by DAMA Mühendislik A.Ş. of Ankara, Türkiye, under the supervision of Mr. Mehmet Ali Akbaba, P. Geo., an independent Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). An updated technical report (“the TV Tower Technical Report”) on the initial resource estimate will be prepared in accordance with NI43-101 and filed within 45 days of this news release on Liberty Gold’s issuer profile on SEDAR at www.sedar.com. Coauthors of the TVT Technical Report are Mehmet Ali Akbaba, P. Geo., Mustafa Atalay, MSc, P.Geo. and Fatih Uysal, MSc, P.Geo., James N. Gray (Advantage Geoservices) and Gary Simmons (G.L. Simmons Consulting LLC). Mr. Gray and Mr. Simmons are both Independent Q.P.s under NI 43-101 and authors of the 2014 Technical Report.

The KCD Mineral Resource Estimate was completed in 2014 by James N. Gray of Advantage Geoservices, Osoyoos, Canada, and will remain current by inclusion in the revised TV Tower Technical Report. The technical report containing the KCD resource estimate, entitled “Independent Technical Report for the TV Tower Exploration Property, Çanakkale, Western Türkiye” with an effective date of January 21, 2014 (the “2014 Technical Report”) was authored by SRK Consulting (Canada) Inc. is available at www.sedar.com under Liberty Gold’s profile and on Liberty Gold’s website.

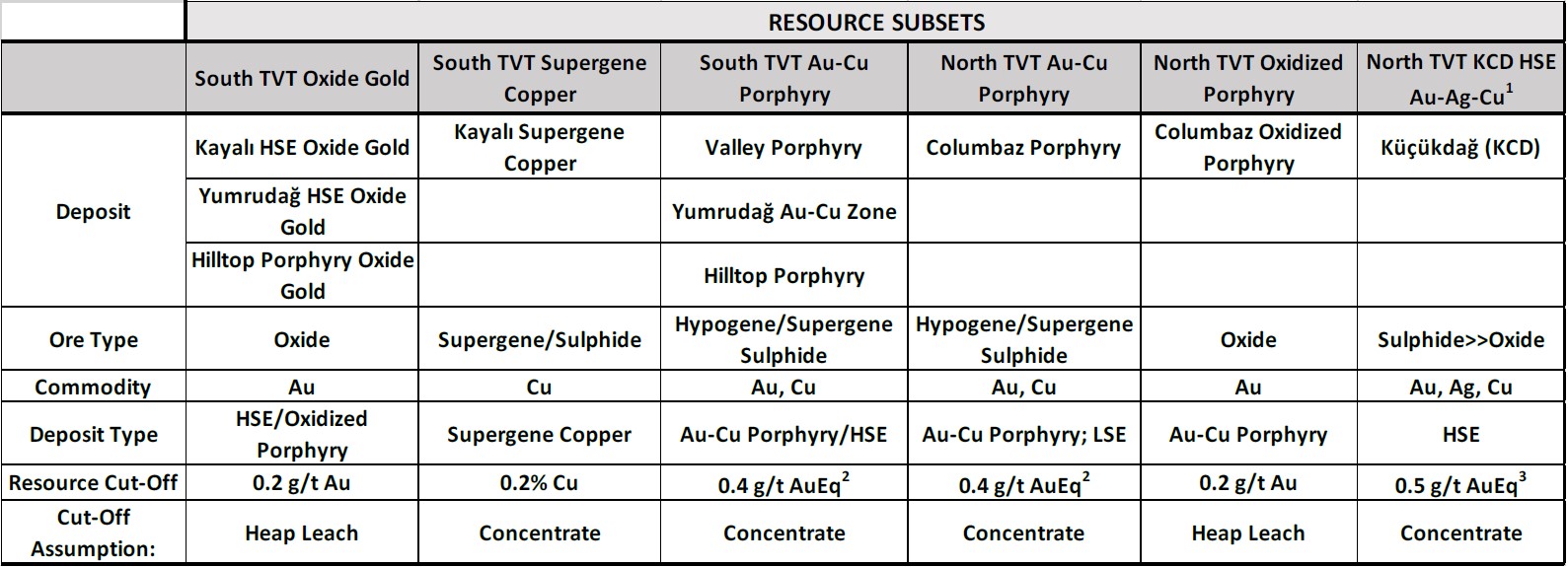

SOUTH TV TOWER OXIDE GOLD RESOURCE

The Kayalı and Yumrudağ gold oxide deposits are located at either end of a 4 km-long ridge in the southern portion of the TV Tower Property. Both deposits are open in several directions, and the Yumrudağ deposit in particular has seen relatively little drilling to date. The deposits comprise elemental gold with iron oxides in a matrix of vuggy quartz replacing intermediate volcanic rocks and are interpreted to represent oxidized high sulphidation epithermal gold systems.

In the central, lower-elevation portion of the ridge, the upper portion of the Hilltop gold-copper porphyry deposit is exposed and oxidized, leaving a shallow blanket of oxidized gold-only mineralization. This mineralization was also included in the estimate.

TABLE 3: South TV Tower Oxide Gold Resource Estimate

- The Qualified Person for the estimate is Mr. Mehmet Ali Akbaba, AIPG, P.Geo. of DAMA Mühendislik A.Ş.

- The Effective Date of the mineral resource estimate is February 9, 2021.

- The volume for each contiguous zone of above cut-off mineralization was defined by wireframing in 3D space and was used to constrain mineralization.

- Metal assays were capped where appropriate using statistical methods.

- Grade was interpolated by domain using Ordinary Kriging.

- Density values were assigned by domain using density data derived from wax-dip immersion of core samples.

- Mineral resources are reported within an optimized conceptual Micromine pit that uses the following input parameters: Au price: US$ 1600 /oz, Cu price: US$3.40 /lb; mining cost: US$1.00/t mined; processing cost: US$5.00/t ore processed by heap leach (including G&A) for oxide zone, US$12.35/t ore processed by flotation (including G&A); Recoveries are 91% Au for Yumrudağ-Hilltop oxide and 76% Au for Kayalı Oxide materials; 65% Au and 87%Cu for sulphide/supergene materials from the all prospects studied. The pit slope angle was 50°.

- AuEq for sulphide/supergene ore types calculated using the following equation: Au (g/t) + Cu(%) / 0.6686 x 1.338. The gold equivalent formula was based on the following parameters: Cu price $3.40/lb,Au $1600/oz, Cu recovery: 87%, Au recovery:65%.

- All figures rounded to reflect the relative accuracy of the estimate; this may result in apparent differences between tonnes, grade and contained metal content.

- The Mineral Resources have been classified as Indicated and Inferred under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council, and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administration National Instrument 43-101.

- No mining or metallurgical factors were applied to the block model grade estimates except gold and copper recovery used for cut-off determination.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated Mineral Resource category.

- Additional details are provided at the end of this news release. The TV Tower Technical Report on the initial resource estimate will be prepared in accordance with NI 43-101 and filed within 45 days of this news release on Liberty Gold’s issuer profile on SEDAR at www.sedar.com

KEY POINTS

- The Kayalı and Yumrudağ gold oxide deposits and Hilltop Porphyry shallow gold oxide zones are located along a 4 km long ridge and contain oxide gold on surface and at shallow depth.

- Column testing by Liberty Gold suggests that Kayalı and Yumrudağ are amendable to heap leaching, with 70 – 90% extraction achieved in four column tests using 0.5 inch crush size. Additional details of the column testing program are provided below, with a full description to be provided in the TV Tower Technical Report.

- Kayalı is open for expansion to the northwest and southeast. Yumrudağ is open in all directions.

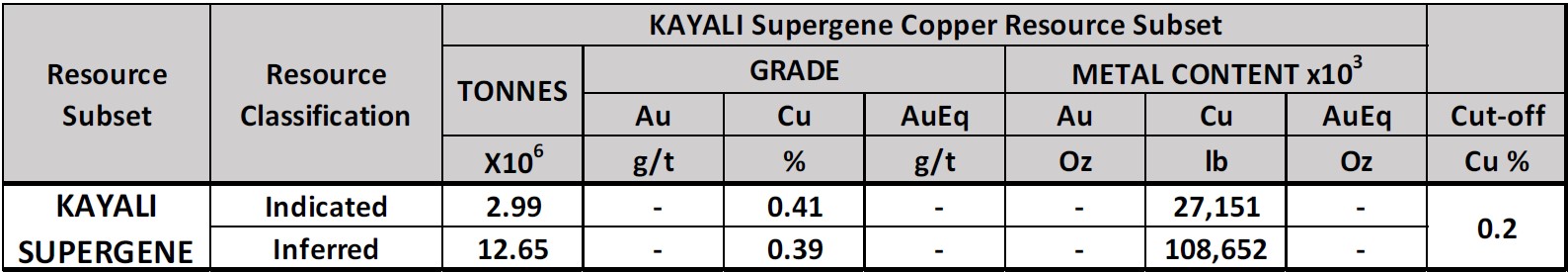

SOUTH TV TOWER SUPERGENE COPPER RESOURCE

The Kayalı deposit oxide gold zone is underlain by a relatively flat-lying blanket of disseminated chalcocite. The potential significance of the copper zone was recognized late in the drilling process, is relatively untested, and potentially open in several directions.

Copper was likely originally part of the unoxidized gold deposit, but was leached and redeposited as chalcocite at the base of the oxidized gold zone. Chalcocite in similar settings is amenable to recovery by conventional flotation.

TABLE 4: South TV Tower Kayalı Supergene Copper Resource1

1See notes below Table 3 and in the Resource Estimation section of this press release for estimation parameters and other information about estimation procedures.

KEY POINTS

- Supergene copper as a potentially economic mineralization type has not been fully explored at TV Tower, with a density of drilling sufficient to estimate a resource only realized at Kayalı.

- The primary copper mineral is chalcocite, which is readily amenable to recovery by flotation and concentration.

- Supergene chalcocite is recognized beneath the oxide zone at Hilltop Porphyry, the lower portion of the Yumrudağ deposit and other areas where oxidized HSE mineralization is present.

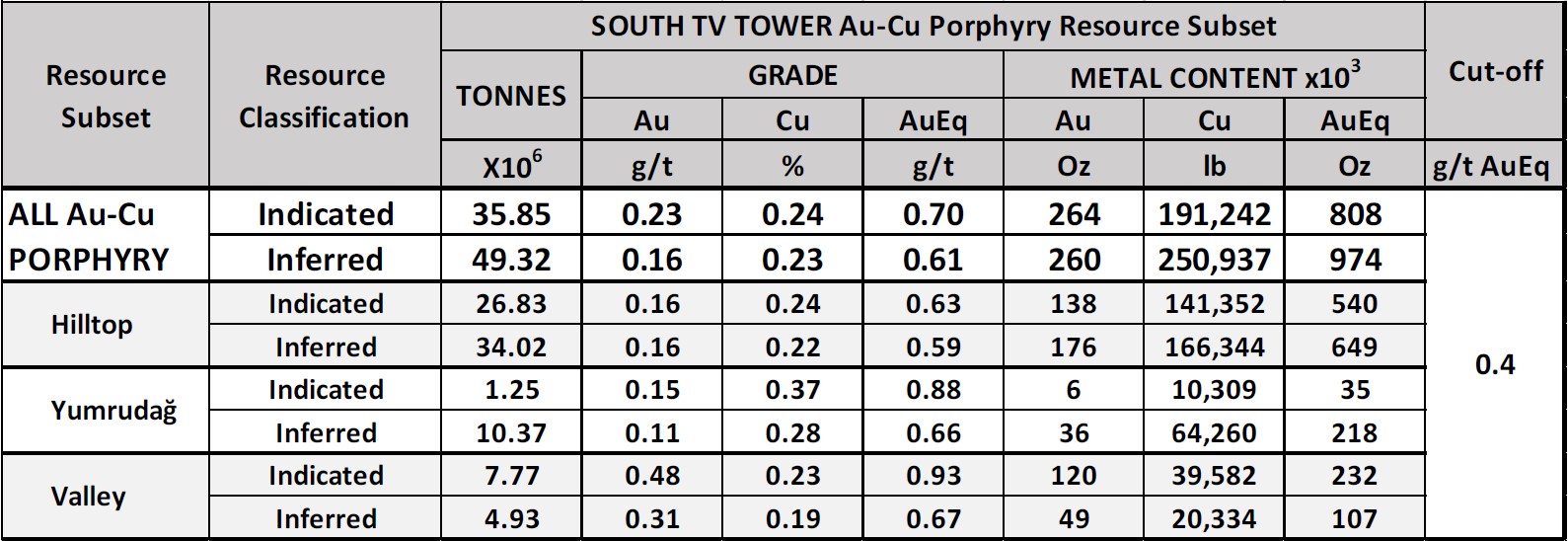

SOUTH TV TOWER AU-CU PORPHYRY DEPOSITS: HILLTOP, VALLEY AND YUMRUDAĞ

Hilltop and Valley are Au-Cu porphyry deposits, characterized by the presence of free gold and copper in chalcopyrite and lesser bornite and chalcocite. Preliminary concentrate testing by Liberty Gold and a previous operator suggest the amenability of both deposits to recovery of copper and gold to a concentrate (see below for more information regarding the metallurgical program).

The Valley porphyry deposit represents the deeper portion of a porphyry system, characterized by the presence of strong quartz stockwork veining, potassium feldspar and magnetite alteration hosted in quartz monzonite. The Hilltop porphyry represents the higher levels of a porphyry system, characterized by free gold and copper in chalcopyrite and chalcocite in sericite and biotite altered quartz monzonite porphyry. The Hilltop deposit remains open in several directions.

Gold-copper mineralization located immediately beneath the Yumrudağ gold oxide zone includes areas of chalcocite mineralization likely representing a supergene copper blanket, superimposed on a weakly-developed Au-Cu porphyry system. The difference in style of mineralization would account for the relatively high ratio of copper to gold in this deposit relative to Hilltop and Valley. It is relatively sparsely drilled, with more drilling necessary to fully define the system, which is open in all directions.

TABLE 5: South TV Tower Au-Cu Porphyry Resource1

1See notes below Table 3 and in the Resource Estimation section of this press release for estimation parameters and other information about estimation procedures.

KEY POINTS

- The Hilltop Au-Cu porphyry deposit lies 3 km to the northeast of the Valley Au-Cu porphyry deposit, and immediately east of the Yumrudağ Cu-Au zone. All three zones of mineralization would logically be processed at a central mill facility.

- The Hilltop and Yumrudağ mineralized zones are open to expansion in several directions.

- Preliminary metallurgical testing by Liberty Gold suggests that the Valley porphyry deposit would be amenable to producing a high-grade concentrate using a flow-sheet similar to the nearby Halilağa Au-Cu porphyry deposit, with concentrate grades after 2 cleaner stages ranging from 32.0% Cu to 44.2% Cu and from 44.7 g/t Au to 84.5 g/t Au.

- Preliminary metallurgical testing at the Hilltop porphyry deposit by a previous operator produced acceptable results using rougher flotation, but cleaner recoveries were poor due to no regrind, so more testing is needed to optimize results. See below for more information regarding the metallurgical programs at TV Tower.

- No metallurgical testing has been carried out at Yumrudağ, but the presence of free gold and copper in chalcocite and chalcopyrite suggest conventional Cu flotation should perform well.

- The South TV Tower Au-Cu porphyry deposits are located approximately 15 km west of the Halilağa Au-Cu porphyry deposit, currently in development.

NORTH TV TOWER DEPOSITS

The northeast portion of the TV Tower Property hosts two deposits: The Columbaz deposit comprising a Au-Cu porphyry system cut by low sulphidation Au-Ag quartz veins and the KCD high sulphidation Au-Ag-Cu deposit, lying 1.5 km to the north of Columbaz.

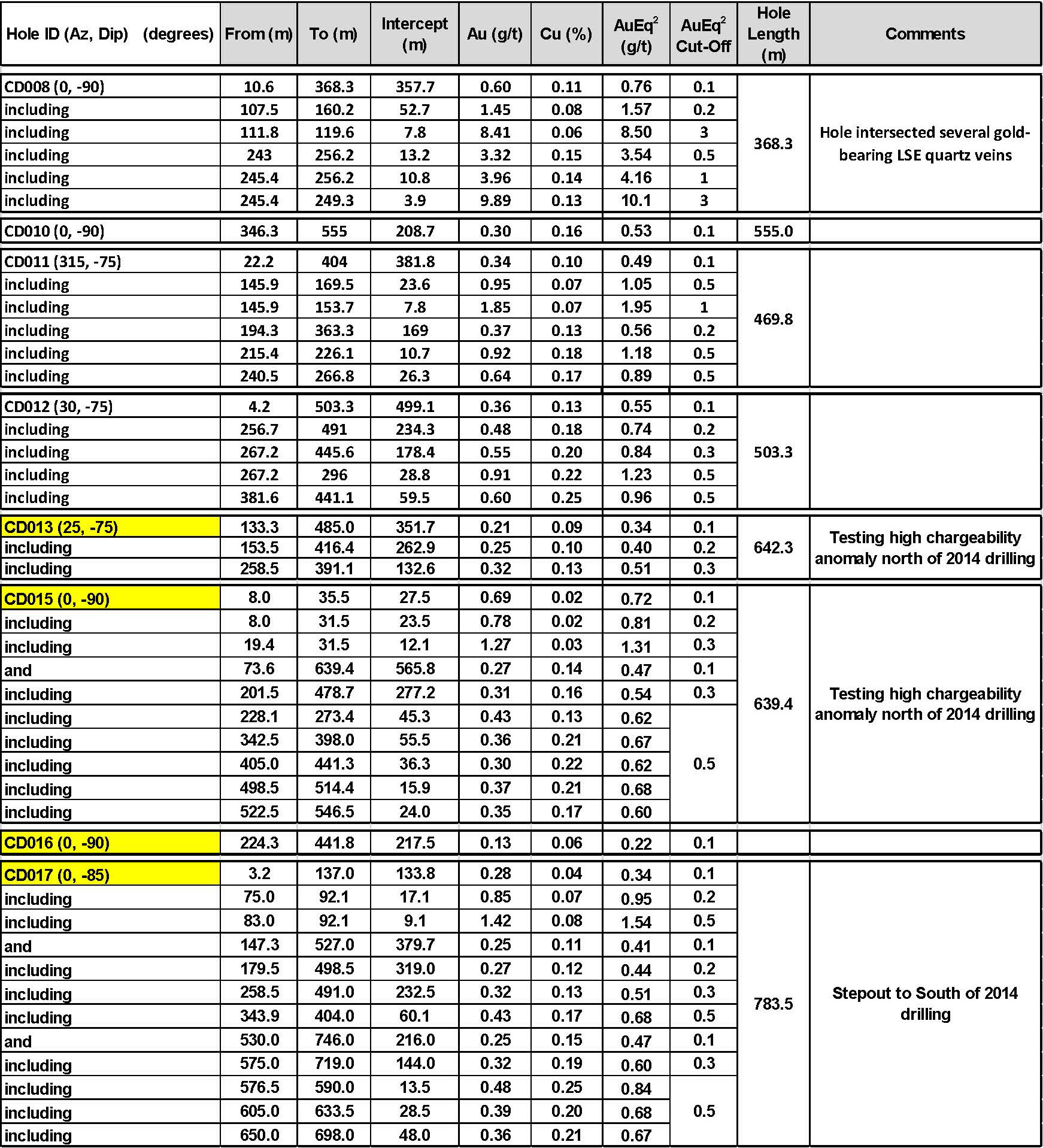

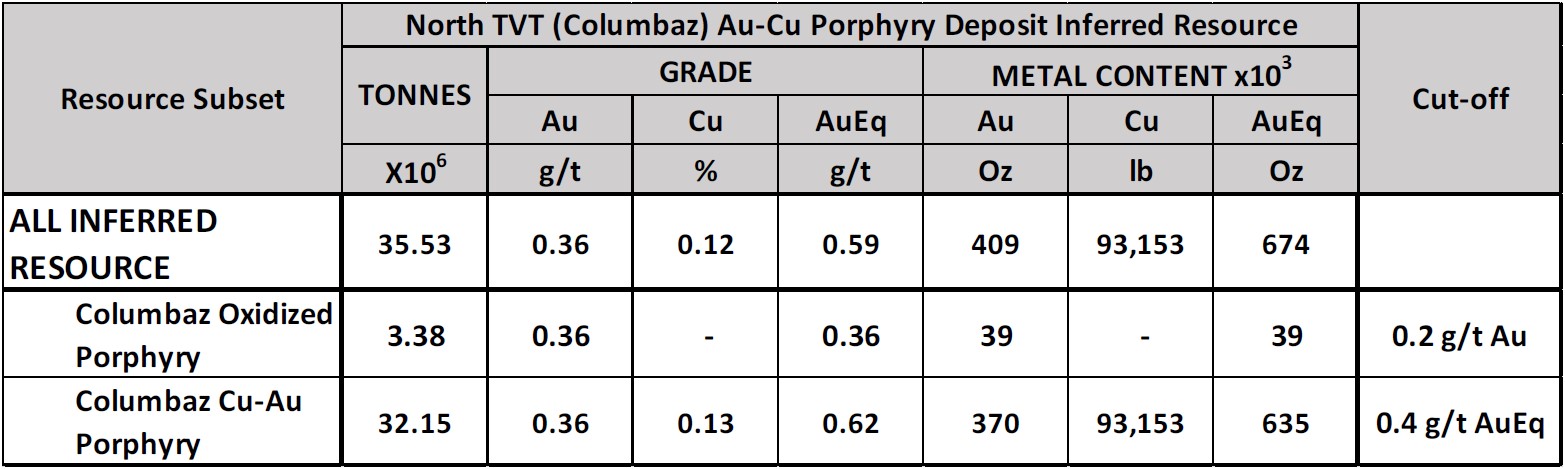

Columbaz Au-Cu Porphyry Deposit

The Columbaz Au-Cu porphyry system was discovered in 2014 when core drilling targeting LSE Au-Ag quartz veins intersected the top of a porphyry system at shallow depth (see press releases dated 22 October, 2014 and 06 February, 2015). A total of 5 holes intersected the porphyry system. A deep induced polarization (“IP”) survey over the area showed that a large chargeability high covered upwards of 0.6 km2, within a 2 km2 area with multiple chargeability highs, an area much larger than had been drill tested. Five additional holes were drilled to the north and south of the original drill holes in late 2020, showing that mineralization continued to the north and south, and to a depth of at least 740 m (Table 6).

The Columbaz porphyry Au-Cu system consists of copper as chalcopyrite and free gold in phyllic, potassic and magnetite altered volcanic rocks, phreatic breccias and polyphase quartz monzonite porphyry of Eocene age. Mineralization extends from surface to over 740 m, and includes a small amount of oxidized, gold-only material. Portions of the system are cut by gold- and silver-bearing, LSE quartz veins. The Columbaz porphyry system has a strong magnetic and IP chargeability signature. The roughly coincident magnetic and IP chargeability anomaly covers several square km extending to the north of the Columbaz resource area, and only a small portion of it has been drill tested to date.

The Columbaz porphyry resource estimate is shown below in Table 7.

For a map of the Columbaz area, IP anomaly and drill collars, please click here:https://libertygold.ca/images/news/2021/April/TVTower_NR040621ColumbazMap.pdf

KEY POINTS

- The Columbaz porphyry system has been intersected by a total of only 11 drill holes, with Au-Cu mineralization extending to a depth of at least 740 m.

- The drill density is sufficient to estimate inferred resources, but the deposit requires more infill and step-out drilling to test the extents of mineralization and estimate indicated resources.

- Drilling to date has tested only a small portion of a much larger IP and magnetic anomaly that extends northward from the Columbaz deposit over an area of approximately 2 km2.

- No metallurgical testing has been carried out at Columbaz. However, the mineralogy is very similar to the Hilltop deposit, for which metallurgical testing indicates that it is amenable to recovery of copper and gold by flotation.

- Permitting is underway to gain access to and test the large, undrilled IP anomaly.

TABLE 6: 2014 and 2020 Drill Highlights1, Columbaz Porphyry Deposit

1Drill holes through CD0012 were drilled in 2014. For complete results, see press releases dated 22 October, 2014 and 06 February, 2015. CD0013 to CD0017 were drilled in 2020. The deposit shape is still relatively poorly understood, such that the above are drilled thicknesses, thought to represent between 30 and 90% of true thickness. CD0014 did not contain significant mineralization. Some smaller or lower grade intervals omitted.

2AuEq based on $1600/oz Au and $3.40/lb Cu, using the equation AuEq = [Au, g/t] + [Cu,%*1.457] and assuming 100% recovery.

TABLE 7: North TV Tower Porphyry Resource Estimate1

1See notes below Table 3 and in the Resource Estimation section of this press release for estimation parameters and other information about estimation procedures.

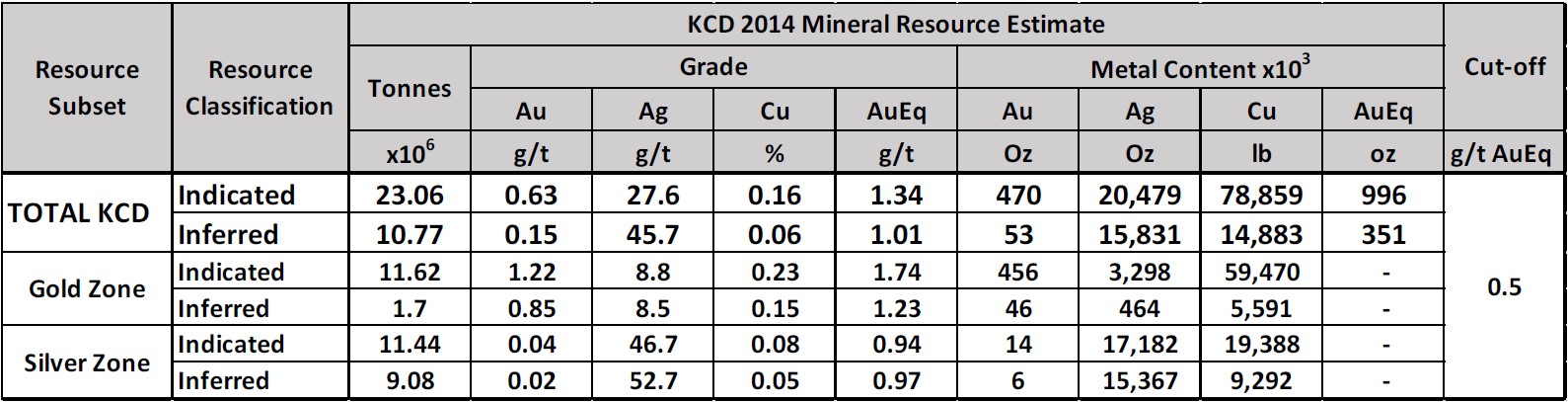

KCD HSE Au-Ag-Cu Deposit

The KCD deposit is a high-sulphidation system characterized by a zone of gold and copper mineralization overlain by a zone of predominantly silver mineralization. KCD was the subject of an intensive drill program in 2012 and 2013, with a maiden resource estimate in 2014. Mineralogically, the gold zone contains largely enargite, silver sulphosalts and gold in association with arsenian pyrite and enargite, while the overlying silver zone contains abundant pyrite with very fine-grained silver minerals. It also contains an average of 18 ppm tellurium in the gold zone.

The resource estimate is still current and will be included in the TV Tower Technical Report. For full details, please see the full 2014 Technical Report available on Liberty Gold’s website or under Liberty Gold’s profile on www.sedar.com.

TABLE 8: KCD Mineral Resource Estimate1

1The Classified Mineral Resource estimate is quoted at a cut-off grade of 0.50 g/t AuEq. At a 0.50 g/t AuEq cut-off, the strip ratio is 1.47:1. Gold equivalence was calculated using a ratio of Au:Ag of $1200:$20, at 75% recovery and copper (“Cu”) at $3/lb at 70% recovery. Additional details are available in the 2014 Technical Report on Liberty Gold’s website or under Liberty Gold’s profile on www.sedar.com

UNDRILLED TARGETS

In addition to the six drilled deposits with resource estimates and possible extensions to these deposits, several other undrilled targets remain on the property. These include:

- Gümüşlük, a gold-copper-silver target hosted in metamorphic rocks suspected to be a listwaenite lode-gold system. The target is a strong copper-gold-silver soil anomaly measuring over 1 km long by 400 m wide, with individual soil samples returning assays up to 6 g/t Au and 92 g/t Ag and rock samples up to 9 g/t Au.

- Tesbihçukuru, an Au-Cu porphyry target located approximately 4 km north of the Hilltop porphyry deposit and 4 km south-southwest of the Columbaz porphyry deposit, characterized by:

- Outcropping, oxidized porphyry-style quartz-stockwork alteration.

- Au up to 0.6 g/t and Cu up to 0.27% in channel samples.

- A large IP chargeability anomaly.

- Kestanecik, 1 km x 1 km zone of strong argillic alteration with LSE quartz veins containing gold and silver.

- Kartaldağ West, a 1 km-long, oxidized HSE gold target located 1.5 km northeast of Gümüşlük.

RESOURCE ESTIMATION (OTHER THAN KCD)

The resource estimate was completed by Mr. Mehmet Ali Akbaba, P. Geo., AIPG, an Independent Qualified Person as defined by NI 43-101, in accordance with the CIM Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. Estimation methods are summarized below. Further details of the estimation methods and procedures will be available in the TV Tower Technical Report, authored by DAMA Mühendislik A.Ş., that will be filed within 45 days of the date of this press release, and which will be available on SEDAR (www.sedar.com) and on Liberty Gold’s website.

The resource estimate is based on results from 30,055.2 metres of drilling in 122 drill holes (113 core and nine reverse circulation) for the deposits (i.e., Hilltop, Yumrudağ, Valley and Kayalı) in the TV Tower South area and 8,353.1 meters of drilling in 11 drill holes for the Columbaz prospect in the TV Tower North area.

Quality-control data generated for the various drill programs were independently verified by DAMA as part of the project review. The resource model consists of a detailed three-dimensional geological model including lithological and grade domains. These, in turn, were used to constrain the interpolation of gold and copper grades. Block grades were estimated by ordinary kriging.

Blocks sizes are 10 x 10 x 5 meters for the South TV Tower deposits and 20 x 20 x10 meters the North TV Tower (Columbaz) deposit. In the South TV Tower database, a total of 9,981 individual assay intervals averaging 1.47 m in length were composited into a total of 7,753 composite intervals of 2.00 m length, while a total of 2,771 individual assay intervals with an average length of 1.42 m in the Columbaz deposit at the North TV Tower sector were composited into a total of 1,978 composite intervals of 2.00 m length.

Gold and copper assay data were reviewed statistically to determine appropriate grade capping levels by domain. A total of 95 gold assays and 51 copper assays in the South TV Tower database and a total of 14 gold assays in the North TV Tower database were capped prior to compositing.

All North TV Tower mineralization (i.e., Columbaz) within the pit shell was classified as Inferred. For the South TV Tower deposits, Mineral Resources estimated with a minimum of two holes and 4 composites within 50 m were classified as Indicated, while all other above cut-off material within the pit shell was classified as Inferred.

The mineral resources are confined within a Micromine pit shell generated by DAMA to ensure reasonable prospects of economic extraction. The pit shell was based on the following parameters: Au: $1,600/oz; Cu: $3.40/lb; Mining cost $1.00/t; processing and G &A (oxide) $5.00/t; processing and G&A $12.35 (sulphide); Recovery: Au (oxide) = 91%; Cu(oxide) = 76%; Au(sulphide) = 65%; Cu (sulphide and supergene) = 87%; Overall pit slope: 50o. Tonnage estimates are based on 1,878 density measurements from the TV Tower South and 642 density measurements from the TV Tower North, which were used to assign average values to lithologic domains of the block model.

METALLURGICAL TESTING

Metallurgical testing was carried out on oxide and hypogene sulphide material from the Kayalı, Yumrudağ, Hilltop, Valley and KCD deposits. KCD metallurgical testing is described in the 2014 Technical Report.

In 2015, three master composites from oxide material in five drill holes at Kayalı (Kayalı-1, Kayalı-2 and Kayalı-3) and one composite from one hole at Yumrudağ (Yum-1) were prepared from drill core and shipped to McClelland Laboratory in Reno, Nevada, USA for a preliminary heap leach amenability study, under the supervision of G.L. Simmons Consulting LLC. Scope of work included:

- Composite preparation and feed analysis

- Detailed comminution test work (Kayalı-1 and Yum-1 only)

- Bottle roll tests (BT) on P801.7mm (168 hour leach) and P8075μm feed sizes

- Head screen analysis

- Column percolation leach tests (CT) on P8012.5mm feeds

- Tail screen analyses on CT leached/rinsed residues

Results show that composites are amenable to cyanidation processing. Highest gold extractions were achieved from P8075μm feeds showing that milling will liberate Au for dissolution by cyanide. Overall, results show that composites Kayalı-1, Kayalı-2 and Kayalı-3 and Yum-1 are potentially amenable to heap leach processing at the P8012.5mm crush size. Respective gold extractions were 84.2, 71.1, 73.6 and 90.6 percent in 80 to 120 days of leaching and rinsing.

In 2014, five master composites (VPMC-1 to VPMC-5) were generated from drill core from the Valley Porphyry deposit and subjected to laboratory flotation testing conducted by John Gathje Consulting, LLC, an independent consultant, using the facilities and support provided by Hazen Research, Inc. (Golden, Colorado). Samples were subject to a primary grind P80 of 140μm followed by rougher flotation using lime to adjust to ±pH 9 and potassium amyl xanthate (PAX) as the collector. The rougher concentrate was reground to a P80 of 20μm and two or three stages of cleaning were used to produce a final copper concentrate product. The pH during cleaning is maintained at ~11 to 11.5 (using lime) to reject pyrite.

For VPMC-1 to VPMC-4 two cleaner stages produced copper concentrates with grades >25% Cu. The average copper concentrate grade from a single cleaner stage for VPMC-1 to 4 was 30.2% Cu with a recovery of 87.0%. The copper grades ranged from 23.2% Cu for VPMC-4 to 37.1% Cu for VPMC-3. The copper recoveries ranged from 85.3% to 89.0%. For VPMC-5 the first stage of cleaner flotation produced a good copper grade of 29.6% Cu but only 58.1% recovery. The low copper recovery is a response that correlates well with its designation as being a transition ore type. The gold values show a concentrate grade of 37.4 g/t Au and 47.5% recovery; again typical of a transition ore type. Further optimization and testing of lower grade material is needed in order to better characterize metallurgical response.

At the Hilltop deposit in 2012, previous owner Chesser Resources Limited commissioned Ausenco and ALS Metallurgy of Balcatta, WA, Australia to carry out preliminary rougher and cleaner floatation testing, which was carried out on three samples from drill hole KAD-02. The samples had a range of Cu grades from 0.3 to 0.4% and gold grades from 0.1 to 0.4 g/t Au. Rougher flotation tests showed that nearly all the sulphides could report to a bulk concentrate with high recoveries of copper and gold. Cleaner flotation tests conducted without regrinding returned poor grades due to incomplete mineral liberation in the rougher concentrate. Flotation performance based on the rougher and cleaner flotation tests, and incorporating an appropriate plant recovery discount, gave estimated recovery performance to final concentrate of 80% Cu and 58% Au. Further optimization is needed to confirm that fine regrinding of rougher concentrates can produce an acceptable grade of final concentrate.

Full details of the metallurgical testing programs at TV Tower will be disclosed in the TV Tower Technical Report.

QUALIFIED PERSONS

The technical information contained in this news release has been reviewed and approved by Mehmet Ali Akbaba, P.Geo. of DAMA Mühendislik A.Ş., Ankara, Türkiye, and independent Qualified Person as defined by NI 43-101 and responsible for the resource estimates disclosed herein. He is independent Qualified Persons within the meaning of NI 43-101 and has reviewed and validated that the information contained in the release is accurate.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of NI 43-101 and has reviewed and validated that the information contained in the release is accurate. Drill samples from 2008 – 2015 programs were assayed by AcmeLabs, an independent laboratory in Ankara, Türkiye and Vancouver, B.C. for gold by Fire Assay of a 30 gram (1 assay ton) charge with ICP-ES or AAS finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. Ag and Cu were determined by aqua regia ICP-MS, with overlimits (>100 ppm Ag or >10,000 ppm Cu) completed by fire assay with gravimetric finish (Ag) or 4-acid digestion with ICP-ES (Cu). Five holes drilled in the Columbaz deposit in 2020 were assayed by ALS Laboratories, and independent laboratory in Izmir, Türkiye and Vancouver, B.C., using a 30 gram fire assay with AA finish for gold and 4 acid digest and ICP-ES for copper and silver. QA/QC included the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface. We are now assessing options at our TV Tower Property in Türkiye in order to crystallize value for shareholders.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals and the potential expansion and development of the TV Tower Project. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the impact from the pandemic of the novel coronavirus (COVID-19), availability of equipment, timing of the publication of any mineral resources, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing of the publication of any mineral resources; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry, including impacts from the pandemic of the novel coronavirus (COVID-19); delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2021 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Cautionary Note for United States Investors

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource”, are Canadian mining terms as defined in, and required to be disclosed in accordance with, National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Definition Standards”), adopted by the CIM Council, as amended. However, these terms are not defined terms under SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Act of 1933, as amended, and normally are not permitted to be used in reports and registration statements filed with United States Securities and Exchange Commission (the “SEC”). The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934, as amended. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

United States investors are cautioned that there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. There is no assurance any mineral resources that the Company may report as “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43- 101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules. United States investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM definitions. United States investors are cautioned that a preliminary economic assessment cannot support an estimate of either “proven mineral reserves” or “probable mineral reserves” and that no feasibility studies have been completed on the Company’s mineral properties.

Accordingly, information contained herein describing the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.